peepo

I wrote an article about betting towards the -1x Quick VIX Futures ETF (BATS:SVIX) by Volatility Shares again in December 2023. Because of the acute volatility up to now week, the ETF is now down over 40% from once I wrote the article and over 55% from the highest set simply final month.

This text is a follow-up for SVIX. This evaluation additionally applies to related ETPs just like the Simplify Volatility Premium ETF (SVOL) and the ProShares Quick VIX Quick-Time period Futures ETF (SVXY). It is vital to notice that SVIX goals to be -1x publicity to VIX futures, whereas SVXY goals to be -0.5x, and SVOL is about -0.2x t0 -0.3x uncovered. SVIX is clearly probably the most aggressive of the three.

Again then, SVOL was the one ETP of the three with any built-in safety within the type of far OTM VIX calls. This was successfully a hedge towards black swan occasions the place the VIX surges over 100% in just a few days. As I write this (Monday, 5 August within the morning), the VIX is coming down from 56 at open to round 41. Fortunately for SVIX, the fund adopted the VIX calls technique some time after I revealed the article.

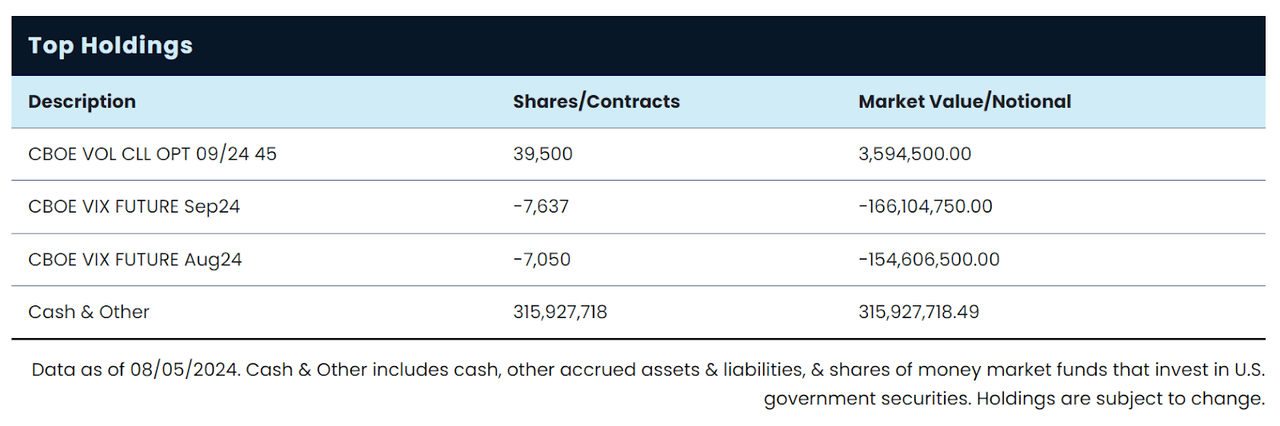

SVIX Holdings (Volatility Shares)

These appear to be VIX 45 calls expiring in September, and the notional dimension is safety for the VIX futures which can be offered brief as part of the -1x VIX futures technique. As I write this, the VIX is up about 70% since Friday and short-term lengthy VIX futures funds like UVXY and VXX are up 47% and 32% respectively. SVIX is barely down 27%, which I take it means the VIX calls it prudently allotted to have kicked in to guard the fund.

The VIX has bounds to how excessive it might probably go as a result of it’s a operate of the weighted common of SPX choices costs, and places at the very least have boundaries and markets have a tendency to not soften upwards, so calls are additionally successfully capped. I believe VIX 41 is kind of excessive and now is an efficient time to begin constructing an SVIX place.

Again To Fundamentals

Purchase low, promote excessive is the way you earn a living. With VIX at these highs, the inverse VIX futures funds, with SVIX being probably the most uncovered and aggressive, are at relative lows. The chance is evident. The VIX would not keep this excessive for lengthy. It has not often spent any time over 50 and right this moment has come down from 56 to 40.

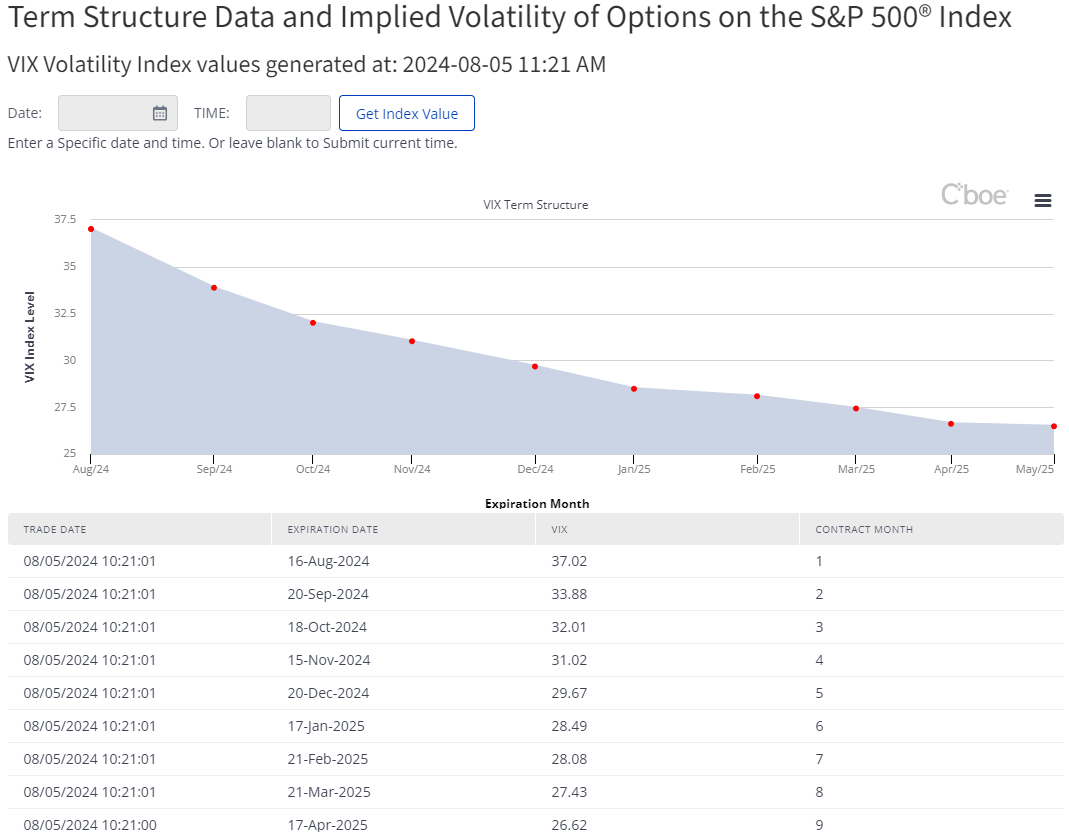

SPX choices can be offered and this may push the VIX down. At the moment, the VIX futures time period construction curve is in steep backwardation, which means the contracts expiring earlier are priced far above those expiring future out:

Time period construction, 5 Aug (CBOE)

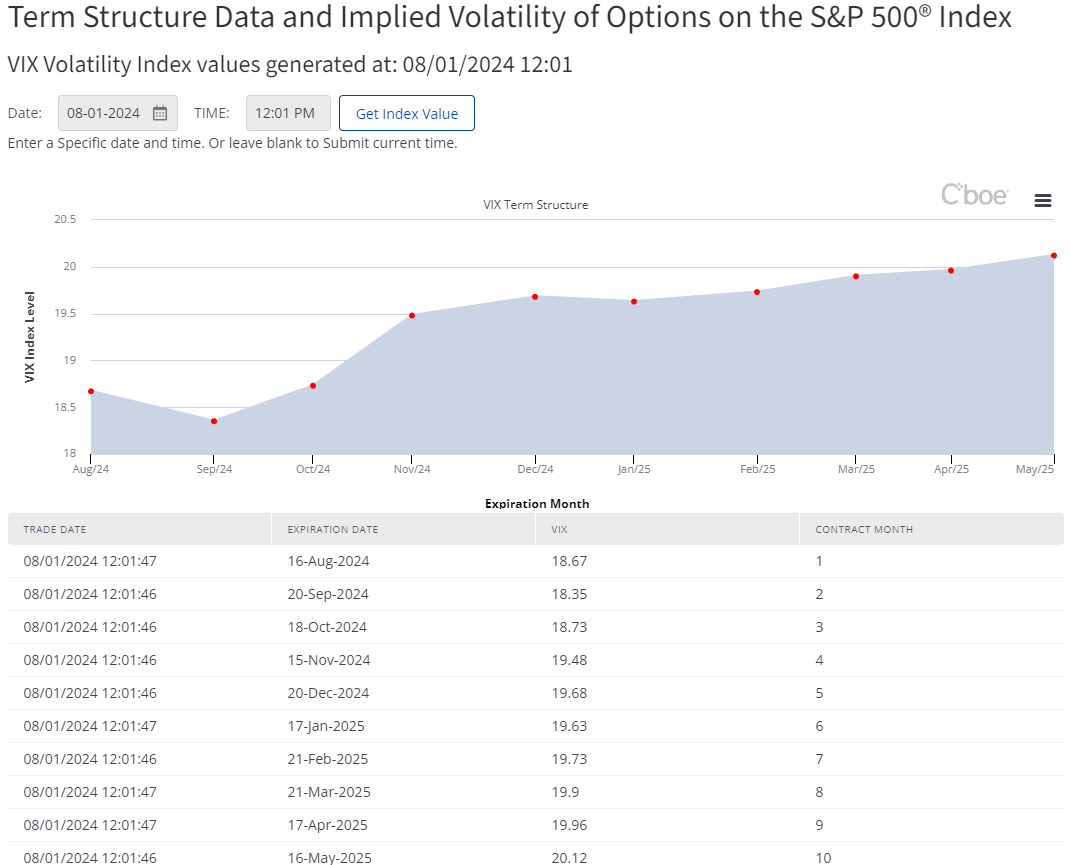

On Thursday 1 August, the time period construction was in contango:

Time period construction, 1 Aug (CBOE)

VIX futures backwardation doesn’t final lengthy. Typically, the contracts fall again down because the spot VIX returns to regular ranges. The present revenue from getting into into SVIX proper now could be that you’re successfully promoting VIX futures right into a backwardation atmosphere, which tends to be a successful wager.

How excessive can the VIX go from right here? If it goes up one other 70% like right this moment, the VIX calls that SVIX holds can be ITM, and this may possible shield the portfolio from additional declines. However going up one other 70% from right this moment would imply VIX is at 68, which might be astronomically excessive contemplating the place the VIX normally is.

Shopping for SVIX now appears extraordinarily probabilistically sound. The draw back is extraordinarily restricted proper now, and the upside is that you’re shopping for right into a “wager towards volatility” technique precisely when volatility is at historic highs. The chance-reward not often will get this good.

Dangers and Conclusion

I am slowly shopping for some SVIX. I believe the most important danger is that administration someway fumbles the bag with the VIX calls, maybe closing all of them out, proper earlier than the VIX goes to 90 in a single day. This state of affairs would in all probability fully destroy the NAV. Nonetheless, loads has to go unsuitable. For one, I belief that most individuals of their place would know to monetize hedges slowly in order to not drastically disrupt the general positioning of the danger profile. One other factor is that the worth of the calls proper now are in all probability what’s satisfying what would in any other case be margin calls on the VIX futures shorts. There isn’t any must eliminate that safety when VIX might nonetheless transfer greater from right here. Lastly, it might require one other 100% rally in not simply the VIX, however the short-term futures as properly to actually wipe out the NAV. I view this as impossible, simply based mostly on what the VIX truly is.

I like to recommend taking up small positions in SVIX. Now’s the time to be a little bit extra aggressive and grasping as a result of there may be positively blood on the streets.