Larry Gibson/iStock via Getty Images

Introduction

As I have been building up my positions in preferred shares over the summer and in the past few months, I also now have to keep tabs on those positions to make sure I’m still comfortable with the performance of the companies that issued the preferred shares. While I’m not necessarily a big fan of hotel REITs (notwithstanding my relatively bullish stance on Park Hotels and Resorts), I do like certain preferred shares from hotel REITs as the risk/reward ratio appears to be quite favorable from a dividend coverage and asset coverage perspective. In this article I’ll catch up on Sunstone Hotel Investors (NYSE:SHO), a REIT with perhaps the strongest balance sheet in the hospitality sector.

The hotel sector is bouncing back

After two rather difficult COVID years, things were finally looking up for the hospitality sector and hotel REITs but the high inflation rate and lower consumer confidence levels may now pose the next challenge. Fortunately most hotel REITs have been very reluctant to pay high distributions and the balance sheets should be in a much better position to get through the next crisis.

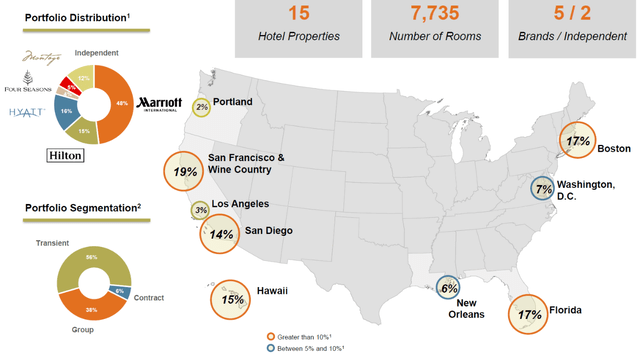

Sunstone Investor Relations

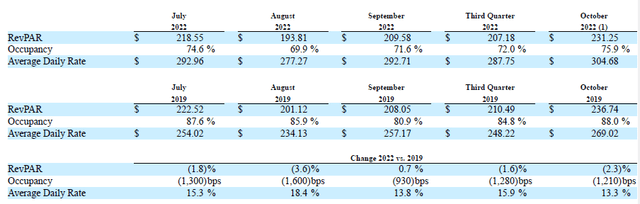

During the third quarter of this year, Sunstone still had to deal with a relatively weaker result on a comparable basis. The occupancy rate was just 72% (compared to 84.8%) while the revenue per available room decreased from $210.49 to $207.18 compared to the third quarter of 2019, the last pre-COVID year.

Sunstone Investor Relations

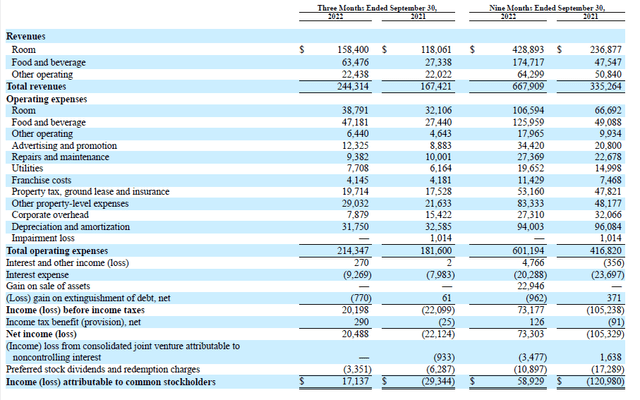

While the net income isn’t very important for a REIT, it does provide a useful look under the hood as the net income result is the starting point for the FFO and AFFO calculations.

And as you can see below, Sunstone’s third quarter wasn’t bad at all. The total revenue increased by almost 50% while the operating expenses increased by less than 20% as a lot of the operating expenses are relatively fixed. The room revenue for instance increased by $40M while the operating expenses increased by just over $6M which means that in excess of 80% of the incremental revenue was converted into operating income. That’s a good result.

Sunstone Investor Relations

As you can see above, the hotel REIT was profitable as it reported a net income of $20.5M based on its operating results and after deducting the $3.35M in preferred dividends, the net income attributable to the shareholders of Sunstone was C$17.1M or $0.08 per share.

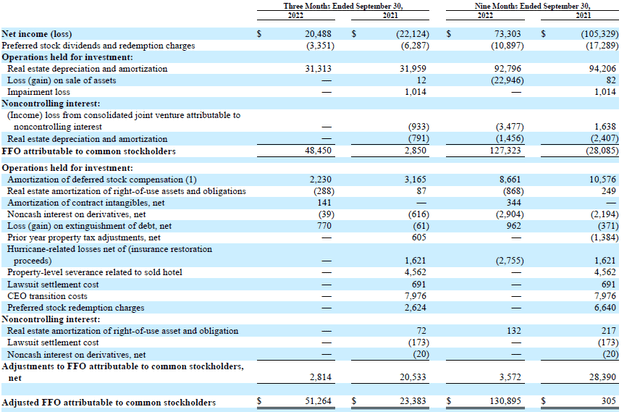

But as mentioned, what really matters are the FFO and AFFO calculations. The FFO calculation was pretty straightforward as it only required to add back the depreciation and amortization expenses, resulting in an FFO of $48.5M. Based on the current share count of 210.4M shares (which is lower than the average share count throughout the quarter), the FFO per share was approximately $0.23.

Sunstone Investor Relations

The AFFO came in at $51.3M, mainly after adding back the impact of share-based compensation. This resulted in an AFFO per share of just over $0.24. The AFFO in the first nine months of the year came in at $0.61 per diluted share, but if I would only use the current share count we are looking at $0.62 per share. Which of course handsomely covers the current $0.05 quarterly dividend.

The preferred shares still offer an attractive risk/reward ratio

Keep in mind both the FFO and AFFO include the impact of the preferred dividends. As you can see in the AFFO table, the $3.35M in Q3 preferred dividends and $10.9M in 9M 2022 preferred dividends already are included in the calculation. This means that in the first nine months of this year the AFFO excluding the preferred dividends would have exceeded $141M which also means the preferred dividends were very well covered as Sunstone needed less than 8% of its AFFO to cover the dividends. This means the dividend coverage ratio was approximately 1,300%, which is very good.

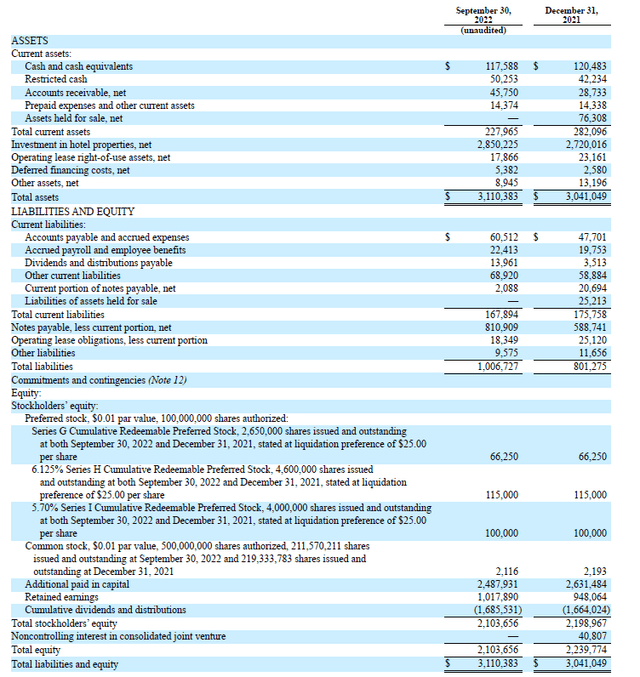

Looking at the asset coverage ratio, we see Sunstone’s balance sheet is still pretty strong. While the REIT acquired more assets which resulted in an expanded balance sheet, I don’t think there’s anything to worry about. If I would include the restricted cash in the equation, the total cash position as of the end of September stood at $168M while the total debt was $813M resulting in a net debt of just $645M. Considering the total book value of the assets was $2.85B as of the end of September, the LTV ratio was less than 25% which is amazingly low.

Sunstone Investor Relations

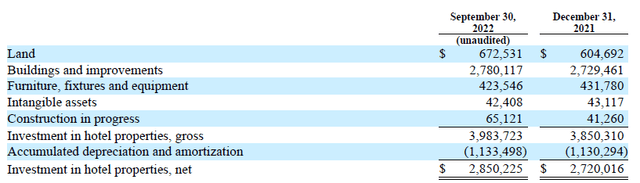

It’s also important to know that the $2.85B book value of the assets includes in excess of $1.1B in accumulated depreciation: The total acquisition cost of the land and buildings exceeded $3.45B (excluding all intangible assets, construction in progress and furniture).

Sunstone Investor Relations

This means the LTV ratio based on the acquisition cost of the real estate assets is less than 20%. That makes the balance sheet exceptionally safe. This also means the 11.25 million preferred shares with a total value of $281.25M are very well covered by the asset base. Even if the already depreciated value of the assets would decrease by 65%, Sunstone will still be able to make creditors and preferred shareholders whole. The balance sheet also clearly shows there is in excess of $1.8B in equity ranking junior to the preferred shares (and that is based on the book value of the assets and does not take the acquisition value or the fair value into consideration).

There are currently two series of preferred shares listed. The H-series are trading with (NYSE:SHO.PH) as ticker symbol and offer a 6.125% preferred dividend for a total of $1.53125 per year while the I-Series are trading with (NYSE:SHO.PI) as ticker symbol offering a 5.7% preferred dividend for a payment of $1.425 per year. Based on the closing prices as of Wednesday, the H-Series and I-Series are currently yielding 8% and 7.7% respectively. Both issues are cumulative and can be called by Sunstone from May 2026 and July 2026 on.

Investment thesis

I think the risk/reward ratio of the Sunstone preferred shares is excellent. While I realize and acknowledge the hotel REIT business isn’t easy and there will always be ups and downs, seeing a balance sheet with an LTV ratio of less than 25% based on the book value and less than 20% based on the acquisition cost definitely draws my attention.

At this point, the H-Series are the most attractive as the yield is higher but the spread between bid and ask on both preferred shares is sometimes relatively wide and limit orders are strongly recommended. I own both series (bought at different moments depending on which one was most attractively priced and I intend to add to my positions.