da-kuk/E+ through Getty Pictures

It’s been about 22 months since I walked away from Gentex Company (NASDAQ:GNTX), and since I offered, the shares have returned one other 15% in opposition to a achieve of ~44% for the S&P 500. A charitable learn of that is that I walked away from an organization that will go on to underperform the S&P 500. Since I’m seemingly in a everlasting “glass half empty” mind set, my manner of decoding it’s that I walked away too quickly and missed out on some additional upside. A small voice in my head would possibly remind me that whereas I held the shares they outperformed the market, however I hardly ever take note of that a part of myself.

At the moment I need to work out whether or not or not it is smart to purchase again in, for the reason that shares have really declined a good bit over the previous yr. I’ll make that willpower by wanting on the monetary historical past right here, and by wanting on the inventory as a factor distinct from the underlying enterprise. Additionally, though I offered my shares, I additionally offered put choices on the enterprise, and that commerce labored out very properly. For that cause, I completely want to write down about my choices commerce.

It’s that point once more. It’s the time once I supply up my “thesis assertion” paragraph to readers who’re serious about my perspective, however by no means serious about wading by means of my verbiage. I’ll come proper to the purpose. I believe Gentex inventory stays very costly, regardless of the truth that the enterprise has simply posted mediocre outcomes. I’m additionally of the view that investments are relative to one another, and in a world the place you may clip 2.9% from a authorities observe, why would you purchase a sluggish grower like this that’s at present yielding a a lot decrease dividend? I made superb cash on this title prior to now, and could be prepared to once more, however for now I’m nonetheless avoiding the title.

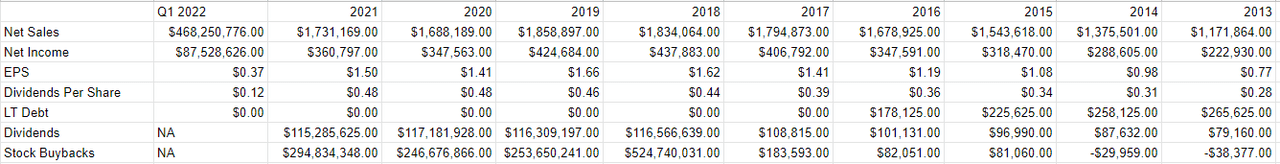

Monetary Snapshot

I’m simply gonna come out with it. For my part, the monetary efficiency in 2021 was mediocre. Gross sales in 2021 have been barely (about 2.55%) greater, and web earnings was up by lower than 4%, relative to 2020. On condition that 2020 was no nice shakes, that’s not an incredible accomplishment in my opinion. When in comparison with 2019, the latest yr seems even worse. Gross sales in 2021 have been about 7% decrease, and web earnings was down absolutely 15% relative to the pre-pandemic interval.

Turning now to the quarter simply introduced this morning, evidently issues have gone within the unsuitable route. Particularly, gross sales are down aboot 3.2% relative to 2021, and the primary quarter of 2022 noticed web earnings absolutely 22.85% decrease than the yr in the past interval. There’s not a lot to get enthusiastic about right here in my opinion.

All that mentioned, the steadiness sheet stays a optimistic standout, and is without doubt one of the strongest I’ve seen. That is evidenced by the truth that as of their newest reporting date, the corporate had money on the books of $262.3 million, and whole liabilities equaled solely $193.4 million. Thus, I don’t assume debt or curiosity bills will crowd out dividend funds anytime quickly. Talking of the dividend…

Every thing’s Relative

I’ve received a confession to make, expensive readers. I’ve the capability to be fairly unpleasant. Please include your shock. One of many many ways in which this has manifested through the years is by the truth that I used to be at all times bothered by the argument that folks have been compelled to purchase shares as a result of authorities bonds supplied such paltry returns. It at all times bothered me that traders with decrease danger tolerances have been pushed into shares as a result of there’s no various (and in addition as a result of we on Bay Road received paid extra once we jammed purchasers into equities). That dynamic appears to be reversing itself in my opinion. Now that traders can gather 2.92% from 10-year treasury notes, how ought to they give thought to the dividend yield of a given inventory?”

That is clearly a really advanced query, with many variables, however I believe a useful first step in deciding what we’d be prepared to pay for shares could be to take a look at the money flows between a 10-year Treasury observe and a given inventory. The inventory might get a valuation “bonus” from potential development, however I believe it’s worthwhile understanding how a lot of the present worth is a perform of that development, and the way a lot is a perform of the money traders can pocket.

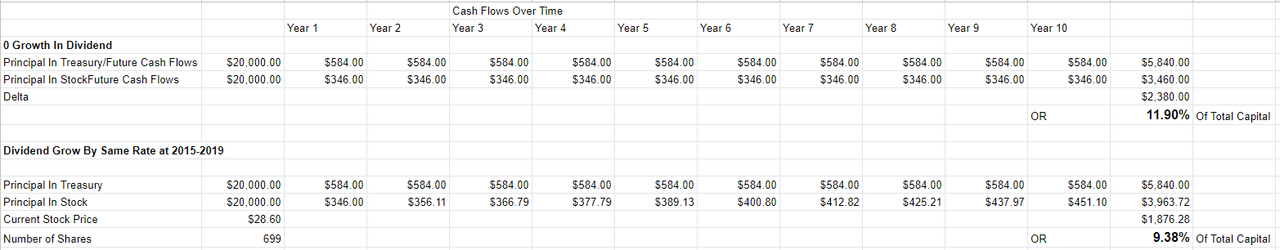

In help of answering the primary a part of this query, I’ve created a easy spreadsheet that tries to begin to deal with this query. It compares the money flows from each the treasury and the inventory over a 10-year interval. It additionally compares the fixed money flows from the treasury to rising dividends on the fairness. I assume the dividend will develop on the similar charge for the subsequent decade because it did for the interval 2015-2019. That is clearly a quite simple assumption, and gained’t be good, clearly, however I believe it can assist supply some perception into the relative funding deserves of every asset.

I’ve utilized this software to Gentex with the next beginning guidelines, and have discovered the next:

The investor can make investments $20,000 in both the treasury or they will make investments that $20,000 to purchase precisely 699 shares of Gentex.

Within the situation the place Gentex doesn’t increase its dividend over the subsequent decade, the treasury investor finishes with an additional $2,380 in money flows, or an additional 11.9% of the unique funding.

Within the situation the place Gentex raises its dividend at a charge of three%, the treasury investor finishes with an additional $1,8760.28 or 9.38% of the unique funding.

For my part, this evaluation means that for an investor to be detached between Gentex inventory, and a 10-year U.S. Treasury observe, they’d have to assume two issues. First, that the corporate will develop its dividend over the subsequent decade on the charge that it did over the interval 2015-2019. Second, that the shares will admire by ~9.5% from now to 2032. Alternatively, if the corporate doesn’t increase the dividend, it’ll want to understand by slightly below 12% between now and 2032.

This software doesn’t reply the query “shares or bonds” definitively, clearly. It doesn’t speak in regards to the dangers related to every funding, and there are apparent, and huge, variations between the dangers of the inventory versus the U.S. authorities. That mentioned, I believe it’s a worthwhile first step. It helps quantify the relative deserves of every, which fits an extended technique to answering the query in my opinion.

Lastly, I ought to say that some variables are a wash. Inflation, as an illustration, will affect $1 acquired from a dividend identically as will affect $1 acquired from Uncle Sam. There are probably important tax variations for People, although. Dividends are taxed in a different way, so you could need to issue your personal relationship with the Inner Income Service into this evaluation. Or, this evaluation could also be related to tax sheltered belongings.

In closing, I believe this software helps to quantify the variations between shares and authorities bonds for the time being. I’d counsel that on the whole, shares are extra dangerous, and are paying traders much less within the phrases of money flows. Thus, traders at the moment are reliant on worth appreciation stemming from both earnings development or a number of growth. For my part, this can be a fairly heavy carry. Regardless of that, I’d be comfy shopping for the shares on the proper worth.

Gentex dividend v 10 12 months Treasuries (Creator calculations based mostly on public sources)

Gentex Finanacials (Gentex investor relations)

The Inventory

A few of you who observe me usually for some cause know what time it’s. It is the purpose within the article the place I flip much more bitter, as a result of I begin writing about risk-adjusted returns, and the way a inventory with a well-covered dividend is usually a horrible funding on the unsuitable worth. Even when an organization grows earnings properly, which isn’t the state of affairs right here, the funding can nonetheless be a horrible one if the shares are too richly priced. It’s because this enterprise, like all companies, is an organisation that takes a bunch of inputs, provides worth to them, after which sells them for a revenue. That is all a enterprise is within the remaining evaluation. The inventory, alternatively, is a proxy whose altering costs mirror extra in regards to the temper of the group than something to do with the enterprise. For my part, inventory worth adjustments are rather more in regards to the expectations of an organization’s future, and the whims of the group than something to do with the enterprise. Because of this I take a look at shares as issues other than the underlying enterprise.

In the event you have been hoping that I might cease blathering about this, and transfer on to my subsequent level, you’d be unsuitable, expensive reader. I need to drive residence the significance of wanting on the inventory as a factor distinct from the enterprise by utilizing Gentex itself for example. The corporate solely launched quarterly outcomes this morning, so there’s no historical past to be guided by but, so I’ll take a look at the interval between the discharge of their newest annual outcomes by means of to yesterday. The corporate launched annual outcomes on February twenty third. In the event you purchased this inventory that day, you are down about 3.3% since then. In the event you waited till April seventh to select a date completely at random, you are up about 4% since. Clearly, not a lot modified on the agency over this brief span of time to warrant a 7% variance in returns. The variations in return got here down solely to the worth paid. The traders who purchased just about equivalent shares extra cheaply did higher than those that purchased the shares at the next worth. Because of this I attempt to keep away from overpaying for shares.

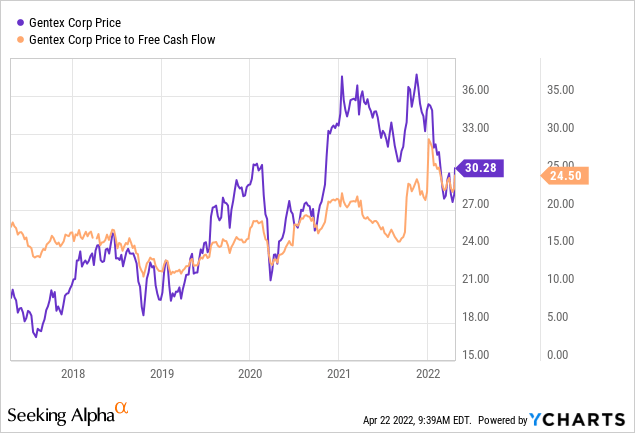

In the event you’re one of many masochists who reads my stuff usually, that I measure the cheapness of a inventory in a couple of methods, starting from the easy to the extra advanced. On the easy aspect, I take a look at the ratio of worth to some measure of financial worth like gross sales, earnings, free money circulate, and the like. Ideally, I need to see a inventory buying and selling at a reduction to each its personal historical past and the general market. In my earlier missive, one of many causes I walked away was as a result of the shares had hit a worth to free money ratio of 15.27. This was 24% dearer than the worth that excited me initially. Regardless of the quite massive drawdown in worth over the previous yr, issues are much more costly now, per the next:

Supply: YCharts

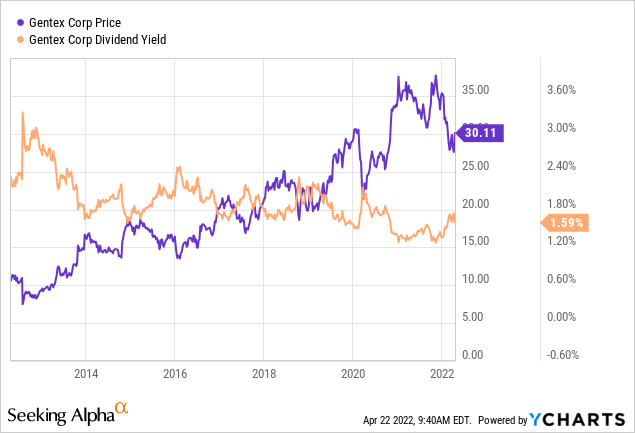

On the similar time that shares are priced close to document valuations, traders are getting close to low dividend yields. I do not know aboot you, expensive reader, however I do not like paying extra and getting much less.

Supply: YCharts

Along with easy ratios, I need to attempt to perceive what the market is at present “assuming” about the way forward for this firm. In an effort to do that, I flip to the work of Professor Stephen Penman and his guide “Accounting for Worth.” On this guide, Penman walks traders by means of how they will apply the magic of highschool algebra to a normal finance components in an effort to work out what the market is “pondering” a few given firm’s future development. This includes isolating the “g” (development) variable within the mentioned components. Making use of this method to Gentex for the time being suggests the market is assuming that this firm will develop at a charge of about 4.5% over the long run. That is fairly optimistic in my opinion, particularly in gentle of the truth that web earnings continues to slip decrease. Given all of this, I am taking my chips off the desk right here.

Choices Cut back Threat, Improve Returns

Whereas I took earnings in June of 2020, I offered 10 December Gentex places with a strike of $20 for $0.70 every, and these expired worhthless, and that enhanced my returns properly. I level this out in an effort to brag most significantly, but additionally to show but once more how brief put choices supply the chance to reinforce returns whereas reducing danger. Had the shares fallen, I might have been obliged to purchase at an incredible worth of $19.30. Because the shares remained above this strike worth, these places expired nugatory, which was additionally an incredible consequence.

Whereas I prefer to attempt to repeat success once I can, I can’t do it on this case as a result of the premia on supply for affordable strike costs is non-existent. As an illustration, I’d be prepared to promote the December Gentex put with a strike of $20, however the bid on these is at present zero. Thus, I have to merely await the shares to drop additional in worth earlier than contemplating shopping for again in.

Conclusion

I believe the shares of Gentex stay costly, regardless of the truth that the corporate has simply posted mediocre outcomes. That is significantly troubling in gentle of the truth that an investor can now clip 2.9% on a “sleep at evening” commerce. I made good cash on this inventory prior to now, and I’d be joyful to purchase again in on the proper worth. The issue is that we’re not close to that worth as we speak.