(Bloomberg) — Investors expect this earnings season to pummel stocks further and will watch Apple Inc. in particular as a bellwether of global economic conditions.

Most Read from Bloomberg

More than 60% of the 724 respondents to the latest MLIV Pulse survey say this earnings season will push the S&P 500 Index lower. That means no end in sight to the dismal run for stocks, after a tumble Friday decisively dashed hopes that the eye-popping two-day rally early last week would be the start of something bigger. About half of poll participants also expect equity valuations to pull back even further from their average of the past decade.

The results underscore Wall Street’s fear that even after this year’s brutal selloff, stocks have yet to price in all the risks stemming from central banks’ aggressive tightening as inflation remains stubbornly high. The outlook isn’t likely to improve any time soon with the Federal Reserve steadfast on hiking rates, likely weighing on growth and profits in the process. Data on Friday showed that the US labor market remains strong, increasing the chances of another jumbo Fed rate hike next month.

“Third-quarter earnings will disappoint with clear downside risks to fourth-quarter analyst estimates,” said Peter Garnry, head of equity strategy at Saxo Bank A/S. “The key risks to third-quarter earnings are the cost-of-living crisis impacting demand for consumer products” and higher wages eating into companies’ profits.

The US earnings season starts in earnest this week with results from major banks, including JPMorgan Chase & Co. and Citigroup Inc., set to give investors a chance to hear from some of Corporate America’s most influential leaders.

Watch Apple

As for stocks to watch in the next few weeks, 60% of survey takers see Apple as crucial. The iPhone maker, which has the heaviest weighting on the S&P 500, will provide insight into an array of key themes, such as consumer demand, supply chains, the effect of the soaring greenback and higher rates. The company reports on Oct. 27. JPMorgan garnered the second-biggest mention, at 25%, but Microsoft Corp. and Walmart Inc. also drew a noteworthy number of votes.

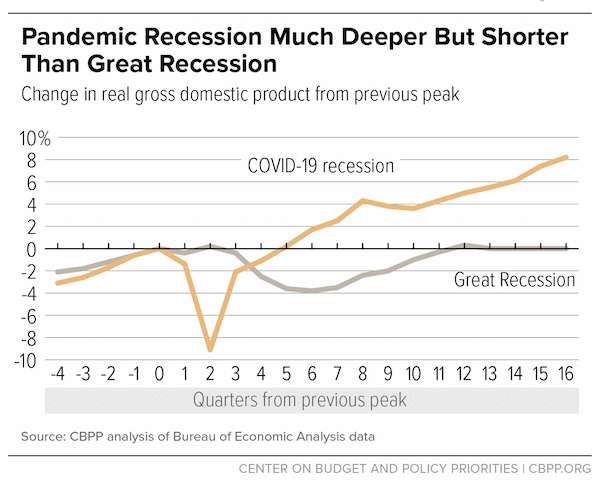

The reporting stretch kicks off with the S&P 500 down 24% this year, on pace for its worst performance since the Great Financial Crisis. Against that grim backdrop, almost 40% of survey participants are inclined to invest more in value stocks, compared with 23% for growth, the earnings outlook for which is vulnerable when interest rates rise. Still, 37% chose neither of those categories, perhaps reflecting Citigroup quantitative strategists’ view that equity markets have “turned decidedly defensive” and are only just starting to reflect the risks of a recession.

US stocks have had an awful year, but so have other financial assets, from Treasuries to corporate bonds to crypto. The balanced 60/40 portfolio mixing stocks and bonds in an attempt to protect against strong moves in the markets either way has lost more than 20% so far this year.

Inflation Fears

Survey respondents expect that references to inflation and recession will dominate earnings calls this season. Only 11% of participants said they expect chief executive officers to utter the word “confidence,” underscoring the gloomy backdrop.

“I’m expecting more cautious and negative guidance on the basis of broad economic weakness and uncertainty and tighter monetary policy,” said James Athey, investment director at abrdn.

About half of poll respondents see equities valuations deteriorating further in the next few months. Of those, some 70% expect the S&P 500’s price-to-earnings ratio to fall to the 2020 low of 14, while a quarter see it tumbling to the 2008 low of 10. The index currently trades at about 16 times forward earnings, below the average for the last decade.

Rough Outlook

Wall Street has a similarly dim view. Citigroup strategists expect a 5% contraction in global earnings for 2023, consistent with below-trend global economic growth and elevated inflation. The bank’s earnings-revisions index shows downgrades outweighing upgrades for the US, Europe and the world, with the US seeing the deepest downgrades. Strategists at Bank of America Corp. expect 20% downside for European earnings per share by mid-2023, while Goldman Sachs Group Inc. counterparts say Asia ex-Japan equities can see more earnings downgrades amid weak macro and industrial data.

With all the pessimism, there’s scope for positive surprises ahead. A beat to lowered earnings expectations is likely in third-quarter reporting, according to Bloomberg Intelligence strategists. Meanwhile, at Barclays Plc, strategists led by Emmanuel Cau said that the results aren’t likely to be a “disaster” due in part to still-high nominal growth, but they doubt the outlook will be constructive.

“Earnings estimates for 2023 have started to move lower but have further to fall. Estimate revisions are a necessary part of creating a durable bottom in equity markets,” said Madison Faller, global strategist at JPMorgan Private Bank. “As estimates drop, investors will be anxious to get more engaged in anticipation of a potential pause in the Fed’s hiking cycle.”

Join us on Oct. 11 at 10 a.m. New York time for a discussion on the survey results with Amy Kong, chief investment officer at Barrett Asset Management, and Kim Forrest, founder and chief investment officer of Bokeh Capital Partners.

To subscribe to MLIV Pulse stories, click here. For more markets analysis, see the MLIV blog.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.