Thirty years in the past, Britain’s snap resolution to withdraw from the European Alternate Price Mechanism made George Soros, a hedge-fund titan, greater than $1bn from his brief positions in opposition to sterling. Hedge funds might not be the monetary giants they had been in 1992, however some speculators nonetheless aspire to “break the financial institution”, to borrow the phrase used to explain Mr Soros’s wager. This time, it’s not the Financial institution of England however the Financial institution of Japan that the would-be bank-breakers have their eyes on.

Your browser doesn’t help the <audio> component.

Save time by listening to our audio articles as you multitask

The boj stands out like a sore thumb on the earth of financial coverage. Whereas the Federal Reserve, the European Central Financial institution and the Financial institution of England are speeding to fight inflation by reversing asset-purchase schemes and elevating rates of interest, the boj is sticking to its weapons. After a gathering on June seventeenth it left its coverage of “yield-curve management”, meant to maintain yields on ten-year Japanese authorities bonds at round 0%, firmly in place. Because the gulf between Japanese and rising American bond yields has widened, the yen has plunged: by 15% this 12 months thus far, to its lowest stage in opposition to the greenback because the late Nineties.

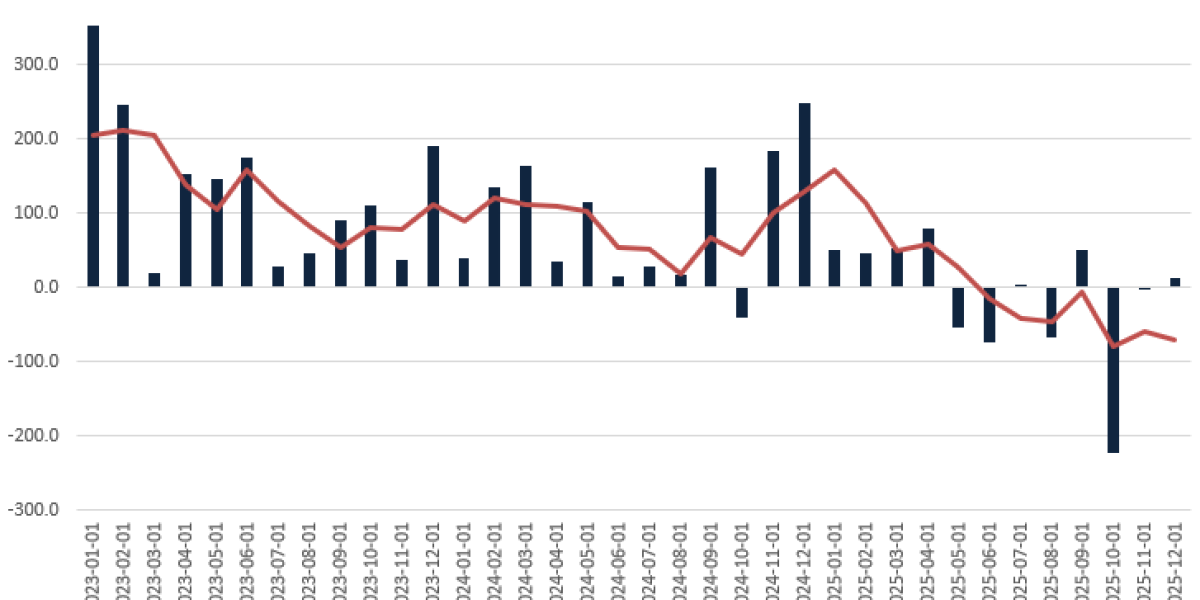

The boj adopted yield-curve management in 2016 as a technique to keep financial stimulus, whereas slowing down the frenetic purchases of Japanese authorities bonds that it had been endeavor since 2013 to spice up inflation. For more often than not its yield cap has been in place, the mere promise to purchase extra bonds if anybody examined its resolve was sufficient to maintain a lid on yields. Extra lately, nevertheless, that dedication has itself been examined. Within the 5 days to June twentieth the central financial institution was pressured to purchase authorities bonds price ¥10.9trn ($81bn) because it sought to suppress yields. Against this, between 2015 and 2021 it by no means purchased greater than ¥4trn in a five-day interval.

Some buyers are betting that the boj will finally be pressured to change, and even abandon, its goal. BlueBay Asset Administration, an funding agency with greater than $127bn in belongings as of September 2021, is short-selling Japanese authorities debt. Mark Dowding, the agency’s chief funding officer, has known as the central financial institution’s place “untenable”. Volatility within the sometimes calm Japanese government-bond market has surged to its highest stage in additional than a decade.

The buyers betting in opposition to the boj may be taking hope from moments when central banks deserted related commitments. Late final 12 months the Reserve Financial institution of Australia’s yield-curve management coverage, which focused three-year Australian authorities bonds, collapsed spectacularly as yields surged and the central financial institution didn’t defend its goal. The Swiss Nationwide Financial institution insisted it might not break its forex peg to the euro within the months main as much as January 2015, earlier than doing exactly that.

To this point, nevertheless, neither Japan’s financial system nor the central financial institution’s inner dynamics trace {that a} change in coverage is coming. Inflation has risen, however not exploded as in different elements of the world; shopper costs rose by 2.5% within the 12 months to April, in contrast with 8.3% in America. Excluding recent meals and power, Japanese costs are nonetheless up by lower than 1% year-on-year, and wages by lower than 2%. There may be little signal of domestically generated worth progress.

The weak yen, in the meantime, has a combined impact. It drives up imported inflation and magnifies the impact of rising dollar-denominated oil costs. However after a few years during which Japan’s worth stage has barely budged, a shallow enhance doesn’t appear an pressing risk. Even with all these exterior shocks, inflation is barely above the central financial institution’s goal of two%. Fast strikes within the forex make planning troublesome for companies, however a weaker alternate fee advantages many exporters of manufactured items, in addition to the holders of Japan’s ¥1.2 quadrillion in abroad belongings, which have gone up in yen phrases.

Nor does the temper inside the boj thus far trace at a coming change in coverage. The central financial institution nonetheless has a number of financial doves in its roosts. Kataoka Goushi was the only board member to vote in opposition to holding coverage unchanged in June, however as a result of he wished much more stimulus, not much less. In early June Wakatabe Masazumi, the financial institution’s deputy governor, stated that financial easing must be pursued to keep up wage progress. And Kuroda Haruhiko, the governor of the boj, is a longtime advocate of financial stimulus to revive Japan’s sluggish financial progress.

Mr Kuroda is now into the ultimate 12 months of his time period. His alternative might be Amamiya Masayoshi, one other deputy governor, who’s so entrenched within the establishment that he’s generally known as “Mr boj”. Mr Amamiya has typically been seen as extra hawkish than Mr Kuroda. However in his most up-to-date feedback on financial coverage, in mid-Could, he spoke in favour of continuous present coverage with out reservations. Barring a change to the home image, or a groundswell of hawkish sentiment inside the boj, buyers anticipating a u-turn are more likely to be disillusioned. ■

For extra professional evaluation of the largest tales in economics, enterprise and markets, signal as much as Cash Talks, our weekly e-newsletter.