Updated on May 31st, 2023 by Bob Ciura

Beer stocks, just like other beverage stocks, come in several different forms. Companies that are engaged in the beer industry offer direct exposure through manufacturing and distribution of beer, while other companies in adjacent industries offer indirect exposure through equity stakes in beer companies.

The beer industry is attractive for long-term income investors. Beer companies enjoy tremendous recession-resistance and consistent profits, which are used in large part to pay dividends to shareholders.

With this in mind, we created a downloadable spreadsheet that focuses on beer stocks. You can download our full Excel spreadsheet of beer stocks (with important financial metrics like dividend yields and payout ratios) by clicking the link below:

This article will discuss the top six beer stocks, each of which offer investors strong competitive advantages and decent long-term growth prospects. As a result, they may fit well in the diversified long-term dividend growth portfolios that we aspire to help investors build here at Sure Dividend.

The following stocks were selected according to the Sure Analysis Research Database. The six beer stocks are ranked according to their 5-year expected annual returns, in ascending order from lowest to highest.

Table Of Contents

You can use the following links to instantly jump to any specific stock:

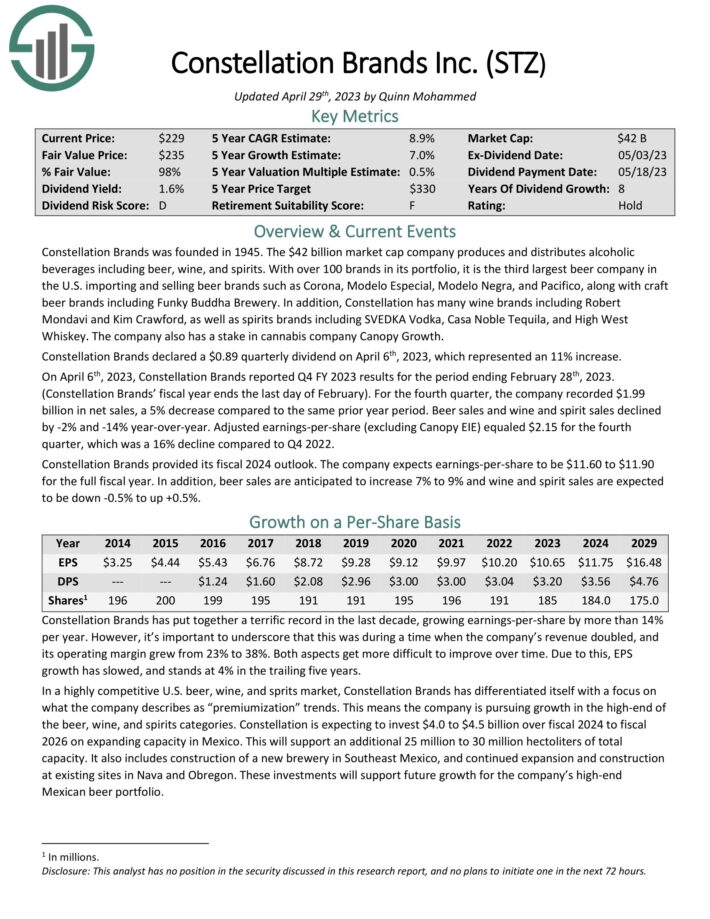

Beer Stock #6: Molson Coors Brewing Company (TAP)

- 5-year expected annual returns: 7.0%

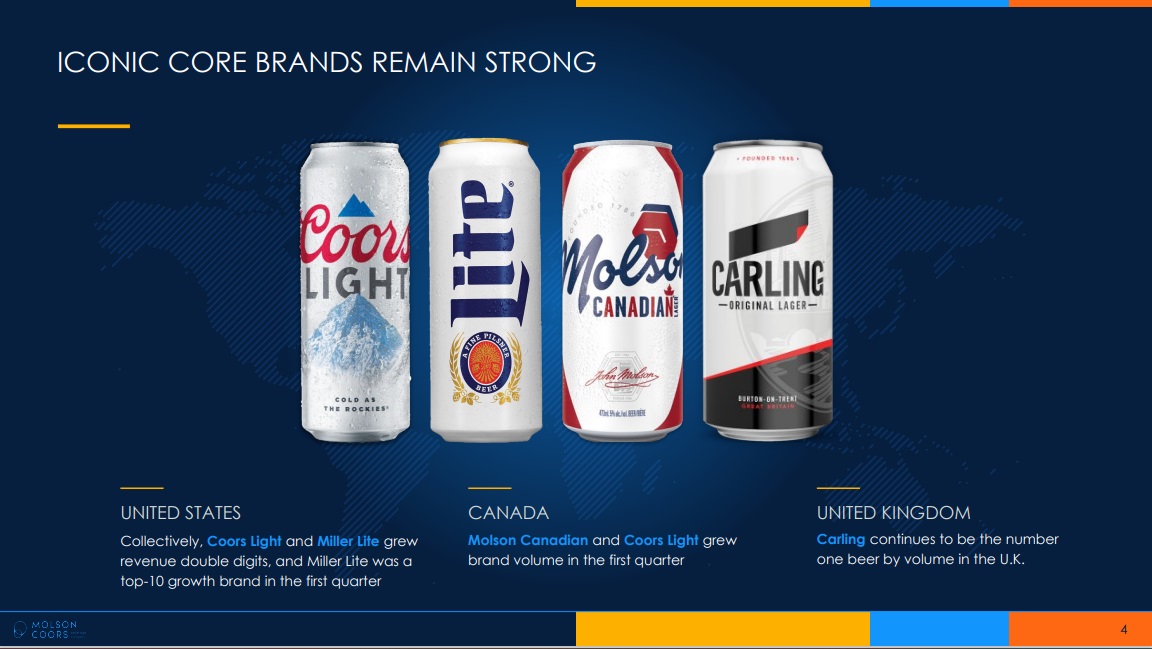

Molson Coors Brewing Company was founded all the way back in 1873 and has since grown into one of the largest U.S. brewers, with a variety of brands including Coors Light, Coors Banquet, Molson Canadian, Carling, Blue Moon, Hop Valley, Crispin Cider, as well as the Miller brands including Miller Lite.

Source: Investor Presentation

In addition to its sizable U.S. presence, the company has diversified internationally into Canada, Europe, Latin America, Asia, and Africa.

Molson Coors enjoys long-standing, entrenched relationships with distributors, retailers, restaurants, bars, and pubs as well as strong consumer loyalty.

Click here to download our most recent Sure Analysis report on Molson Coors (preview of page 1 of 3 shown below):

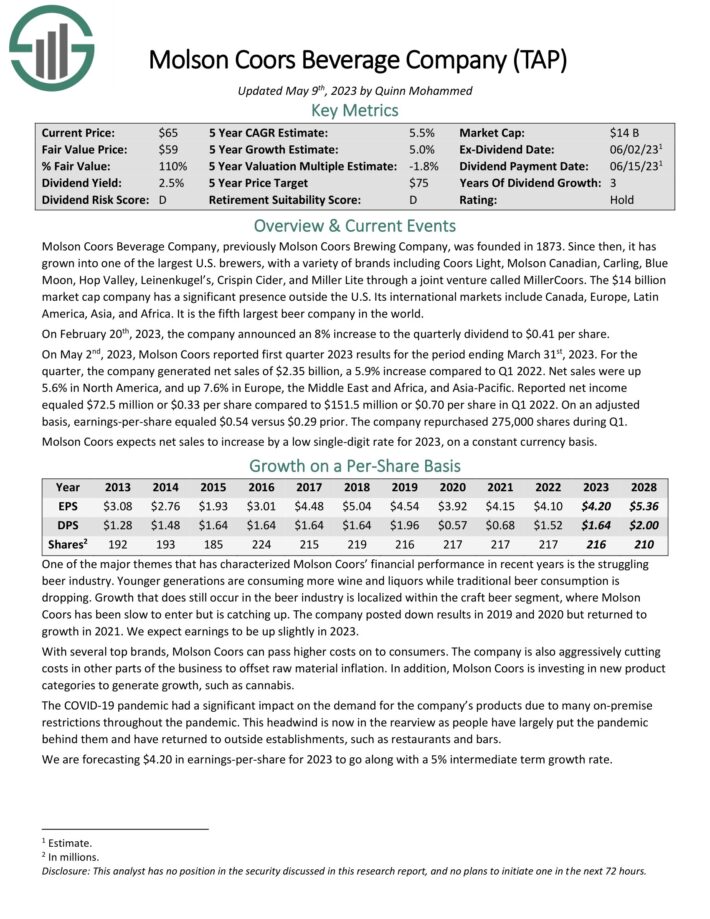

Beer Stock #5: Anheuser-Busch InBev SA/NV (BUD)

- 5-year expected annual returns: 7.8%

Anheuser-Busch InBev SA/NV is the largest brewer in the world thanks to the 2008 merger of InBev and Anheuser-Busch and the 2016 acquisition of SABMiller. The company produces, markets and sells over 500 different beer brands around the world and owns five of the top ten beer brands and 18 brands with over $1B in sales. These include Budweiser, Stella Artois and Corona.

Overall, AB-InBev has 17 individual beers that each generate at least $1 billion in annual sales.

Click here to download our most recent Sure Analysis report on BUD (preview of page 1 of 3 shown below):

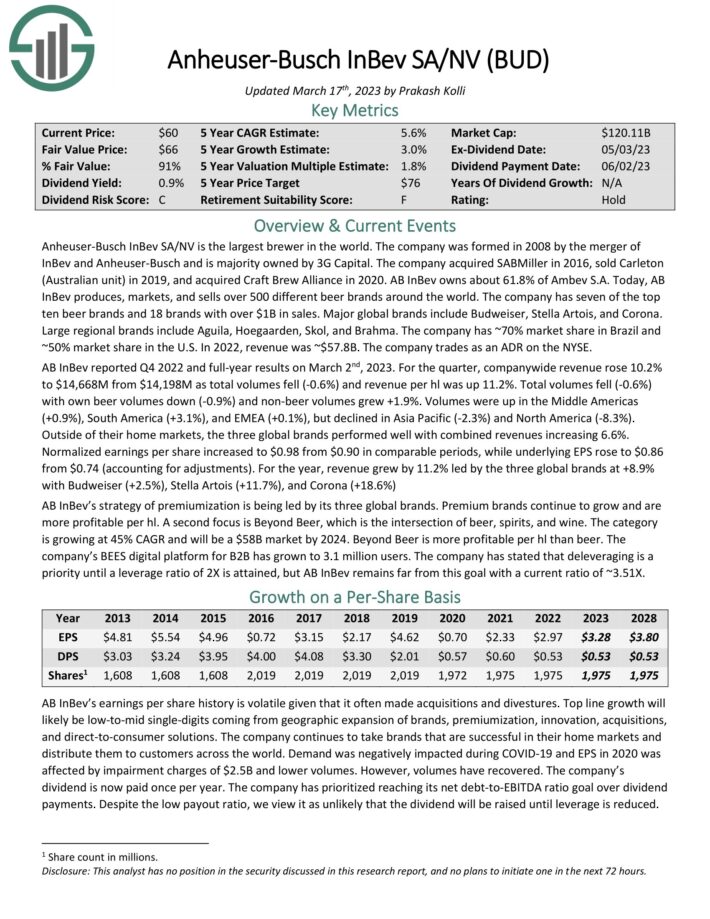

Beer Stock #4: Constellation Brands (STZ)

- 5-year expected annual returns: 8.2%

Constellation Brands was founded in 1945 and has grown into a global alcoholic beverage giant, producing and distributing over 100 brands of beer, wine, and spirits, including Corona, Modelo Especial, Modelo Negra, Pacifico, Ballast Point, Funky Buddha Brewery, Robert Mondavi, Clos du Bois, Kim Crawford, Mark West, Black Box, SVEDKA Vodka, Casa Noble Tequila and High West Whiskey.

Despite its clear strengths, Constellation Brands does have some risks. These include its heavy dependence on Mexican Beer (which supplies over two-thirds of its operating profits), ongoing and intensifying competition from sizable rivals, and its large stake in Canadian cannabis producer Canopy Growth.

Click here to download our most recent Sure Analysis report on STZ (preview of page 1 of 3 shown below):

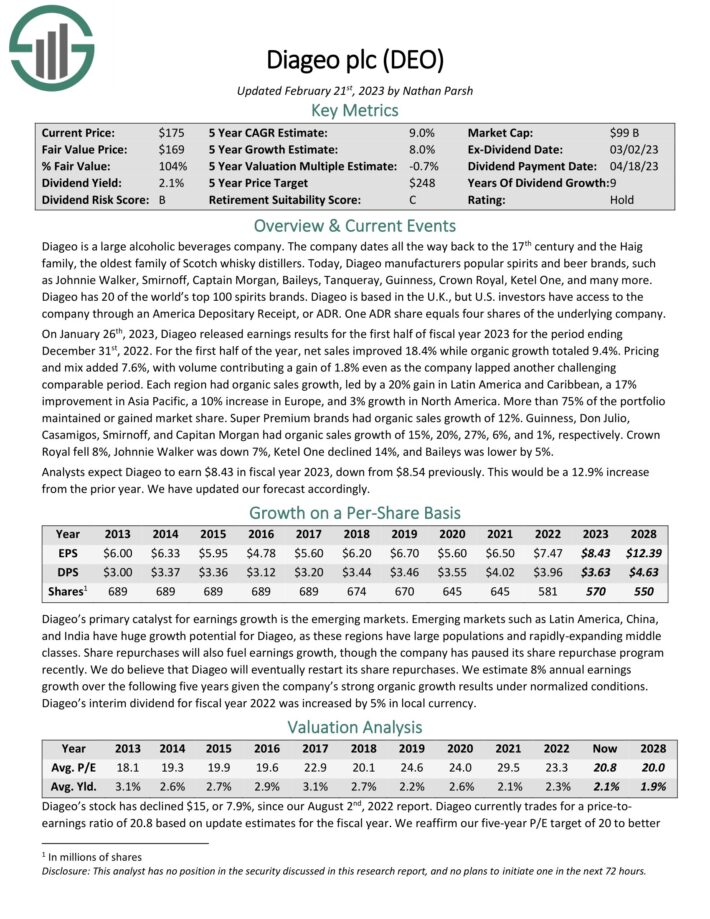

Beer Stock #3: Diageo (DEO)

- 5-year expected annual returns: 10.3%

Diageo is one of the oldest and largest alcoholic beverages companies. It dates all the way back to the 17th century and today owns 20 of the world’s top 100 spirits brands. Diageo manufacturers popular spirits and beer brands, such as Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and many more.

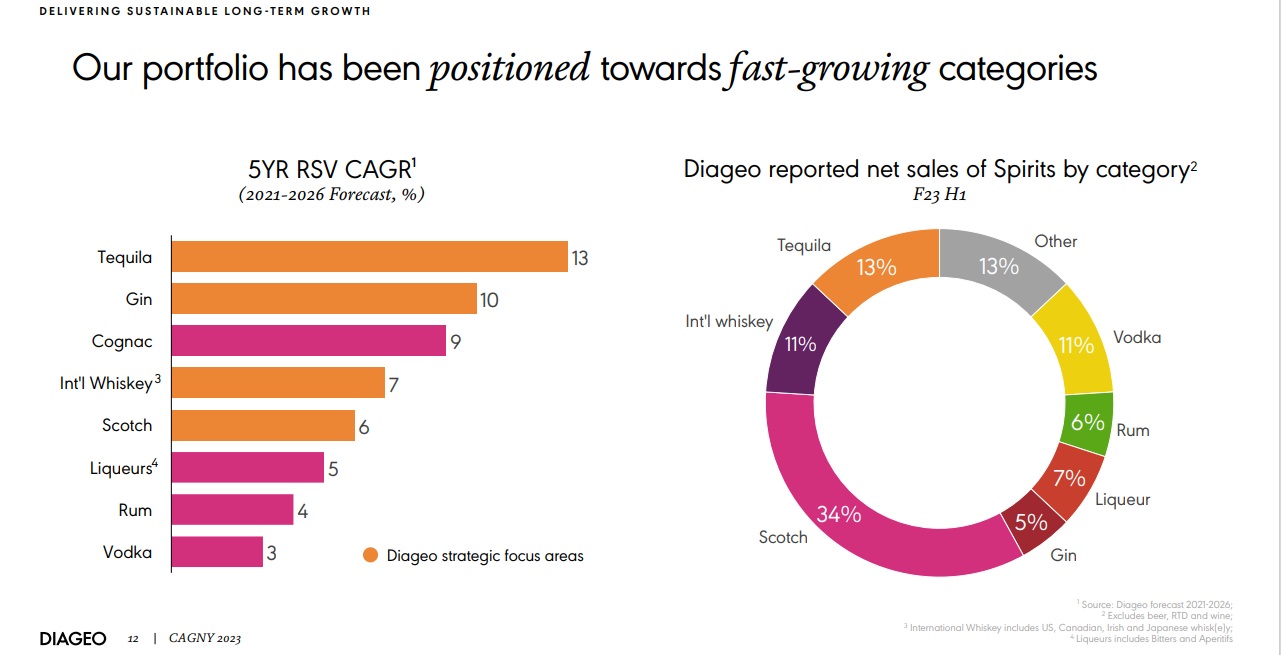

Source: Investor Presentation

Similar to its peers, Diageo’s strong growth is driven by its brand power and lower cost competitive advantages. With 3 of the top 10, 13 of the top 50, and 20 of the world’s top 100 global premium distilled spirits brands, the company enjoys strong consumer loyalty and new consumer preference. This enables them to charge higher prices and increase their margins and returns on invested capital.

Furthermore, the company’s large global volume gives them strong pricing power with suppliers and better economies of scale in production and distribution, cutting costs and further improving margins and economies of scale.

Click here to download our most recent Sure Analysis report on Diageo (preview of page 1 of 3 shown below):

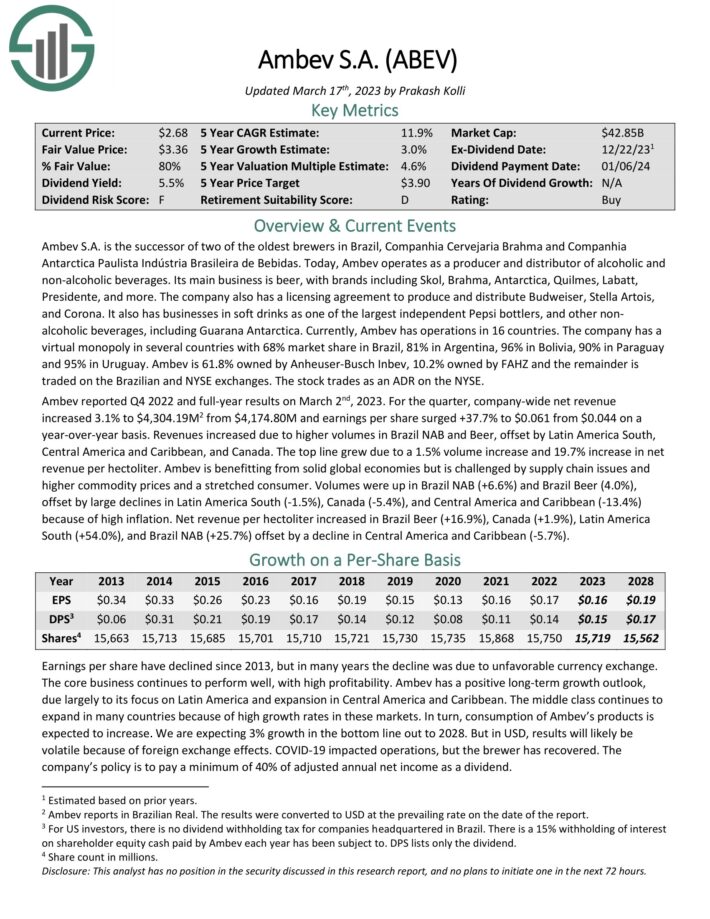

Beer Stock #2: Ambev SA (ABEV)

- 5-year expected annual returns: 12.1%

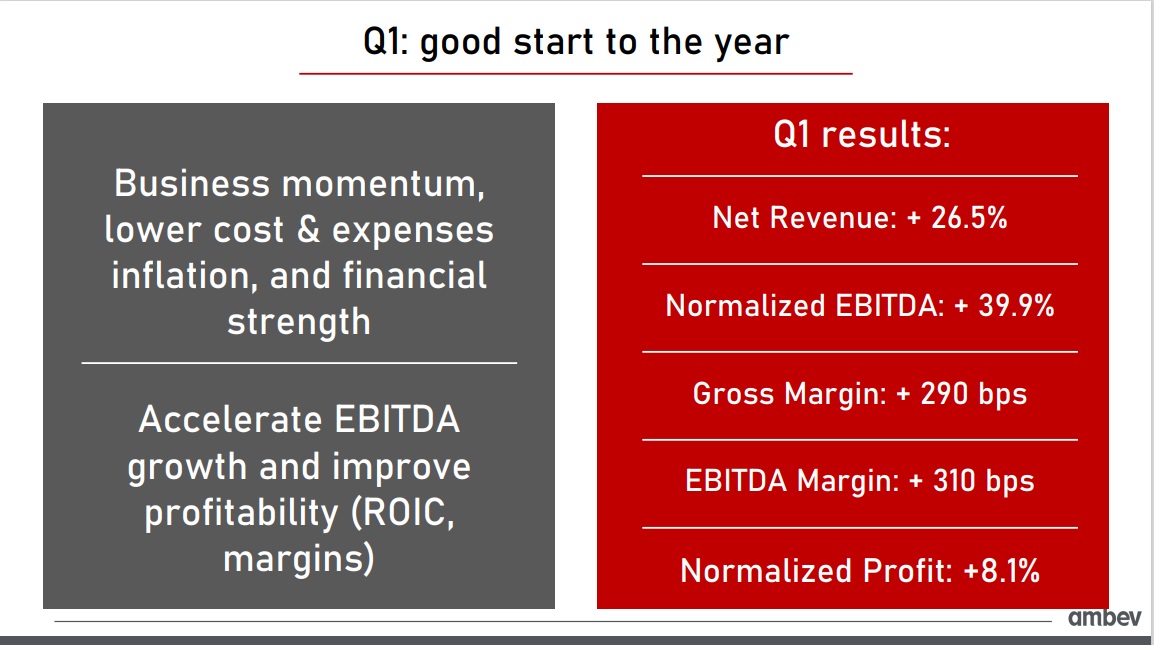

Ambev SA is the largest brewer in Latin America, with a presence in 16 countries. It is engaged in producing and distributing alcoholic and non-alcoholic beverages.

Its main business is beer, with brands including Skol, Brahma, Antarctica, Quilmes, Labatt, Presidente, and also has a licensing agreement to produce, bottle, sell and distribute Budweiser, Stella Artois, and Corona in South America.

Source: Investor Presentation

Investors should note that because the dividend is declared in Brazilian currency, payment in U.S. dollars will fluctuate based on exchange rates.

Click here to download our most recent Sure Analysis report on Ambev (preview of page 1 of 3 shown below):

Beer Stock #1: Altria Group (MO)

- 5-year expected annual returns: 12.8%

Altria Group was founded by Philip Morris in 1847 and today has grown into a consumer staples giant. While it is primarily known for its tobacco products, it is significantly involved in the beer business due to its 10% stake in global beer giant Anheuser-Busch InBev.

Related: The Best Tobacco Stocks Now, Ranked In Order

The Marlboro brand holds over 42% retail market share in the U.S.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

Final Thoughts

The beer industry has numerous players with global diversification and strong competitive advantages. Each offers investors a unique angle on the market. Some focus heavily on individual geographies, such as Molson Coors in the U.S. market and Ambev in Latin America, while Altria offers indirect exposure to the beer industry through its stake in AB InBev.

Companies that operate in beer widely enjoy strong profit margins, and the ability to withstand even the deepest recessions. Beer should continue to see steady demand each year, and the largest beer stocks enjoy high profit margins thanks to their ability to raise prices over time.

These six beer stocks have positive growth prospects and return cash to shareholders through hefty dividends. Risk-averse income investors looking for steady dividend payouts should take a closer look at beer stocks, particularly in uncertain economic times.

Further Reading

If you are interested in finding high-quality dividend growth stocks, and other income investing opportunities, the following Sure Dividend resources will be of interest to you.

Blue Chip Stock Investing

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].