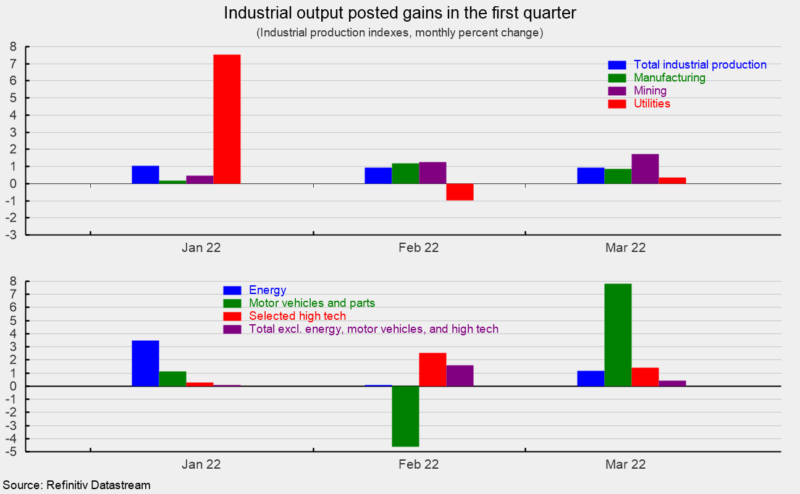

Industrial manufacturing elevated 0.9 p.c in March following the same 0.9 p.c achieve in February and a 1.0 p.c rise in January. The good points lead to a really sturdy 12.1 p.c annualized tempo for the primary three months of 2022 and pushes whole industrial output to its highest stage ever, and clearly above the December 2019 stage previous to the pandemic (see first chart). Over the previous yr, whole industrial output is up 5.5 p.c.

Complete industrial capability utilization elevated 0.7 factors to 78.3 p.c from 77.7 p.c in February, the best since January 2019 (see first chart). Nonetheless, whole capability utilization stays properly beneath the long-term (1972 via 2021) common of 79.5 p.c.

Manufacturing output – about 74 p.c of whole output – additionally posted a 0.9 p.c enhance for the month (see first chart). Manufacturing output is at its highest stage since July 2008 and is 2.9 p.c above its December 2019 pre-pandemic stage (see first chart). From a yr in the past, manufacturing output is up 4.9 p.c.

Manufacturing utilization elevated 0.3 factors to 78.7 p.c, properly above the December 2019 stage of 75.6 p.c and the best stage since July 2007, and barely above its long-term common of 78.1 p.c. Nonetheless, it stays properly beneath the 1994-95 excessive of 84.7 p.c (see first chart).

Mining output accounts for about 14 p.c of whole industrial output and posted a robust 1.7 p.c enhance final month (see high of second chart). During the last 12 months, mining output is up 7.0 p.c.

Utility output, which is usually associated to climate patterns and is about 12 p.c of whole industrial output, rose 0.4 p.c (see high of second chart) with pure gasoline off 2.9 p.c however electrical up 0.9 p.c. From a yr in the past, utility output is up 7.5 p.c.

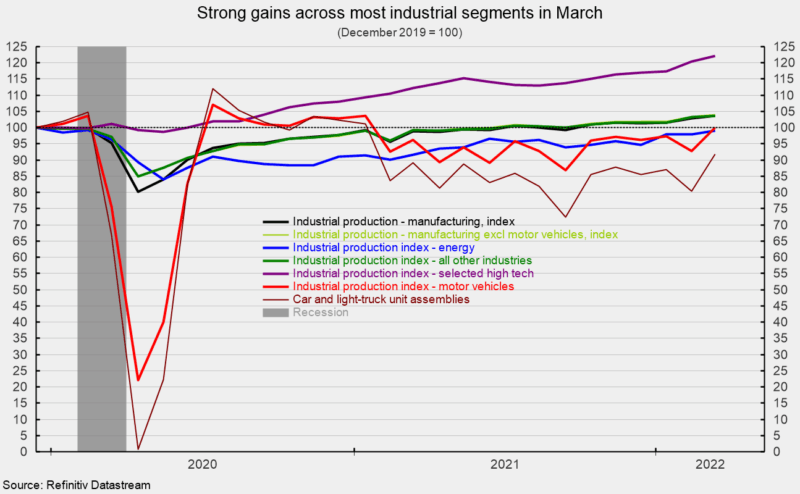

Among the many key segments of commercial output, power manufacturing (about 27 p.c of whole output) elevated 1.2 p.c for the month (see backside of second chart) with good points throughout 4 of the 5 parts. Complete power manufacturing is up 8.2 p.c from a yr in the past however is barely beneath the December 2019 stage (see third chart). Motor-vehicle and elements manufacturing (just below 5 p.c of whole output), one of many hardest-hit industries in the course of the lockdowns and post-lockdown restoration, continues to be impacted by a semiconductor chip scarcity, although output gained sharply in March. Motor-vehicle and elements manufacturing jumped 7.8 p.c for the month following a 4.6 p.c drop in February and a 1.1 p.c rise in January (see backside of second chart). From a yr in the past, car and elements manufacturing is up 3.9 p.c however is the same as the December 2019 stage (see third chart).

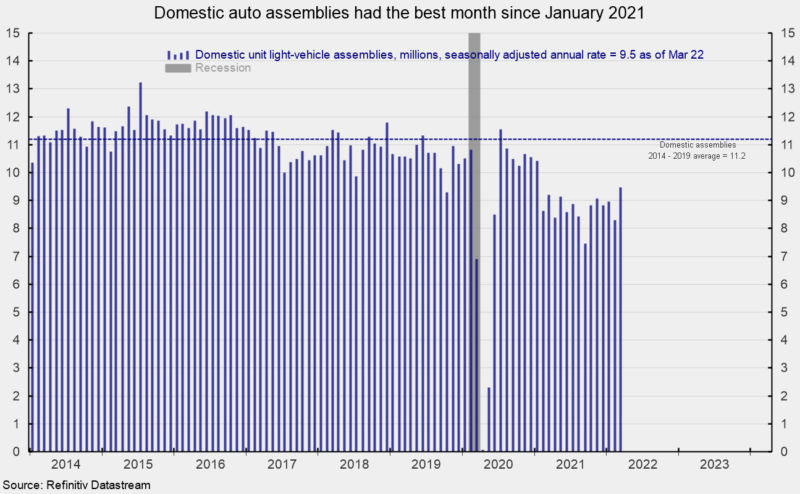

Complete car assemblies rose to 9.75 million at a seasonally-adjusted annual fee, the best since January 2021 however nonetheless properly beneath the pre-pandemic common (see fourth chart). That consists of 9.47 million gentle autos and 0.28 million heavy vehicles. Inside gentle autos, gentle vehicles have been 7.62 million whereas automobiles have been 1.86 million.

The chosen high-tech industries index rose 1.4 p.c in March (see backside of second chart), and is up 8.9 p.c versus a yr in the past, and about 22 p.c above December 2019 (see third chart). Excessive-tech industries account for simply 1.9 p.c of whole industrial output.

All different industries mixed (whole excluding power, high-tech, and motor autos; about 67 p.c of whole industrial output) rose 0.3 p.c in March (see backside of second chart). This vital class is 4.5 p.c above March 2021 and 4.0 p.c above December 2019 (see third chart). Industrial output posted a sturdy, broad-based achieve in March. Whereas many measures of output are again to or above pre-pandemic ranges, ongoing shortages of and disruptions to labor provide, rising prices and shortages of supplies, and logistical and transportation bottlenecks proceed to restrain the power of producers to satisfy the considerably larger demand that has emerged following the lockdown recession. Moreover, sustained upward strain on costs, ongoing waves of latest COVID-19 circumstances, geopolitical turmoil and world financial disruptions surrounding the Russian invasion of Ukraine, and a brand new Fed tightening cycle are sustaining an elevated stage of threat and uncertainty for the financial outlook.

:max_bytes(150000):strip_icc()/Health-GettyImages-HydrationDrinksForAthletes-d59cb0e245b34ebe8a86bba45e88c70d.jpg)