Revealed on June third, 2025 by Bob Ciura

We advocate long-term buyers give attention to high-quality dividend shares. To that finish, we view the Dividend Kings as among the many greatest dividend shares to buy-and-hold for the long term.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

Over the previous 50+ years, the U.S. has gone via a wide range of financial downturns, wars, inventory market crashes, and plenty of different tough durations. Only a few of those embrace the tech bubble, the Nice Recession, the coronavirus pandemic, and extra.

And but, the Dividend Kings continued to boost their dividends annually, via all of it.

Because of this we consider the Dividend Kings are the best-of-the-best in dividend longevity.

The downloadable Dividend Kings Spreadsheet Record beneath accommodates the next for every inventory within the index amongst different essential investing metrics:

- Payout ratio

- Dividend yield

- Value-to-earnings ratio

You’ll be able to see the total downloadable spreadsheet of all 55 Dividend Kings (together with essential monetary metrics equivalent to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

Shares which have elevated their dividends for over 50 years have demonstrated the flexibility to proceed mountaineering their dividends, even throughout recessions.

This can be a testomony to the energy and sturdiness of their enterprise fashions and aggressive benefits.

The next 10 shares have maintained the longest dividend streaks.

Desk of Contents

You’ll be able to immediately soar to any particular part of the article by clicking on the hyperlinks beneath:

Longest Dividend Development Streak #10: Johnson & Johnson (JNJ)

- Dividend Development Streak: 63 years

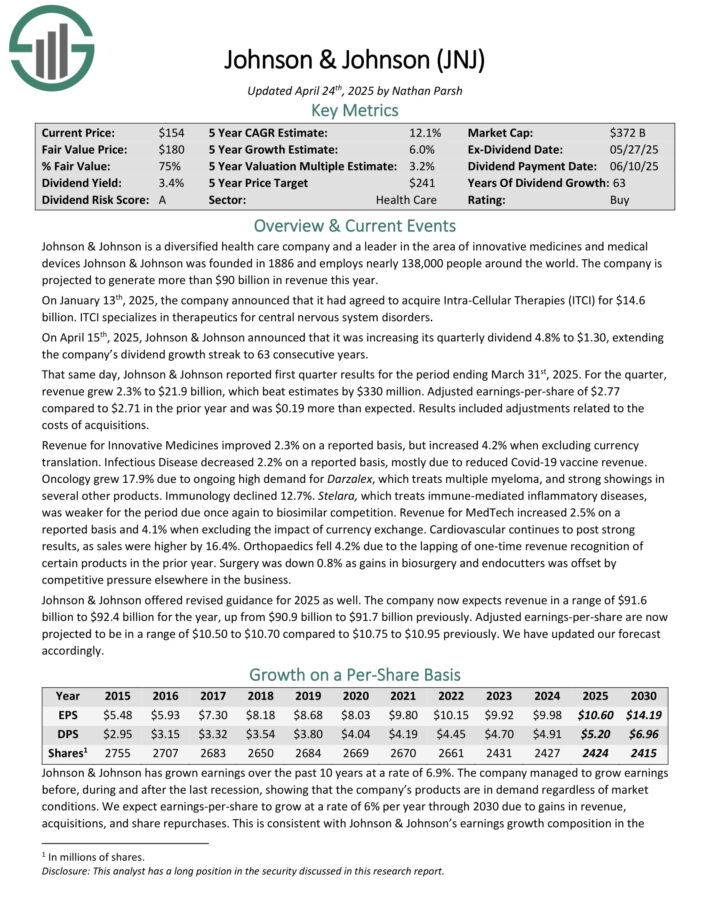

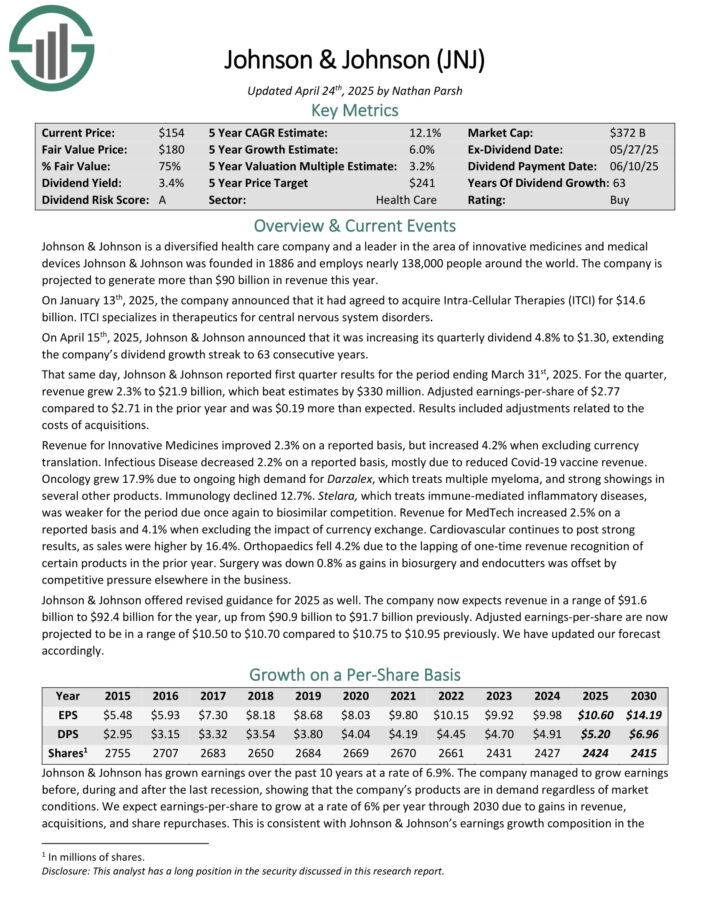

Johnson & Johnson is a diversified well being care firm and a frontrunner within the space of progressive medicines and medical gadgets Johnson & Johnson was based in 1886.

On April fifteenth, 2025, Johnson & Johnson introduced that it was growing its quarterly dividend 4.8% to $1.30, extending the corporate’s dividend progress streak to 63 consecutive years.

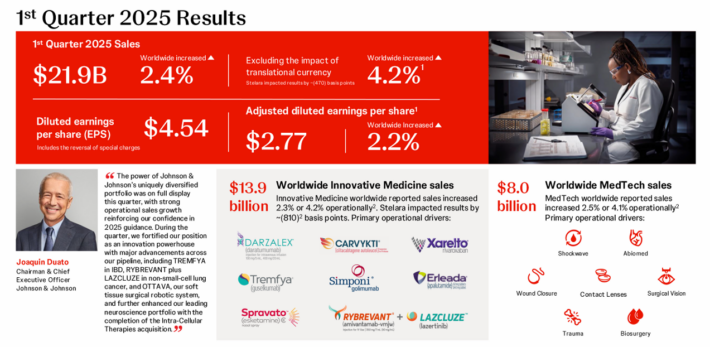

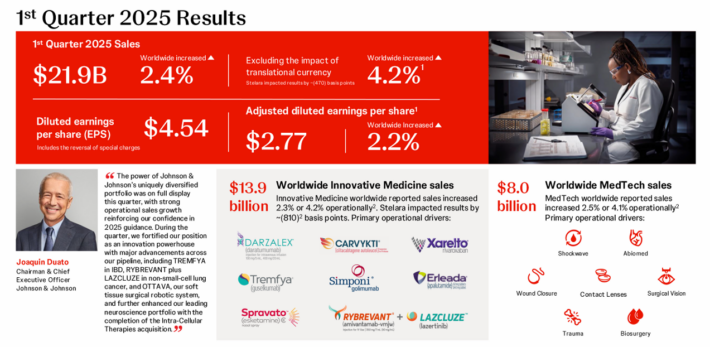

Supply: Investor Presentation

That very same day, Johnson & Johnson reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 2.3% to $21.9 billion, which beat estimates by $330 million.

Adjusted earnings-per-share of $2.77 in comparison with $2.71 within the prior yr and was $0.19 greater than anticipated. Outcomes included changes associated to the prices of acquisitions.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNJ (preview of web page 1 of three proven beneath):

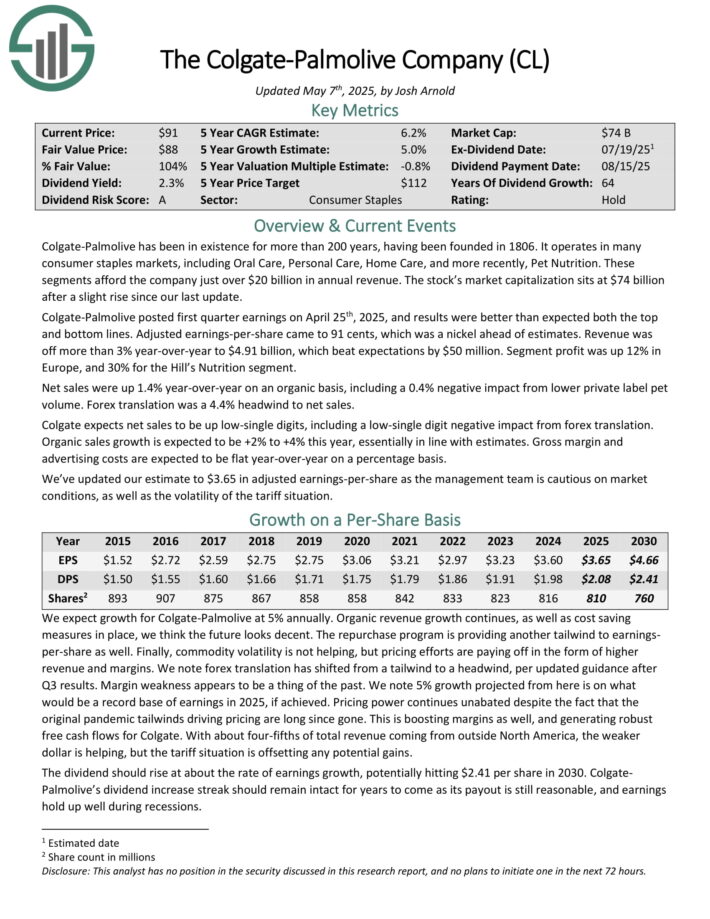

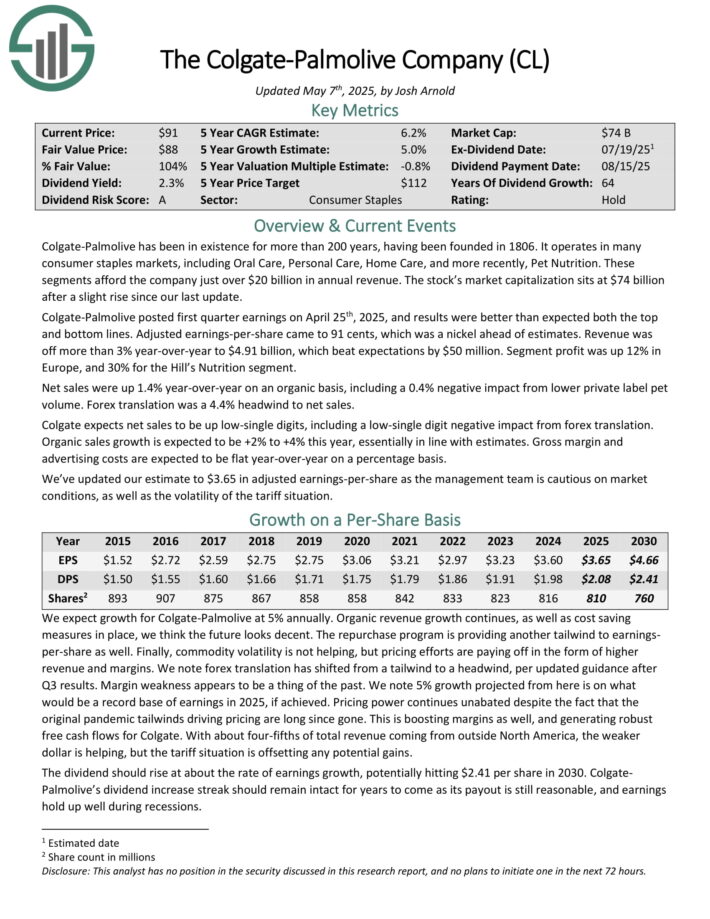

Longest Dividend Development Streak #9: Colgate-Palmolive Co. (CL)

- Dividend Development Streak: 64 years

Colgate-Palmolive was based in 1806 and has constructed a powerful and intensive portfolio of client manufacturers. It operates globally, promoting in most nations world wide.

About one-sixth of its income comes from Hill’s pet meals division, which has proven very robust progress lately.

The opposite five-sixths of income comes from a mixture of cleansing and private care merchandise, with the corporate’s most recognizable manufacturers being Colgate (tooth care) and Palmolive (cleaning soap).

The corporate has structured itself into 4 models: Oral Care, Private Care, House Care, and Pet Diet.

Supply: Investor presentation

Colgate-Palmolive posted first quarter earnings on April twenty fifth, 2025, and outcomes had been higher than anticipated each the highest and backside traces. Adjusted earnings-per-share got here to 91 cents, which was a nickel forward of estimates.

Income was off greater than 3% year-over-year to $4.91 billion, which beat expectations by $50 million. Phase revenue was up 12% in Europe, and 30% for the Hill’s Diet section.

Internet gross sales had been up 1.4% year-over-year on an natural foundation, together with a 0.4% unfavorable influence from decrease personal label pet quantity. Foreign exchange translation was a 4.4% headwind to web gross sales. Colgate expects web gross sales to be up low-single digits, together with a low-single digit unfavorable influence from foreign exchange translation. Natural gross sales progress is anticipated to be +2% to +4% this yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on CL (preview of web page 1 of three proven beneath):

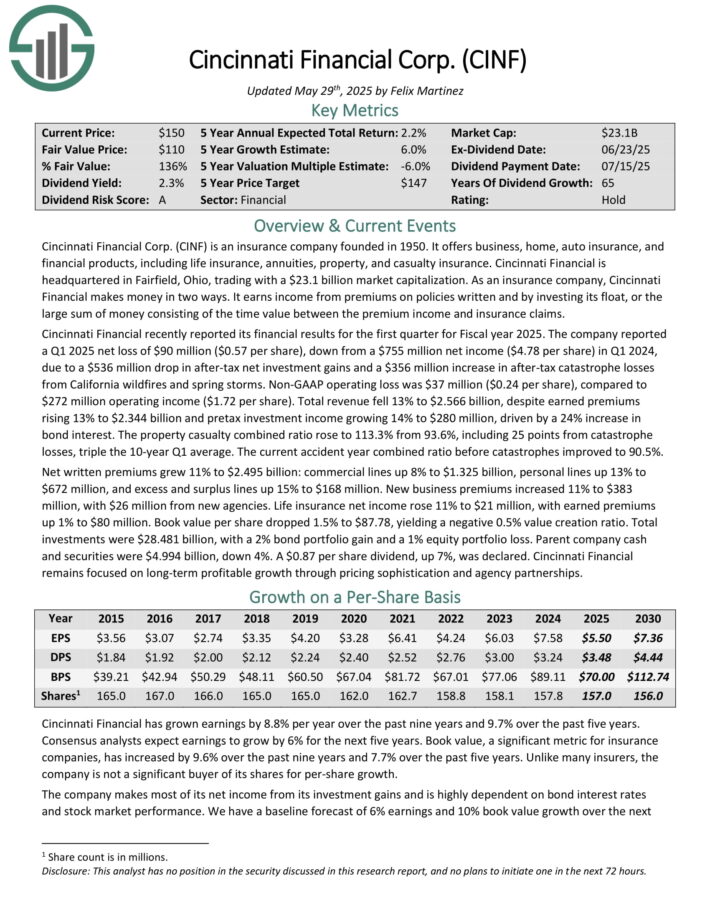

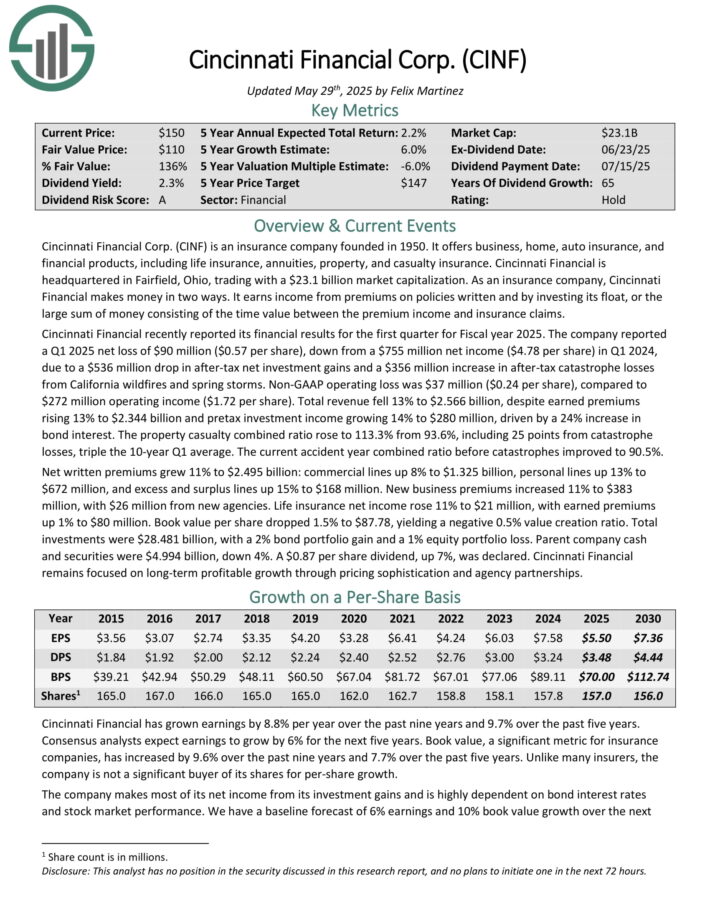

Longest Dividend Development Streak #8: Cincinnati Monetary Corp. (CINF)

- Dividend Development Streak: 65 years

Cincinnati Monetary is an insurance coverage firm based in 1950. It affords enterprise, residence, auto insurance coverage, and monetary merchandise, together with life insurance coverage, annuities, property, and casualty insurance coverage.

Cincinnati Monetary not too long ago reported its monetary outcomes for the primary quarter for Fiscal yr 2025. The corporate reported a Q1 2025 web lack of $90 million ($0.57 per share), down from a $755 million web revenue ($4.78 per share) in Q1 2024, resulting from a $536 million drop in after-tax web funding good points and a $356 million improve in after-tax disaster losses from California wildfires and spring storms.

Non-GAAP working loss was $37 million ($0.24 per share), in comparison with $272 million working revenue ($1.72 per share). Whole income fell 13% to $2.566 billion, regardless of earned premiums rising 13% to $2.344 billion and pretax funding revenue rising 14% to $280 million, pushed by a 24% improve in bond curiosity.

The property casualty mixed ratio rose to 113.3% from 93.6%, together with 25 factors from disaster losses, triple the 10-year Q1 common. The present accident yr mixed ratio earlier than catastrophes improved to 90.5%.

Internet written premiums grew 11% to $2.495 billion: industrial traces up 8% to $1.325 billion, private traces up 13% to $672 million, and extra and surplus traces up 15% to $168 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on CINF (preview of web page 1 of three proven beneath):

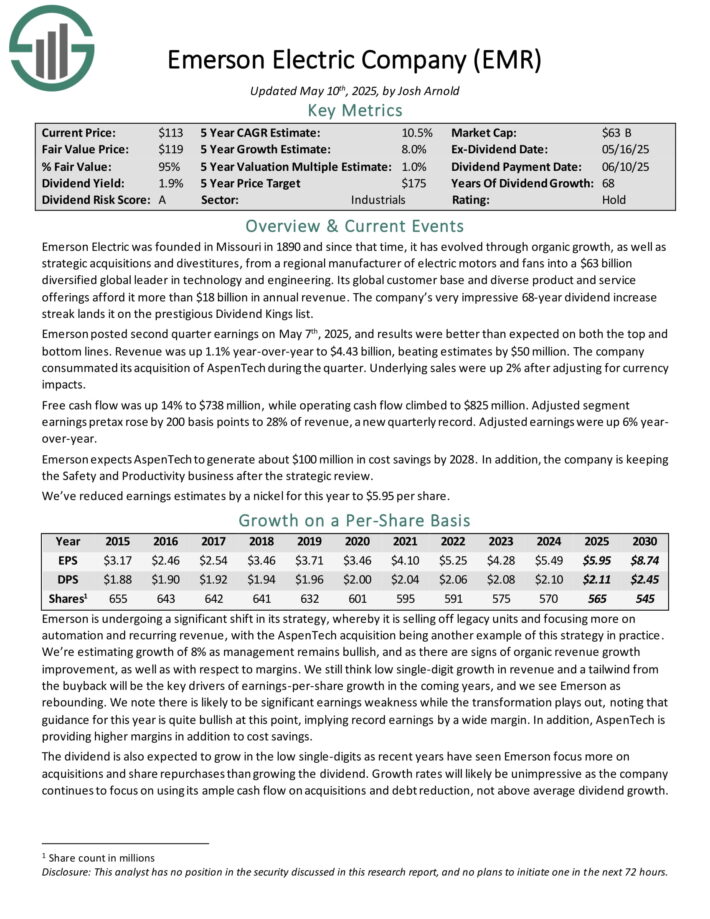

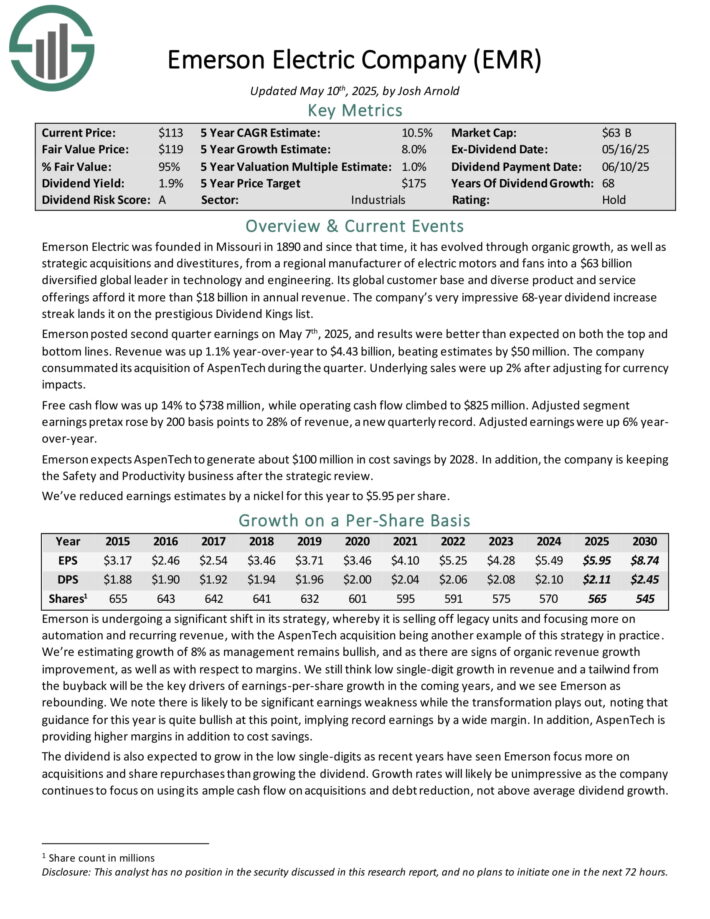

Longest Dividend Development Streak #7: Emerson Electrical Co. (EMR)

- Dividend Development Streak: 68 years

Emerson Electrical was based in Missouri in 1890 and since that point, it has advanced via natural progress, in addition to strategic acquisitions and divestitures, from a regional producer of electrical motors and followers right into a diversified international chief in expertise and engineering.

Its international buyer base and various product and repair choices afford it greater than $18 billion in annual income.

Emerson posted second quarter earnings on Could seventh, 2025, and outcomes had been higher than anticipated on each the highest and backside traces. Income was up 1.1% year-over-year to $4.43 billion, beating estimates by $50 million.

The corporate consummated its acquisition of AspenTech throughout the quarter. Underlying gross sales had been up 2% after adjusting for forex impacts.

Free money circulation was up 14% to $738 million, whereas working money circulation climbed to $825 million. Adjusted section earnings pretax rose by 200 foundation factors to twenty-eight% of income, a brand new quarterly report. Adjusted earnings had been up 6% year-over-year.

Emerson expects AspenTech to generate about $100 million in value financial savings by 2028. As well as, the corporate is conserving the Security and Productiveness enterprise after the strategic evaluate.

Click on right here to obtain our most up-to-date Positive Evaluation report on EMR (preview of web page 1 of three proven beneath):

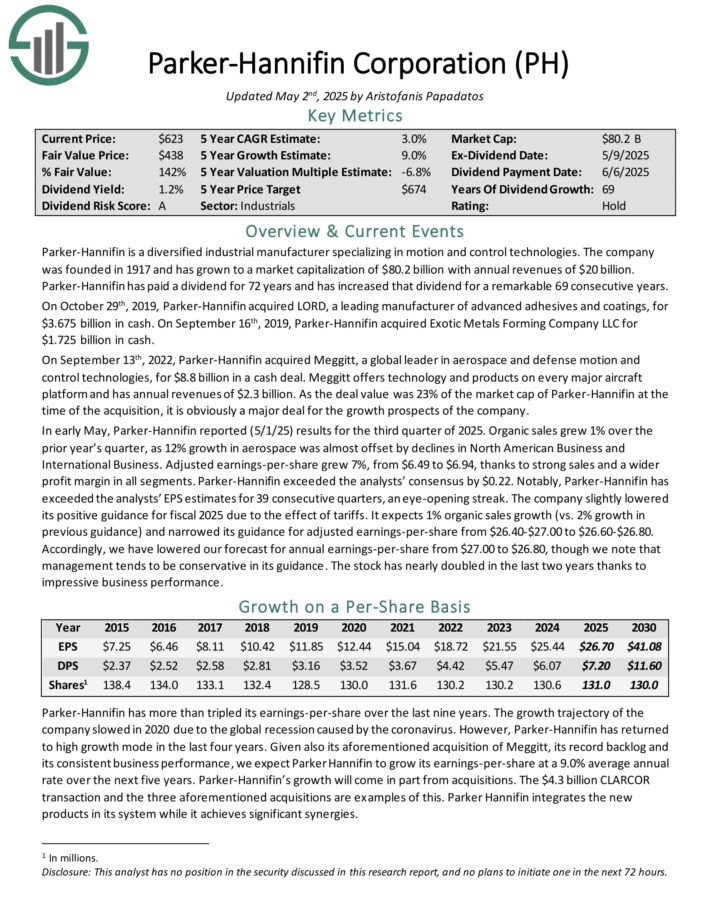

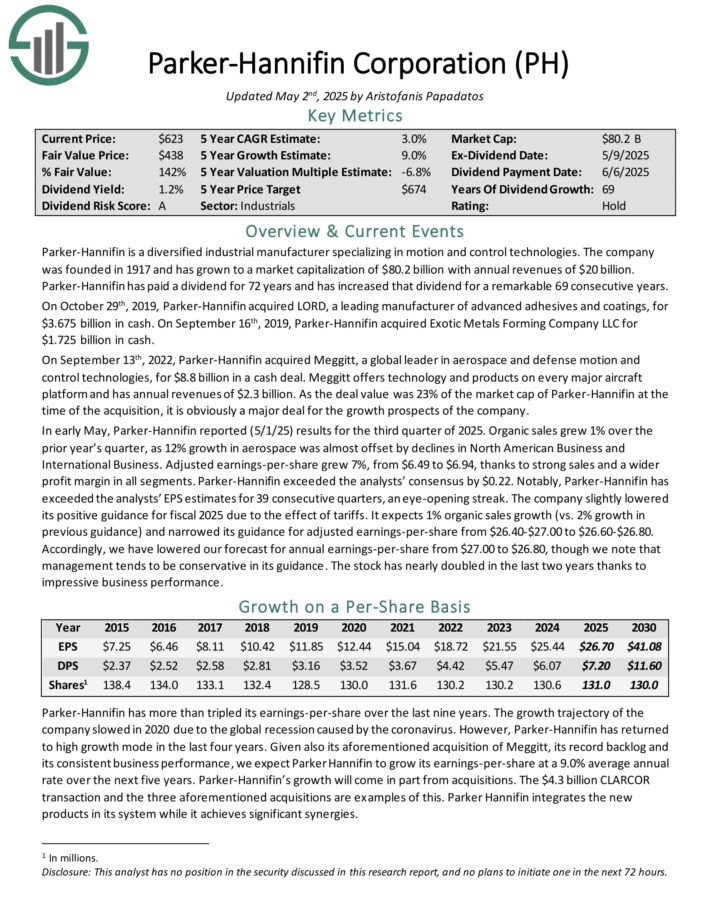

Longest Dividend Development Streak #6: Parker-Hannifin Corp. (PH)

- Dividend Development Streak: 69 years

Parker-Hannifin is a diversified industrial producer specializing in movement and management applied sciences. The corporate generates annual revenues of $20 billion.

Parker-Hannifin has elevated the dividend for 69 consecutive years.

Supply: Investor Presentation

In early Could, Parker-Hannifin reported (5/1/25) outcomes for the third quarter of 2025. Natural gross sales grew 1% over the prior yr’s quarter, as 12% progress in aerospace was nearly offset by declines in North American Enterprise and Worldwide Enterprise.

Adjusted earnings-per-share grew 7%, from $6.49 to $6.94, due to robust gross sales and a wider revenue margin in all segments.

Parker-Hannifin exceeded the analysts’ consensus by $0.22. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 39 consecutive quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on Parker-Hannifin (preview of web page 1 of three proven beneath):

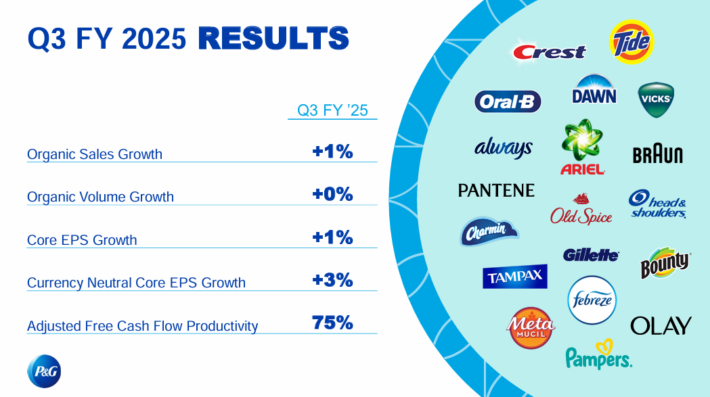

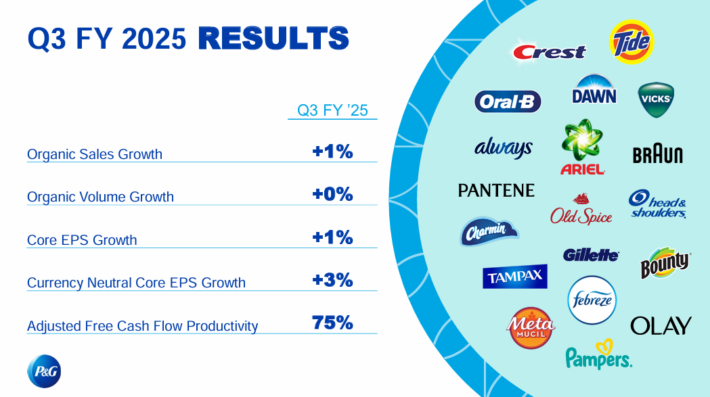

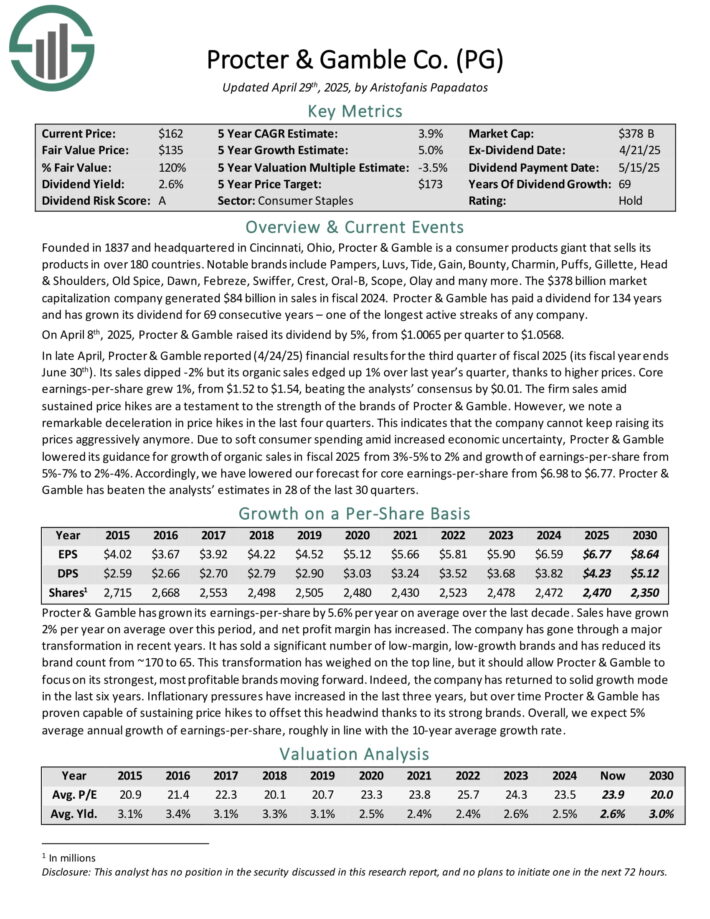

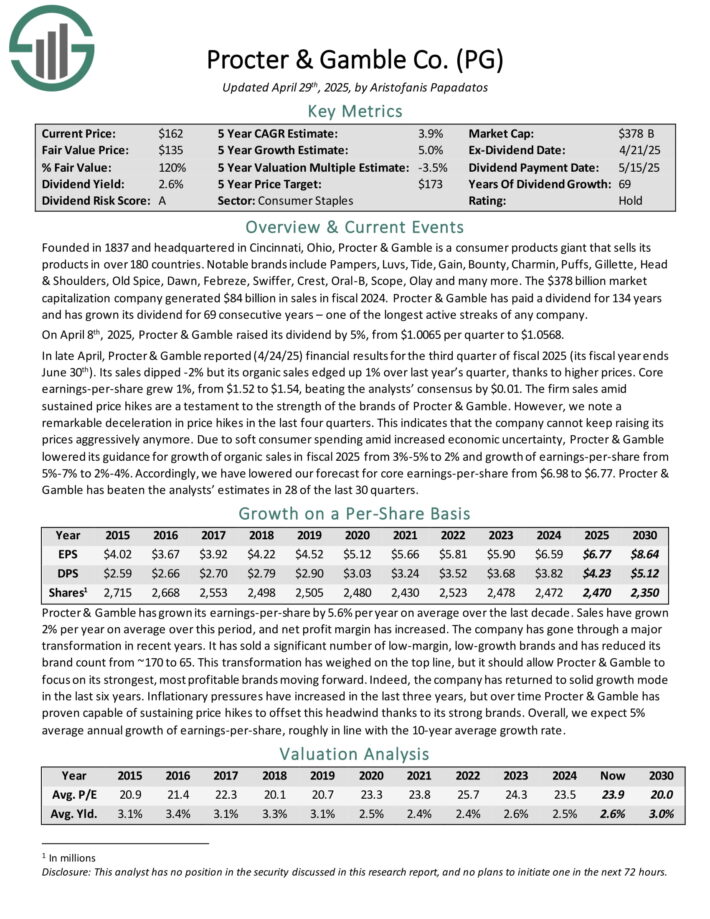

Longest Dividend Development Streak #5: Procter & Gamble Co. (PG)

- Dividend Development Streak: 69 years

Procter & Gamble is a client merchandise big that sells its merchandise in over 180 nations.

Notable manufacturers embrace Pampers, Luvs, Tide, Achieve, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Previous Spice, Daybreak, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and plenty of extra.

Procter & Gamble has paid a dividend for 134 years and has grown its dividend for 69 consecutive years – one of many longest lively streaks of any firm.

On April eighth, 2025, Procter & Gamble raised its dividend by 5%, from $1.0065 per quarter to $1.0568.

In late April, Procter & Gamble reported (4/24/25) monetary outcomes for the third quarter of fiscal 2025 (its fiscal yr ends June thirtieth).

Supply: Investor Presentation

Gross sales dipped -2% however its natural gross sales edged up 1% over final yr’s quarter, due to increased costs.

Core earnings-per-share grew 1%, from $1.52 to $1.54, beating the analysts’ consensus by $0.01. The agency gross sales amid sustained value hikes are a testomony to the energy of the manufacturers of Procter & Gamble.

Click on right here to obtain our most up-to-date Positive Evaluation report on PG (preview of web page 1 of three proven beneath):

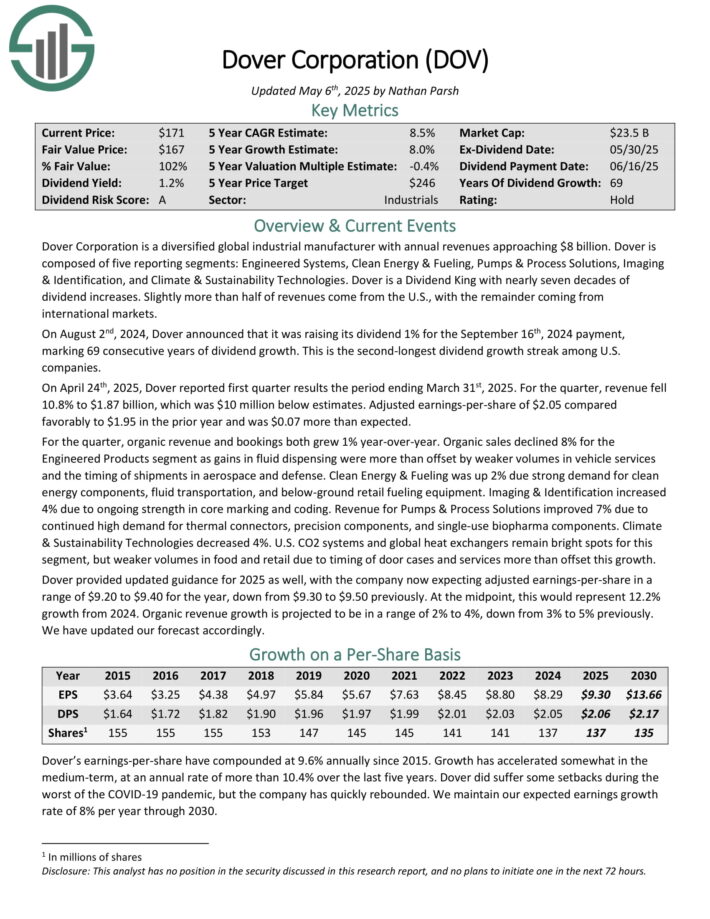

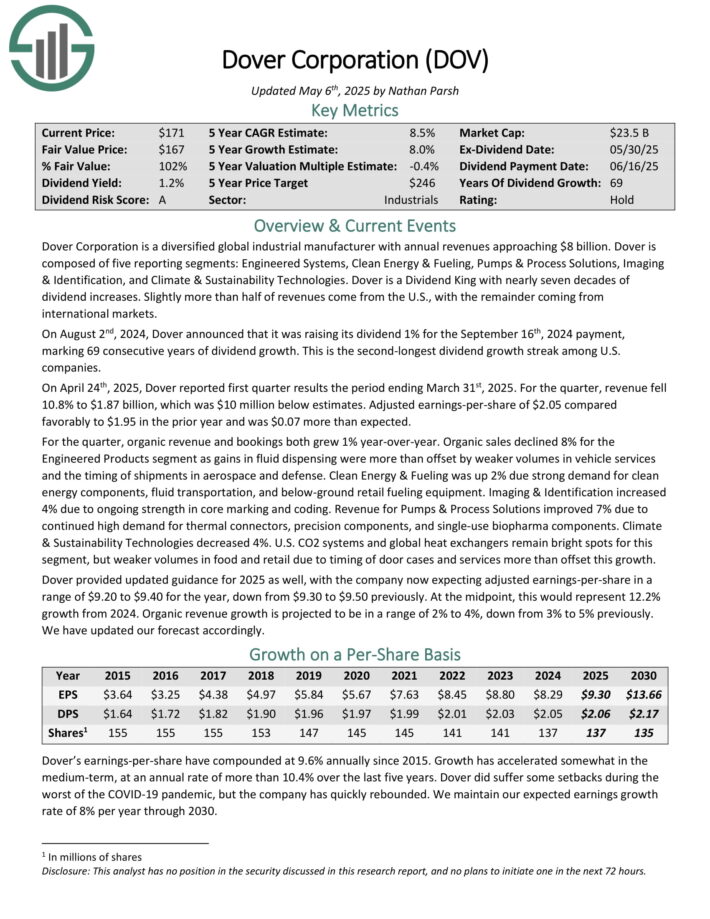

Longest Dividend Development Streak #4: Dover Corp. (DOV)

- Dividend Development Streak: 69 years

Dover Company is a diversified international industrial producer with annual revenues approaching $8 billion.

Dover consists of 5 reporting segments: Engineered Methods, Clear Power & Fueling, Pumps & Course of Options, Imaging & Identification, and Local weather & Sustainability Applied sciences.

On April twenty fourth, 2025, Dover reported first quarter outcomes the interval ending March thirty first, 2025. For the quarter, income fell 10.8% to $1.87 billion, which was $10 million beneath estimates.

Adjusted earnings-per-share of $2.05 in contrast favorably to $1.95 within the prior yr and was $0.07 greater than anticipated.

For the quarter, natural income and bookings each grew 1% year-over-year. Natural gross sales declined 8% for the Engineered Merchandise section as good points in fluid shelling out had been greater than offset by weaker volumes in car companies and the timing of shipments in aerospace and protection.

Dover offered up to date steering for 2025 as effectively, with the corporate now anticipating adjusted earnings-per-share in a spread of $9.20 to $9.40 for the yr. On the midpoint, this might characterize 12.2% progress from 2024. Natural income progress is projected to be in a spread of two% to 4%.

Click on right here to obtain our most up-to-date Positive Evaluation report on DOV (preview of web page 1 of three proven beneath):

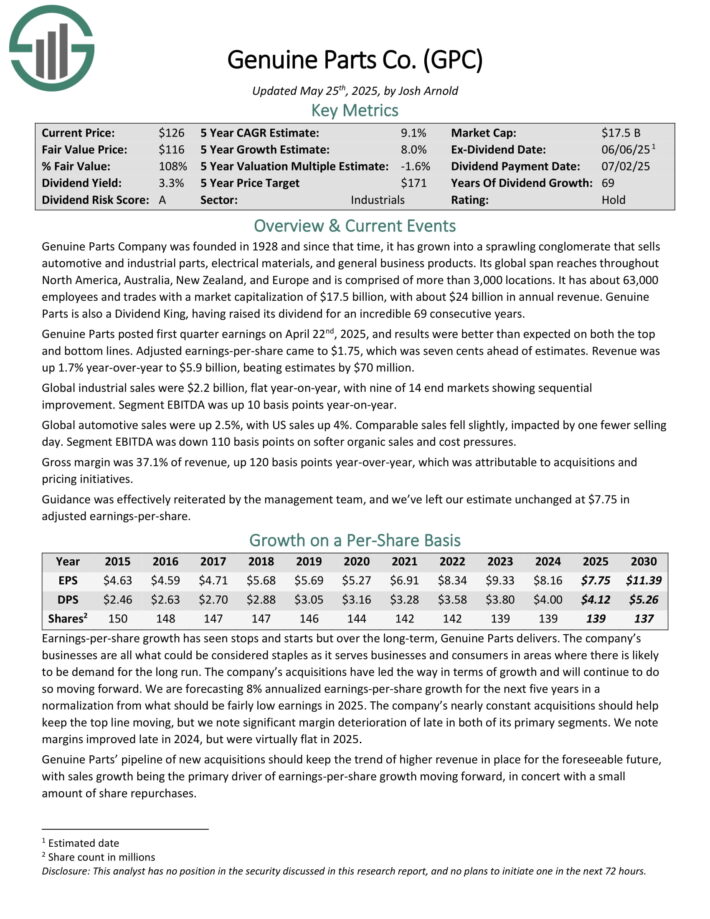

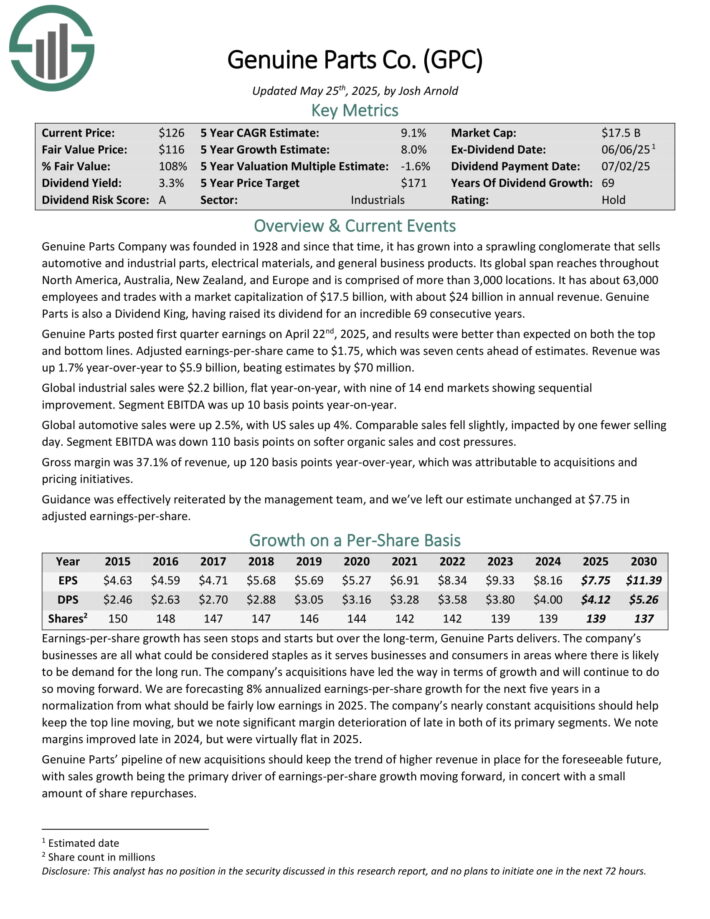

Longest Dividend Development Streak #3: Real Components Co. (GPC)

- Dividend Development Streak: 69 years

Real Components Firm was based in 1928 and since that point, it has grown right into a sprawling conglomerate that sells automotive and industrial elements, electrical supplies, and common enterprise merchandise.

Its international span reaches all through North America, Australia, New Zealand, and Europe and is comprised of greater than 3,000 places. It has about $24 billion in annual income.

Real Components posted first quarter earnings on April twenty second, 2025, and outcomes had been higher than anticipated on each the highest and backside traces.

Adjusted earnings-per-share got here to $1.75, which was seven cents forward of estimates. Income was up 1.7% year-over-year to $5.9 billion, beating estimates by $70 million.

International industrial gross sales had been $2.2 billion, flat year-on-year, with 9 of 14 finish markets displaying sequential enchancment. Phase EBITDA was up 10 foundation factors year-on-year.

International automotive gross sales had been up 2.5%, with US gross sales up 4%. Comparable gross sales fell barely, impacted by one fewer promoting day. Phase EBITDA was down 110 foundation factors on softer natural gross sales and price pressures.

Gross margin was 37.1% of income, up 120 foundation factors year-over-year, which was attributable to acquisitions and pricing initiatives.

Click on right here to obtain our most up-to-date Positive Evaluation report on GPC (preview of web page 1 of three proven beneath):

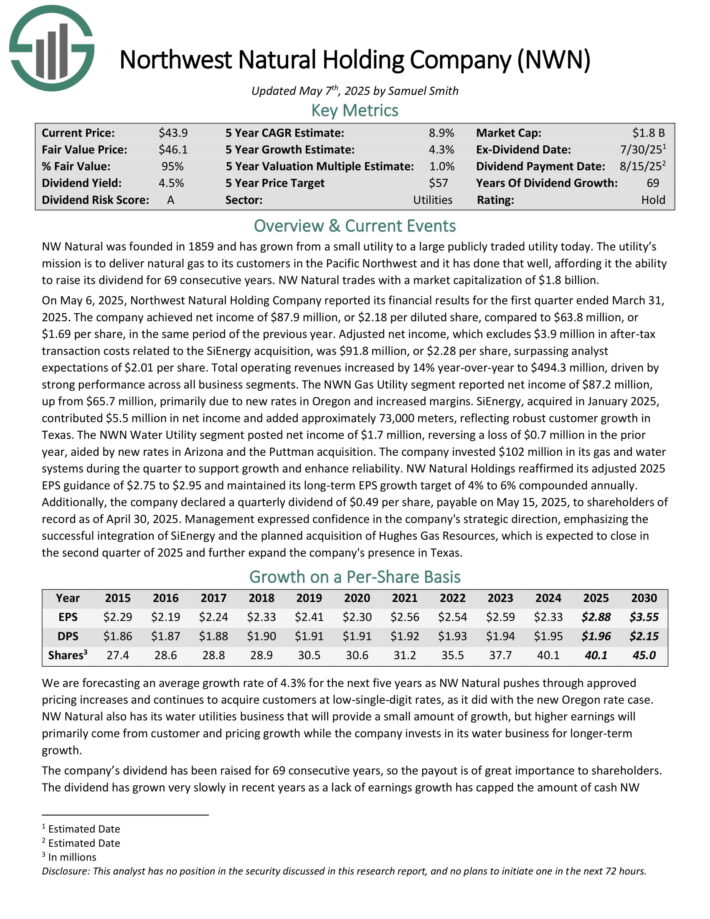

Longest Dividend Development Streak #2: Northwest Pure Holding (NWN)

- Dividend Development Streak: 69 years

NW Pure was based in 1859 and has grown from a small utility to a big publicly traded utility right this moment. The utility’s mission is to ship pure fuel to its clients within the Pacific Northwest.

On Could 6, 2025, Northwest Pure Holding Firm reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved web revenue of $87.9 million, or $2.18 per diluted share, in comparison with $63.8 million, or $1.69 per share, in the identical interval of the earlier yr.

Adjusted web revenue, which excludes $3.9 million in after-tax transaction prices associated to the SiEnergy acquisition, was $91.8 million, or $2.28 per share, surpassing analyst expectations of $2.01 per share. Whole working revenues elevated by 14% year-over-year to $494.3 million, pushed by robust efficiency throughout all enterprise segments.

The NWN Fuel Utility section reported web revenue of $87.2 million, up from $65.7 million, primarily resulting from new charges in Oregon and elevated margins. SiEnergy, acquired in January 2025, contributed $5.5 million in web revenue and added roughly 73,000 meters, reflecting sturdy buyer progress in Texas.

The NWN Water Utility section posted web revenue of $1.7 million, reversing a lack of $0.7 million within the prior yr, aided by new charges in Arizona and the Puttman acquisition.

NW Pure Holdings reaffirmed its adjusted 2025 EPS steering of $2.75 to $2.95.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven beneath):

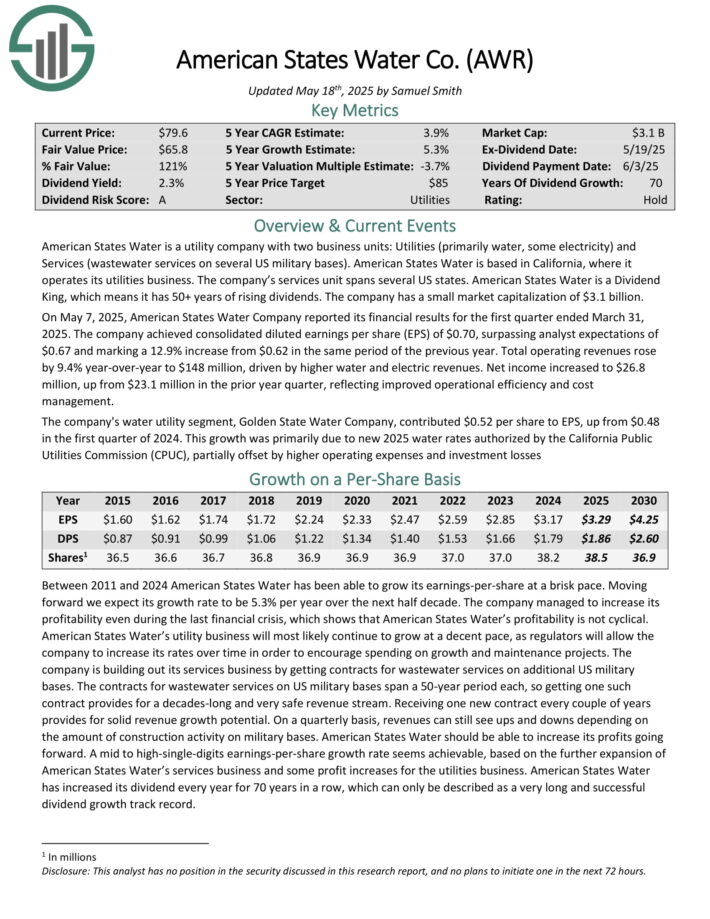

Longest Dividend Development Streak #1: American States Water (AWR)

- Dividend Development Streak: 70 years

American States Water is a utility firm with two enterprise models: Utilities (primarily water, some electrical energy) and Providers (wastewater companies on a number of US army bases).

American States Water is predicated in California, the place it operates its utilities enterprise. The corporate’s companies unit spans a number of US states.

On Could 7, 2025, American States Water Firm reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved consolidated diluted earnings per share (EPS) of $0.70, surpassing analyst expectations of $0.67 and marking a 12.9% improve from $0.62 in the identical interval of the earlier yr.

Whole working revenues rose by 9.4% year-over-year to $148 million, pushed by increased water and electrical revenues. Internet revenue elevated to $26.8 million, up from $23.1 million within the prior yr quarter, reflecting improved operational effectivity and price administration.

The corporate’s water utility section, Golden State Water Firm, contributed $0.52 per share to EPS, up from $0.48 within the first quarter of 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on AWR (preview of web page 1 of three proven beneath):

Further Studying

The Dividend Kings checklist just isn’t the one method to rapidly display for shares that often pay rising dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

:max_bytes(150000):strip_icc()/Health-GettyImages-1163723632-780d7541a140489594c99fe9001f3f79.jpg)