Should you’ve ever felt annoyed by slow-loading finance web sites cluttered with adverts and pop-ups, you’re not alone. StockAnalysis.com has quietly constructed a popularity as one of many cleanest, quickest platforms for researching shares and ETFs—and on this evaluation, I’ll break down whether or not it lives as much as the hype in 2026.

SPECIAL OFFER: For the second time in firm historical past, StockAnalysis.com is working a 20% low cost on all annual Inventory Evaluation plans. Meaning you may get Professional for $5.27/month, or Final for $13.27/month!

The Backside Line: Is StockAnalysis.com Value Utilizing in 2026?

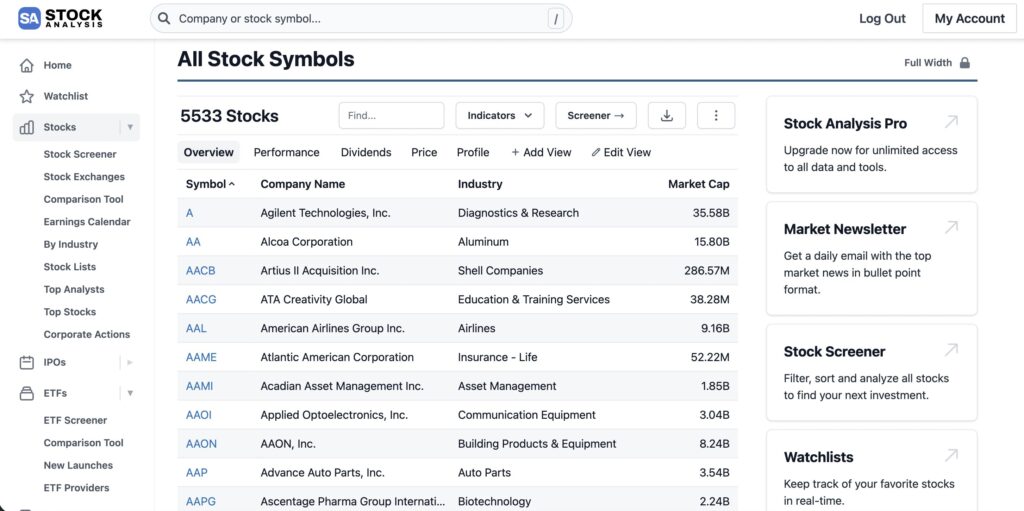

After in depth testing in early 2026, I can confidently say that StockAnalysis.com delivers on its promise of being a “Yahoo Finance however higher” expertise for normal buyers. Since its 2019 launch, the platform has grown to draw thousands and thousands of month-to-month visits, and it’s simple to see why. The location pulls monetary knowledge from respected suppliers like S&P World and Nasdaq Knowledge Hyperlink, which suggests the numbers you’re seeing are correct and up to date inside minutes of earnings releases.

StockAnalysis.com is finest fitted to data-driven buyers, swing merchants, and ETF buyers who already know how one can interpret monetary statements and valuation metrics. Should you’re comfy analyzing shares by yourself and simply want quick entry to dependable numbers, this platform will really feel like a breath of contemporary air. Nevertheless, when you’re an absolute newbie wanting hand-holding explanations or step-by-step funding steerage, you could discover the expertise overwhelming—the location delivers knowledge, not training.

The free model is surprisingly highly effective for primary inventory analysis, providing entry to screeners, watchlists, and primary monetary statements throughout 130,000+ world shares and funds. The Professional plan (round $79/12 months) unlocks deeper historic knowledge, ad-free shopping, and knowledge exports, whereas the Limitless plan (round $199/12 months) is designed for heavy customers who want limitless downloads and integration workflows. Consumer sentiment throughout app shops and evaluation platforms hovers round 4.7–4.9 stars, with most critiques praising the pace and knowledge high quality.

At a look:

- Professionals: Quick web page masses, clear interface, complete U.S. and world protection, wonderful inventory screener with 290+ filters, robust worth for cash

- Cons: Restricted interpretive steerage, charts much less subtle than devoted technical evaluation instruments, no API entry, portfolio analytics are primary

- Greatest for: Skilled DIY buyers, dividend and ETF researchers, merchants who need fast knowledge entry

- Skip if: You want instructional content material, neighborhood dialogue, or superior backtesting

Need deeper monetary knowledge with out the muddle? Strive StockAnalysis Professional and unlock 10–40 years of monetary historical past, superior screeners, and ad-free analysis

What StockAnalysis.com Is (and Isn’t)

StockAnalysis.com is a inventory and ETF analysis web site and app based in 2019 by Kris Gunnars, who additionally runs his personal funding agency. The platform is operated by a small workforce mixing finance experience and software program growth, which explains its concentrate on knowledge integrity and quick digital supply. In contrast to newsletter-style providers that push inventory picks and opinion items, StockAnalysis.com takes a minimalist strategy—consider it as a “Bloomberg-lite” expertise designed particularly for retail buyers.

The core idea is easy: pages load shortly and current fundamentals, inventory costs, and analysis instruments for over 130,000 shares and mutual funds throughout U.S. and world markets. You gained’t discover long-form opinion articles or social feeds right here. As an alternative, you get clear entry to the numbers that matter.

What it’s:

- An information-focused platform providing monetary statements, valuation ratios, dividend historical past, insider exercise, analyst scores, worth targets, IPO knowledge, and customizable screeners

- Protection spans U.S. equities, ETFs, and an increasing checklist of worldwide markets

- Accessible by way of net browser and cell app (iOS/iPadOS/macOS, with Android customers accessing by way of cell net)

- Design philosophy emphasizes quick pages load instances and minimal visible muddle

What it’s not:

- No long-form editorial content material or neighborhood dialogue options

- No AI chat assistant or social buying and selling integration

- No public API for programmatic entry (attributable to knowledge licensing restrictions)

- Not a substitute for devoted technical evaluation platforms when you want superior charting

The platform is constructed for buyers who need to get in, seize correct knowledge, and make funding selections with out wading by means of noise.

My Palms-On Expertise Utilizing StockAnalysis.com

I examined StockAnalysis.com extensively in January 2026 throughout each desktop (Chrome on Home windows) and the iOS app on an iPhone working iOS 17. My aim was to simulate actual analysis workflows—scanning for trending shares, reviewing detailed financials, and constructing watchlists—to see how the platform holds up below sensible use.

The homepage greets you with a world search bar entrance and heart, flanked by sections highlighting market movers and trending shares. Fast hyperlinks to the inventory screener, watchlist web page, IPO calendar, and ETF instruments are readily accessible with out scrolling. The structure is intuitive sufficient that new buyers can navigate instantly, whereas skilled merchants will admire not having to hunt for options.

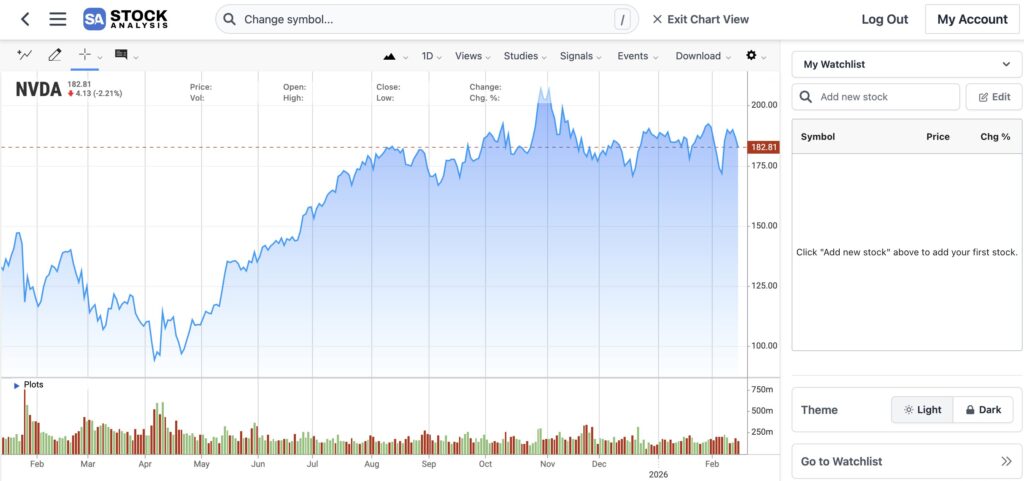

Opening a well-liked ticker like NVDA or AAPL brings you to an summary tab displaying the value chart, key ratios (P/E, EV/EBITDA, dividend yield), market cap, 52-week vary, and a fast valuation snapshot. What impressed me most was pace—pages load in below a second on a typical residence connection, and switching between tabs (Overview, Financials, Dividends, Statistics, Profile) occurs nearly instantaneously.

For U.S. shares, the Financials part is especially deep. You possibly can view quarterly and annual earnings statements, steadiness sheets, and money stream statements going again 10–40 years on Professional, relying on the corporate. The power to toggle between uncooked values and per-share metrics is a pleasant contact for buyers evaluating corporations of various sizes. Professional and Limitless tiers additionally unlock CSV and Excel exports, which I discovered important when constructing spreadsheet fashions.

I examined the inventory screener by filtering for all U.S. large-cap dividend shares with yield above 3% and payout ratio under 70%. The screener returned leads to seconds, and I might save the filter for future use. With round 290+ filters spanning fundamentals, worth metrics, dividends, sector, and nation, the screener rivals instruments that price considerably extra.

The cell expertise mirrored the desktop high quality. Charts, customizable watchlists, and worth alerts remained responsive all through testing. Darkish mode labored easily for night analysis periods, and the app by no means crashed or lagged throughout my week of use.

Key Options and Instruments Defined

This part serves as a function tour of StockAnalysis.com for 2026 customers. I’ll break down every main instrument and clarify the way it suits right into a typical analysis workflow.

Inventory & ETF Dashboards

Each ticker web page—whether or not it’s MSFT, SPY, or QQQ—opens to a complete dashboard. You’ll see the present worth with actual time costs throughout market hours (together with pre-market and after-hours quotes for U.S. exchanges), a customizable worth chart, valuation metrics, analyst worth targets, and peer comparisons. Chart timeframes vary from 1-day to max (full historic knowledge), with primary technical indicators like transferring averages, RSI, and quantity overlays accessible. That stated, when you want superior charting instruments like Fibonacci retracements or VWAP, you’ll need to complement with a devoted technical knowledge platform.

Financials Part

That is the place StockAnalysis.com really shines for basic evaluation. The Financials tab presents earnings statements, steadiness sheets, and money stream knowledge in each quarterly and annual views. For established U.S. corporations, Professional subscribers can entry 40+ years of monetary historical past—a depth that’s uncommon outdoors of pricey terminals like Capital IQ. You possibly can swap between absolute values and per-share metrics with a single click on, and the structure makes it simple to identify traits in income development, margins, or debt ranges. That is the form of detailed financials that severe buyers want for researching shares.

Inventory & ETF Screeners

The screener is arguably the platform’s strongest function. With roughly 290+ filters, you may slice and cube the market primarily based on just about any standards. Instance filters embrace:

- Worth: P/E ratio, P/B ratio, EV/EBITDA, PEG ratio

- Progress: Income development fee, EPS development, projected earnings

- Dividends: Present yield, dividend development streak, payout ratio

- ETFs: Expense ratio, property below administration, underlying index tracked

I ran a number of sources of screens throughout my testing, from attempting to find undervalued small-caps to figuring out high-yield REITs, and the screener dealt with every request shortly. It can save you customized screens and modify columns to show precisely the metrics you care about.

Watchlists & Portfolio Monitoring

Including tickers to your watchlist is a one-click affair—simply hit the plus icon on any inventory web page. The watchlist web page updates in actual time with out requiring a full web page reload, exhibiting day change, complete change, and primary efficiency metrics. You possibly can create a number of lists (I arrange separate ones for “Progress Concepts,” “Dividend Core,” and “Watch Later”) to prepare your analysis. Portfolio monitoring is accessible however stays primary—you gained’t discover deep efficiency attribution, danger analytics, or tax lot monitoring right here.

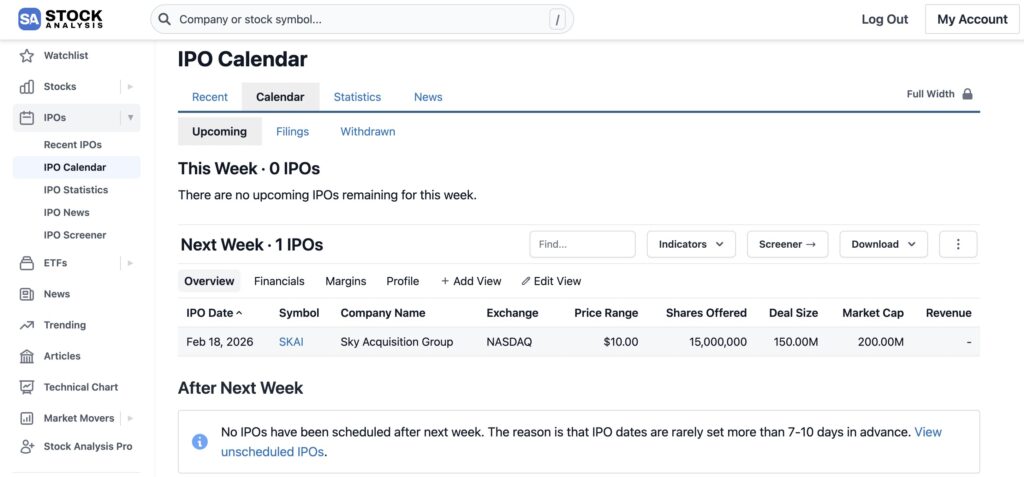

IPO Calendar & Information

The IPO calendar shows upcoming and up to date public choices with dates, ticker symbols, alternate listings, and providing sizes. It’s an ideal instrument for staying conscious of recent market entrants, although don’t count on deep editorial evaluation on every IPO. The information part aggregates headlines related to your watchlist and market movers, maintaining you knowledgeable with out overwhelming you with social media noise.

Morning Publication & E-mail Alerts

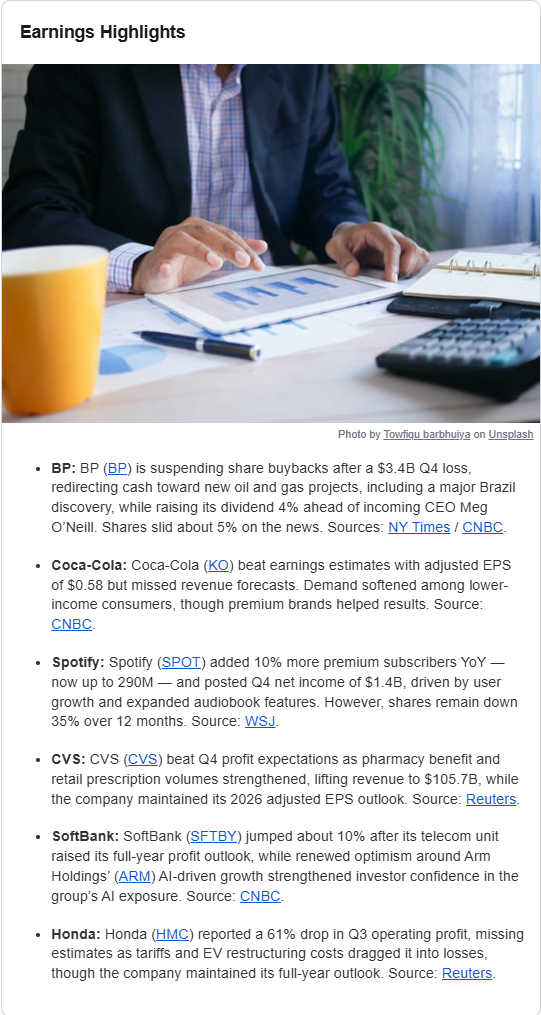

StockAnalysis.com additionally provides a free weekday morning e-newsletter delivered earlier than U.S. markets open. After reviewing a number of points, I’d describe it as a data-first briefing fairly than an opinion-heavy market recap.

Every version sometimes contains:

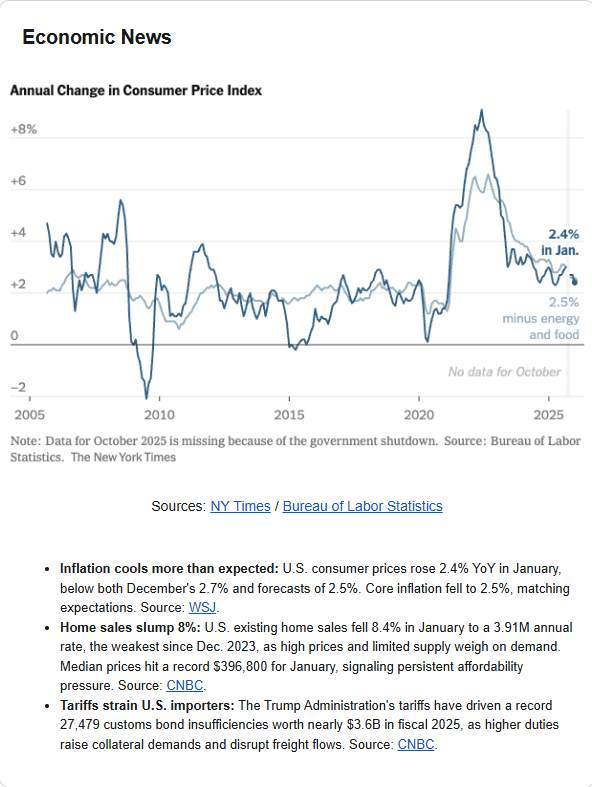

- Key financial occasions for the day (CPI, inflation knowledge, Fed-related releases)

- Latest earnings studies with income, EPS, and year-over-year comparisons

- Upcoming earnings to look at

- Weekly IPO calendar updates

- Main market movers and headline summaries

- Pre-market index efficiency (S&P 500, Nasdaq, Dow)

What stands out is the format. As an alternative of paragraphs of commentary, you get structured, scannable knowledge. For instance, earnings are damaged down clearly:

- Income (with YoY change)

- Whether or not the corporate beat or missed estimates

- EPS efficiency and shock quantities

Should you’re the kind of investor who prefers uncooked numbers over opinions, it is a robust match. It feels extra like a Bloomberg-style snapshot than a e-newsletter making an attempt to push inventory picks.

There’s minimal editorial spin. You gained’t discover daring predictions or emotional takes — simply concise summaries and hyperlinks again to full financials contained in the platform.

For lively merchants, dividend buyers, and earnings-focused buyers, this makes it simple to:

- Establish in a single day movers

- Observe corporations reporting after the shut

- Spot macro catalysts earlier than the opening bell

It’s not meant to exchange in-depth evaluation or a premium analysis e-newsletter. However as a every day market orientation instrument, it’s genuinely helpful.

Should you already use the screener and monetary dashboards, the e-newsletter pairs properly together with your workflow — it highlights what’s transferring, and you may instantly leap into deeper analysis.

Energy-Consumer Options

For these on paid plans, a number of conveniences unlock. Darkish mode makes night analysis periods simpler on the eyes. Customized columns within the screener allow you to show precisely the metrics you want. Knowledge exports to Google Sheets or CSV format allow integration with your personal spreadsheets and fashions. Limitless plan subscribers get limitless downloads, which is crucial for skilled bloggers, small RIAs, or anybody constructing data-intensive workflows.

Should you’re severe about basic evaluation, the Professional plan unlocks 40+ years of monetary historical past, 200+ screener filters, and downloadable Excel/CSV exports.

Pricing, Plans, and Worth for Cash

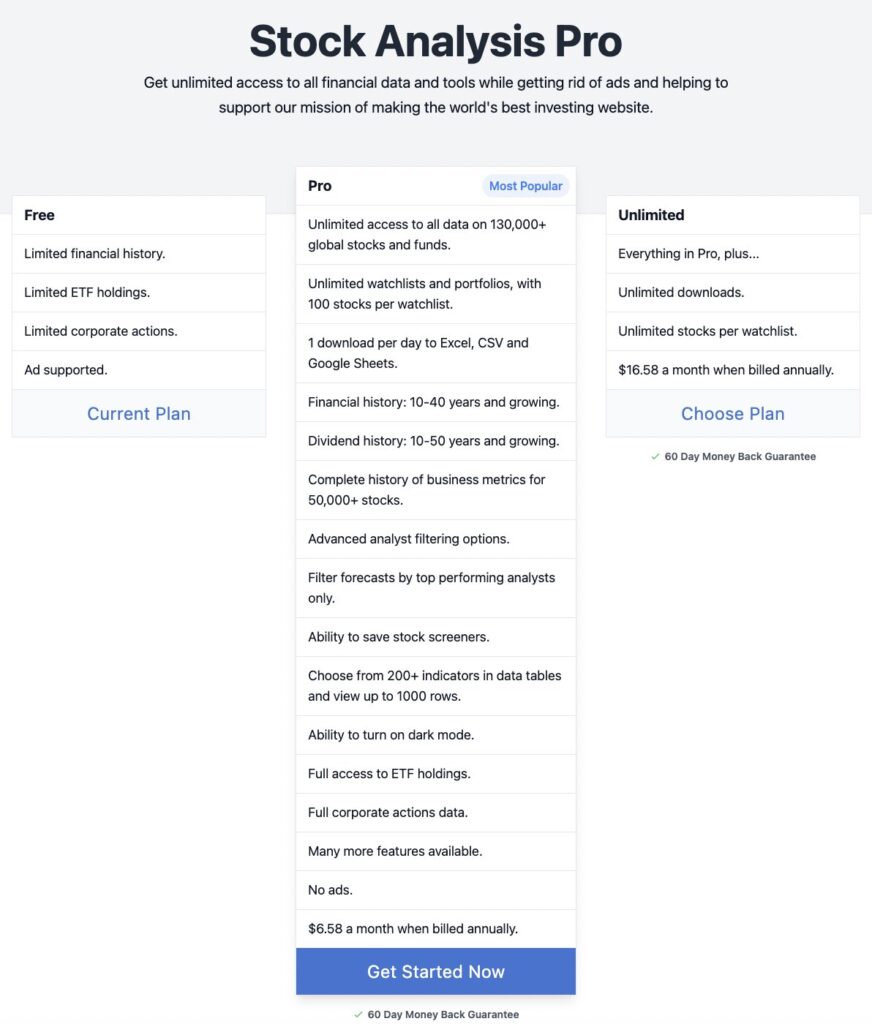

StockAnalysis.com operates on a freemium mannequin with three principal tiers: Free, Professional, and Limitless. In contrast to some platforms that gate primary options behind paywalls, the free model right here is genuinely helpful for on a regular basis inventory analysis.

2026 Pricing Breakdown:

- Free: $0, ad-supported. Entry to all tickers, primary monetary statements, screeners (with some filter limitations), watchlists, and portfolio monitoring. No bank card required.

- Professional: $5.27/month, billed yearly. Removes adverts, unlocks 10–40 years of historic knowledge, expands screener filters, allows knowledge exports, and supplies close to actual time costs for many U.S. exchanges.

- Limitless: $13.27/month, billed yearly. Designed for heavy customers who want limitless CSV/Excel downloads, making it supreme for quants, monetary bloggers, and small funds that don’t need to pay for costly terminals.

What Stays the Identical Throughout Tiers:

All customers get entry to the total universe of 130,000+ shares and funds, primary financials together with earnings statements, steadiness sheets, and money stream knowledge, watchlists, and the core screener performance. The free model is greater than enough for informal buyers checking on a handful of positions.

What You Unlock with Professional:

The leap to Professional is sensible when you regularly analyze historic knowledge for pattern evaluation. Having 40 years of monetary historical past for main corporations is invaluable for understanding long-term enterprise efficiency. The removing of adverts and sooner knowledge refreshes additionally enhance the expertise considerably. Exports turn into accessible, which is crucial when you construct your personal spreadsheet fashions.

What You Get with Limitless:

The Limitless plan is primarily about quantity. Should you’re working frequent screens, downloading historic knowledge units recurrently, or feeding data into exterior instruments, the limitless downloads justify the upper worth. For many particular person buyers, Professional can be enough.

One standout function is the 60-day money-back assure on paid plans. That is considerably extra beneficiant than the 7–30 day home windows typical of finance instruments in 2026, supplying you with ample time to guage whether or not the paid model suits your workflow.

Is It Good Worth?

In comparison with alternate options costing $150–$300+ per 12 months (like In search of Alpha Premium at $239/12 months or Inventory Rover’s premium tiers), StockAnalysis.com provides robust worth in case your analysis type leans closely on uncooked fundamentals and screener-driven discovery. You’re not paying for editorial content material or neighborhood options—simply clear, quick entry to correct data.

For lower than $6 per 30 days (billed yearly), StockAnalysis Professional provides you limitless entry to knowledge on 130,000+ world shares — with out adverts.

Strengths, Limitations, and Who It’s Greatest For

After spending appreciable time with StockAnalysis.com, right here’s my synthesis of what works, what doesn’t, and who ought to take into account signing up.

Strengths:

- Very quick web page masses and responsive UI on each net and app—that is persistently the quickest finance analysis website I’ve used

- Complete protection spanning U.S. shares, ETFs, and increasing world markets with over 130,000 securities

- Clear, well-organized monetary statements and metrics that make basic evaluation simple

- Wonderful inventory screener with 290+ filters and customization choices rivaling paid-only instruments

- Worth-for-money pricing with a beneficiant 60-day refund window on paid plans

- Knowledge sourced from respected suppliers like S&P World, making certain correct knowledge you may belief

- Nice for monitoring meme shares and market movers with real-time updates

Limitations:

- Little or no built-in rationalization of what the info means—when you don’t know what a metric signifies, the platform gained’t train you

- Charts are much less subtle than specialist technical evaluation instruments; lacks interpretation for superior setups

- Portfolio analytics are primary with no deep efficiency attribution, danger evaluation, or tax reporting

- No native API for automated buying and selling algorithms or programmatic knowledge entry

- The small workforce means function growth could also be slower than bigger rivals

Greatest For:

- Skilled buyers who already know how one can interpret fundamentals and don’t want hand-holding

- DIY merchants who need to shortly scan for alternatives utilizing screeners

- Lengthy-term dividend and ETF buyers needing dependable dividend and expense ratio knowledge

- Anybody annoyed with cluttered platforms like Yahoo Finance or different websites overloaded with adverts

- New buyers who’re comfy studying on their very own and simply want entry to dependable knowledge

Could Want One thing Else:

- Absolute novices requiring step-by-step instructional content material and guided studying

- Traders who rely closely on superior technical indicators, backtesting, or automated buying and selling

- These in search of neighborhood dialogue, copy-trading options, or social funding feeds

- Customers who want API entry for quantitative methods or algorithmic commerce execution

The underside line is that StockAnalysis.com works finest as a quick, main knowledge supply. Many customers will discover it invaluable to mix it with different instruments—maybe a e-newsletter for inventory picks or a charting platform for technical setups—however as a analysis basis, it’s onerous to beat at this worth level.

Nonetheless uncertain? You possibly can attempt StockAnalysis Professional fully risk-free with a 60-day money-back assure — no questions requested. Take a look at the total platform and determine if it suits your investing type.

FAQs

Sure, the free model is genuinely practical and never only a teaser. You possibly can entry screeners, primary monetary statements, watchlists, portfolio monitoring, and actual time costs with out paying something. No bank card is required to check the free instruments—you may merely create an account and begin researching shares instantly.

The platform has operated since 2019 and is backed by Vefir ehf., an organization primarily based in Iceland. Knowledge comes from respected sources together with S&P World and Nasdaq Knowledge Hyperlink, that are industry-standard suppliers utilized by institutional buyers. Consumer scores throughout app shops and evaluation websites common round 4.8/5 stars, and the location maintains clear knowledge methodology pages explaining the place data comes from. There’s no indication of any commerce execution or cash dealing with—it’s purely a analysis instrument.

The platform makes use of automated high quality checks and sources from established knowledge suppliers, making it one of many extra dependable free choices accessible. That stated, occasional small discrepancies can happen throughout all knowledge distributors. For important numbers—particularly earlier than making massive funding selections—I like to recommend double-checking towards main firm filings (10-Ok, 10-Q) or the SEC’s EDGAR database.

Contemplate Professional when you regularly use screeners, want entry to historic knowledge going again many years, or need to export knowledge to Google Sheets or Excel for customized evaluation. The Limitless plan is sensible for skilled bloggers who publish data-heavy content material, small RIA corporations managing shopper analysis, or lively merchants working frequent screens who want limitless downloads. Should you’re an off-the-cuff investor checking a couple of positions weekly, the free model will doubtless meet your wants.

In comparison with article-heavy platforms like In search of Alpha, StockAnalysis.com is quicker, cleaner, and extra centered on uncooked knowledge fairly than contributor opinions and inventory scores. In search of Alpha provides extra interpretive content material and neighborhood dialogue, whereas StockAnalysis.com excels at pure knowledge entry. Inventory Rover provides extra subtle portfolio analytics and charting for the next worth level. Neither is objectively “higher”—it relies on whether or not you prioritize pace and knowledge (StockAnalysis.com) or evaluation and neighborhood (rivals).

Should you’ve made it this far, you’re clearly severe about discovering the fitting instruments to your analysis workflow. StockAnalysis.com gained’t make funding selections for you—and it gained’t faux to. What it is going to do is offer you quick, dependable entry to the monetary and technical knowledge it is advisable make these selections your self.

Begin with the free model to check the screener and monetary statements on shares you already comply with. If you end up wanting deeper historic knowledge or ad-free shopping, the Professional plan is an affordable improve at $79/12 months. Both approach, you’ll have an ideal instrument that respects your time and delivers correct data with out the muddle.

Rating of Prime Inventory Newsletters Based mostly on Final 3 Years of Inventory Picks as of December 27, 2025

We’re paid subscribers to dozens of inventory and possibility newsletters. We actively monitor each advice from all of those providers, calculate efficiency, and share our outcomes of the highest performing inventory newsletters whose subscriptions charges are below $500. The primary metric to search for is “Return vs S&P500” which is their return above that of the S&P500. So, primarily based on December 27, 2025 costs:

Greatest Inventory Newsletters Final 3 Years’ Efficiency

| Rank | Inventory Publication | Picks Return | Return vs S&P500 | Picks w Revenue | Max % Return | Present Promotion |

|---|---|---|---|---|---|---|

| 1. | Alpha Picks | 82% | 56% | 76% | 1,583% | February SALE: SAVE $50 NOW |

| Abstract: 2 picks per 30 days primarily based on In search of Alpha’s Quant Ranking; persistently beating the market yearly since launch; tells you when to promote they usually have bought nearly half. See full particulars in our full Alpha Picks evaluation. Or get their Premium service to get their QUANT RATINGS in your shares to higher handle your present portfolio–read our Is In search of Alpha Value It? article to be taught extra about their Quant Rankings. | ||||||

| 2. | Zacks Worth Investor | 60% | 40% | 54% | 692% | February Promotion: $1, then $495/yr |

| Abstract: 10 inventory picks per 12 months on January 1st primarily based on Zacks’ Quant Ranking; Retail Value is $495/yr and contains 6 totally different providers together with these under. Learn our Zacks Evaluation. | ||||||

| 3. | Moby.co | 50% | 16% | 74% | 2,569% | February Promotion: Subsequent choose free! |

| Abstract: 60-150 inventory picks per 12 months, segmented by {industry}; persistently beating the market yearly; retail worth is $199/yr. Learn our full Moby Evaluation. | ||||||

| 4. | Zacks Prime 10 | 36% | 15% | 71% | 170% | February Promotion: $1, then $495/yr |

| Abstract: 10 inventory picks per 12 months on January 1st primarily based on Zacks’ Quant Ranking; Retail Value is $495/yr and contains 6 totally different providers. Learn our Zacks Evaluation. | ||||||

| 5. | TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Present Promotion: Save $180 |

| Abstract: About 1 choose/week specializing in quick time period trades; Lifetime common return of 355% vs S&P500’s 149% since 2015. Retail Value is $379/yr. Learn our TipRanks Evaluation. | ||||||

| 6. | Motion Alerts Plus | 27% | 5% | 66% | 208% | Present Promotion: None |

| Abstract: 100-150 trades per 12 months, a lot of shopping for and promoting and short-term trades. Learn our Jim Cramer Evaluation. | ||||||

| 7. | Zacks Residence Run Investor | 5% | -0.4% | 45% | 241% | February Promotion: $1, then $495/yr |

| Abstract: 40-50 inventory picks per 12 months primarily based on Zacks’ Quant Ranking; Retail Value is $495/yr. Learn our Zacks Evaluation. | ||||||

| 8. | Canines of the Dow Technique | 16% | -1.8% | 43% | 44% | Present Promotion: None |

| Abstract: Purchase the ten highest yielding dividends shares within the Dow Jones Industrial Common on January 1st and promote on Dec thirty first every year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | February Promotion: NONE |

| Abstract: Maintains prime 50 shares to put money into primarily based on IBD algorithm; Retail Value is $495/yr. Learn our Traders Enterprise Day by day Evaluation. | ||||||

| 10. | Inventory Advisor | 34% | -3.9% | 75% | 289% | February Promotion: Get $100 Off |

| Abstract: 2 picks/month and a pair of Greatest Purchase Shares lists specializing in excessive development potential shares over 5 years; Retail Value is $199/yr. Learn our Motley Idiot Evaluation. | ||||||

| 11. | Zacks Beneath $10 | -0.2% | -4% | -4.3 | 263% | February Promotion: $1, then $495/yr |

| Abstract: 40-50 inventory picks per 12 months primarily based on Zacks’ Quant Ranking; Retail Value is $495/yr. Learn our Zacks Evaluation. | ||||||

| 12. | Rule Breakers | 34% | -5.1% | 69% | 320% | Present Promotion: Save $200 |

| Abstract: Rule Breakers is included with the Idiot’s Epic Service. Get 5 picks/month specializing in disruptive know-how and enterprise fashions; Lifetime common return of 355% vs S&P500’s 149% since 2005; Now a part of Motley Idiot Epic. Learn our Motley Idiot Epic Evaluation. | ||||||

| Prime Rating Inventory Newsletters primarily based on their final 3 years of inventory picks overlaying 2025, 2024, and 2023 efficiency as in comparison with S&P500. S&P500’s return relies on common return of S&P500 from date every inventory choose is launched. NOTE: To get these outcomes you should purchase equal greenback quantities of every choose on the date the inventory choose is launched. Investor Enterprise Day by day Prime 50 primarily based on efficiency of FFTY ETF. Efficiency as of December 27, 2025. | ||||||

Source link