Again in late June when the Senate signed off on President Trump’s laws to change federal spending priorities whereas conserving deficits caught within the multi-trillion greenback (teradollar) vary—The One Bloated Brobdingnian Invoice (BBB)—the heroic Rand Paul was the one price range hawk to vote towards it in opposition to deficit spending (in distinction to Democrats and some centrist Republicans, who rejected the BBB’s shift in spending priorities away from Medicaid). 4 different Senatorial price range hawks—Ron Johnson, Mike Lee, Rick Scott, and Cynthia Lummis—flipped their votes to “sure” after barely higher Medicaid cuts have been added to the invoice, making it attainable for J.D. Vance to forged a decisive tie-breaking vote in favor of the BBB.

Quick ahead to November 10, and the Senate simply barely mustered the 60 votes wanted to cross a Persevering with Decision (CR) after greater than a month of partisan bickering, prolonging present spending priorities but additionally permitting a beforehand scheduled reduce in Obamacare subsidies to enter impact, which Democrats abhor. Senator Paul as soon as once more was the only Republican holdout due to his opposition to Teradollar deficits, whereas Paul’s spendthrift Republican colleagues have been joined by a handful of Democrats (thus ending the “shutdown Kabuki”) who have been prepared to surrender the subsidies with a view to resume full funding of the forms and of different switch beneficiaries.

Each side of the BBB/CR divide insist that Senator Paul is fallacious to demand a lot bigger spending cuts with a view to cut back deficits instantly, claiming that their most well-liked (although diametrically opposed) tax insurance policies would obtain important deficit reductions in the long term by rising tax revenues. Is there any reality to their beliefs about tax income offsets?

Within the case of Republican spendthrifts, their argument is that conserving tax charges low and including different focused tax cuts will develop the financial system sooner, thus rising revenues sufficient in future fiscal years to greater than offset present spending will increase. This “supply-side” narrative is derived from an financial concept related to Arthur Laffer that Ronald Reagan popularized forty-five years in the past. Laffer identified that there should be some optimum tax price between 0 p.c and 100% that maximizes the state’s income, so—all different issues being equal—it’s attainable for a decrease price to generate larger income whether it is nearer to the optimum stage than the upper price.

Whereas the Republican spendthrifts concede that there’ll nonetheless be deficits within the brief run, they see these deficits as a short lived however vital evil for funding a Pentagon arms build-up to wage pricey wars overseas, and for funding Homeland Safety to wage a pricey warfare at residence towards an “invasion” by overseas vegetable pickers, lodge maids, food-cart distributors, janitors, and so forth., and their households (smeared as being the “worst of the worst” by Homeland Safety). They pin their hopes on financial development ultimately fixing the deficit downside.

Within the case of Democrat spendthrifts, they oppose cuts to welfare state switch advantages on the expense of the poor with a view to maintain revenue tax charges low for the good thing about the wealthy. Democrats additionally object to sure Republican spending will increase, notably Trump’s warfare on immigrants. Democrats don’t dispute the existence of Laffer’s revenue-maximizing tax price, however they imagine that present tax charges are effectively beneath that stage. They dismiss conventional Republican “supply-side” arguments as a “trickle-down” fantasy; they imagine they’ll and will tax larger revenue earners extra intensely with a view to fund extra advantages for the poor, if not institute “democratic socialism” instead of non-public earnings.

There are a number of intractable issues making an attempt to resolve partisan disagreements about what the optimum Laffer price is. First, Laffer’s curve describing the quantitative relationship between charges and revenues is consistently altering in unknown methods. Thus, we are able to’t use previous knowledge to scrupulously mannequin the form of future curves. Second, the advantages of higher financial development, and thus elevated revenues, within the extra distant future, even when realized with a given price discount, may be greater than offset by the added prices of servicing the extra money owed one accumulates within the nearer future. Third, not every thing else is equal whereas tax charges are modified—there are lots of different causal elements that may have an effect on financial development. Greater near-term deficits are a specific concern as a result of they could must be financed on the expense of productive investments, thus offsetting any development advantages derived from decrease tax charges. For instance, in OECD international locations in current a long time, the share of GDP related to authorities spending has been correlated negatively to actual GDP development charges.

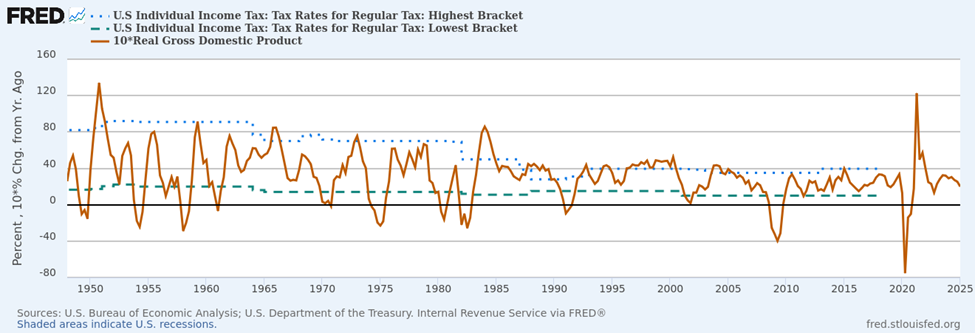

Reasonably than take up the hopeless job of modeling future price/income relationships, perhaps America’s prior historical past of adjustments in tax charges for the very best and lowest revenue brackets and adjustments in GDP share of federal tax receipts and in actual GDP development charges can be extra informative, conserving in thoughts the caveat that previous correlations won’t maintain up sooner or later:

Determine 1—Federal revenue tax charges (p.c) and federal receipts as p.c of GDP

Sources: FRB St. Louis and IRS by way of FRED®

Determine 2—Federal revenue tax charges (p.c) and annual actual GDP development price (p.c x10)

Sources: BEA and IRS by way of FRED®

The very first thing we discover in these knowledge is that the GDP share of federal tax receipts (determine 1) have been remarkably secure because the Second World Conflict, averaging about 16 p.c. No matter small adjustments do happen appear completely unrelated to the very best bracket’s tax price. Likewise, there doesn’t appear to be any relationship between GDP development charges and the tax price of the very best bracket (determine 2). Whereas such relationships would possibly exist, their results are far too small relative to different adjustments to be observable.

Each Republicans and Democrats are usually not telling the reality in regards to the revenue taxes paid by the richest revenue earners in America—the speed for the very best bracket merely hasn’t mattered very a lot with respect to both revenues or development. Herbert Hoover’s and Franklin Roosevelt’s enormous will increase within the highest bracket’s price and cuts in that price by John F. Kennedy, Ronald Reagan, and George W. Bush didn’t have any discernible influence. Neither supply-side development of GDP and revenues nor decreased soaking of the wealthy follows from decreasing charges paid by the very best revenue earners. Whereas the long run may be completely different, there may be nothing in previous knowledge to assist both celebration’s claims of a major relationship between adjustments of the tax charges imposed on excessive earners and subsequent federal revenues.

One correlation that’s obvious in these graphs includes the tax price paid by the lowest revenue bracket, after which solely with respect to the share of GDP extorted as receipts (determine 1). This occurred when FDR began soaking the working poor extra intensely simply earlier than World Conflict II. If both celebration have been severe about rising revenues, perhaps they need to imitate FDR and check out taxing the poor extra intensely, although after all neither celebration dares try this.

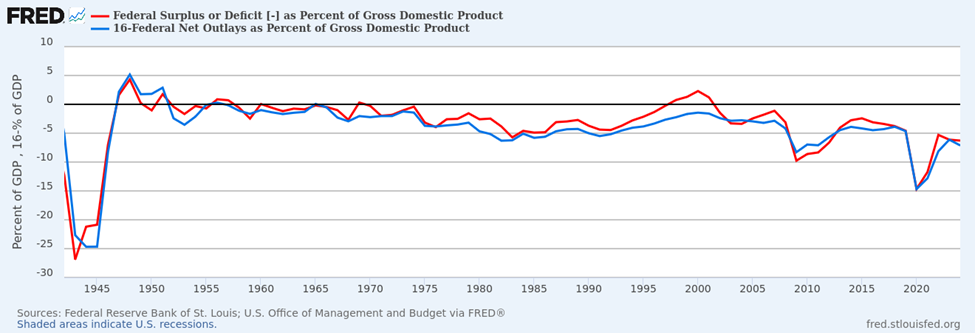

If the share of GDP taken as federal taxes stays caught near 16 p.c of GDP, then the GDP share of deficits should carefully monitor spending’s share. By subtracting federal outlays as a proportion of GDP from 16 p.c, we are able to simply visualize simply how carefully altering spending ranges has matched altering deficits as a proportion of GDP (determine 3):

Determine 3—Federal Deficits (p.c) and 16 p.c much less Internet Federal Outlays as p.c of GDP

Sources: FRB St. Louis and OMB by way of FRED®

The details are indeniable—because the Second World Conflict, adjustments in deficits have all the time been carefully correlated to adjustments in spending, to not adjustments in tax charges. Senator Paul, together with Thomas Massie—the corresponding sole price range hawk of the Home of Representatives—are completely appropriate to deal with spending reductions as the one viable path in direction of lowering deficits.

Democrats must be taught that, whereas many among the many very rich do unjustly revenue from governmental rigging of market outcomes, steeply progressive revenue tax charges can neither unrig America’s corporatist financial system nor fund its welfare state at current profit ranges. Enjoying Robin Hood with revenue taxes is neither sensible nor simply. The welfare state has merely grown too large to be sustainable; with out cuts now, advantages will ultimately be overwhelmed by hyperinflation or undergo compelled reductions as a result of insolvencies of the Social Safety and Medicare Belief Funds.

Likewise, Republicans must be taught that there isn’t a magical financial development fairy and recover from their Libertarian Derangement Syndrome. As of late no Republicans, other than Senator Paul and Congressman Massie, dare to suggest even the slightest cuts to Social Safety, Medicare, the Pentagon, or Homeland Safety, however that solely makes elevated deficits (made worse by compounding debt service prices) and accelerating greenback inflation inevitable. For all their tribalistic variations with Democrats over cultural points, their spendthrift fiscal priorities put them in league with Democrats as a bipartisan fiscal most cancers threatening to kill America’s financial system with a metastasizing federal debt.