Just_Super/iStock via Getty Images

Investment Thesis: I take a bullish view on Target Hospitality given that overall revenue growth remains strong and the company’s balance sheet metrics look solid.

In a previous article back in November, I made the argument that Target Hospitality (NASDAQ:TH) could continue to see upside from here, on the basis of strong revenue growth across the Government segment, as well as a decrease in long-term debt to total assets.

Since then, the stock is up by just over 33%:

investing.com

The purpose of this article is to assess whether the strong growth in upside that we have been seeing can continue from here.

Performance

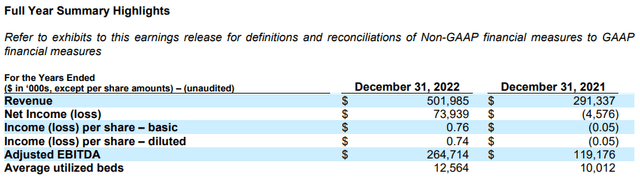

We can see that Target Hospitality saw strong growth in revenue over the past year, with revenue up by 72% from that of December 2021:

Target Hospitality Q4 2022 Press Release

Additionally, while the company was operating at a net loss in the previous year – diluted income per share has rebounded strongly to $0.74.

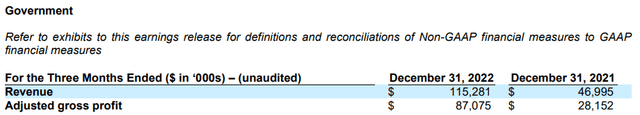

Moreover, when looking at the two largest segments by revenue – Government and Hospitality & Facilities Services – South, we can see that the Government segment has by far led the bulk of revenue growth for Target Hospitality overall:

Target Hospitality Q4 2022 Press Release

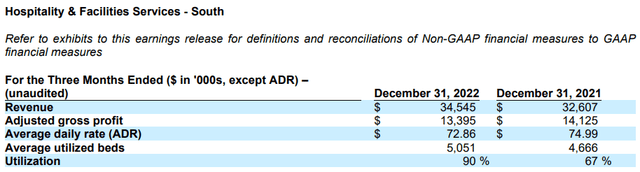

For Hospitality & Facilities Services – South, we can see that in spite of slight growth in revenue – adjusted gross profit actually decreased from that of the previous year:

Target Hospitality Q4 2022 Press Release

From a balance sheet standpoint, we can see that the company’s long-term debt to total assets ratio has been decreasing over the past year, which is encouraging:

| Dec 2021 | Sep 2022 | Dec 2022 | |

| Long-term debt, net | 330212 | 333275 | 328848 |

| Total assets | 513392 | 729698 | 771727 |

| Long-term debt to total assets ratio | 0.64 | 0.46 | 0.43 |

Source: Figures sourced from Target Hospitality Q3 and Q4 2022 financial results. Figures provided in $ in thousands, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

Moreover, the company’s cash and cash equivalents has been bolstered significantly over the past year – from just over $23 million in December 2021 to over $181 million in December 2022.

Risks and Looking Forward

As we have seen, the Government segment – driven by the Expanded Humanitarian Community – has been responsible for the bulk of Target Hospitality’s revenue growth.

We have seen that Hospitality & Facilities Services – South, which is a geographic area that includes the southeast corner of New Mexico and a significant portion of Western Texas (which is also known as the Permian Basin) – is a key resource-producing region in the United States.

We previously saw that with concerns over a lack of supply of oil and gas reserves from Russia as a result of sanctions due to the ongoing situation in Ukraine – more workers were ultimately deployed to the basin in order to bolster oil production – which in turn led to higher demand for lodging services to accommodate such workers.

However, with inflationary trends having also affected the cost of drilling and production – we have been seeing a trend whereby oil exports have been rising but production levels have been lagging behind.

As such, we have been therefore seeing modest growth in revenue across the Hospitality & Facilities Services – South segment – as the cost of hiring more workers becomes prohibitive and hence accommodation demand starts to plateau.

In this regard, while the Government segment has continued to show a strong pace of growth – recent performance does signify that Target Hospitality is becoming more dependent on this segment to sustain overall revenue growth.

Conclusion

To conclude, Target Hospitality has continued to show strong performance across the Government segment. The main risk to the company at this time is that Target Hospitality becomes overly dependent on this segment to sustain revenue as growth across Hospitality & Facilities Services – South starts to plateau.

However, overall revenue growth remains strong and the company’s balance sheet metrics look strong. I continue to take a bullish view on Target Hospitality.