Revealed on October twenty eighth, 2025 by Bob Ciura

Most traders focus totally on the expansion prospects of shares as a way to establish probably the most enticing holdings for his or her portfolios.

Nonetheless, valuation is equally necessary. When market sentiment turns adverse for a inventory resulting from a brief headwind, its valuation might develop into too low-cost.

When the headwind subsides, the valuation of the inventory is prone to revert to regular ranges.

Consequently, traders may doubtlessly earn important whole returns by buying high quality dividend development shares, when they’re low-cost.

The Dividend Kings are a choose group of 56 shares which have elevated their dividends for a minimum of 50 consecutive years.

We created a full record of all 56 Dividend Kings.

You may obtain the complete record, together with necessary monetary metrics akin to dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Shares with low P/E ratios can provide enticing returns if their valuation multiples broaden.

And when a low P/E inventory additionally has a market-beating dividend yield, traders get ‘paid to attend’ for the valuation a number of to extend.

This text will focus on the ten most cost-effective Dividend Kings proper now.

Desk of Contents

The desk of contents under permits for simple navigation. The shares are listed by 5-year annual return anticipated from an increasing valuation a number of, in ascending order.

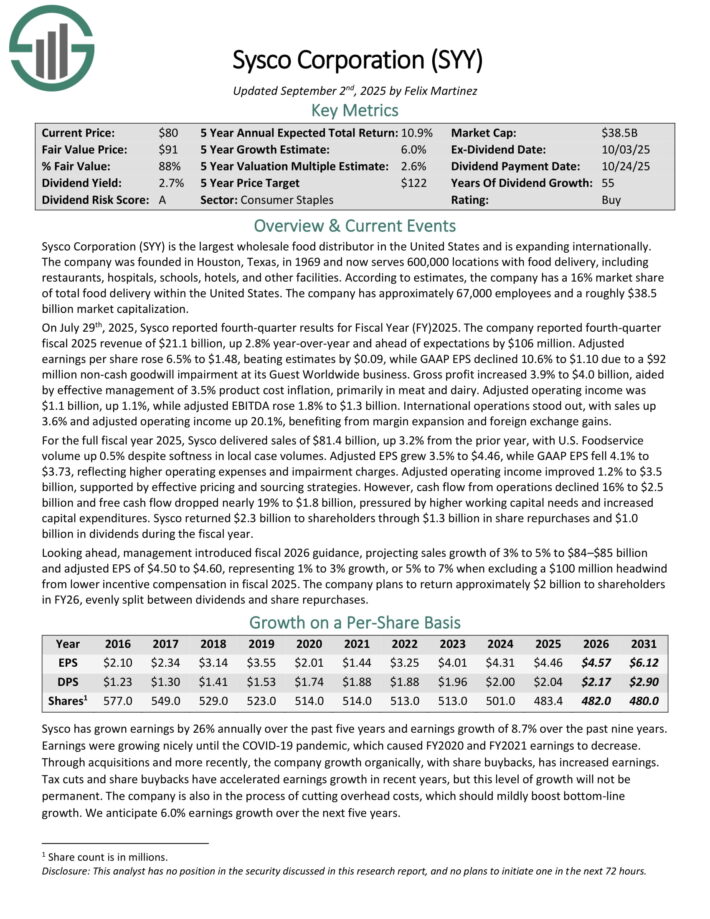

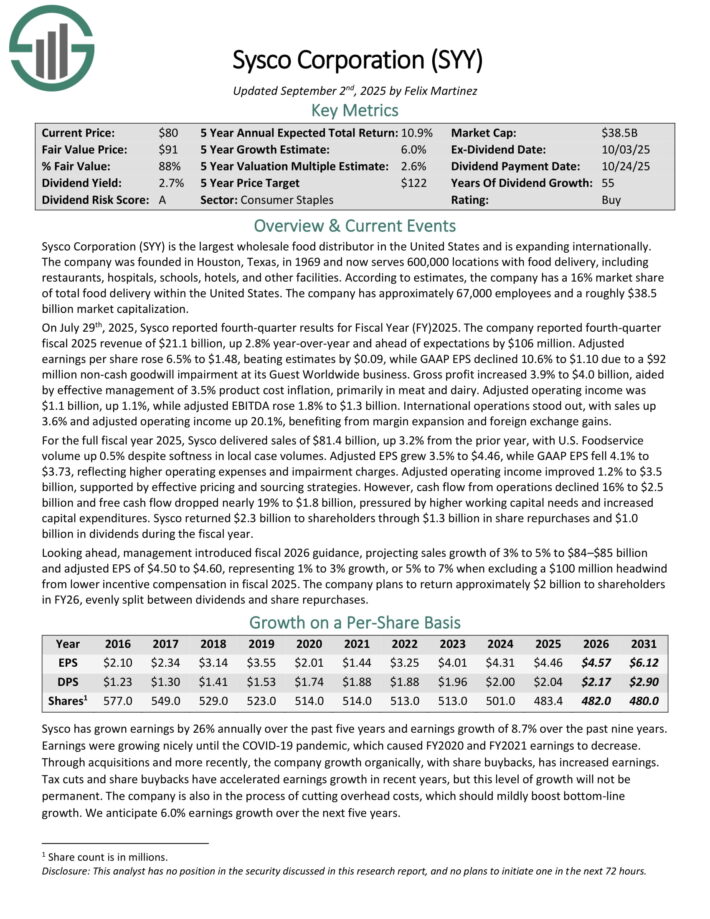

Least expensive Dividend King: Sysco Corp. (SYY)

- Annual Valuation Return: 2.6%

Sysco Company (SYY) is the most important wholesale meals distributor in the US and is increasing internationally.

The corporate was based in Houston, Texas, in 1969 and now serves 600,000 areas with meals supply, together with

eating places, hospitals, colleges, lodges, and different amenities. In response to estimates, the corporate has a 16% market share

of whole meals supply inside the US.

On July twenty ninth, 2025, Sysco reported fourth-quarter outcomes for Fiscal 12 months (FY) 2025. The corporate reported fourth quarter fiscal 2025 income of $21.1 billion, up 2.8% year-over-year and forward of expectations by $106 million.

Adjusted earnings per share rose 6.5% to $1.48, beating estimates by $0.09, whereas GAAP EPS declined 10.6% to $1.10 resulting from a $92 million non-cash goodwill impairment at its Visitor Worldwide enterprise. Gross revenue elevated 3.9% to $4.0 billion, aided by efficient administration of three.5% product value inflation, primarily in meat and dairy.

Adjusted working revenue was $1.1 billion, up 1.1%, whereas adjusted EBITDA rose 1.8% to $1.3 billion. Worldwide operations stood out, with gross sales up 3.6% and adjusted working revenue up 20.1%, benefiting from margin growth and overseas alternate positive aspects.

For the complete fiscal yr 2025, Sysco delivered gross sales of $81.4 billion, up 3.2% from the prior yr, with U.S. Foodservice quantity up 0.5% regardless of softness in native case volumes.

Adjusted EPS grew 3.5% to $4.46, whereas GAAP EPS fell 4.1% to $3.73, reflecting increased working bills and impairment fees. Adjusted working revenue improved 1.2% to $3.5 billion, supported by efficient pricing and sourcing methods.

Money movement from operations declined 16% to $2.5 billion and free money movement dropped almost 19% to $1.8 billion, pressured by increased working capital wants and elevated capital expenditures.

Sysco returned $2.3 billion to shareholders by $1.3 billion in share repurchases and $1.0 billion in dividends throughout the fiscal yr.

Wanting forward, administration launched fiscal 2026 steering, projecting gross sales development of three% to five% to $84–$85 billion and adjusted EPS of $4.50 to $4.60, representing 1% to three% development, or 5% to 7% when excluding a $100 million headwind from decrease incentive compensation in fiscal 2025.

The corporate plans to return roughly $2 billion to shareholders in FY26, evenly cut up between dividends and share repurchases.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYY (preview of web page 1 of three proven under):

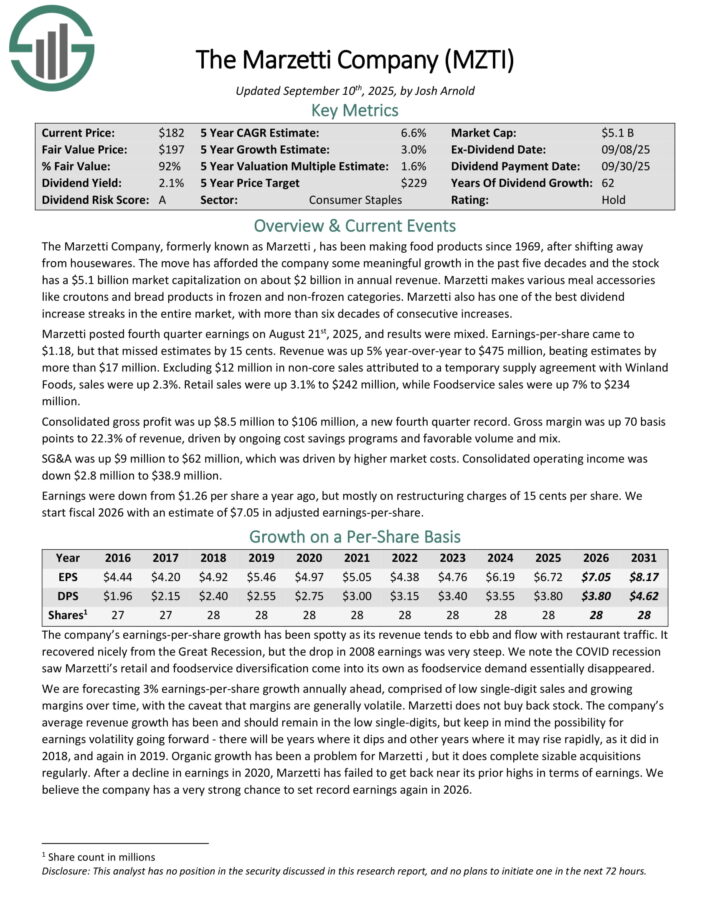

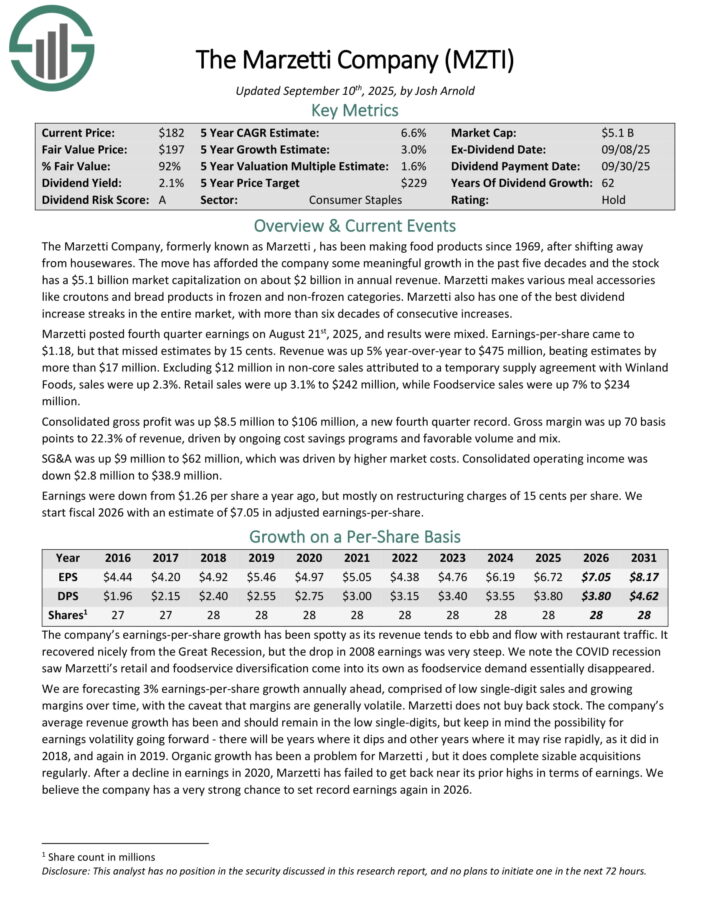

Least expensive Dividend King: The Marzetti Firm (MZTI)

- Annual Valuation Return: 3.7%

The Marzetti Firm has been making meals merchandise since 1969, after shifting away from housewares.

Marzetti makes varied meal equipment like croutons and bread merchandise in frozen and non-frozen classes. Marzetti additionally has top-of-the-line dividend improve streaks in the whole market, with greater than six a long time of consecutive will increase.

Marzetti posted fourth quarter earnings on August twenty first, 2025, and outcomes had been combined. Earnings-per-share got here to $1.18, however that missed estimates by 15 cents. Income was up 5% year-over-year to $475 million, beating estimates by greater than $17 million.

Excluding $12 million in non-core gross sales attributed to a brief provide settlement with Winland Meals, gross sales had been up 2.3%. Retail gross sales had been up 3.1% to $242 million, whereas Foodservice gross sales had been up 7% to $234 million.

Consolidated gross revenue was up $8.5 million to $106 million, a brand new fourth quarter report. Gross margin was up 70 foundation factors to 22.3% of income, pushed by ongoing value financial savings packages and favorable quantity and blend.

SG&A was up $9 million to $62 million, which was pushed by increased market prices. Consolidated working revenue was down $2.8 million to $38.9 million.

Earnings had been down from $1.26 per share a yr in the past, however totally on restructuring fees of 15 cents per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on MZTI (preview of web page 1 of three proven under):

Least expensive Dividend King: Tennant Co. (TNC)

- Annual Valuation Return: 4.3%

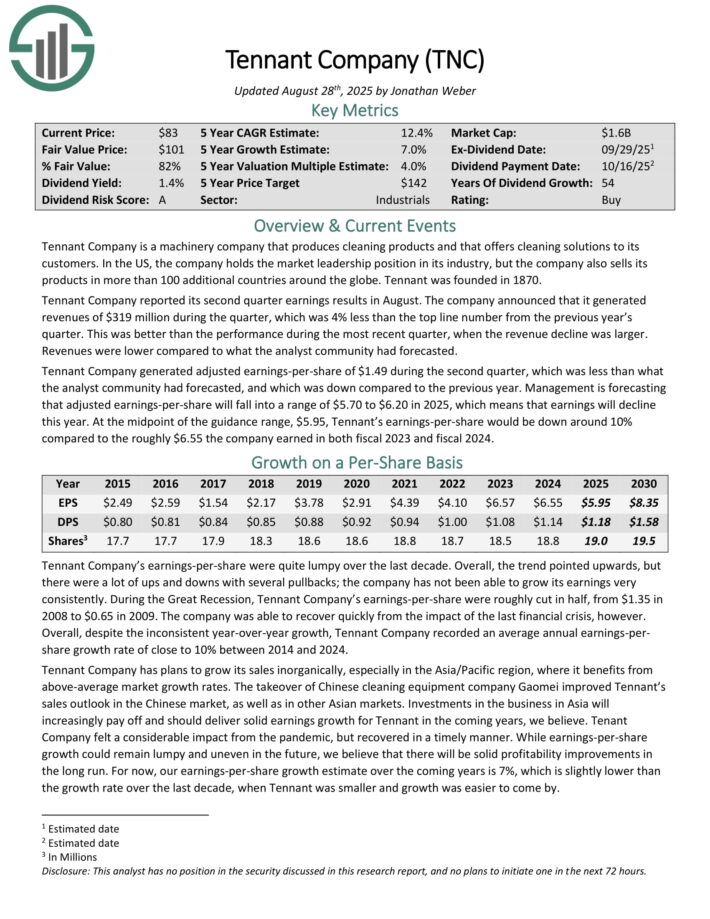

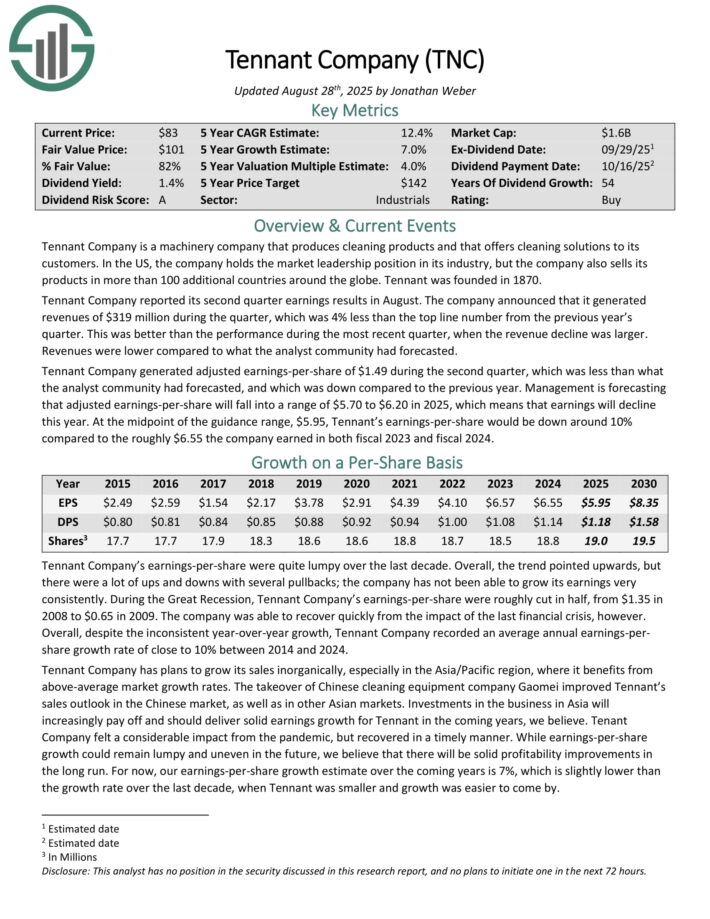

Tennant Firm is a equipment firm that produces cleansing merchandise and that gives cleansing options to its clients.

Within the US, the corporate holds the market management place in its business, however the firm additionally sells its merchandise in additional than 100 extra international locations across the globe. Tennant was based in 1870.

Tennant Firm reported its second quarter earnings ends in August. The corporate introduced that it generated revenues of $319 million throughout the quarter, which was 4% lower than the highest line quantity from the earlier yr’s quarter.

This was higher than the efficiency throughout the latest quarter, when the income decline was bigger. Revenues had been decrease in comparison with what the analyst group had forecasted.

Tennant Firm generated adjusted earnings-per-share of $1.49 throughout the second quarter, which was lower than what the analyst group had forecasted, and which was down in comparison with the earlier yr.

Administration is forecasting that adjusted earnings-per-share will fall into a variety of $5.70 to $6.20 in 2025, which implies that earnings will decline this yr. On the midpoint of the steering vary, $5.95, Tennant’s earnings-per-share could be down round 10%.

Click on right here to obtain our most up-to-date Certain Evaluation report on TNC (preview of web page 1 of three proven under):

Least expensive Dividend King: Hormel Meals (HRL)

- Annual Valuation Return: 4.8%

Hormel was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with almost $10 billion in annual income.

Hormel has saved with its core competency as a processor of meat merchandise for properly over 100 years, however has additionally grown into different enterprise traces by acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Just some of its prime manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

Hormel posted third quarter earnings on August twenty eighth, 2025, and outcomes had been very weak, together with disappointing steering for the fourth quarter.

Adjusted earnings-per-share got here to 35 cents, which was six cents gentle of estimates. Income was up 4.5% year-over-year to $3.03 billion, beating estimates by $50 million. Natural internet gross sales had been up 6% year-over-year on quantity positive aspects of 4%, with worth and blend comprising the opposite 2%.

The corporate additionally famous its value financial savings program is working and serving to save about $125 million yearly. Gross revenue was flat year-on-year, with inflationary headwinds offset by prime line positive aspects. The corporate famous 400 foundation factors of uncooked materials value inflation, a large headwind to margins.

Money movement from operations had been $157 million, whereas capex was $72 million, and dividends paid had been $159 million. Steering for This autumn was for internet gross sales of ~$3.2 billion, about $50 million gentle of consensus. Earnings are anticipated at ~39 cents.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven under):

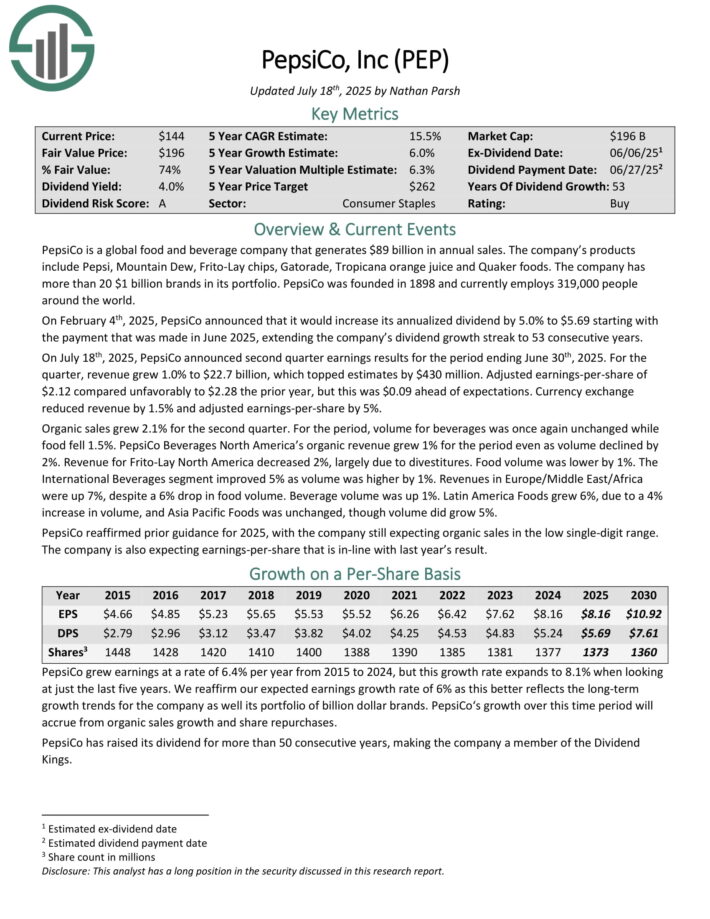

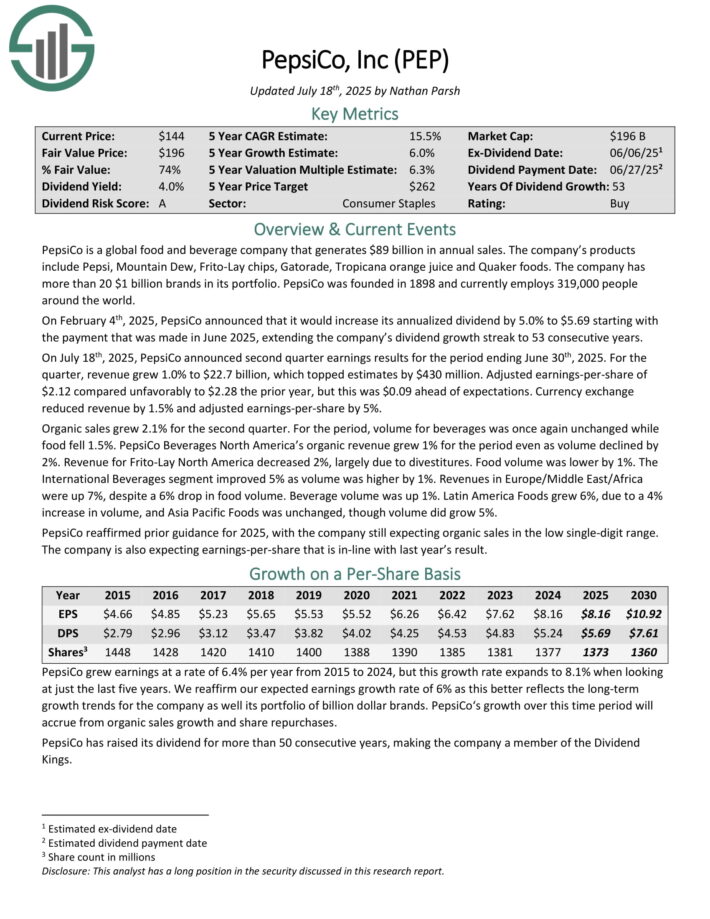

Least expensive Dividend King: PepsiCo Inc. (PEP)

- Annual Valuation Return: 5.1%

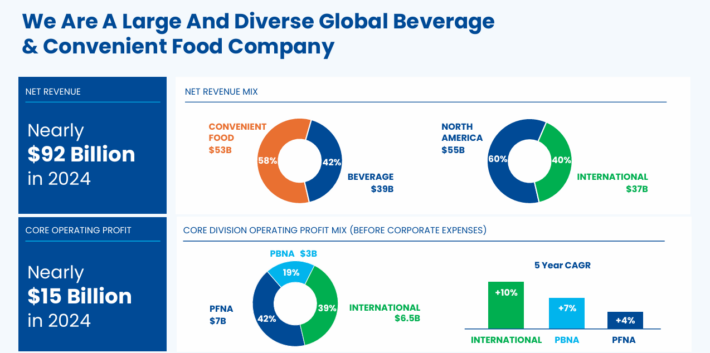

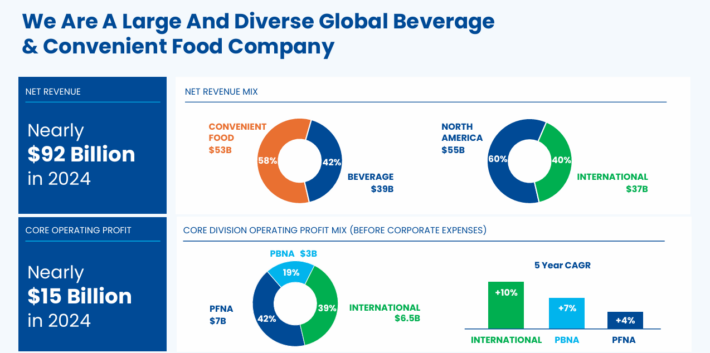

PepsiCo is a world meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is cut up roughly 60-40 when it comes to meals and beverage income. Additionally it is balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July 18th, 2025, PepsiCo introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 in contrast unfavorably to $2.28 the prior yr, however this was $0.09 forward of expectations. Foreign money alternate diminished income by 1.5% and adjusted earnings-per-share by 5%.

Natural gross sales grew 2.1% for the second quarter. For the interval, quantity for drinks was as soon as once more unchanged whereas meals fell 1.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven under):

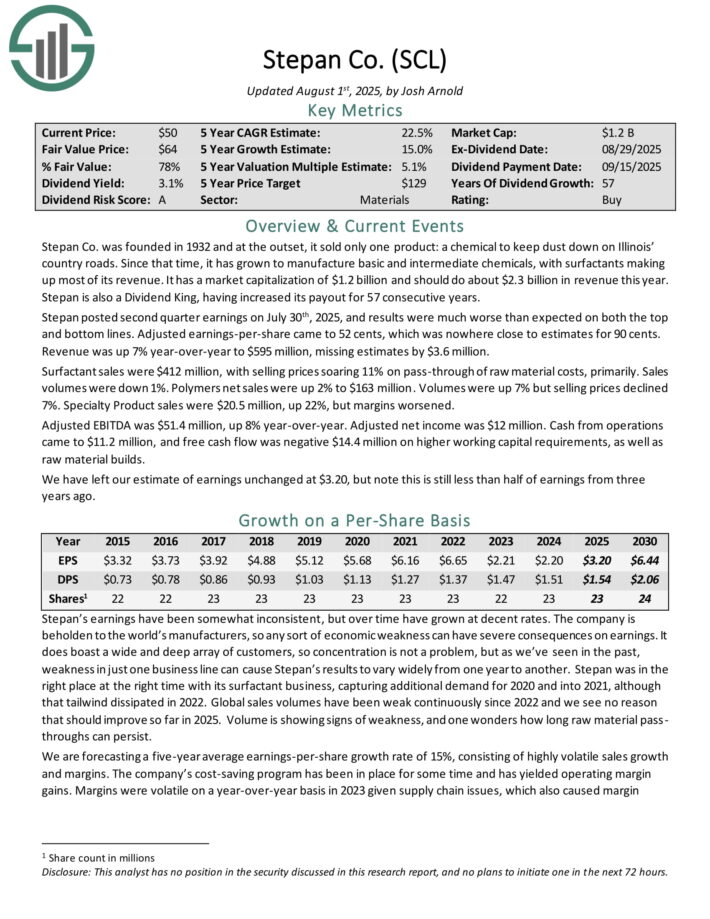

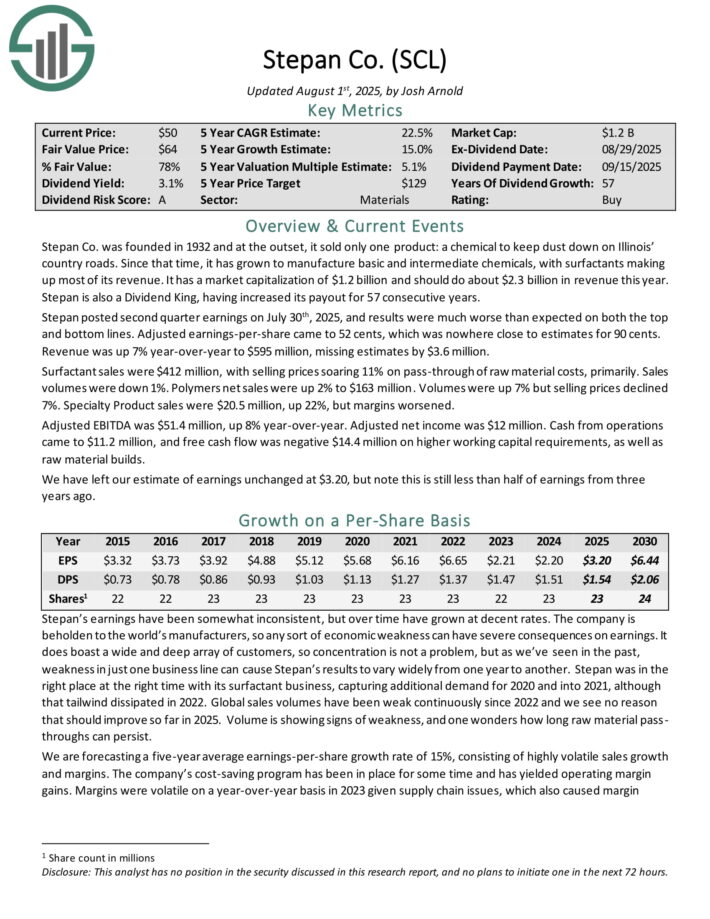

Least expensive Dividend King: Stepan Co. (SCL)

- Annual Valuation Return: 7.1%

Stepan manufactures fundamental and intermediate chemical compounds, together with surfactants, specialty merchandise, germicidal and material softening quaternaries, phthalic anhydride, polyurethane polyols and particular elements for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise traces: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets.

The surfactants enterprise is Stepan’s largest by income. A surfactant is an natural compound that accommodates each water-soluble and water-insoluble parts.

Stepan posted second quarter earnings on July thirtieth, 2025, and outcomes had been a lot worse than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 52 cents, which was nowhere near estimates for 90 cents. Income was up 7% year-over-year to $595 million, lacking estimates by $3.6 million.

Surfactant gross sales had been $412 million, with promoting costs hovering 11% on pass-through of uncooked materials prices, primarily. Gross sales volumes had been down 1%. Polymers internet gross sales had been up 2% to $163 million. Volumes had been up 7% however promoting costs declined 7%. Specialty Product gross sales had been $20.5 million, up 22%, however margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted internet revenue was $12 million. Money from operations got here to $11.2 million, and free money movement was adverse $14.4 million on increased working capital necessities, in addition to uncooked materials builds.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCL (preview of web page 1 of three proven under):

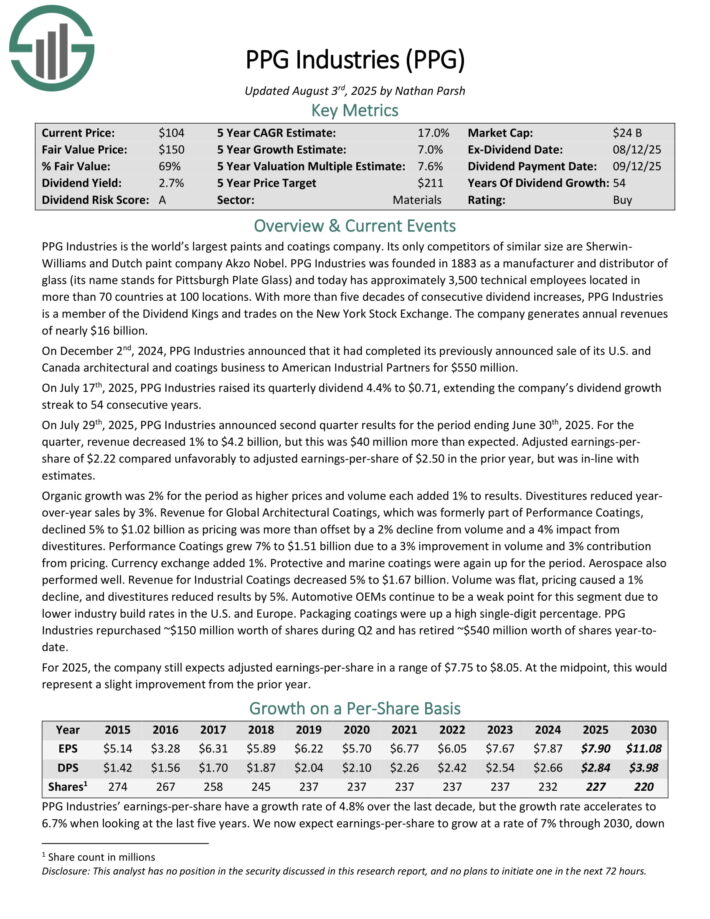

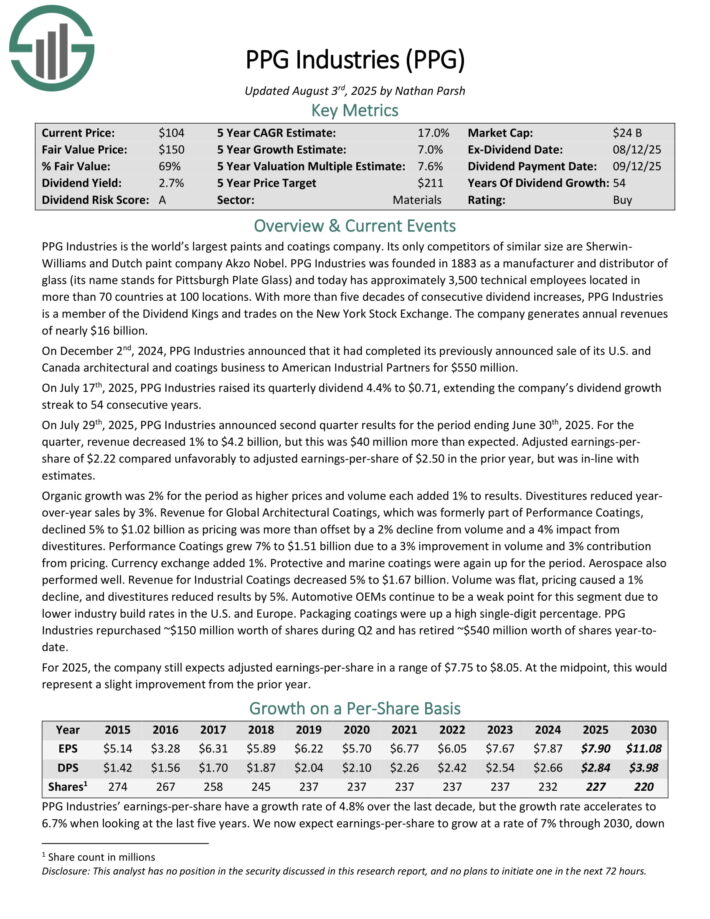

Least expensive Dividend King: PPG Industries (PPG)

- Annual Valuation Return: 7.3%

PPG Industries is the world’s largest paints and coatings firm. Its solely opponents of comparable measurement are Sherwin-Williams and Dutch paint firm Akzo Nobel.

PPG Industries was based in 1883 as a producer and distributor of glass (its identify stands for Pittsburgh Plate Glass) and at the moment has roughly 3,500 technical workers positioned in additional than 70 international locations at 100 areas.

On July seventeenth, 2025, PPG Industries raised its quarterly dividend 4.4% to $0.71, extending the corporate’s dividend development streak to 54 consecutive years.

On July twenty ninth, 2025, PPG Industries introduced second-quarter outcomes. For the quarter, income decreased 1% to $4.2 billion, however this was $40 million greater than anticipated. Adjusted earnings-per-share of $2.22 in contrast unfavorably to adjusted earnings-per-share of $2.50 within the prior yr, however was in-line with estimates.

Natural development was 2% for the interval as increased costs and quantity every added 1% to outcomes. Divestitures diminished year-over-year gross sales by 3%. Income for World Architectural Coatings declined 5% to $1.02 billion as pricing was greater than offset by a 2% decline from quantity and a 4% impression from divestitures.

Efficiency Coatings grew 7% to $1.51 billion resulting from a 3% enchancment in quantity and three% contribution from pricing. Foreign money alternate added 1%. Protecting and marine coatings had been once more up for the interval.

PPG Industries repurchased ~$150 million price of shares throughout Q2 and has retired ~$540 million price of shares year-to-date.

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven under):

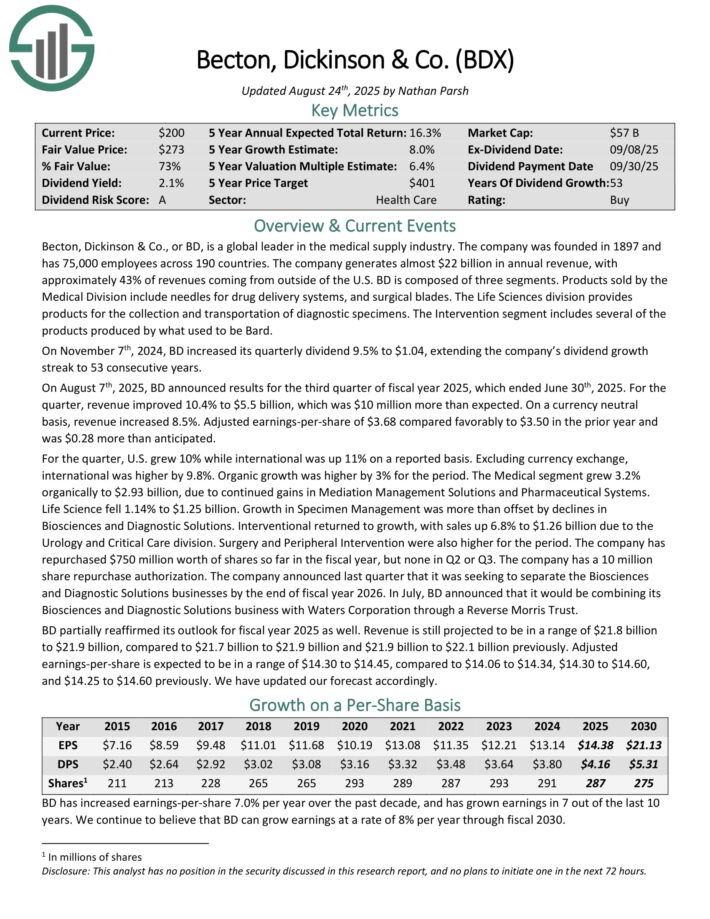

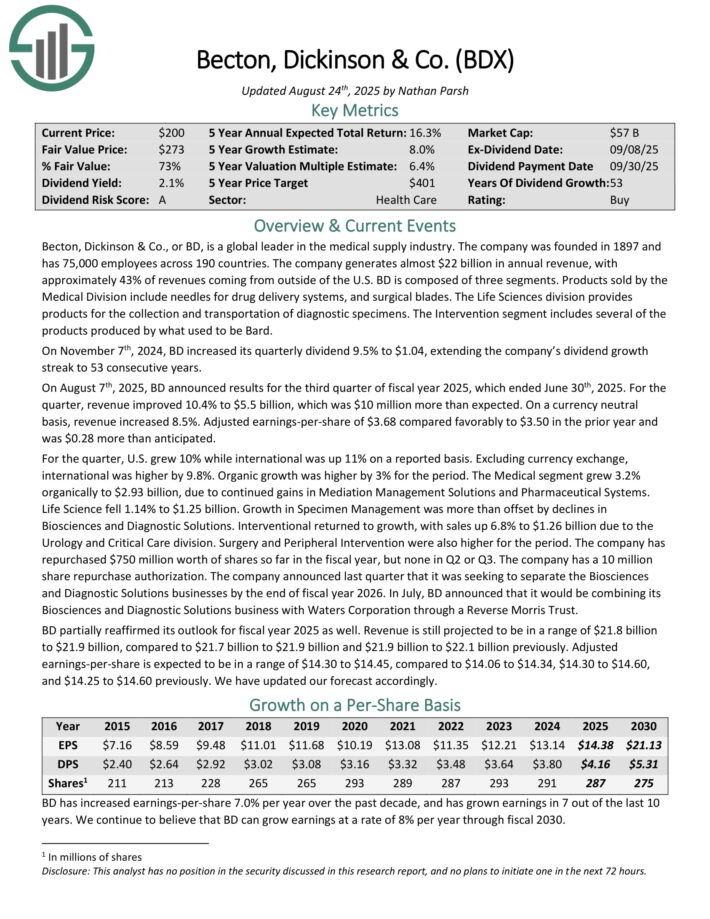

Least expensive Dividend King: Becton Dickinson & Co. (BDX)

- Annual Valuation Return: 7.9%

Becton, Dickinson & Co. is a world chief within the medical provide business. The corporate was based in 1897 and has 75,000 workers throughout 190 international locations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

Becton, Dickinson & Co., or BD, is a world chief within the medical provide business. The corporate generates virtually $22 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

On August seventh, 2025, BD introduced outcomes for the third quarter of fiscal yr 2025, which ended June thirtieth, 2025. For the quarter, income improved 10.4% to $5.5 billion, which was $10 million greater than anticipated.

On a forex impartial foundation, income elevated 8.5%. Adjusted earnings-per-share of $3.68 in contrast favorably to $3.50 within the prior yr and was $0.28 greater than anticipated.

For the quarter, U.S. grew 10% whereas worldwide was up 11% on a reported foundation. Excluding forex alternate, worldwide was increased by 9.8%. Natural development was increased by 3% for the interval.

BD partially reaffirmed its outlook for fiscal yr 2025 as properly. Income continues to be projected to be in a variety of $21.8 billion to $21.9 billion, in comparison with $21.7 billion to $21.9 billion beforehand. Adjusted earnings-per-share is anticipated to be in a variety of $14.30 to $14.45.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDX (preview of web page 1 of three proven under):

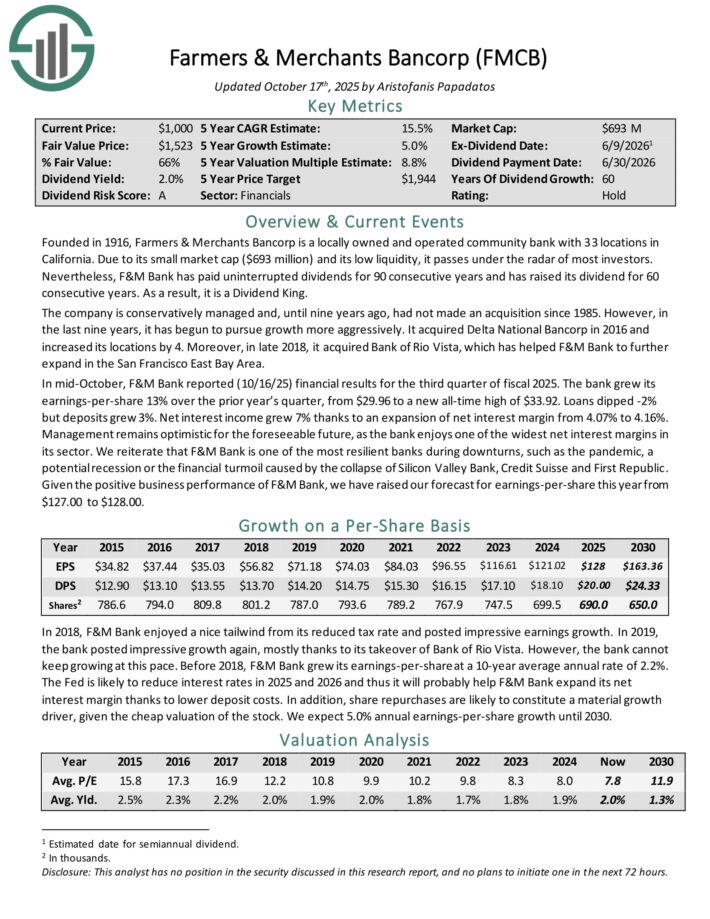

Least expensive Dividend King: Farmers & Retailers Bancorp (FMCB)

- Annual Valuation Return: 8.3%

Based in 1916, Farmers & Retailers Bancorp is a domestically owned and operated group financial institution with 33 areas in California. As a consequence of its small market cap and its low liquidity, it passes below the radar of most traders.

Nonetheless, F&M Financial institution has paid uninterrupted dividends for 90 consecutive years and has raised its dividend for 60 consecutive years. Consequently, it’s a Dividend King.

The corporate is conservatively managed and, till 9 years in the past, had not made an acquisition since 1985. Nonetheless, within the final 9 years, it has begun to pursue development extra aggressively.

It acquired Delta Nationwide Bancorp in 2016 and elevated its areas by 4. Furthermore, in late 2018, it acquired Financial institution of Rio Vista, which has helped F&M Financial institution to additional broaden within the San Francisco East Bay Space.

In mid-October, F&M Financial institution reported (10/16/25) monetary outcomes for the third quarter of fiscal 2025. The financial institution grew its earnings-per-share 13% over the prior yr’s quarter, from $29.96 to a brand new all-time excessive of $33.92. Loans dipped -2% however deposits grew 3%. Web curiosity revenue grew 7% due to an growth of internet curiosity margin from 4.07% to 4.16%.

Click on right here to obtain our most up-to-date Certain Evaluation report on FMCB (preview of web page 1 of three proven under):

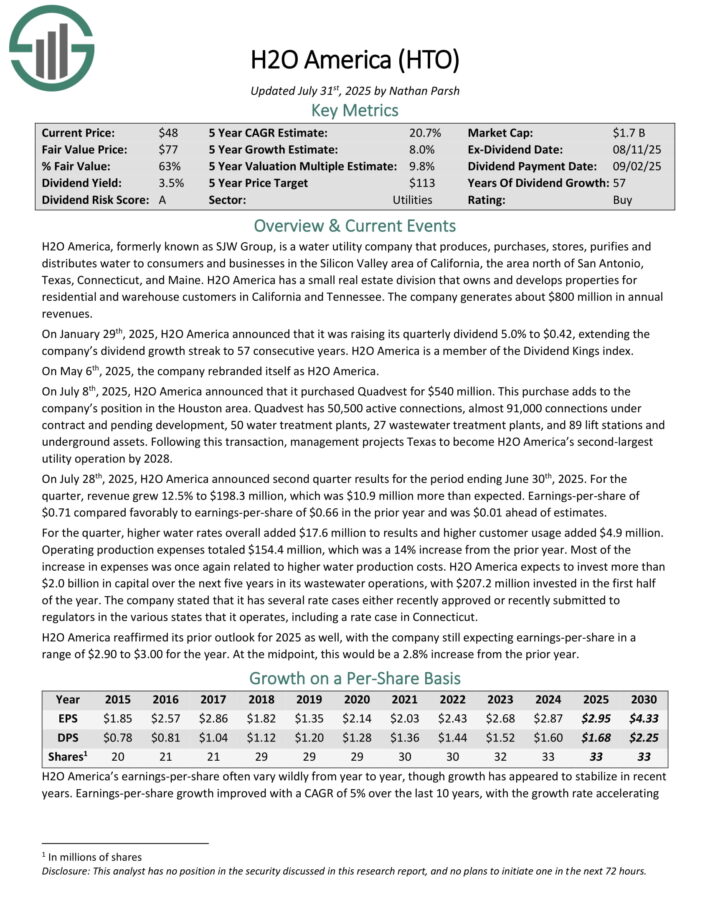

Least expensive Dividend King: H2O America (HTO)

- Annual Valuation Return: 9.0%

H2O America, previously generally known as SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the world north of San Antonio, Texas, Connecticut, and Maine.

It additionally has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

On July eighth, 2025, H2O America introduced that it bought Quadvest for $540 million. This buy provides to the corporate’s place within the Houston space.

Quadvest has 50,500 lively connections, virtually 91,000 connections below contract and pending improvement, 50 water therapy vegetation, 27 wastewater therapy vegetation, and 89 elevate stations and underground belongings.

On July twenty eighth, 2025, H2O America introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 12.5% to $198.3 million, which was $10.9 million greater than anticipated.

Earnings-per-share of $0.71 in contrast favorably to earnings-per-share of $0.66 within the prior yr and was $0.01 forward of estimates.

For the quarter, increased water charges total added $17.6 million to outcomes and better buyer utilization added $4.9 million. Working manufacturing bills totaled $154.4 million, which was a 14% improve from the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on HTO (preview of web page 1 of three proven under):

Extra Studying

The next Certain Dividend databases include probably the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].