gahsoon/E+ via Getty Images

Investment Thesis

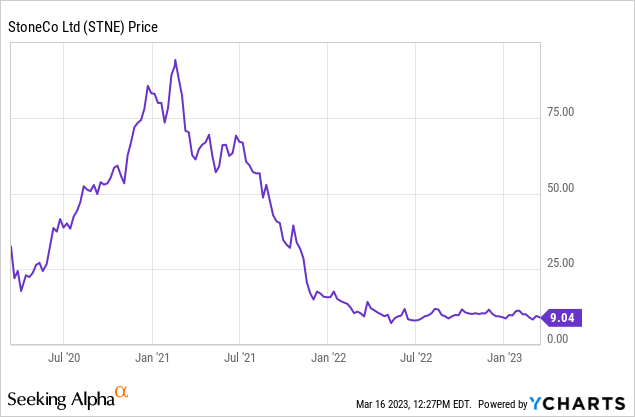

StoneCo (NASDAQ:STNE) is roughly flat since my last coverage in September yet it remains over 90% below its all-time high. I still think the drop is unjustified and presents a great buying opportunity for investors. The market seems to be overlooking the company’s fundamentals, despite it continuing to execute and make solid progress. The latest earnings once again showed strong top-line growth and excellent improvement in the bottom line. The current valuation also remains very cheap with multiples significantly below peers, which should present meaningful upside potential. Therefore I rate the company as a buy.

Q4 Earnings

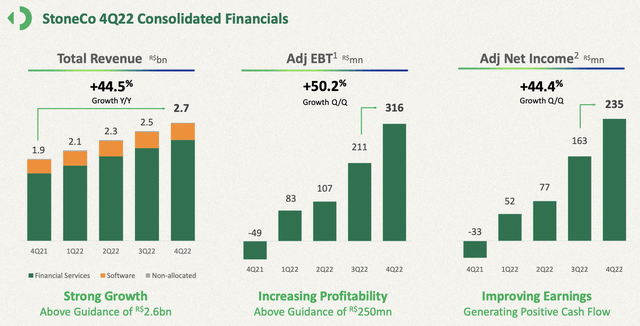

StoneCo announced its fourth-quarter earnings last week and the results are excellent, especially in this volatile economy. The company reported revenue of R$2.71 billion, up 44.5% YoY (year over year) compared to $1.87 billion. Most of the growth is driven by the financial services segment, which grew 49.3% YoY from $1.55 billion to $2.31 billion, or 85% of total revenue. TPV (total payment volume) increased by 12.4% from $89 billion to $100.1 billion, while the number of active payments clients increased by 46.3% from 1.8 million to 2.6 million. The software segment was softer, but revenue was still up 20.8% YoY from $311.4 million to $376.4 million, thanks to increased adoption of POS (point of sale) solutions and higher transaction volume.

The bottom line was also outstanding thanks to improved operating leverage, as the increase in costs and expenses slowed. While revenue was up by 44.5%, costs of revenue were only up 8%. This resulted in the gross profit jumping 63.4% YoY from R$1.23 billion to R$2.01 billion. The gross profit margin was 74.2%, up 840 basis points compared to 65.8%.

The increase in expenses was also moderate. Selling expenses were only up 27.6% YoY from R$318.4 million to R$406.1 million. Most of the increase is attributed to financial expenses, as rising interest rates resulted in higher provisions for credit loss. Financial expenses grew 33.5% YoY from R$676.8 million to R$903.4 million. This increase is actually much lower compared to peers. For instance, PagSeguro’s (PAGS) latest earnings indicated a 112% increase in financial expenses. The discipline in expenses resulted in the adjusted EBITDA skyrocketing 85.8% YoY from R$684.7 million to R$1.27 billion, or 46.9% of revenue. It also flipped from a net loss of R$(32.5) million to a net income of R$234.8 million, with a net income margin of 8.7%.

Rafael Martins, VP, on operating leverage

Throughout 2022 we saw operating leverage gains in almost all lines. Our cost and expenses as a percentage of revenue decreased more than 1,400 basis points in the fourth quarter compared to the prior year. Cost of services decreased from 34.5% of revenue in the fourth quarter 2021 to 25.8% this quarter, a gain of 870 basis points. Our selling expenses as a percentage of revenue decreased 200 basis points to 15%. Administrative expenses grew less than our revenue gaining 130 basis points of operational leverage.

StoneCo

Valuation

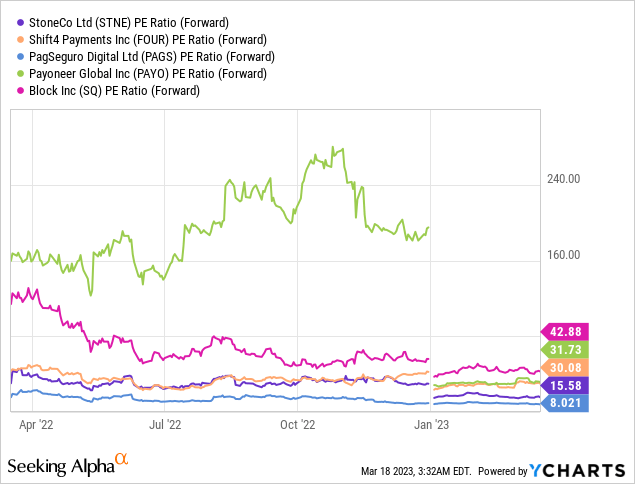

The valuation of StoneCo continues to remain extremely compressed as the share price fails to rebound. The company is currently trading at a fwd PE ratio of 15.6x which is very cheap compared to other fintech peers such as Block (SQ), Shift4 Payments (FOUR), and Payoneer (PAYO), as shown in the chart below. These companies are trading at a fwd PE ratio of 30.1x or upwards, which represents a whopping premium of at least 100%+. This is unjustified in my opinion as StoneCo actually reported the strongest revenue growth among the group in the latest quarter, and has better profitability.

The only company with a lower multiple is fellow Brazilian peer PagSeguro with a fwd PE ratio of 8.0x. However, it is also growing much slower. In the latest quarter, it reported revenue growth of 22.2% which is substantially lower than StoneCo’s 44.5%. I understand the company operates in a different continent that carries higher volatility and geopolitical risk, but I still think the current valuation gap is too big and should offer meaningful upside potential.

Investor Takeaway

StoneCo stock remains a buy in my opinion as the company has solid execution and a compelling valuation. Despite the underwhelming price action in the past few months, the company continued to execute and its latest earnings showed excellent improvement in both the top and the bottom line. The customer base continues to expand rapidly while the increase in costs and expenses slowed. Its current valuation is also very discounted with multiples significantly below peers. Yet, it is actually growing revenue at the fastest pace among the peer group. While there are certainly geopolitical risks in regard to the business, I believe most of the pessimism is likely priced in considering the 90% drop in share price. The current risk-to-reward ratio looks very attractive due to the mismatch in financial performance and valuation, therefore I rate it as a buy.