Yves right here. This text describes how Trump’s tariff antics are destabilizing an already way-too-fragile US monetary system. It mentions some components current within the SVB-bailout-era wobbles, reminiscent of over-exposure to commercial-real property, in addition to a not-sufficiently-recognized peril, that of personal credit score funds, to which too many banks are uncovered. We’ve not written anyplace close to as a lot about this as we wish because of the lack of excellent information. A brand new story within the Monetary Instances, Personal credit score might ‘amplify’ subsequent monetary disaster, examine finds, makes basically the identical level. Should you learn the piece, you’ll see the very approximate strategies the researchers had to make use of to attempt to dimension the magnitude of financial institution publicity.

This data hole is all too acquainted. It tremendously resembles the runup to the monetary disaster, when these following how the wheels had been coming off had been effectively conscious of how CDOs had been an enormous a part of the issue. But there was hardly any good data on them. I used to be complaining recurrently on this web site that finanical regulators must be hauling each huge and medium sized financial institution in to seek out out what their exposures had been and what else they might be taught concerning the market, in order to get a greater image of the net of publicity. The Financial institution of England, in its semi-annual Monetary Stability Report, appeared to be the one main regulator trying to get its arms about the issue (and it did a reasonably good job, however it was nonetheless clearly not enough to the magnitude of the dangers).

One essential a part of this evaluation, however you must learn a little bit of the way in which in, was of a cover-up of the function of the very giant scale hedge fund foundation commerce in triggering the spike in 10 and 30 yr Treasury yields, which induced Trump to again off bigly from his “Liberation Day” tariffs. This scheme was an accident ready to occur, of the choosing up pennies in entrance of a steamroller kind, besides with leverage. However numerous essential events didn’t need the parlous state of the US monetary system to be seen as the reason for the tsuris, therefore the efforts to divert consideration from that discovering.

By Thomas Ferguson, Analysis Director for the Institute of New Financial Pondering;

Professor Emeritus, College of Massachusetts, Boston and Servaas Storm, Senior Lecturer of Economics, Delft College of Expertise. Initially printed on the Institute for New Financial Pondering web site

“Finance, like time, devours its personal youngsters.”

—Honoré de Balzac

Bracket for a second qualms concerning the Second Coming’s Cheshire Cat tariff politics and discuss of invading Greenland, sweeping up Ukrainian mineral rights, or erecting Mediterranean seaside resorts. As an alternative, concentrate on one of many highest-profile pledges President Trump and Vice President Vance made to Joe Rogan and their exultant supporters in excessive tech and associated industries: rolling again globalist “socialism” and severing the choking tentacles of Massive Authorities.

Right here, the primary impression is robust that the brand new management has actually tried to ship, even when its ballyhooed efforts to trim the federal price range are clearly falling far wanting Elon Musk’s guarantees. As Musk returns to his enterprise pursuits, DOGE crews have rampaged by means of one federal company after one other, slashing folks and budgets. Not even the famously thrifty Social Safety Administration escaped their chainsaw. The Schooling Division has been downsized and is slated to be phased out. Federal help for science and training is being minimize to the bone, together with the State Division, international help, and even the Nationwide Climate Service. The Publish Workplace is being decimated for what appears like a attainable privatization down the highway, whereas the administration and Congressional Republicans are reaching an settlement on draconian cuts to Medicaid packages for poorer Individuals.[1]

However media impressions could be famously deceiving. They might simply level analysts within the flawed course. Current occasions in monetary markets elevate profound questions on this libertarian resurgence – whether or not, in truth, a well-recognized specter famously identified for haunting Europe is even now stealing additional into American cash markets.

Treasury Distemper

On April 2nd, the President proposed tariffs dramatically larger than most observers anticipated. Celebrations of “Liberation Day” had been minimize brief, as US and world inventory markets cratered (Determine 1). Usually, when vultures circle over fairness markets, traders flee into bonds, particularly US Treasuries, supposedly the world’s most secure asset.

Supply: FRED Database.

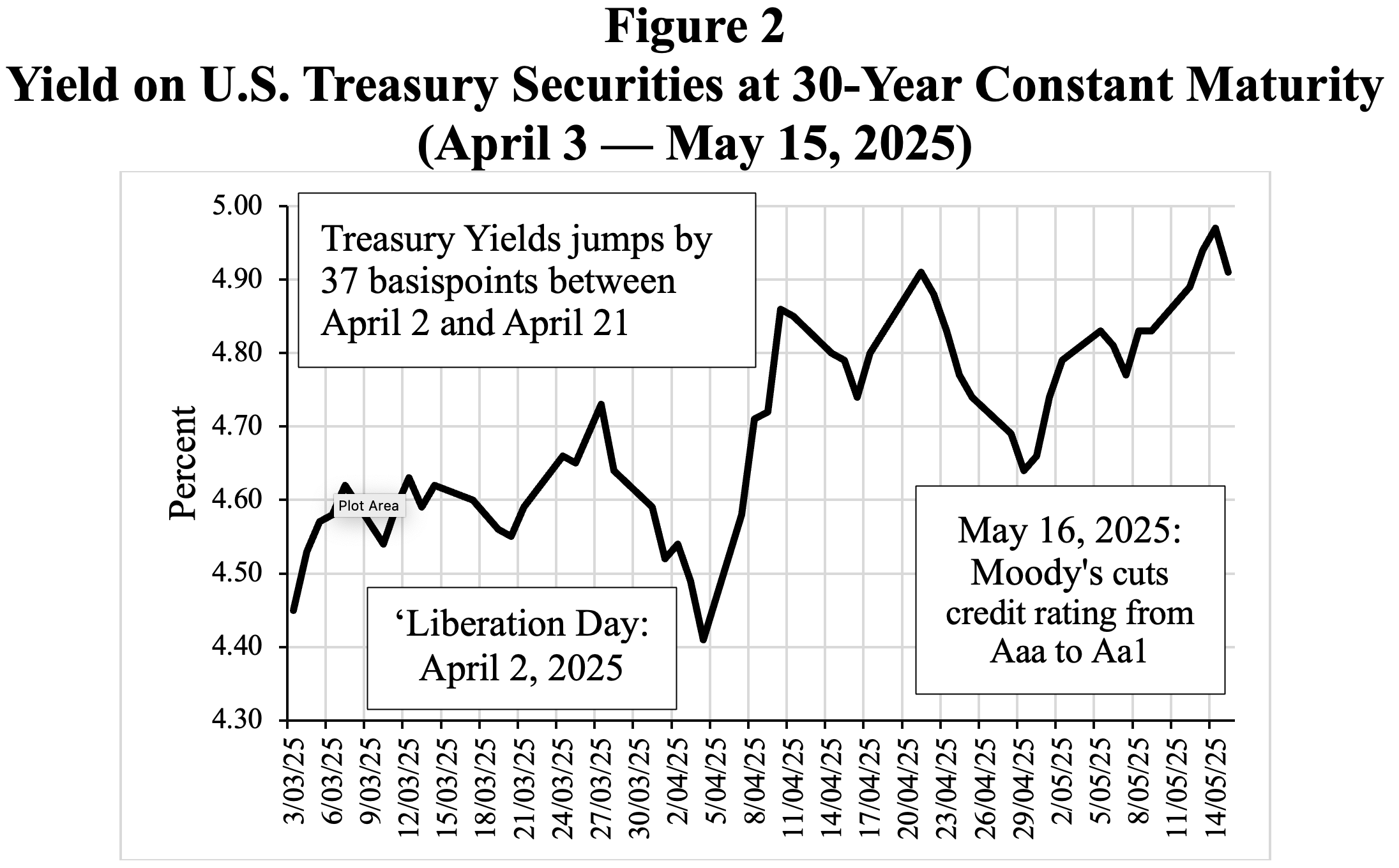

This time, although, bond traders additionally headed for the exits. Yields on US Treasuries, which go up when their homeowners promote en masse, shot up (Determine 2). Because the London Instances reported, by Wednesday of the next week, “the yield on US 30-year bonds had recorded its largest three-day rise in almost 40 years.” Alarm deepened as phrase acquired round that no less than one Federal Reserve Financial institution President with deep expertise in monetary bailouts was dropping hints that some sort of intervention may be attainable, and federal funds futures markets began pricing in Fed emergency motion.

Supply: FRED Database.

Amid a flurry of experiences that tariff-skeptical aides had been frantically imploring a course change, the President abruptly known as a timeout on April 9th. Explaining that he was “watching the bond market,” which he termed “very tough,” he delay implementing many – removed from all – tariffs for ninety days. Together with a profitable Treasury public sale of long-term debt, the reversal soothed markets, resulting in a rebound in shares.

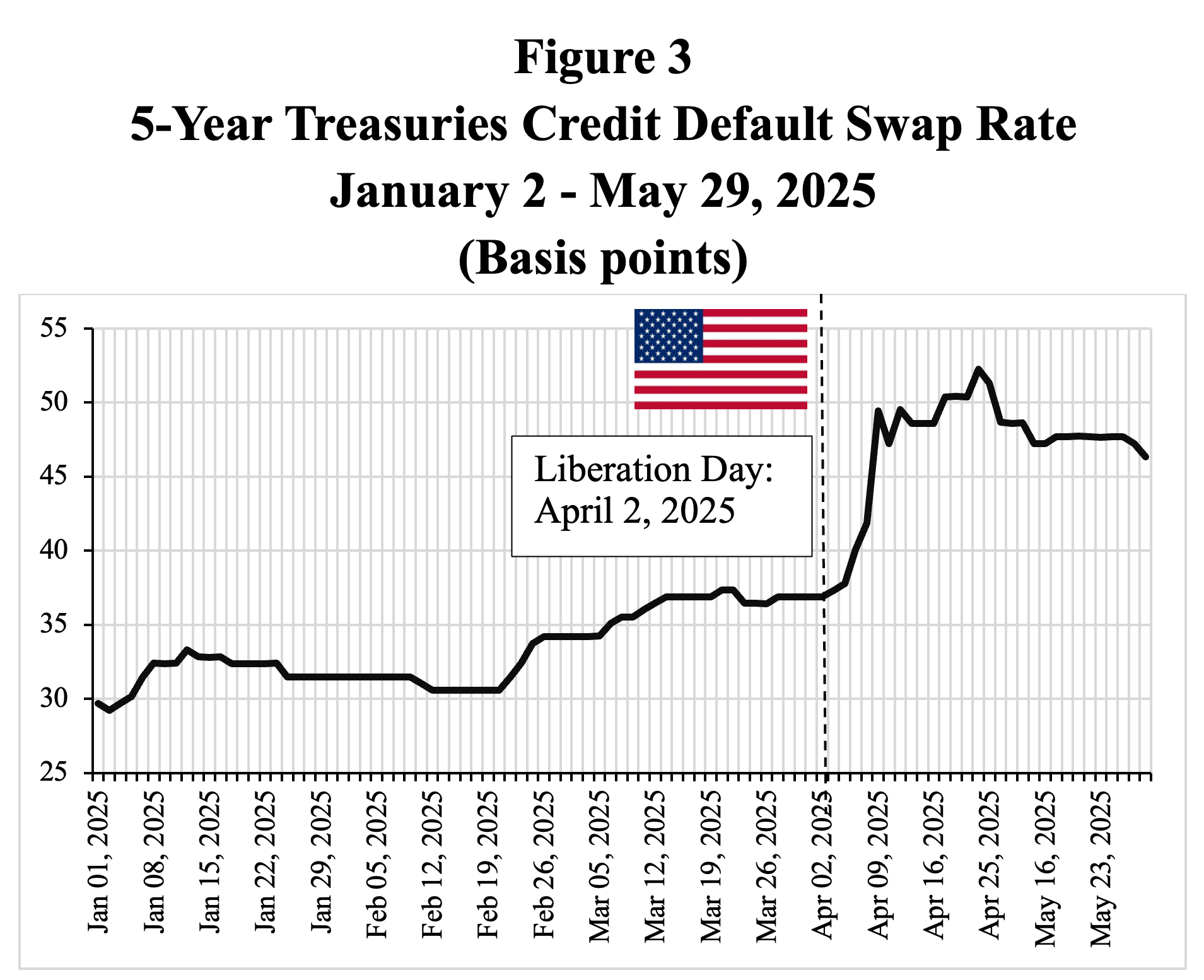

From the beginning, most media analysts targeted on the plunge in inventory markets and scorched the tariff determination. However an electrical shock additionally ran by means of monetary markets, as they acknowledged that one thing extraordinary was taking place within the $28 trillion US Treasury bond markets. Bond traders have clear doubts concerning the stability of the Treasury market: the value of US credit score default swaps — that are supposed to guard bond traders if America fails to honor its debt, and are an indicator of market sentiment — has elevated considerably (see Determine 3). On Might 16, 2025, Moody’s Scores minimize the US’ sovereigncredit ranking down one notch to Aa1 from Aaa, the very best attainable, citing the rising burden of financing the federal authorities’s price range deficit and the rising price of rolling over current debt amid excessive rates of interest. The turmoil is in no way over.

Supply: https://www.investing.com/rates-bonds/united-states-cds-5-years-usd-historical-data .

The Key: Persevering with Monetary Fragility

The market meltdown in April provoked a riot of claims and counterclaims about precisely what was occurring. A singularly coherent account emerged very early in tales within the London Instances and another papers. Citing economists working in markets and the Financial institution of England, the Instances reported {that a} “sharp sell-off in US authorities bonds, often known as treasuries, threatens to imperil hedge funds that exploit the small value distinction between the spot value of sovereign bonds and bets on their future value — the so-called “foundation commerce.”

Hedge funds use foundation trades to generate an arbitrage revenue that must be nearly riskless in regular markets.[2] They borrow cash (by way of so-called “repurchase agreements”[3]) to purchase an precise Treasury bond whereas concurrently agreeing to dump it later by promoting a corresponding futures contract.

Usually, the lender advances a bit lower than the worth of the Treasury bond to the hedge fund to guard itself in opposition to fluctuations in its worth, with the distinction known as a “haircut” on it. The sale of the futures contract by the hedge fund additionally entails a value: it advances a modest share of the transaction’s complete worth in money to the customer. If financing charges at each ends are fairly steady, the agency can snag an arbitrage revenue.

Rate of interest jolts, nevertheless, can abruptly flip the paired transactions poisonous. Lenders might demand extra “margin,” that means a rise within the money superior as safety for the repo, together with the Treasury itself. For hedge funds, this will pose an issue. As a result of the distinction, or foundation, between spot and futures costs of Treasuries is usually tiny, they usually use giant quantities of borrowed cash to amplify their bets, so-called “leverage.”

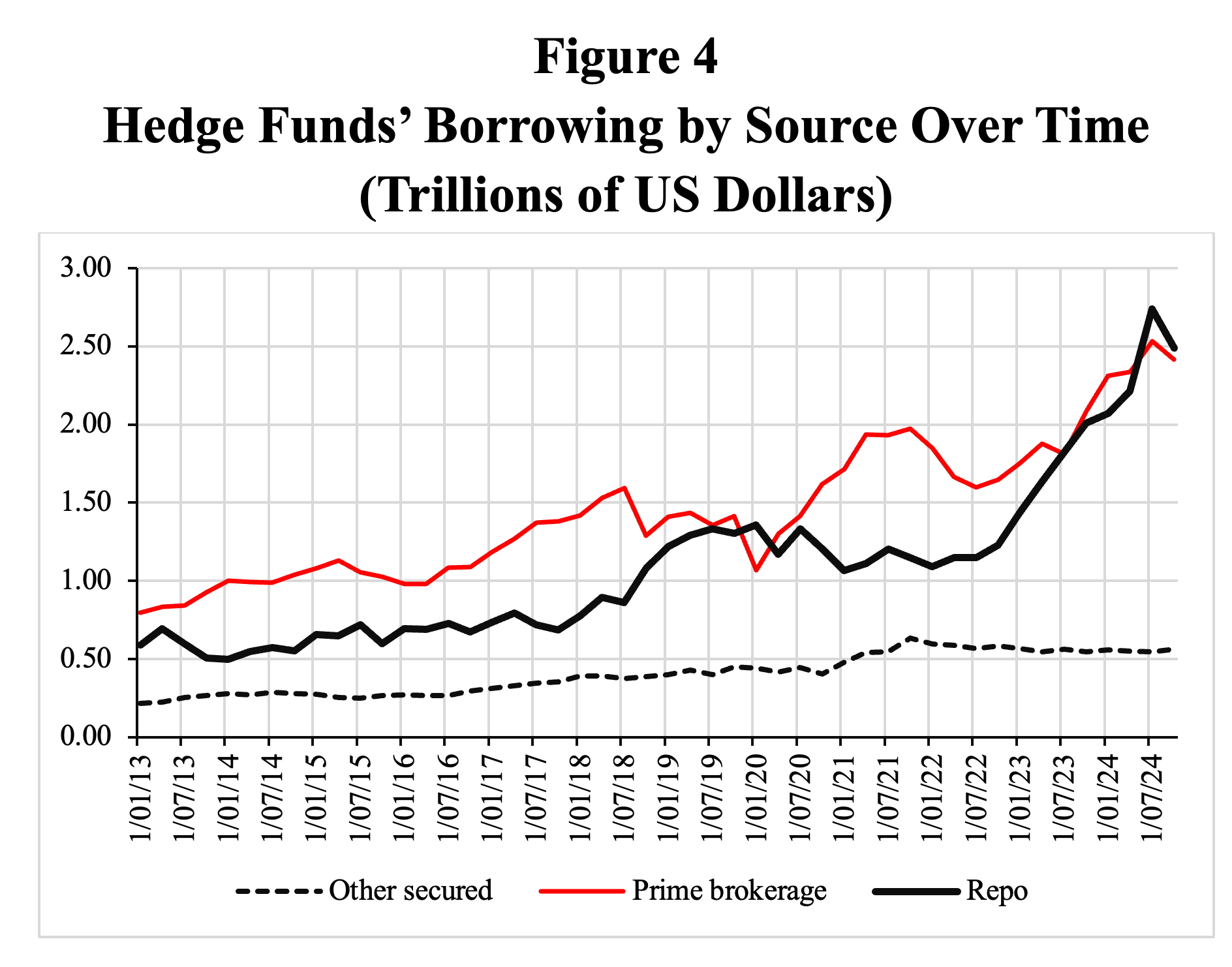

Knowledge counsel that hedge fund leverage in foundation markets can vary from 50-to-1 and even to 100-to-1, i.e., the funds borrow 50 or 100 {dollars} for each greenback of their very own they’ve in danger. As could be seen in Determine 4, hedge funds’ borrowing by way of repos has grown enormously in recent times: from round $0.7 trillion in 2017 to a sizeable $2.7 trillion within the third quarter of 2024. Hedge funds’ internet brief place in Treasury futures reached $ 1.1 trillion in Might (2025), up from $990 billion on April 1 and $434 billion earlier than the onset of the COVID disaster, based on a latest article within the Monetary Instances of Might 22, 2025.

Massive, surprising actions in bond costs, such because the Trump announcement triggered, can thus create critical issues. Calls for for extra margin in extremely leveraged positions can threaten the money place of the commerce, the agency, or, in extremis, an entire sector.

A “former senior Financial institution of England policymaker” advised the Instances “that the excessive leverage — using borrowed funds — utilized by hedge funds to make bets on US bonds, often known as treasuries, was one of many causes for the weird sharp fall in costs and spike in yields on Wednesday.”

Supply: U.S. Workplace of Monetary Analysis (OFR).

The previous central banker zeroed in on an underlying reason for the unusual developments: a aggressive race to the underside in monetary regulation: “Regulators will not be doing sufficient with respect to containing leverage.” “The US is transferring in the other way, and different central banks are being bamboozled by their very own banks to observe.”

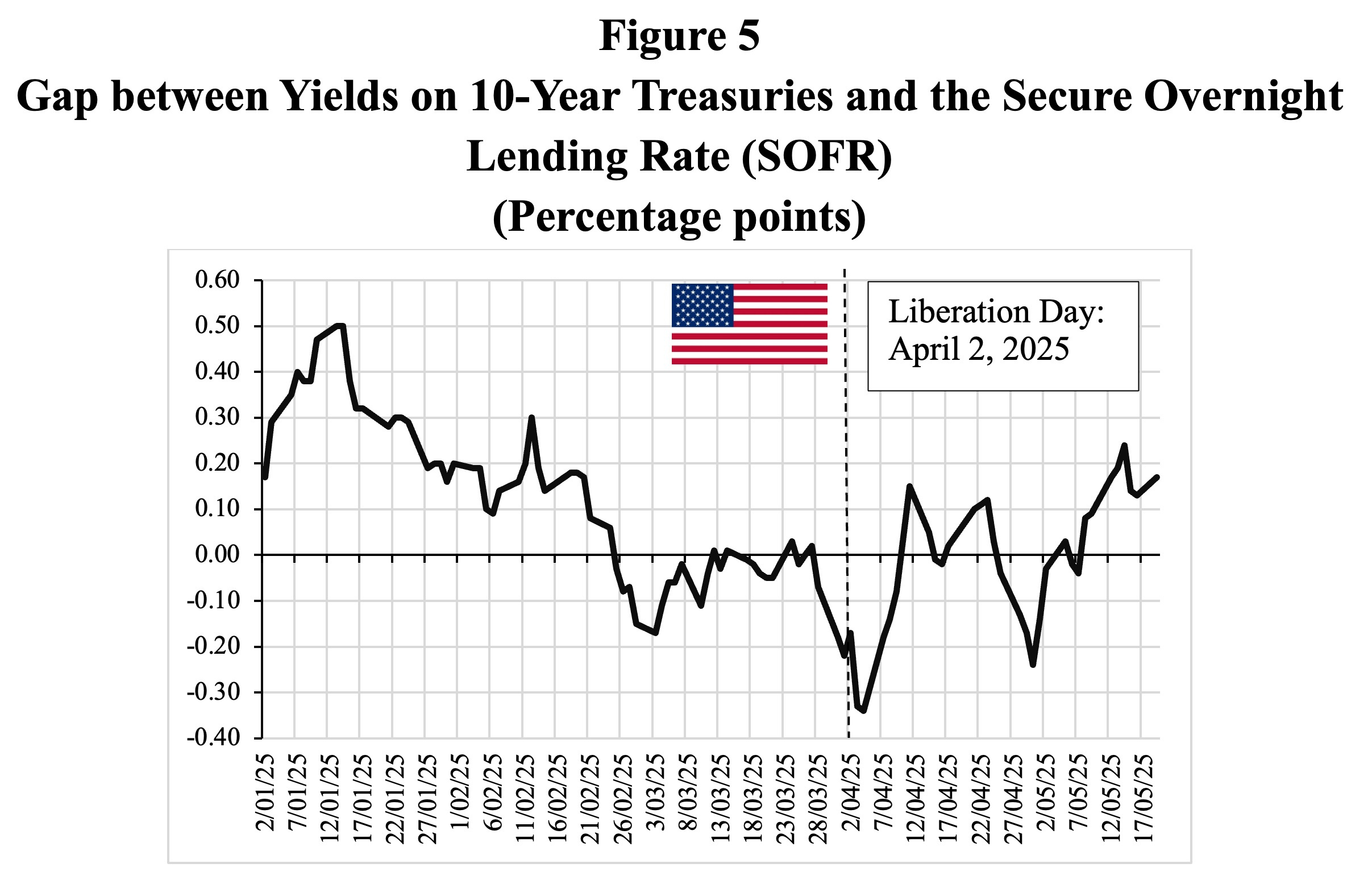

An account within the Monetary Instances strengthened the race-to-the-bottom theme even because it raised a yellow flag concerning the emphasis on foundation trades. The piece highlighted a unique commerce together with runaway animal spirits giddy on the prospect of sweeping monetary market deregulation: “At the beginning of the yr, lots of people had been getting excited by the prospect of the brand new Trump administration unwinding quite a lot of the post-crisis regulatory edifice…. Consequently, hedge funds went lengthy Treasuries and brief swaps within the expectation that the unfold would flip from being deeply unfavorable to nearer to zero. However the convergence commerce solely works with a lot of leverage. And the latest volatility can have ratcheted up margins throughout the board, forcing some to unwind these trades. That in flip turns the swap unfold much more unfavorable, and results in one other spherical of margin calls, and so forth.”

Exhibit A on this account was a quickly widening hole between 10-year Treasuries and the so-called Safe In a single day Lending Fee (SOFR), as is proven in Determine 5. The inference that actors, seemingly hedge funds, had been promoting rather a lot in a rush was tough to keep away from.

The prognosis carried a weighty implication: that not merely the tariff proposals, however elevated monetary fragility inside the US monetary system was a elementary ingredient in what had simply occurred. The implications for the Trump administration’s controversial deregulatory agenda for the monetary sector had been stark.

Supply: FRED Database.

The Cowl-Up

Pushback within the media and from finance and politically linked coverage makers got here rapidly. Critics superior two principal responses. The primary was that the entire episode was vastly exaggerated. They insisted on benchmarking the turbulence to the dreaded “sprint for money” that broke out when COVID struck in March of 2020 – a monetary market freeze-up that ended solely when the Federal Reserve launched an enormous new spherical of quantitative easing and emergency securities purchases. It was a peculiar selection of scale, since analysts wringing their arms over the April market turmoil had plainly said that the latest turbulence was nothing just like the onset of COVID: “we aren’t almost there now.”

Citing information from J.P. Morgan Chase, a serious main vendor in Treasuries, the dissenters poured scorn on the notion that Treasury foundation trades by hedge funds defined a lot. A narrative within the Wall Road Journal, for instance, in contrast complaints about foundation trades to a seek for a “boogeyman.” It additionally brushed apart suspicions of any regulatory race to the underside. In dismissing each potentialities, the piece breezed previous acknowledgements that some market developments advised in favor of each.

The Journal piece was equally dismissive of the proof from swaps, concluding that if there have been something actually flawed, it was regulatory restrictions on financial institution leverage. The response mirrored a typical criticism put ahead for some years by Jamie Dimon and lots of different bankers, that the reforms imposed on banks within the wake of the 2008 monetary disaster limit their means to step in to fill voids when extra thinly capitalized “shadow banks” – hedge funds, excessive frequency merchants, and others that more and more dominated the market since – grow to be skittish.[4]

Nellie Liang, a former US Treasury official now related to the Brookings Establishment, struck comparable notes, although in a much less derisive key. She acknowledged that for a number of days, the info on rate of interest swaps did certainly counsel actual turmoil. However she echoed the “not an excessive amount of to see right here” narrative, and its fake comparability to 2020: “accessible proof means that the present episode to date isn’t a repeat of the market dysfunction in March 2020.”

She urged that some credit score for April 2025’s happier end result derived from classes regulators realized from the sooner catastrophe. She praised the Fed, the Treasury, and different US regulators for ensuring that “way more information on Treasury securities transactions and on hedge funds are being disclosed to the general public,” and for introducing different measures to strengthen liquidity inside Treasury markets. Amongst these had been a brand new Treasury “buyback program to permit sellers to promote off-the-run securities on a predictable foundation to assist unencumber their steadiness sheets” and a Fed “standing facility to finance Treasury repo with pre-authorized sellers and banks which might encourage sellers to spend money on market-making capability and help liquidity in occasions of market stress.”

Regardless of the elevated market transparency, she handed on questions concerning the function of foundation trades and even swaps. She insisted that extra information wanted to be analyzed earlier than reaching any conclusions. However, remarkably, murky information didn’t preclude her from avowing that a part of the treatment may effectively be to extend the leverage permitted to the very largest banks, particularly by decreasing the “Supplementary Leverage Ratio” (SLR) of the large financial institution holding corporations that personal the six largest US Treasury securities sellers.[5] The justification, as soon as once more, was that rolling again this post-2008 reform would permit banks to soak up extra Treasuries coming onto the market.[6]

A latest evaluation of the April market turmoil from Robert Perli, head of the Fed’s System Open Market Account. added essential twists to the rising regulatory consensus response. Prefacing his remarks by permitting that “I and my colleagues on the Federal Reserve’s Open Market Desk (the Desk) monitor carefully” developments in Treasury market liquidity, Perli additionally started with a swipe on the March 2020 strawman: “though liquidity in Treasury money markets turned strained in early April, these markets continued to operate.”

The query, in fact, was how they functioned and their results on market members. Right here, he supplied a number of fascinating observations. Not all are utterly persuasive, although, for our functions, the factors of distinction are second-order.

We’re open-minded, however reserved, for instance, about his assurances that hedge fund foundation trades counted for little within the April turmoil. Recalling how Fed analyses of the 2020 breakdown initially minimized the function hedge funds performed in that, solely to be corrected later by a examine from the Treasury’s Workplace of Monetary Analysis, we predict future analyses would profit from direct confrontations with the Bloomberg information introduced in Rivas.[7] These point out a marked widening of the “foundation” (the unfold between present and future costs essential to the commerce’s profitability) within the run-up to the President’s swap. This should have led to substantial promoting.[8] Another latest Fed accounts of the turmoil additionally point out substantial unwinding of leveraged trades by hedge funds throughout early April.[9]

Furthermore, the headline emphasis Perli (and Liang) place on general market “liquidity” proved to be a poor indicator for understanding the hedge fund conduct in March 2020.[10] Now it’s broadly accepted that hedge funds unwound huge numbers of foundation trades then. These, nevertheless, are particulars that may be left for one more time.

Different factors in Perli’s evaluation are of first-order significance and level to elementary points which have to date acquired much less consideration than they deserve.

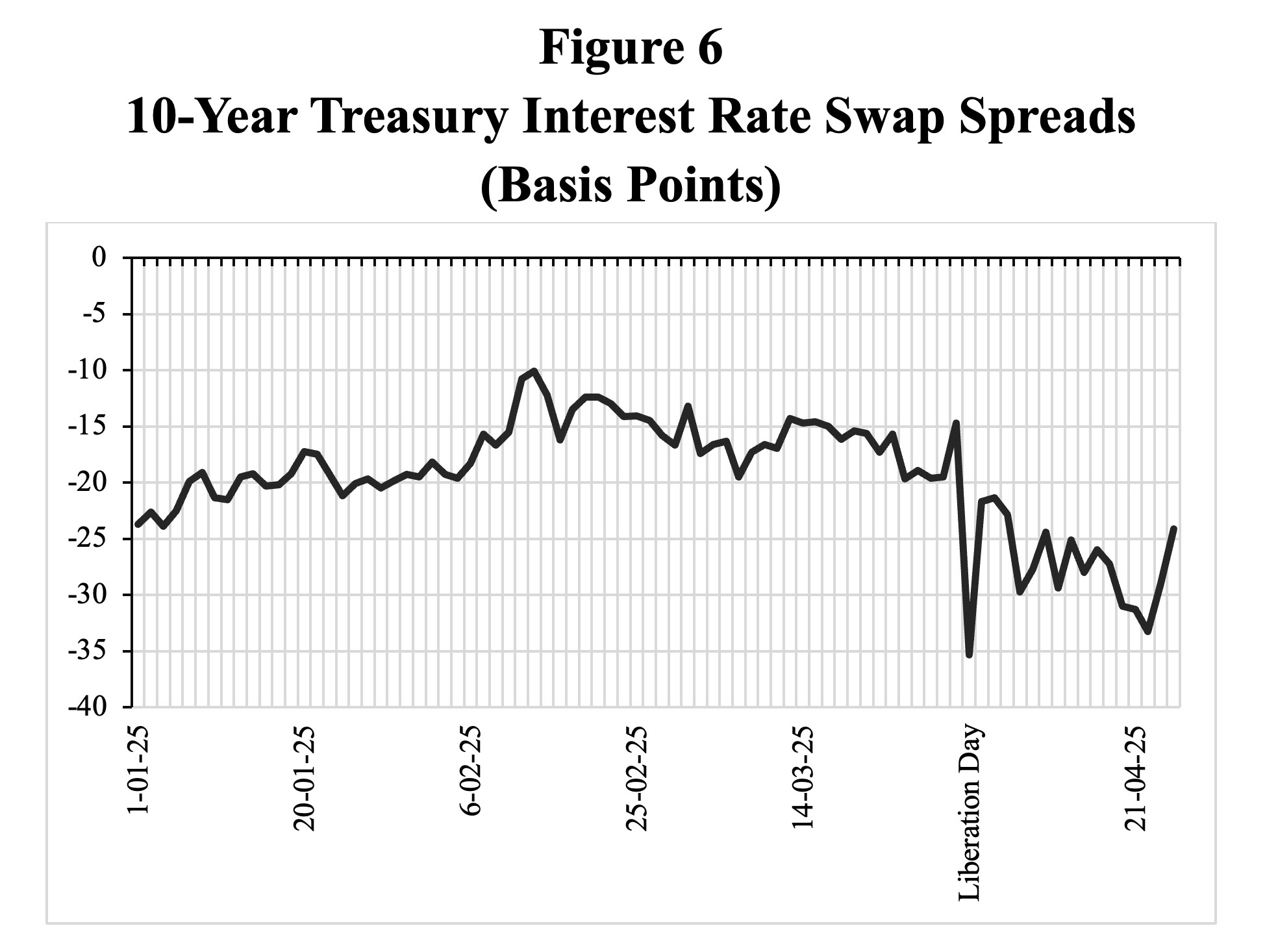

First is his backhanded affirmation of the declare by the nameless onetime Financial institution of England regulator within the London Instances that visions of deregulatory sugar plums had been certainly dancing within the heads of market members and that these helped destabilize swap costs: “Reportedly, many leveraged traders had been positioned to learn from a lower in Treasury yields of longer maturity relative to equivalent-maturity rate of interest swaps, partially because of the expectation for an easing of banking regulation that will bolster financial institution demand for Treasuries. Since swap spreads are outlined because the swap fee minus the Treasury yield, leveraged traders had been making a directional wager that swap spreads would improve.”

The purpose is illustrated by Determine 6. The ten-Yr Treasury rate of interest swap unfold, which is unfavorable to start with, rose from circa -20 foundation factors on January 20, 2025 – President Trump’s inauguration day – to round -15 foundation factors in early April, 2025, in anticipation of a decreasing of the SLR and better demand for Treasuries. Federal Reserve Chair Jerome Powell additionally messaged help for a diminished SLR in his semi-annual Financial Coverage Report on February 12, citing the necessity to bolster liquidity within the Treasury markets.[11]

Nonetheless, in April, when markets moved adversely, members bolted for the exits: “The unwinding concerned promoting longer-term Treasury securities, which seemingly exacerbated the rise in longer-term Treasury yields.”

Which, in fact, led to additional downward spirals. The swap unfold dropped to -33 foundation factors on April 22. “Numerous measures of illiquidity within the Treasury money market quickly neared and even exceeded the degrees seen in March 2023 throughout the banking sector stress episode. Importantly, although, they remained effectively under their March 2020 ranges.”

Supply: U.S. Workplace of Monetary Analysis (OFR).

Slouching Towards 24/7 Single-Payer

The extent to which the marketing campaign to downplay the April turbulence is solely a display screen to ease a path to additional deregulation is an fascinating query, however not one we have to resolve right here. Bundesbank President Joachim Nagel has since commented that “we skilled appreciable turbulence; on sure days, I generally felt that we weren’t removed from a meltdown within the monetary markets” and warned that strife over tariffs can readily reignite monetary markets. We expect it’s secure to conclude that the early April Treasury market turmoil spotlights actual vulnerability in monetary markets. Which brings us to Perli’s hanging dialogue of measures that the Fed is now considering for the subsequent disruptions.

His start line is revealing; certainly, it’s all essential: An effort to make clear the operational that means of that Protean time period “liquidity.” “I outline funding liquidity inside the Treasury repo market as the power to finance current and new Treasury positions by way of repos in a well timed vogue and at a predictable price—that’s, with little rollover danger. Often, when funding liquidity is ample, mispricing throughout Treasury markets is predicted to be restricted as a result of traders can finance the transactions to reap the benefits of arbitrage alternatives.”

As if by an invisible hand, these simply occur to be exactly the circumstances for worthwhile massively leveraged trades by banks and hedge funds, excessive frequency merchants, and different gamers “offering liquidity” in Treasury markets, particularly for repurchase agreements (see once more Determine 4).[12]

Perli outlines the considering behind this emphasis: “Funding liquidity is extra prone to stay plentiful if cash market charges will not be too risky, which, in flip, is determined by the provision and efficacy of financial coverage implementation instruments for guaranteeing fee management inside the Federal Reserve’s ample reserves framework.”

As instruments for such intervention, he emphasizes two Fed services for “fee management”: one is the In a single day Reverse Repo Facility (ON RRPF), which “helps put a flooring below cash market charges by permitting cash funds and another entities to position money on the Federal Reserve at a predetermined fee.”

The opposite is the Standing Repo Facility (SRF) arrange after the cash markets’ March 2020 near-death expertise. This “helps help market functioning and dampen upward strain on cash market charges by permitting main sellers and sure depository establishments to acquire liquidity from the Federal Reserve at a fee equal to, or probably barely larger than, the ability’s minimal bid fee.”

This brings us to the guts of the matter: In occasions of conflict, army chaplains had been keen on repeating that there have been no atheists in foxholes. We should conclude that these days, in Treasury markets, there aren’t any libertarians, solely grateful recipients of single-payer insurance coverage for ailing monetary markets.

The conclusion is strengthened by different joyful information that Perli delivered: that one other spherical of what would in some other context be decried as state socialism is imminent: “The SRF is a vital a part of the Federal Reserve’s toolkit, significantly when liquidity circumstances tighten….we’re at all times evaluating its parameters….As a part of this analysis, the Desk has performed technical workout routines that consisted of morning SRF operations that additionally settle within the morning, carried out along with the long-standing operations that happen and settle within the afternoon.”

At a time when many distinguished Wall Road executives had been biking like Glockenspiel collectible figurines out and in of the foremost media warning of the necessity for cuts in authorities, Perli reported enthusiastically that cash markets had been thumbs up on the Fed’s proposals.[13]

His desk’s “market outreach following the March quarter-end revealed that main sellers see the early-settlement SRF operations as an enhancement that will increase the chance that the SRF will probably be used when economically handy to take action….Sellers additionally reported that early settlement lowers hurdle charges—that’s, the speed in extra of the SRF fee they’re keen to pay available in the market earlier than selecting to entry the SRF.”

Thus inspired, Perli assured his viewers that the Fed “plans on making early-settlement SRF auctions a part of the common SRF each day schedule, sooner or later within the not-too-distant future.”

However there was extra. Perli promised additional visits from Santa Claus to the markets. “This doesn’t imply that there gained’t be room for additional enchancment…. Notably, reported hurdle charges within the tri-party repo market section, the place the SRF operates, are materially larger than the SRF fee. In different phrases, our counterparties inform us that they should see market charges considerably above the SRF fee earlier than being keen to entry the ability…The place attainable, Federal Reserve workers will proceed to search for methods to enhance the efficacy of the SRF.”

Whether or not the brand new Fed present bundle will arrive in time for Christmas, when the President has urged that many American youngsters might be making do with notably fewer dolls than earlier than, isn’t a easy query. Regardless of the blithe assurances, it’s obvious that coverage circles are evaluating a wealthy menu of choices for aiding monetary markets on the whole and repos particularly past these Perli talked about.

In the previous couple of years, rising numbers of analysts have seen that the marketplace for “Treasury securities has faltered repeatedly since late 2008.” The 2020 and April 2025 instances mentioned listed here are however two; 2019 witnessed appreciable turmoil, 2023 was one other. That final provoked astonishment from many exterior analysts who frightened that

The Federal Reserve dangers transferring past its function as a lender of final resort to a prop that markets must operate even in regular occasions….

The newest signal of the Fed’s mission creep got here on Sept. 30, when typical end-of-the-quarter strains on Treasury markets led to a $2.6 billion drawdown of its funding backstop, known as the Standing Repo Facility (SRF), because it was arrange in 2021 after a market scare.

The power, which permits some lenders to borrow in opposition to collateral reminiscent of Treasuries, was set as much as alleviate money shortfalls available in the market, which may result in sudden spikes in short-term rates of interest that threaten monetary stability.

However two banking sources who requested anonymity to talk candidly and a market knowledgeable advised me there was no liquidity downside that day, and indicators of monetary stress had been under regular ranges.

As an alternative, these folks stated the drawdown highlighted a potent structural challenge: At about $28 trillion, the Treasury market has grow to be too giant….

Already, the Fed and market members are floating concepts that will pull the central financial institution even deeper into markets, starting from centrally clearing some transactions to broadening who can borrow from it and providing the SRF earlier within the day.[14]

That is the actual context of the coverage discussions now in progress. With swelling federal authorities debt accessible for repos, 2023’s wave of financial institution failures, and the skinny capitalization of so many shadow banks, underlying anxieties about cash market fragility had been intensifying effectively earlier than the April turbulence. And we’re positive that the Bundesbank President isn’t the one individual worrying about what occurs subsequent.

Solely days earlier than the President’s announcement, for instance, the Brookings Establishment printed a paper by 4 senior economists, together with a former Federal Reserve governor, reviewing proposals for guaranteeing liquidity in Treasury markets. Their favourite would create one more Fed facility to supply 24/7 surveillance and attainable intervention in repo markets. The authors will not be blind to the attainable ethical hazards that include single-payer insurance coverage, although we don’t imagine their proposed mechanism is as antiseptic as they counsel. However to time period this a straw within the wind is an understatement: it’s extra like a phone pole crusing by in a hurricane.

It’s apparent that in monetary markets the entire is now much more weak than the assorted components – and that every one too lots of the latter are paying homage to fantasy concoctions dreamed up by a monetary engineering crew captained by Lewis Carroll and Hieronymus Bosch.

For instance, amid all of the handwringing over thinly capitalized and opaque shadow banks, these are actually much more intertwined with the common banking system than often acknowledged. Crypto can also be ready within the wings, sure to import a wild, poisonous array of latest hazards into the banking system. And in an more and more belligerent multi-polar world economic system, routine leverage charges of fifty or 100 to 1 are a digital invitation to catastrophe: Immediately tariff threats, tomorrow, anyone’s border claims, or local weather catastrophe, or carry commerce reversals can abruptly disrupt everybody’s calculations. We all know, as a result of they have already got.

There’s additionally the looming query of how the deep tensions between the Federal Reserve and the White Home will probably be resolved when Jerome Powell’s time period as Fed Chair runs out lower than a yr from now.

Sorting by means of hazards to secure belongings in such a world requires specific consideration of state insurance policies relating to industrial management and alliances in addition to home politics. In such a world, the system’s stability can’t probably be enhanced by lowering capital necessities for the most important, most systemically essential monetary establishments. That is hope that solely money-driven political methods might probably indulge. This dream will very seemingly flip right into a nightmare, as a result of easing the SLR for the most important banks and sellers within the Treasury market is probably going additionally to encourage the already highly-leveraged hedge funds — the very fragilities that policymakers declare to be mitigating.

The Evident Hole: Finance and the Actual Financial system

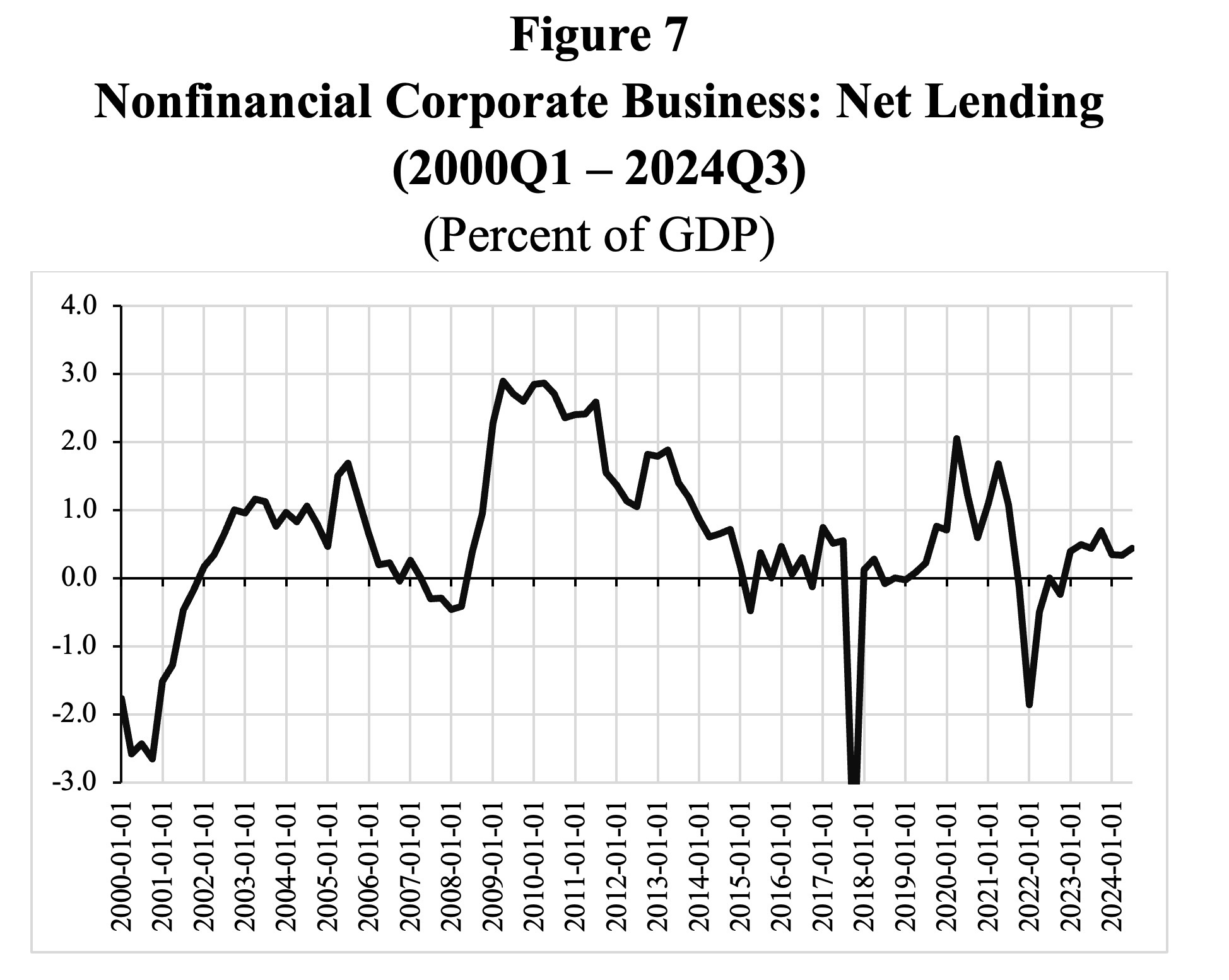

The standard justification for intermediation in monetary markets is its significance for actual capital formation. A primary level to notice is that US non-financial companies are internet lenders, in a macroeconomic sense, as a result of their (excessive) earnings exceed their mounted investments (see Determine 7). Which means the necessity of (usually cash-rich) non-financial companies for monetary intermediation is fairly restricted, no less than on the mixture stage.

Supply: FRED Database.

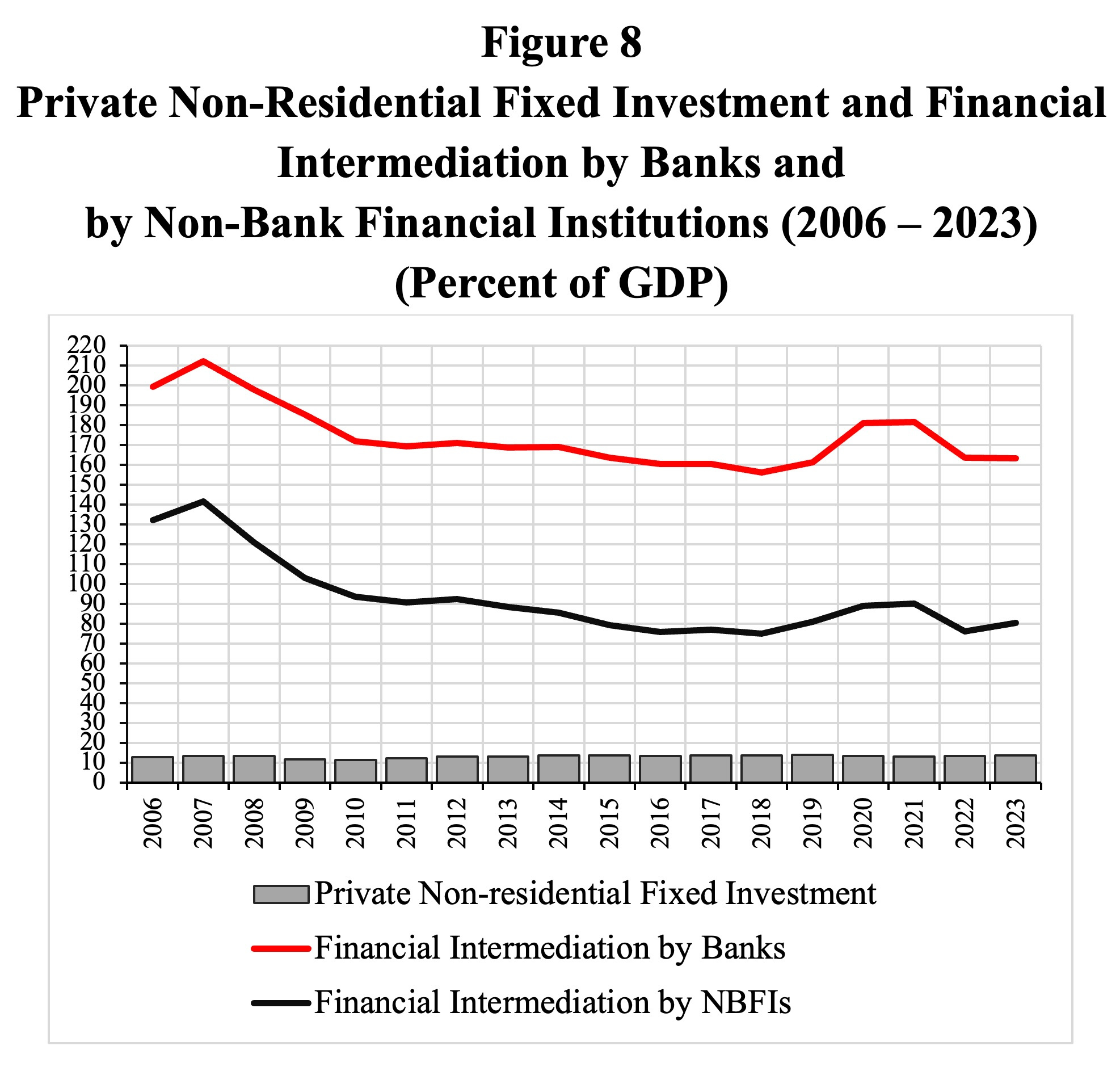

Not that this has stopped the monetary sector from increasing exponentially. As proven in Determine 8, the belongings of US non-bank monetary establishments (aka “shadow banks”) which encompass loans and monetary investments, equaled round 93% of American GDP throughout 2006-2023, whereas the belongings of business banks add one other 81% (on common); therefore, the whole scale of monetary intermediation is round 174% of GDP, whereas personal non-residential mounted funding summed to solely 13% of GDP. It’s evident that the majority of (shadow-bank) monetary intermediation within the US doesn’t serve actual capital formation in any actual sense.[15]

Sources: Monetary Stability Board, Database on World Monitoring Report on Non-Financial institution Monetary Intermediation; FRED Database Notes: The pink line exhibits the sum of financial institution and NBFI intermediation (as a share of GDP). The non-bank monetary intermediation (NBFI) establishments embrace cash market mutual funds (MMFs), hedge funds, broker-dealer corporations, insurance coverage corporations, securitization-based credit score intermediation, and different finance corporations.

As talked about earlier, banks and shadow banks are additionally working and rising carefully collectively. As an alternative of lending on to corporations, business banks are actually lending to non-bank monetary establishments (NBFIs), which then usually lend to the identical underlying non-financial companies (within the mixture). Actually, as reported by Robin Wigglesworth (2025) within the Monetary Instances (Might 29), business financial institution lending to “these NBFIs has quintupled over the previous decade to effectively over $1tn, and now accounts for greater than 10 per cent of all US banking loans (and almost 5 per cent of all belongings).”[16] By lending to non-banks, as a substitute of to corporations, business banks slip round capital requirement guidelines: the risk-weighted capital necessities on “Industrial and Industrial Loans” to corporations are a lot larger than the capital requirement on NBFI loans. By evading regulation on this approach, the banks present extra leverage, and as their NBFI lending grows, so too does general leverage and systemic danger within the monetary business.

The obtrusive distinction between bourgeoning monetary paper and actual capital formation is making the declare that finance serves the actual economic system, to the extent it was ever true, look fairly threadbare. The astronomical gross flows surging by means of modern cash markets are at most solely obliquely associated to actual financial exercise; a excessive share, most likely most, originate in efforts to hedge hazards that the method itself, with all its leverage and tiny margins, creates.

Socialism for the Wealthy

Ever because the post-2008 reforms, financiers have been combating and spending huge sums on lobbying, political contributions, and revolving doorways, to undermine them. They now imagine that they stand getting ready to complete victory. However piling up of dangers and leverage, because the world economic system restructures, ensures a endless succession of shocks with the potential to spiral uncontrolled. The result’s the exact reverse of free markets: an ever heavier and extra obtrusive hand intervening to safe an infinity of worthwhile transactions for a choose few with entry to credit score, regulatory connections, and the assets required to dominate legislatures and executives.

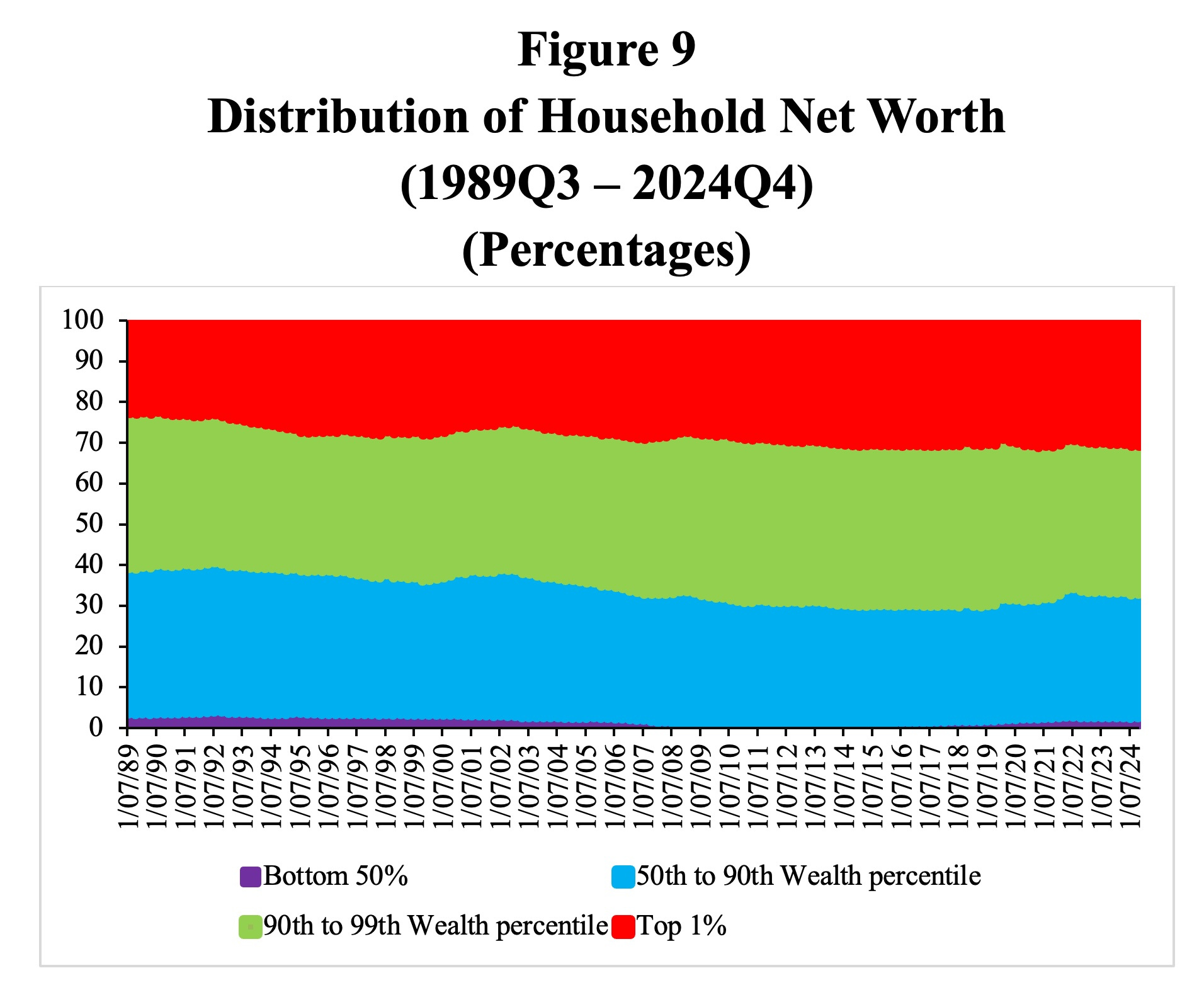

We’re witnessing the slow-motion extension of single payer insurance coverage for monetary markets, pure and easy, and the perfection of a surprising world-class machine for extracting assets from everybody else. This equipment makes finance successfully a “heads I win, tails you lose” enterprise: the implicit backstop supplied by the Federal Reserve supplies banks and now, increasingly, shadow banks, with many benefits, starting from tailor-made bailouts to enhanced credit score rankings and decrease financing prices whereas incentivizing them to undertake dangerous transactions. By extracting rents from public security nets, the monetary sector helps the super-rich to prop up their disproportionate share in family wealth, whereas disempowering the underside 50% or extra American households. As Determine 9 exhibits, the wealthiest 10% of US households handle to seize greater than two-thirds of family internet wealth, and the wealthiest 1% declare greater than 30% of family internet wealth. To take action, the wealthiest want the state.

Supply: FRED Distributional Monetary Accounts.

The wealthy and highly effective champion free markets solely rhetorically. They need to have the ability to run their very own nanny state in order that when they’re in hassle, the Fed or taxpayers will bail them out immediately. The concept Bernie Sanders is probably the most distinguished socialist within the US is all flawed.

__________

The authors benefited from feedback by very useful colleagues with broadly numerous views. Our due to Phillip Basil, Robert McCauley, Perry Mehrling, and Walker Todd for cautious readings and feedback. We additionally owe a longer-term debt to the late Edward J. Kane, whose examine of the 2019 repo controversy we’re particularly gratified to reference.

[1] The Senate has but to behave on the invoice, and lots of modifications have been proposed, as calls for for larger cuts grow to be extra intense because of bond market anxieties. Fears of voter anger on the cuts additionally run excessive. As this paper seems, the proposal is to chop Medicaid and different social packages by roughly $880 billion to assist cowl the price of $4.5 trillion in tax breaks. In response to a preliminary estimate from the Congressional Finances Workplace, the proposals would cut back the variety of folks with well being care by 8.6 million in 2034.

[2] Nomenclature in monetary markets isn’t exact, for extra causes than we now have time to debate right here. That’s true even for apparently standardized classifications utilized by regulatory our bodies in numerous international locations. In apply, the label “hedge fund” shades insensibly over to embrace excessive frequency buying and selling and different actions. And trades involving securities aside from Treasuries carry a lot larger dangers.

[3] The identify is complicated. Repurchase agreements are economically loans, with the twist that the borrower truly sells the collateral for the mortgage to the lender for a brief interval, promising to purchase it again at a barely larger value. That turns into the lender’s revenue. Examine with loans from a pawnshop. In these debtors’ deposit one thing priceless with the lender, however proceed to legally personal it so long as they repay. Within the foundation commerce, the treasury invoice is itself the collateral, although with, crucially, an additional margin of money that may change with market circumstances.

[4] The principle home laws was the Dodd-Frank invoice, enacted in 2010. US regulators coordinated with worldwide regulators in a number of rounds of “Basel agreements.” The US has not ratified the Basel III accords and with the change in administrations seemingly by no means will. As this piece goes to press, EU regulators are asserting postponement of a few of their very own Basel 3 reforms on the grounds that they may drawback European banks.

[5] The SLR is a non-risk weighted capital requirement, which is especially affected by high-volume, low-risk actions reminiscent of Treasury market intermediation. For the most important banks, particularly these with giant vendor subsidiaries, the SLR rule has implied larger capital necessities than risk-based capital guidelines in recent times, limiting their willingness and skill to intermediate in Treasury markets. Consequently, the marketplace for Treasuries turns into extra depending on intermediation by shadow-bank corporations together with hedge funds who’ve picked up the function of banks and their vendor subsidiaries.

Banks topic to particular Federal Reserve’s prudential requirements should preserve an SLR of no less than 3%. Nonetheless, the eight US globally systemically essential banks (which don’t all personal main sellers) are subjected to an enhanced SLR, which successfully requires them to keep up an SLR effectively above the minimal stage of 5% (see Desk 1). This, they really feel, is unduly hurting their companies.

Desk 1

U.S. World Systemically Vital Banks: Property and SLRs

(2024, second quarter)

| Whole belongings

($ billions) |

SLR

(%) |

|

| Financial institution of America Company | 3258 | 5.98 |

| Financial institution of New York Mellon Company | 429 | 6.83 |

| Citigroup Inc. | 2406 | 5.89 |

| Goldman Sachs Group, Inc. | 1653 | 5.45 |

| JPMorgan Chase & Co. | 4143 | 6.09 |

| Morgan Stanley | 1212 | 5.46 |

| State Road Company | 326 | 6.27 |

| Wells Fargo & Firm | 1940 | 6.67 |

| $ Whole, % Weighted Common | 15367 | 6.00 |

Supply: S. Pellerin (2024), Federal Reserve Financial institution of Kansas Metropolis.

[6] As mentioned under, the treatment is definitely one other symptom of the illness. Industrial banks immediately maintain about $1.7 trillion in Treasury securities, accounting for roughly 6% of the Treasury market and seven% of their very own steadiness sheets. As Wenxin Du writes within the Monetary Instances(Might 22, 2025): “The concept decrease complete leverage necessities would encourage significantly extra Treasury holdings from these business banks is questionable. The collapse of Silicon Valley Financial institution in 2023 after struggling losses on huge holdings of Treasuries when rates of interest rose highlighted the dangers right here. Prudent administration would discourage banks from rising long-term bond holdings funded by flighty deposits.”

[7] The literature on the 2020 disaster is giant and options continued rear guard actions. We lack the house to survey it. The identical holds for discussions of Fed bailout precedents and the extent to which these stretch conventional divisions between financial and financial insurance policies.

[8] Acharya and Laarits is one other detailed evaluation of the April turmoil that avows its outcomes are according to an unwinding of foundation trades, although the examine doesn’t concentrate on them. Curiously, the minutes of the Federal Reserve Open Market Committee for April 30-Might 1 embrace a remark within the workers evaluation of the present financial state of affairs that “the prevalence of the premise commerce by hedge funds appeared to have declined from its peak however remained elevated by historic requirements.”

[9] For instance, web page 27 of the Federal Reserve’s April 2025 Monetary Stability Report asserts that “Whereas hedge funds’ leverage rose to historic highs within the third quarter of 2024 and remained concentrated among the many largest hedge funds, it seemingly decreased in early April as some hedge funds unwound leveraged positions amid heightened market volatility.” The examine repeats the purpose on p. 33: “hedge funds’ leverage has seemingly decreased from traditionally excessive ranges as a result of repositioning and unwinding levered trades in April.” And that “hedge fund repositioning and deleveraging might have contributed to the latest market volatility, each in equities and dangerous belongings in addition to in some longer-dated Treasury securities.” After all, foundation trades are just one sort of leveraged trades.

[10] This level is technical and deserves an extended dialogue than we want right here: “Whereas funds seem to have partially exited these trades primarily based on gross sales of the cheapest-to-deliver notes, it’s not clear that these gross sales truly impaired Treasury market liquidity. As an alternative, the premise commerce seems to have continued to supply internet liquidity to underlying Treasuries relative to comparable off-the-run securities.” Its weight can also be affected by how critically one takes the comparability between March 2020 and April 2025, together with the actions of Fed within the former case and President Trump within the different.”

[11] When requested at a Home Monetary Companies Committee listening to if the Federal Reserve will look into revisions to the supplementary leverage ratio, Powell replied: “Sure, I imagine we are going to. I’ve, for a very long time, like others, been considerably involved concerning the ranges of liquidity within the Treasury market. The quantity of Treasuries has grown a lot sooner than the intermediation capability has grown, and one apparent factor to do is to decrease, is to scale back the efficient [supplementary] leverage ratio, the bindingness of it. In order that’s one thing I do count on we are going to return to and work on with our new colleagues on the different businesses, and get achieved.”

[12] A reader of a draft of this paper commented that “a part of the purpose you’re making right here is the round nature of a lot this exercise…the Fed is saying there must be enough liquidity within the repo market, however that liquidity is collateralized by the identical asset that the liquidity is getting used to buy.” Sure.

[13] Anticipating will increase in governmental borrowing fueled by rising price range deficits, Scott Bessent, the Secretary of the Treasury, desires the cash markets to easily take in extra Treasuries. Therefore, Bessent favors regulatory reform, stating (on April 9, 2025), “I beforehand raised considerations about whether or not the leverage capital restrictions are too often binding. The financial institution regulators are actually laborious at work to develop a proposal to make sure that leverage capital capabilities as applicable.”

[14] Paritosh Bansal, “Within the Market: How Harris, Trump guarantees might feed market’s habit to the Fed,” Reuters, October 30, 2024.

[15] The monetary sector additionally originates loans for consumption and for mortgages. Shopper credit score by banks quantities to circa 16-19% of GDP throughout 2010-2024. Whole family debt (which incorporates bank card debt, different client loans auto loans, pupil loans, and mortgages) stands at $18.2 trillion within the first quarter of 2025, or round 60% of GDP. Whole intermediation by banks and non-bank monetary establishments stands at round 170% of GDP. It have to be borne in thoughts that the monetary wizardry by banks and different monetary corporations is critically depending on (real-economy) collateral together with Treasuries, mortgage-backed securities, and asset-backed securities involving automotive loans, bank card debt and so on. Banks are greater than keen to originate credit score to households in trade for the underlying collateral that they will then use for his or her alchemical monetary actions. Our conclusion stays unchanged, subsequently: the colossal gross flows that sweep by means of the monetary system are in no way essential to help households and shoppers.

[16] Wigglesworth’s article is predicated on a brand new report printed by Barclays’ macro, credit score and financial institution analysis analysts Jeffrey Meli, Bradley Rogoff, and Peter Troisi.

See authentic put up for references