Darren415

There are four basic ways of making money with equities:

- Capital Appreciation,

- Dividend Income (if applicable),

- Covered Call Premiums,

- Naked Put Premiums.

The first two ways go together without any special effort. If you own a dividend-paying stock, you will automatically receive cash distributions if you own the shares on the ex-dividend date.

Option writing income only comes to those who understand the techniques and use them to their advantage.

Covered calls by themselves can bring in nice income while still leaving room for decent capital appreciation.

Naked put writing can generate terrific premium income while also providing nice margins of safety versus the trade inception price.

When all three transactions (buy shares, sell covered calls, and short naked puts) are done simultaneously, the results can be spectacular. I call that mix of trades a “buy/write combination.”

I will go over the possible ways those can play out a bit later.

The first step in designing a Buy/write is to find stocks with excellent upside potential. My pick for that is G-III Apparel Group, Ltd. (GIII).

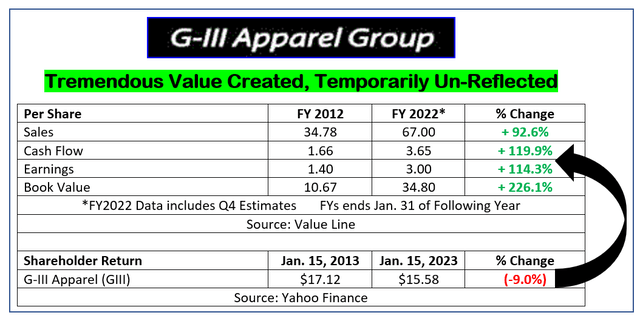

The company has prospered over the past decade, yet its shares are 9% lower than exactly 10 years earlier.

Yahoo Finance, self

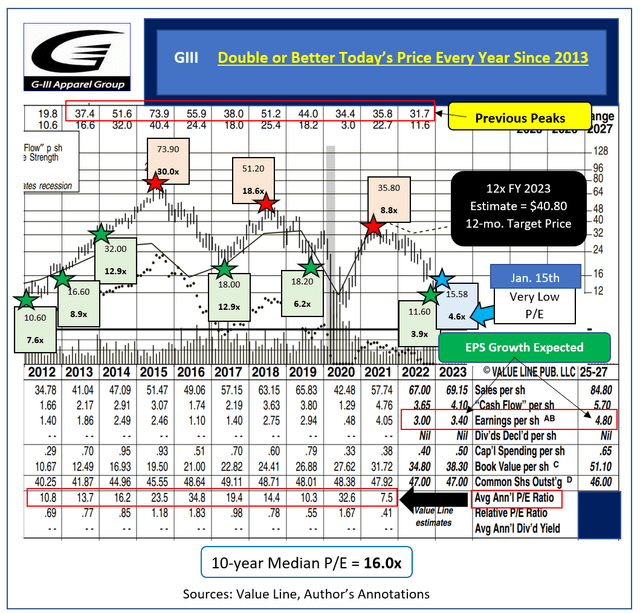

GIII’s average P/E since 2012 ran about sixteen times. Due to P/E compression, it closed out last week at just 4.6 times Value Line’s FY 2023 EPS estimate for them. If all goes well and the multiple expands, GIII could potentially rise quite a bit over the coming six to twelve months.

Value line, self

Company officers, including the CEO, are the best qualified to know if GIII’s future appears bright. Substantial insider buys, totaling $3.381 million on Dec. 5, 2022, suggest they think things look good.

insidercow.com, self

There is absolutely nothing wrong with simply buying GIII and waiting for the expected rebound.

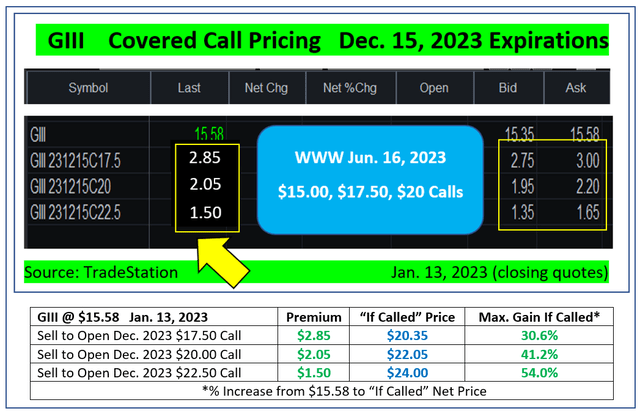

Selling out-of-the-money covered calls, though, brings in an immediate and substantial sum which reduces risk and qualifies for the “bird-in-the-hand” theory. I laid out the actual pricing on GIII’s Dec. 15, 2023 expiration date calls with the shares at $15.58.

Selling lower-strike price calls brings in more money upfront but limits the maximum gains on the back end if GIII makes a large upturn by expiration day.

I would go for the gusto by shorting the $22.50 calls for $1.50 per share.

TradeStation, self

If GII is $22.50 or higher by Dec. 15th your shares will be “called away” for a net price of $24 ($22.50 + $1.50) per share.

Could GIII be higher than that by then? Sure. Who cares, though, when you would be up by 54% from the trade inception price and 70.4% from the actual $14.08 /share out-of-pocket cost ($15.58 – $1.50 in call premium).

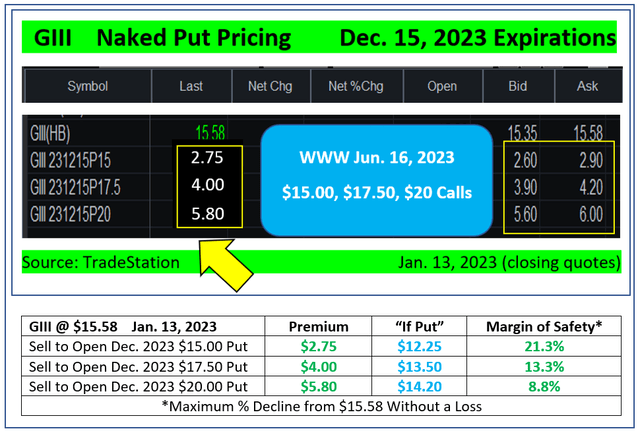

Now we will look at the naked put side of the transaction. It is not crazy to go for the $20 strike price put with its $5.80 per share premium. That translates into a worst-case, forced purchase price of just $14.20. That provides 8.8% in downside protection in case things do not go as expected.

TradeStation, self

$15.00 or $17.50 strike price puts would add extra downside protection but offer less up-front money.

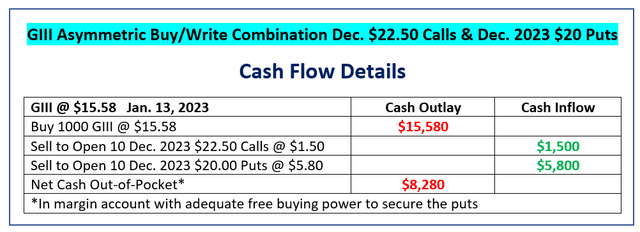

Now we will put the three transactions together to see the cash flow details of the entire buy/write combo. I will use a 1000-share, Ten-call & Ten-put example. It could be done with as little as 100 shares.

Self

There are just three possible ways for this combination to play out on expiration day.

GIII could finish below $20.00, it could close between $20.01 and $22.49, or it could finish at $22.50 or higher.

Here is how those various outcomes would be upon expiration:

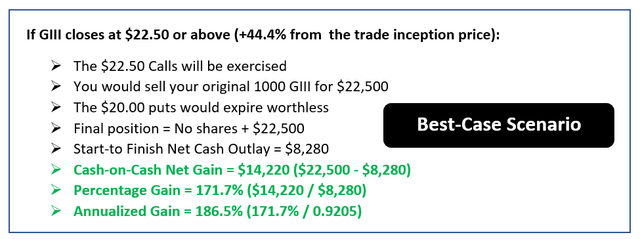

My hope is that GIII rises to at least $22.50. If so, the best-case scenario detailed next will apply.

Self

Any upturn of at least 44.4% will translate into a superb 171.7% total return on the combination, achieved in just under one year. How cool is that?

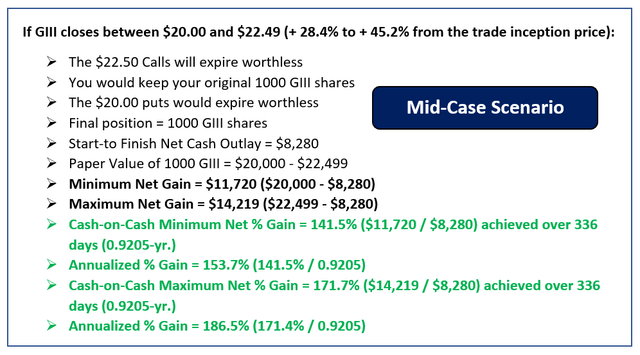

If GIII rises to at least $20, but not more than $22.49, the following mid-case scenario will unfold.

Self

A minimum gain of at least $28.4% would morph into a 141.4% profit on the full combination. The gain could reach almost the best-case scenario’s level if GIII finishes not far under $22.50.

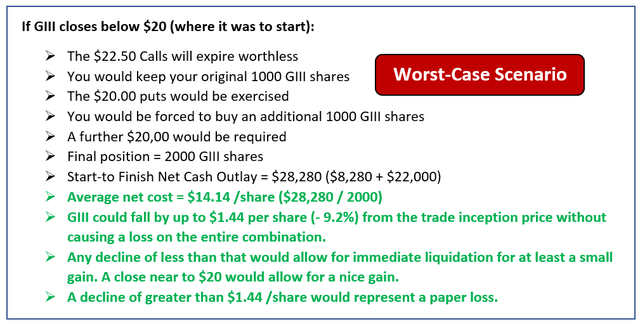

What if GIII does not reach $20 by expiration day?

If so, the worst-case scenario described below would play out.

Barring a major decline, however, even that would not appear scary. Combination sellers would end up with double-sized positions in GIII, but at an incredibly attractive average cost of just $14.14 per share.

Any expiration date pullback of less than 9.2% from the trade inception price would still allow for immediate liquidation for at least a small profit. If GIII closes not far below $20 the gain could be quite large. A close just below $20 would hold almost as much of a gain as the mid-case scenario.

Self

Only a severe sell-off on this great-looking stock would give cause for regret.

Why do the combination plays work so powerfully to amplify the gains? You are essentially “booking” two opposite bets from the option sales. The call buyer believes GIII will be much higher by Dec. 15, 2023. The put buyer thinks just the opposite. He can only win if GIII drops to south of $14.20.

They could both end up being wrong, No matter what, only one of them can possibly be correct. If the optimistic call buyer wins, you win, also. If they are both wrong, you will still pocket nice gains across almost all possible outcomes.

Simple buy-and-hold buyers of GIII at $15.58 would need to see it rise to $37.62 to capture the same percentage gain as the minimum return on the mid-range combination.

Equaling the best-case percentage gain would equate to a buy and hold purchaser seeing GIII surge to $42.33 per share.

That same buy and hold investor would be down 9.2% on paper if GIII fell to $14.14 versus a break-even at that price for the worst-case combination writer.

The power of combination strategies is huge. It just takes an understanding of the intricacies of the technique and a large enough initial bankroll to implement it.

As with most things in life… the rich, and smart, tend to get richer.

Disclosure: Long GIII shares, short both GIII put and call options.