wellesenterprises

I do not learn about you, however to me, one of the attention-grabbing issues in regards to the market is watching situations the place share costs considerably diverge from fundamentals. As a long-oriented worth investor, I like discovering alternatives the place an organization is buying and selling at a big low cost to its intrinsic worth. However there’s additionally a sure morbid fascination that I’ve with seeing the alternative, which might be a case the place an organization is drastically overpriced.

One such instance of this may be seen by taking a look at electrical car producer Tesla (NASDAQ:TSLA). And the scenario relating to the corporate has change into much more extreme over the previous couple of months. You see, since I final rated the corporate a ‘promote’ again in April of this 12 months, shares have skyrocketed by 35.6%. That is nicely above the 7% enhance seen by the S&P 500 over the identical window of time. Nevertheless, it’s price mentioning that since I initially rated it a ‘promote’ in June of 2023, the inventory remains to be down 9.3% whereas the S&P 500 has soared by 23.9%.

The current upswing seen by shares is perhaps considered by buyers as an indication that the image for the enterprise is popping round. However primarily based alone observations, the alternative is true. The market is getting overly enthusiastic about an organization that’s not solely struggling, however that can probably proceed to wrestle much more shifting ahead. Along with this, vital issues over the standard and incentives of Elon Musk ought to stoke in buyers much more fears. In mild of all of this, I’ve determined to take and much more aggressive step myself by downgrading the inventory from a ‘promote’ to a ‘sturdy promote’. It is a designation that I assigned shares that both have vital elementary or authorized points, or which can be buying and selling at large premiums in comparison with what you’d anticipate.

The image is worsening

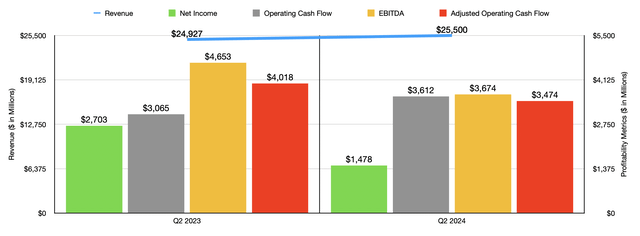

Essentially talking, issues should not going nicely for Tesla. At a excessive degree, we want solely to take a look at monetary efficiency seen this 12 months in comparison with final 12 months. Within the newest quarter, which might be the second quarter of the 2024 fiscal 12 months, the corporate reported income of $25.50 billion. This does symbolize a 2.3% enhance over the $24.93 billion generated one 12 months earlier. However that is actually solely due to sure non-core operations just like the automotive regulatory credit that noticed gross sales develop from $282 million to $890 million, its Vitality Technology and Storage phase that reported a surge in income from $1.51 billion to $3.01 billion, and its companies and different operations that reported an increase from $2.15 billion to $2.61 billion.

Writer – SEC EDGAR Information

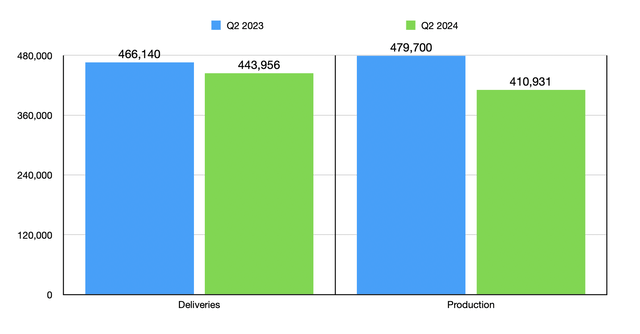

All of those enhancements are nice to see. And administration ought to be lauded for them. Nevertheless, the core of the enterprise, which might be its automotive gross sales class, reported a drop in gross sales from $20.42 billion to $18.53 billion. That is a 9.3% drop 12 months over 12 months. This was pushed partially by a decline within the variety of autos delivered from 466,140 within the second quarter of 2023 to 443,956 the identical time this 12 months. To administration’s credit score, they did attribute round 13,000 of this decline to the early part of the manufacturing ramp of the corporate’s up to date Mannequin 3 at its Fremont manufacturing unit. However contemplating that complete deliveries throughout this time fell by 22,184, it is clear that there are different points at play. This matter is made worse by the truth that this bigger decline elements in round 4,000 further deliveries involving the Mannequin S, Mannequin X, and Cybertruck, with most of that enhance pushed by the Cybertruck. The corporate additionally suffered from a drop in pricing. Administration didn’t say by how a lot pricing adjustments impacted income. However they did say that it was the first purpose for the decline.

Writer – SEC EDGAR Information

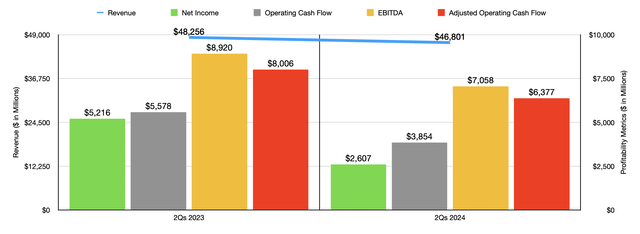

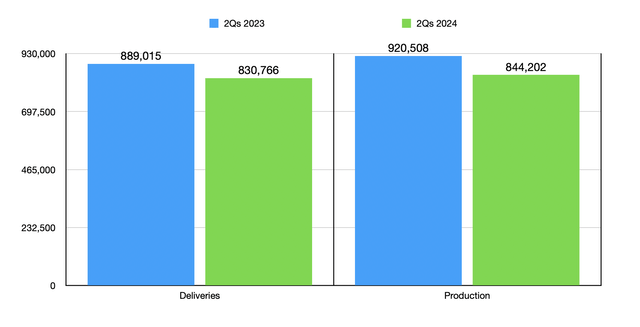

As you’ll be able to see within the chart under, monetary efficiency for the primary half of 2024 in comparison with the primary half of 2023 is similar to what we noticed within the second quarter of this 12 months relative to the identical time final 12 months. Although the corporate is seeing progress in some components of its operations, earnings and money flows are plummeting as car pricing drops and because the variety of deliveries declines considerably. Actually, earlier, I said that automotive gross sales income for the second quarter of this 12 months was down 9.3% in comparison with the identical time final 12 months. However for the primary half of this 12 months as a complete, it was down a whopping 11%.

Writer – SEC EDGAR Information

This strikes that one among a number of issues that Tesla has on its fingers proper now. And that’s the undeniable fact that the electrical car market is changing into more and more aggressive. As I detailed in an article relating to rival Rivian Automotive (RIVN) again in April, electrical car costs are rapidly approaching parity with gasoline powered ones. Based on one estimate, it is believed that by 2027, electrical car costs can be even decrease than the costs of gas-powered ones. No matter your emotions relating to Elon Musk and the job that he’s doing, he precisely identified in January of this 12 months that the Chinese language electrical car market poses a considerable threat to American autos.

Writer – SEC EDGAR Information

That is true not solely within the Chinese language market, but in addition right here within the US. To compete with this, all electrical car producers are going to begin coming beneath pricing stress. Actually, an article in Bloomberg from June of this 12 months identified that there are actually three electrical car producers with operations within the US that now promote their electrical autos at a worth that is decrease than the common new car. Particularly, this ought to be long-range electrical autos (these with not less than 300 miles of vary on a single cost). One among these occurs to be Tesla. However the different two are Hyundai-Kia and Basic Motors (GM).

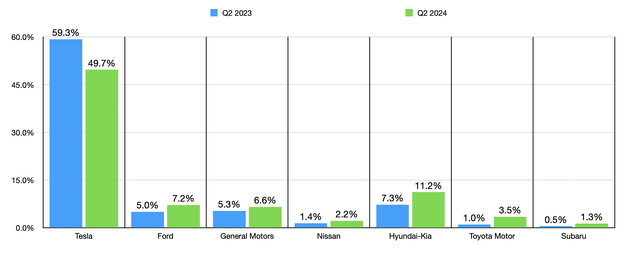

Writer – Cox Automotive Information

Opposite to some rhetoric that has developed over the previous a number of months, the variety of electrical autos offered within the US just isn’t declining. Within the second quarter of 2024, there have been 330,463 electrical autos offered on this nation. That marked a rise of 11.9% in comparison with the 295,355 offered the identical time final 12 months. However throughout this time, Tesla reported a drop of 6.3% within the variety of electrical autos offered all through the nation. Actually, the corporate’s market share continues declining. Within the second quarter, it was 49.7%. That was down from 52.1% within the first quarter and down from 59.3% within the second quarter of 2023. Different corporations are doing significantly higher. Hyundai-Kia reported an increase in market share from 7.3% within the second quarter of 2023 to 11.2% on the similar time this 12 months. Basic Motors noticed an increase from 5.3% to six.6%. And Ford (F) grew its market share from 5% to 7.2%. Even marginal gamers within the electrical car area are performing nicely. Within the chart above, you’ll be able to see the year-over-year enchancment in market share for the second quarter for a few of these corporations.

It in all probability does not assist that Tesla is not considered because the golden normal of the electrical car area. Automobile and Driver not too long ago reported that solely one of many firm’s fashions, the Mannequin 3, ranked in its checklist of the highest 9 greatest electrical autos within the nation. It got here in at quantity 4. Nevertheless, Edmunds did say that the Mannequin 3 stays the second-best electrical car within the luxurious class. So it will not be correct to say that Tesla is down for the depend. So far as the standard of electrical autos goes, and the value at which it sells a few of them, it’s nonetheless the large participant.

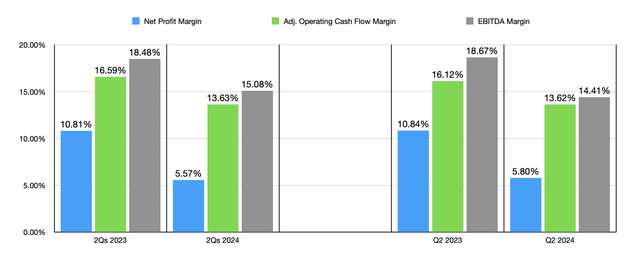

Writer – SEC EDGAR Information

Up to now, Tesla was in a position to generate sturdy margins from its dominant, market chief place. However these days are probably gone. Within the chart above, you’ll be able to see the online revenue margin for the corporate, in addition to its working money move margin, its adjusted working money move margin, and its EBITDA margin, for the newest quarter in comparison with the identical time final 12 months, and for the primary half of this 12 months in comparison with the primary half of 2023. The truth that we’re within the early days of elevated competitors on this area is disconcerting since additional margin contraction brought on by worth reductions, to not point out the decline in manufacturing and deliveries, is sort of definitely to happen shifting ahead.

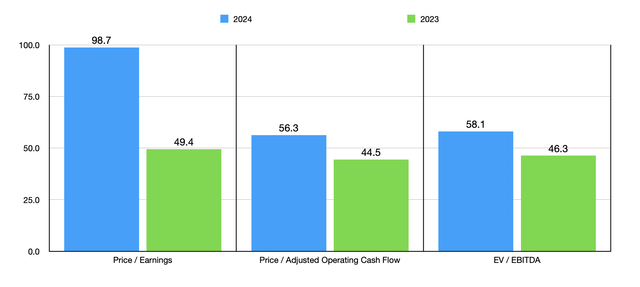

Writer – SEC EDGAR Information

If shares of the enterprise have been buying and selling on a budget, I believe I might be extra open minded to the image. However within the chart above, you’ll be able to see how shares of the enterprise are priced relative to earnings and adjusted working money move. I additionally embody the EV to EBITDA a number of. This chart consists of historic outcomes for 2023 and estimates for 2024. Since administration doesn’t present any steering for what earnings or money flows is perhaps for this 12 months, the 2024 estimates have been calculated by assuming that the remainder of this 12 months will seem like the primary half of this 12 months relative to the identical time of 2023. However even when we have been to imagine that fundamentals would find yourself reverting again to what they have been final 12 months, the inventory remains to be extremely expensive, particularly contemplating the market dynamics that I already talked about.

There are different points as nicely

To compound issues, Tesla’s woes embody non-fundamental elements as nicely. A few of the actions taken by Elon Musk can solely be construed as reckless at greatest, or downright dangerous to the corporate at worst. The primary is the corporate’s choice to award him a pay package deal of $55.8 billion. This plan initially dates again to 2018. Earlier this 12 months, the Delaware Courtroom of Chancery issued an opinion that said that the award ought to be rescinded. Lengthy story quick, on the firm’s Annual Assembly of Stockholders, shareholders who have been thought of ‘disinterested’ dominated in favor of a pay package deal that might considerably enhance Musk’s possession within the firm. Nevertheless, the following listening to on the matter to see if this may finally undergo is about for August 2nd of this 12 months.

The dilution that buyers would see from this might be vital. It will enhance his possession from 13% to roughly 25% if all goes in keeping with plan. Sadly, he needed to mainly threaten the corporate into this place by saying that he was ‘uncomfortable’ rising the corporate by utilizing AI and robotics if he didn’t have such a big possession stake. Even said that he would ‘favor to construct merchandise outdoors of Tesla’ if it got here to that. Though I’m no legal professional, this definitely seems like a breach of fiduciary responsibility to me.

One other current situation entails Musk’s possession over xAI, which is an organization centered across the growth of huge language fashions and AI that’s being developed to compete with different gamers like OpenAI and its ChatGPT know-how. If this have been simply one other facet challenge like SpaceX, that might be one factor. Nevertheless, he has been actively diverting AI chips from Tesla to go to xAI and Twitter, and hiring away workers from Tesla to work on the know-how. That is regardless of the truth that xAI just isn’t a subsidiary of Tesla. Add on prime of this his choice to method Tesla’s Board of Administrators with a proposal to have Tesla make investments $5 billion into this challenge at a time when even he acknowledges the electrical car area is going through severe competitors, and buyers have each proper to be nervous.

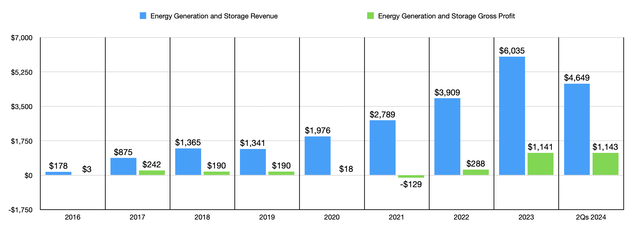

Writer – SEC EDGAR Information

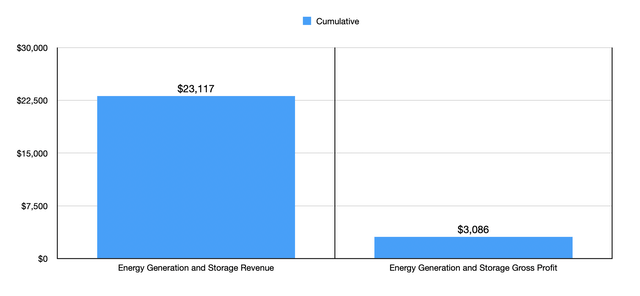

It is also price stating that this sort of self-dealing has not precisely been all that worthwhile for the corporate previously. Again in 2016, Musk had Tesla purchase up one other one among his corporations, SolarCity, in a deal valued on the time at $2.15 billion. This was an all-stock transaction. However by the point you account for the present share worth of Tesla and issue within the two totally different inventory splits the corporate has seen, that transaction right now equates to a worth of $38.74 billion. For an enterprise that, since that point, has generated solely $3.09 billion price of gross revenue for Tesla shareholders, it is clear that the deal has thus far been dangerous to the corporate. Admittedly, the Vitality Technology and Storage phase this now falls beneath is lastly beginning to do very well. So the image may finally change. However even allocating that capital to nearly the rest would have been extra worthwhile.

Writer – SEC EDGAR Information

The one saving grace that the agency could have at its disposal can be to get into the robotaxi area. It is a market that Musk himself has lauded. Moreover, I’ve talked about it in prior articles, together with in my article from April. However there are additionally vital dangers and prices related to a transfer on this path.

Takeaway

Essentially talking, Tesla is going through some points. The corporate additionally has different issues, largely on account of Elon Musk and rising aggressive pressures. Add on prime of this the truth that we’re probably within the early days of this elevated degree of competitors, and consider how costly shares are, and I completely assume that Tesla warrants a ‘sturdy promote’ ranking at the moment.