Scott Olson/Getty Pictures Information

Thesis

There’s a lot disagreement within the markets at present. Nonetheless, the consensus on the wholesome meals market is (for essentially the most half) the identical. One participant of latest notability within the area is Sweetgreen (SG).

Why this specific participant?

Sweetgreen, the millennium targeted restaurant group that serves “wholesome meals” at scale, had an astonishing $6 billion valuation in its November IPO that has since been slashed in half on nothing aside from market pullbacks fueled by worry and panic.

As of October twenty fifth, the corporate had 140 eating places and plans to double its footprint throughout the U.S. within the subsequent 3-5 years. Now, any firm at that dimension that plans on doubling its attain inside that timeframe is spectacular. Nonetheless, scaling with out eventual profitability isn’t sustainable. Subsequently, analyzing the underlying fundamentals is one of the best ways to see how the corporate plans on attaining sustainable profitability.

With a rising footprint and no retractions in its fundamentals, Mr. Market may be giving observant buyers an actual shopping for alternative within the area.

Sweetgreen 2021 Financials

Revenues

Sweetgreen’s revenues grew 54% on $339.9 million in 2021 revenues in comparison with $220.6 million in 2020. This was largely pushed by two components. The primary of which was 31 new retailer openings for the yr.

The second contributing issue to income will increase was largely pushed by a 25% improve in similar retailer gross sales versus destructive 26% in 2020. To a a lot lesser extent, a 4% improve in menu costs additionally contributed to this.

Okay, so Candy inexperienced’s income improve was fueled by double digital retailer openings and will increase in similar retailer gross sales. Nonetheless, there’s a refined distinction between the 2 drivers. Retailer openings are powered by the corporate, as any firm with sufficient monetary backing can open shops. The latter is the true driving issue to income technology. Wanting carefully, most transactions on this firm are by digital channels.

Digital Income Channel

In 2020, complete digital income was 75% of gross sales whereas 56% of the digital income was by Sweetgreen’s owned digital channel. Now, this is smart. 2020 was the yr of lockdowns and one ought to count on these ranges of digital gross sales. Nonetheless, one must also see an nearly proportional drop in these channels in 2021. This wasn’t essentially the case.

SG digital menu (CNBC)

Complete digital income made up 67% of gross sales of which 46% was owned digital revenues. Now an 8% drop in complete digital income and 10% in owned income is fascinating. For one, these ranges are anticipated with the reopening phases of 2021. Nonetheless, digital income nonetheless made up practically 70% of all income for this firm.

If this development continues, I count on Sweetgreen to essentially shine. Why? as a result of digital gross sales channels are at all times extra environment friendly. The effectivity generated by it will inevitably result in improved working margins.

Why is working margin so vital? Nicely, the meals business already has low margins, and as an alternative depends on quantity. Digital channels can churn out extra orders extra rapidly, with much less labor inputs. Subsequently, if Sweetgreen acts on this mannequin it may possibly attain profitability ahead of anticipated.

Profitability

Sweetgreen is rapidly gaining profitability with scale. In 2021, the corporate doubled its retailer openings and nearly halved its losses. As an illustration, Sweetgreen’s 2021 loss from operations was $134.4 million with a destructive 40% working margin. 2020’s loss from operations was $141.6 million with a destructive 64% working margin.

The purpose right here is that Sweetgreen solely opened 15 new shops in 2020, however opened 31 in 2021 and lowered its losses whereas scaling. This alerts to me that Sweetgreen is changing into higher at determining learn how to flip their mannequin worthwhile with every new retailer opening. Why can I make this argument?

Sweetgreen is already worthwhile on the restaurant degree, simply not on its operations as a gaggle. In 2021, restaurant degree revenue was $40.4 million on a 12% revenue margin. The revenue margin one yr earlier was destructive 4%.

SG Inventory Valuation: Analyzing Administration’s Projections

Sweetgreen has offered outlook on its 2022 projections:

- At the least 35 Internet New Restaurant Openings

- Income starting from $515 million to $535 million

- Identical-Retailer Gross sales Change of between 20% and 26%

- Restaurant-Degree Revenue Margin between 16% and 17%

- Adjusted EBITDA between $(40) million to $(33) million

Sweetgreen is predicting 51% income development on its base case. Final yr hosted 31 retailer openings and revenues grew at 54%. Subsequently, if all different components are saved fixed, Sweetgreen’s 51% prediction needs to be simply achievable.

The identical retailer gross sales (SSS) improve of 20%-26% can also be fairly achievable. In 2021, SSS grew 25%. This will fairly simply be pushed by its digital and in-store channels as extra individuals turn into conscious of the Sweetgreen model. At many places within the U.S., Sweetgreen has turn into a staple. Nonetheless, I need to admit I base this simply over my very own observations.

The restaurant degree revenue margin must also profit from the digital pushed income generator because it boosts effectivity and quantity. Subsequently, I’ll agree it will fall someplace between 16% and 17%. Adjusted EBITDA will naturally comply with and fall someplace within the predicted vary. Its 2020 adjusted EBITDA was destructive $107.5 million, whereas its 2021 determine was destructive $63.1 million.

My projections

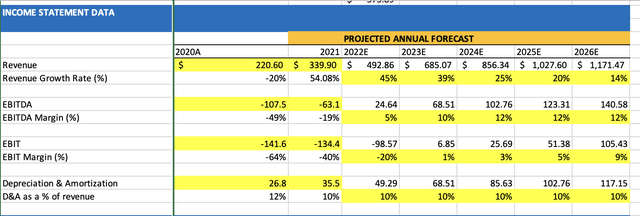

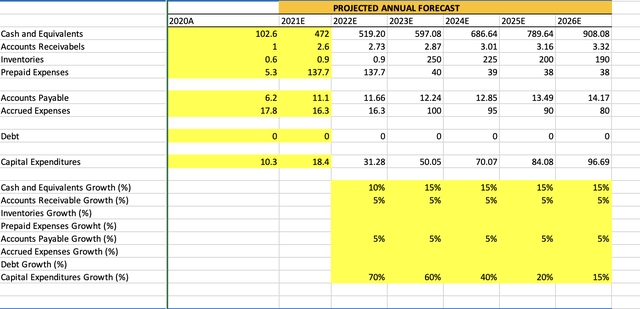

After 2022, I predicted revenues will develop 45%, 39%, 25%, 20% and 14%, respectively. This can symbolize the preliminary income technology as the corporate pours out extra CAPEX for retailer openings and finally fall to the business common as competitors erodes its development. I additional predicted its working margin will obtain profitability by 2023 and gradual to across the 9% business common discovered on In search of Alpha’s quant evaluation by 2026. The EBITDA margin will comply with an analogous sample and fall across the business common of 12% by 2026.

Progress charges (William Sabga-Aboud) Steadiness sheet projections (William Sabga-Aboud)

I made a decision to make use of a ten% WACC to replicate that the corporate has little to no debt, however faces intense competitors that serves as the majority of its threat. Moreover, with no noticeable aggressive benefit, the earlier level is additional bolstered.

Lastly, when it comes to development in perpetuity, I’ve determined to make use of a 4% development fee to replicate the truth that this firm won’t ever develop quicker than the U.S. financial system in perpetuity.

Fairness Worth Per Share

Placing all of it collectively, I received an fairness worth per share of $32 at present based mostly by myself future projections. At a present inventory worth of $26.50, my projection represents a 20% upside from present ranges. I imagine this can be a important sufficient margin of security to justify an entry into the place.

The Backside Line

Sweetgreen is a candy beast when checked out essentially. The corporate has little to no debt, is rapidly increasing its footprint and enhancing its operational efficiencies by driving gross sales by its digital channels. I imagine these components will permit it to proceed its trajectory of first attaining profitability, and secondly, solidifying its model because the staple for wholesome meals within the U.S.

When it comes to its valuation, with heightened income development charges and profitability by 2023, I justify an fairness worth of $32 at present. This represents 20% upside and a passable entry level to enter the place in the event you agree in regards to the firm’s long run prospects.