NatanaelGinting

Responding To The Doubters

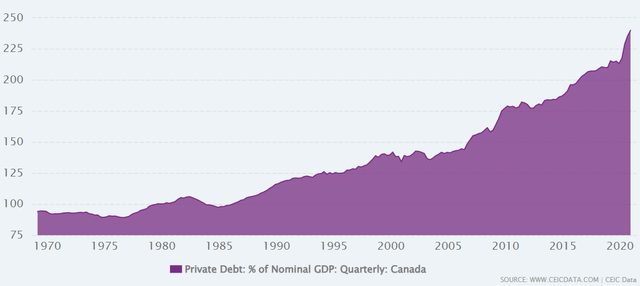

Five months ago, we wrote the article “TD And Royal Bank: Canada’s About To Implode.” In the article, we argued that Canadian banks are priced too richly given where Canada stands in the debt cycle. Canada now has a private debt to GDP ratio of 230%:

Canada’s Private Debt As A Percent Of GDP (CEIC)

For reference, before the American financial system melted down in 2008, the United States had a private debt to GDP ratio of just 170%.

We got a lot of pushback on the first article in this series, especially on the strength of Canada’s financial system. While the country’s financial system may be stronger than that of the U.S. in 2008, we’d argue it is now more vulnerable than ever before. We’ll see why. In the decade ahead, we project returns of 5% per annum for The Toronto-Dominion Bank (NYSE:TD) and Royal Bank of Canada (NYSE:RY). But, it could be a bumpy ride.

Canada’s Financial Folly

When a country’s housing market goes straight up for 30 years, people get really crazy. In Canada, there are mom-and-pop “real estate investors,” towns full of empty vacation homes, and parents co-signing on mortgages their kids can’t afford. Why rent when the value of homes only goes up? That’s the mantra on the street, especially in the hotter economies of BC and Ontario.

Not only do Canadians speculate on real estate, but they do so with variable and 5-year-fixed loans, and, they borrow against the inflated equity in their homes. The latter is known as a home equity line of credit. Essentially, people use their home equity to secure a loan to buy a new RV, boat, furniture set, you name it. It seems to us that this row of debt dominoes can collapse if interest rates spike too high. And, Canadian banks are not immune to eating huge losses if it does.

CHMC Mortgage Insurance

Many point to Canada’s CMHC mortgage insurance as protection against a housing collapse. CMHC is a government agency that insures many of the mortgage loans made by chartered banks like TD and Royal Bank. But, CMHC has highlighted some concerning trends when it comes to this:

“As of the first quarter of 2021, only 35% of outstanding residential mortgages extended by chartered banks were insured. This share was over 60% in 2012.”

Corporate Debt And Ponzi Schemes

It’s not uncommon for Canadian corporations to carry debt loads representing anywhere from 10 to 20 times their net income. BCE Inc. (BCE), Enbridge (ENB), and Fortis (FTS) are all excellent examples of this. Not only do Canadian corporations carry dangerous amounts of debt, but they dilute shareholders to maintain their stretched dividend yields. Canadian banks often have a plethora of risky options when it comes to their corporate loan portfolios.

A Closer Look At The Businesses

Below are the 2021 earnings by segment for TD and Royal Bank.

TD Bank

| Total | $14,298 |

| Segment | Net Income (Millions CAD) |

| Canadian Retail | $8,481 |

| U.S. Retail | $4,985 |

| Wholesale Banking | $1,570 |

| Corporate | $(738) |

Royal Bank

| Total | $16,050 |

| Segment | Net Income (Millions CAD) |

| Personal & Commercial Banking | $7,847 |

| Wealth Management | $2,626 |

| Insurance | $889 |

| Investor & Treasury Services | $440 |

| Capital Markets | $4,187 |

| Corporate Support | $61 |

We have some key takeaways here. First off, TD has more U.S. exposure than Royal Bank. This could turn out to be a net positive for TD. Second, both of these banks earn a lot of money from wealth management and trading fees. They often charge $10 on the buy and $10 on the sell within their trading platforms. Meanwhile, zero-trading-fee apps like Wealthsimple have dramatically improved their offerings. For most investors, companies like Questrade and Wealthsimple offer a better value proposition. We could see downward pressure on TD and Royal Bank’s pricing power when it comes to investment services.

Prospective Returns

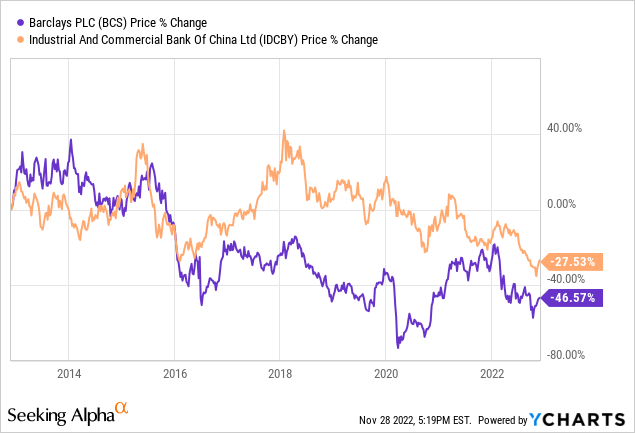

While TD and Royal Bank look cheap on a price to earnings basis, PE’s can be deceiving when it comes to banks. I recently read an article on China’s largest bank, ICBC, written back in 2012. The article argued that the bank was cheap as it had a 5% dividend yield, price to book of 1.3, and PE ratio of 6. The stock went nowhere over the next decade. The same can be said for European banks like Barclays PLC (BCS):

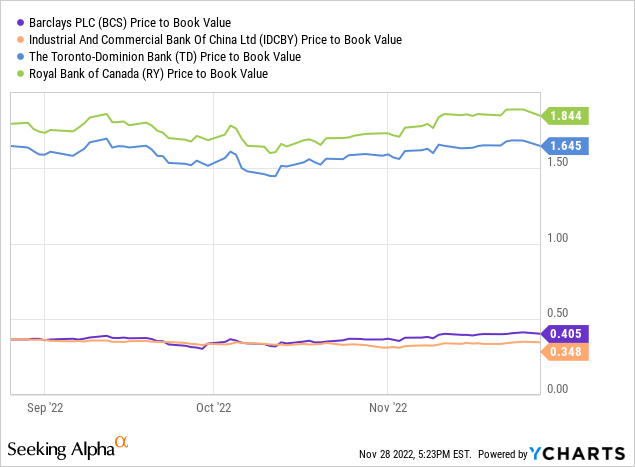

Despite facing similar debt cycle issues, these same banks now trade at a huge discount to TD and Royal Bank on a price to book basis:

We think TD and Royal Bank’s loan growth will struggle in the years ahead. We expect P/B multiples to contract, weighing on long-term returns. Here’s a look at our expected returns with dividends reinvested:

| Annualized Returns | 5% | 5% |

| Metric | TD Bank | Royal Bank |

| Book Value Per Share | $40.52 (52.53 CAD) | $53.14 (68.88 CAD) |

| Compound Annual Growth | 5% | 5% |

| Terminal Multiple | 1.2x | 1.3x |

| 2032 Price Target | $79 (103 CAD) | $113 (146 CAD) |

We believe our framework here can be applied to other Canadian banks as well, including Bank of Nova Scotia (BNS) and Bank of Montreal (BMO).

Risks To The Thesis

The above is our base-case scenario. There’s a chance TD and Royal Bank manage to grow faster or slower. Banks with strong balance sheets tend to gain share in bad recessions. This was the case with JPMorgan Chase (JPM) in ’08. Book value multiples can also change based on investor sentiment and perceived risk. As you saw above, many international banks trade at a small fraction of book value.

Conclusion

Warren Buffett, who sports a terrific investment record in financial institutions, once said, “Be fearful when others are greedy and be greedy when others are fearful.” Buffett bought Bank of America shares in 2011 at a small fraction of book value, when the risks were low and the reward was high. This is not the case with Canadian banks today. Canadians tend to perceive TD and Royal Bank as blue chip investments with very little risk. They point to the past, when these banks sailed smoothly through the great financial crisis. But, the present is not the past. Canadian debt levels have risen tremendously, there are new entrants in investment banking, and comparative valuations are stretched. There may be better opportunities in the beaten down stocks of global institutions.

As for Buffett, his most recent bank investment was Citigroup (C), which we covered here. Until next time, happy investing.