nattanan_zia/iStock through Getty Photographs

By Antoine Bouvet, Senior Charges Strategist; Benjamin Schroeder, Senior Charges Strategist

Greenium takes it on the chin in illiquid markets

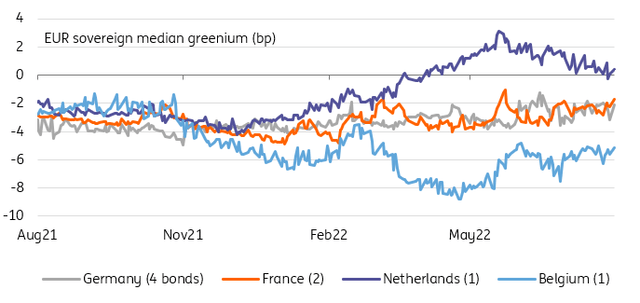

As is the case in lots of markets, 2022 has proved a bruising yr for inexperienced bonds. There stays a irritating heterogeneity in how the greenium trades throughout sovereign and SSA (Sub-sovereign, Supranational, and Companies) curves. As now we have highlighted in earlier reviews, we discover a greenium, ie a bent for inexperienced bonds to commerce with decrease yields than their friends, exists on most curves however this hides discrepancies between inexperienced bonds throughout the similar curves, and there isn’t any uniform means of pricing greenium from one curve to the following. And but, paradoxically, the 2022 market turmoil has, for the primary time proven, the start of an analytical resolution to this inexperienced bond pricing conundrum.

2022 has introduced a discount in greeniums, and better dispersion

Refinitiv, ING

The UK, Germany, and in our view Belgium, will quickly discover themselves within the headlines as a consequence of new inexperienced bonds issuance. All three have seen their greeniums shrink over the previous few months, albeit by various levels. As is usually the case, some markets bucked that development, as an example, the Netherlands, however we discover this an attention-grabbing improvement nonetheless given the shortage of correlation between greeniums, and given the worsening liquidity situations which have lately characterised markets.

Varied indicators of market liquidity have steadily worsened this yr

As common readers know, now we have repeatedly burdened the worsening buying and selling situations in authorities bond markets this yr, owing to each macroeconomic uncertainties and a change in market construction with central banks stopping their QE programmes and, in some instances, going into reverse. Even in markets the place stability sheet discount isn’t but a actuality, latest feedback by ECB officers Isabel Schnabel and Joachim Nagel confirmed that this needs to be on buyers’ radars over the medium time period. The upshot is that numerous market liquidity indicators have steadily worsened this yr, with summer season buying and selling situations additionally including to current issues.

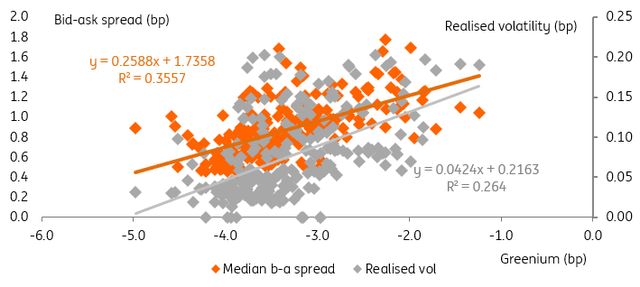

Lastly some rationalization for greenium adjustments

That worsening of liquidity situations and shrinking of sovereign greeniums is greater than a mere coincidence. We discover that bid-ask spreads and realised volatility, our two proxies for liquidity, have the best explanatory energy when making an attempt to mannequin the greenium on sovereign and SSA curves. The contribution of every issue varies from issuer to the following however the indicators and relevance are constant. This can be a exceptional outcome given the shortage of uniformity in pricing greeniums. For example, the correlation between every bond’s greenium on the identical curve could be very weak, and the greenium throughout curves can also be insignificant.

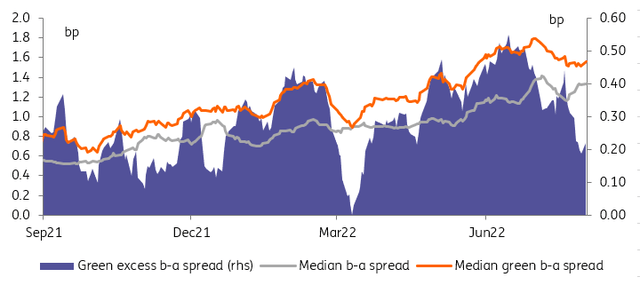

Inexperienced German bonds appear to be much less liquid than their non-green friends

Refinitiv, ING

The tendency of the greenium to shrink when liquidity worsens is just not a mirrored image of the liquidity of inexperienced bonds particularly, however moderately an impact of buying and selling situations throughout all bonds on a curve, inexperienced or not. We discover that inexperienced bonds are typically extra and typically much less liquid than their non-green friends relying on the curve. In Germany as an example, notably with a ‘managed’ greenium, inexperienced bonds aren’t extra liquid than their friends, however the reverse is true for KFW, the massive German SSA issuer.

Greater bid-ask spreads and realised volatility prompted a decrease German greenium

Refinitiv, ING

None of this implies liquidity situations are guilty for the existence of a greenium within the first place. An imbalance between provide (presumably slowing this yr, see beneath) and demand (with inexperienced reserve administration a brand new potential driver for future progress) stays the prime suspect.

Liquidity is a key driver of each day greenium adjustments

As an apart, it nonetheless doesn’t appear like provide has caught up sufficient for demand for greeniums to vanish, though we are able to argue that a greater stability between the 2 may have allowed secondary elements to play a extra vital position. For now, liquidity is a key driver of day-to-day greenium adjustments. It’s notable {that a} change in market regime characterised by greater volatility and fewer beneficiant liquidity situations has upended the best way many markets behave; inexperienced bonds are not any exception.

Masked by unstable Supra issuance, general EUR denominated SSA ESG provide remains to be gaining traction

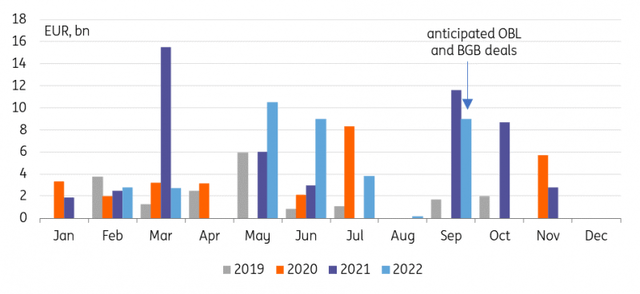

Germany and certain Belgium are the following giant eurozone sovereign issuers that can turn out to be lively within the inexperienced bond area. Germany has simply kicked off investor conferences for the upcoming launch of a brand new 5Y inexperienced bond through syndication which ought to happen in September.

Markets are additionally nonetheless awaiting Belgium’s new inexperienced bond which had been flagged within the funding outlook, and given the issuer’s typical sample it additionally appears prone to are available in September. It’s anticipated that the brand new inexperienced bond may once more be a 15Y following up on the prevailing 2033 maturity, which was launched in 2018, but additionally solely reopened this month in a small scale. The eventual maturity will most likely solely be determined after gauging the place investor demand lies.

12 months-to-date EUR sovereign inexperienced issuance stands near €30bn, in comparison with €35bn In 2021

The 2 aforementioned offers would possible already represent near €10bn of latest inexperienced EUR sovereign issuance for September. Whereas alone that is nonetheless behind what has been noticed within the earlier two years, it seems to observe a seasonal sample the place exercise notably picks up after the summer season. 12 months-to-date EUR sovereign inexperienced issuance stands near €30bn, solely considerably decrease than the €35bn at an analogous stage final yr and ultimately a complete of greater than €61bn for 2021. However the EUR inexperienced sovereign market has solely began to mature over the previous few years with new main eurozone issuers coming into the market with outstanding offers, Italy and Spain in 2021 and Austria solely this yr.

EUR sovereign inexperienced issuance sample nonetheless marked by outstanding offers

Debt businesses, ING

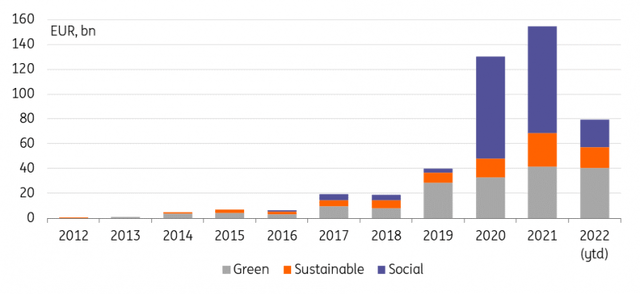

Wider sovereign-related and supranational ESG issuance (excluding aforementioned central authorities bonds) presently stands at almost €80bn yr so far. €112bn had been issued on the similar stage final yr, and in whole ultimately greater than €150bn.

12 months-to-date EUR SSA ESG issuance presently stands at €80bn, in comparison with €112bn in 2021

Nonetheless, social bond issuance over the course of the pandemic significantly led to some distortion of the headline determine given the outstanding position of the EU’s SURE programme. It alone raised near €92bn over a quick timespan from late 2020 to early 2021. This masks an underlying development the place particularly inexperienced issuance has steadily elevated. The EU is in fact additionally a driver of inexperienced issuance – we have had the NGEU since final yr. That ought to last more than the SURE programme,

The EU issued €50bn for the NGEU within the first half of 2022 and has flagged one other €50bn for the second. Of the quantity issued to this point €16bn has been in inexperienced bonds, thus barely greater than 32%. That is barely forward of the 30% which the EU has nonetheless flagged as a funding share for inexperienced bonds.

EUR denominated SSA ESG issuance

ING

There’s an opportunity that this yr’s inexperienced sovereign and SSA issuance will outweigh that of earlier years however it appears the part of speedy acceleration appears to be over. Decrease, or not less than slower progress in provide comes as greeniums shrink and show better volatility. There may be nonetheless a case to be made for demand exceeding provide in the long term however the previous few months have confirmed that common market situations matter. In phases of low market liquidity, a gradual greenium can now not be taken without any consideration.

Content material Disclaimer

This publication has been ready by ING solely for info functions regardless of a selected consumer’s means, monetary state of affairs or funding targets. The data doesn’t represent funding suggestion, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Authentic Put up