JHVEPhoto

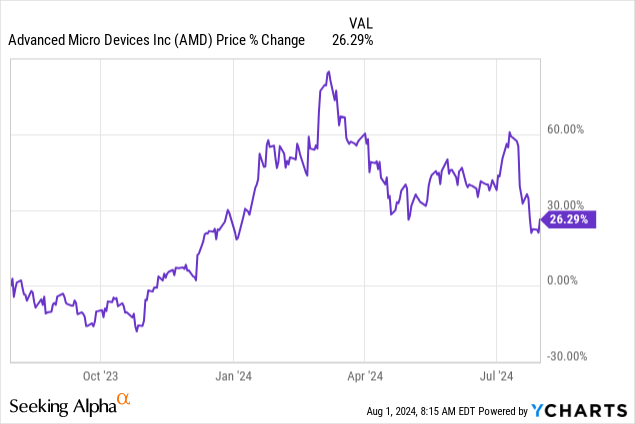

Superior Micro Gadgets, Inc. (NASDAQ:AMD) reported better-than-expected Q2 ’24 outcomes, giving shares a much-needed elevate on Wednesday. AMD’s shares have languished within the final couple of weeks, mainly over fears that the AI increase was petering out. Nonetheless, AMD supplied a powerful counterargument with its Q2 ’24 earnings report that confirmed a large 115% year-over-year income progress within the Information Middle phase.

AMD’s Information Middle income share doubled to 49% Y/Y whereas its earnings soared as effectively. AMD’s free money move is simply at first of what I see as a multi-year ramp, given its current begin of MI300 Intuition AI accelerator shipments. With AMD’s shares additionally correcting to the draw back within the final a number of weeks, I imagine the chipmaker is in a really engaging purchase the drop scenario!

Earlier score

I’ve indicated in my work on AMD in July that AMD was set for a significant acceleration of revenues, and by extension, free money move progress, in its Information Middle enterprise. It’s because the chipmaker has began to roll out its new MI300X chips at scale: AI GPU Underdog With Critical Catalysts. AMD’s Q2 ’24 outcomes confirmed promise, particularly concerning its accelerating progress momentum within the Information Middle phase and its free money move ramp. As per AMD’s outlook for Q3 ’24, income progress in Information Middle is about to speed up. This confirms my expectations for a probably important FCF ramp within the second half of the yr.

AMD is beginning to see actual tailwinds within the Information Middle phase

In the previous couple of weeks, a brand new consensus appeared to have fashioned available in the market for chipmakers like AMD and Nvidia (NVDA). This consensus indicated that share costs of firms benefiting from the AI revolution had run forward of the basics and that it was getting tougher for firms to high expectations. AMD not solely reported better-than-expected Q2 ’24 outcomes, nevertheless it additionally helped make a profitable counterargument for AI investments like AMD.

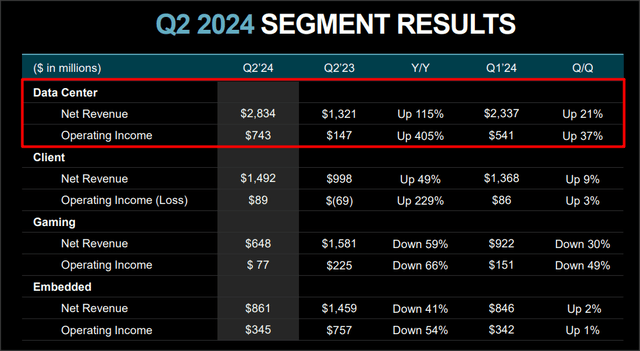

Searching for Alpha

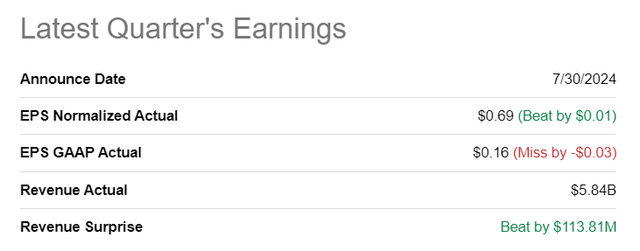

AMD generated $5.8B in revenues within the second quarter, displaying 9% year-over-year progress. Nonetheless, AMD is seeing some critical, Nvidia-like momentum in its Information Middle enterprise which, as I defined in July, was nearly to kick into excessive gear given the beginning of MI300 Intuition AI accelerator shipments. Not surprisingly, AMD is crushing it in Information Middle proper now: this phase generated $2.8B in revenues, displaying a extremely spectacular 115% progress price. What’s much more spectacular is that the share of AMD’s Information Middle revenues elevated to 49% in Q2 ’24, up from simply 25% in Q2 ’23. Nvidia’s Information Middle share soared to 87% in FQ1 ’25, and I indicated in my Information Middle efficiency comparability between Nvidia and AMD that AMD is making large progress in catching as much as Nvidia.

This implies the share contribution of AMD’s Information Middle phase about doubled in nearly one yr, and what’s equally necessary is that this progress is very worthwhile for AMD: the phase’s working earnings elevated by 405% in comparison with the year-earlier interval. In different phrases, AMD’s Information Middle phase earnings elevated 3.5X sooner than its surging phase revenues.

AMD

AMD’s free money move is ramping up

AMD is beginning to see the beginnings of what I recommended in July was a significant free money move upsurge that’s inextricably linked to the ramp in Information Middle GPU shipments. The free money move hit $439M in Q2 ’24, displaying 73% progress. This progress is pushed mainly by AI GPU accelerator shipments which might be in red-hot demand by the Information Middle business and which might be used to energy compute-intensive massive language fashions.

What’s interesting right here is that AMD remains to be lagging broadly behind Nvidia when it comes to free money move margins – Nvidia generated an insane free money move margin of 57% in its first fiscal quarter – however AMD is slowly catching up. Since This autumn ’23, AMD’s free money move margin doubled from 4% to eight% and as AMD is on the brink of ship AI GPU accelerators at scale (which I count on to occur on the finish of the yr in addition to in Q1 ’25), AMD ought to be capable of translate GPU cargo momentum into critical FCF margin progress. I’d not be stunned, on the present run-rate of revenues, to see one other doubling of the corporate’s free money move within the second half of the yr. That will imply, even at steady FCF margins, AMD may be capable of shut in on $2.0B in annual free money move this yr.

AMD, $hundreds of thousands | Q2’23 | Q3’23 | This autumn’23 | Q1’24 | Q2’24 | Y/Y Development |

Income | $5,359 | $5,800 | $6,168 | $5,473 | $5,835 | 9% |

GAAP web money supplied by working actions | $379 | $421 | $381 | $521 | $593 | 56% |

Purchases of property and gear | ($125) | ($124) | ($139) | ($142) | ($154) | 23% |

Free Money Circulation | $254 | $297 | $242 | $379 | $439 | 73% |

Free Money Circulation % Of Internet Revenues | 5% | 5% | 4% | 7% | 8% | 59% |

(Supply: Creator)

What helps this progress is that firms like Microsoft (MSFT) have mentioned that they do not plan to reduce their AI investments going ahead. Massive firms like Microsoft, Google (GOOG), or Meta Platforms (META) are key drivers of AI GPU spend and are liable for crammed order books at Nvidia and AMD. This additionally explains why AMD’s outlook requires an acceleration of Information Middle revenues and never a deceleration.

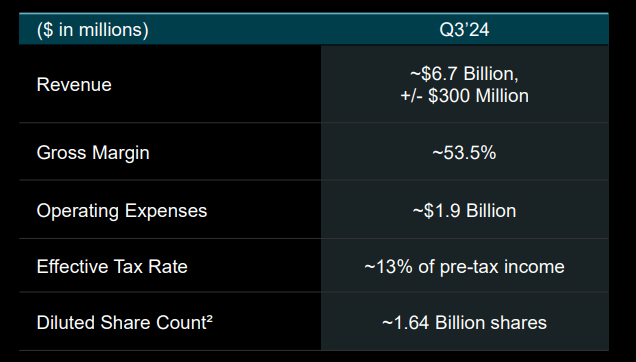

The chipmaker expects to develop its income to $6.7B (and as excessive as $7.0B) in Q3 ’24 which means a Q/Q progress price of 15%. This means an 8 PP acceleration of progress within the high line, on a Q/Q foundation, in comparison with Q2 ’24 and signifies that AI GPU demand is strengthening, not weakening in any respect.

AMD

AMD is a discount on the drop

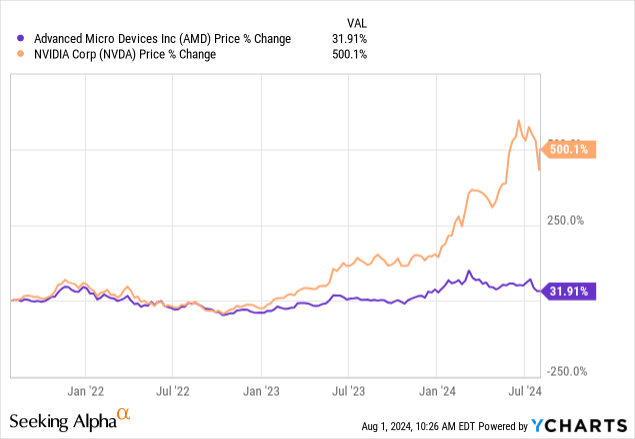

Some traders could really feel uncomfortable shopping for into AMD, or Nvidia for that matter, as valuations have soared. Nonetheless, AMD has nonetheless broadly underperformed Nvidia’s shares in the latest previous, primarily as a result of Nvidia acquired a head-start within the AI GPU market by way of the well timed improvement and launch of the game-changing H100 GPU. The rationale for AMD’s underperformance is the corporate’s late improvement of AI GPUs.

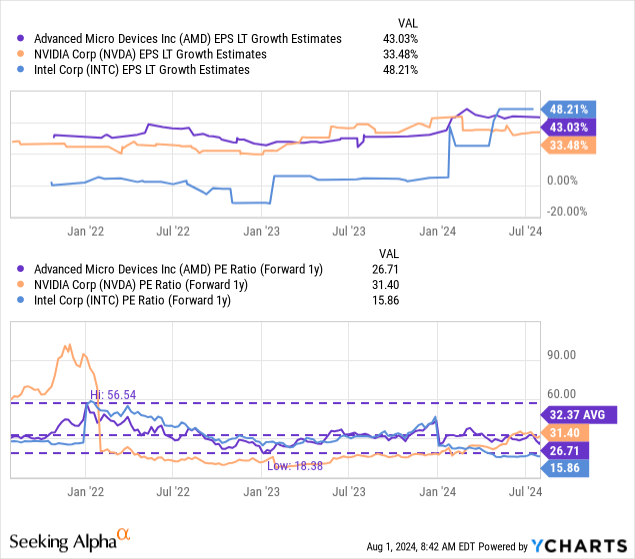

The excellent news is that the latest correction in shares of AMD has created a stable shopping for alternative, for my part. Shares of AMD are at the moment buying and selling at a price-to-earnings ratio of 26.7X, and a few traders could argue it is a excessive multiplier to pay for a semiconductor firm. I’d disagree for 3 causes:

- AMD’s free money move margins, as little as they’re now, may simply double within the second half of the yr because the chipmaker ships its MI300X Intuition chips at scale (I count on this to be the case in This autumn ’24 and Q1 ’25).

- Information Middle income progress is about to speed up (as per AMD’s Q3 steerage).

- Buyers should underestimate the potential for considerably sooner EPS progress on the again of continued investments in AI GPU infrastructure.

Nvidia’s shares are at the moment priced at a 31.4X ahead (FY 2025) P/E ratio. That is additionally not exaggerated, on condition that Nvidia owns greater than 90% of the Information Middle GPU market. In truth, I imagine Nvidia’s shares have change into considerably extra engaging on the drop as effectively. Whereas I additionally purchased a bit extra Nvidia for my long-term progress portfolio up to now two weeks, I particularly doubled on AMD given its a lot decrease valuation.

AMD is buying and selling 17% beneath its 3-year common P/E ratio, and AMD is projected to develop its EPS by 43% in the long run, in comparison with 33% for Nvidia and 48% for Intel (INTC). Intel and AMD have greater EPS expectations as a result of each firms have launched AI GPUs to compete with Nvidia – Intel launched the Gaudi 3 AI accelerator earlier this yr – and have significantly lagged Intel’s improvement pipeline. In different phrases, AMD and Intel are “catch-up” AI performs and commerce at extra engaging P/E ratios than Nvidia.

I imagine AMD may simply return to its common P/E ratio of 32X, particularly because the Information Middle progress story performs out. For me, that is all about free money move progress and whereas AMD’s FCF margins could not approximate Nvidia’s any time quickly, the chipmaker’s free money move pattern is clearly pointing in the fitting course. Since FCF margins are additionally fairly low nonetheless, a doubling of free money flows is way simpler to realize for AMD than for Nvidia. A 32X P/E ratio for AMD implies a good worth of $175.

In the long run, I’d count on AMD to commerce at a good greater P/E ratio – 35-36X, assuming that the corporate could make inroads into the AI GPU business, seize market share, and develop its FCF margins. This is able to indicate a good worth of as much as $200.

Dangers with AMD

AMD has lagged Nvidia within the Information Middle phase for years, however lastly seems prepared with its MI300 Intuition AI accelerators to alter the sport at the least a bit in its favor. What would change my thoughts about AMD is that if the chipmaker did not see a major growth in its free money move margins. That is what my bullish argument for AMD is all about. Moreover, I’d be involved if the corporate have been to see disappointing gross sales for its MI300 accelerator chips.

Closing ideas

Whereas I’ve elevated my Nvidia place within the final couple of weeks, I particularly overweighted AMD as a result of its potential for accelerating top-line progress within the Information Middle phase. AMD is about to expertise a major acceleration of free money move progress within the second half of the yr, particularly in FY 2025, as the corporate totally scales shipments for its MI300 chips. With AMD’s shares correcting recently and Microsoft confirming that it has no plans in anyway to reduce AI spending, I imagine that current market considerations in regards to the progress trajectory of AMD and Nvidia are exaggerated. In truth, I imagine we’re nonetheless on the very starting of AMD’s AI GPU progress curve!