JHVEPhoto

It has been virtually two years since I revealed my first and solely article about Stanley Black & Decker, Inc. (NYSE:SWK) in August 2022. Again then, I wrote in my conclusion:

In my view, we are able to name Stanley Black & Decker at least pretty valued proper now because it appears to be buying and selling under the calculated intrinsic worth – even when utilizing moderately cautious assumptions. However, the chance for a recession and bear market that’s nonetheless upon us is moderately excessive. I’d assume the inventory to say no additional in such a state of affairs and if the inventory ought to decline additional, entry level could be round $65-70. Regardless of being a “Purchase” from a basic perspective, I’d charge the inventory as “Maintain” as I count on decrease inventory costs within the coming quarters.

And though the inventory has not reached the entry level I discussed in my final article, the inventory declined within the meantime. Nonetheless, the rally in the previous couple of weeks really led to the inventory now buying and selling 22% greater in comparison with August 2022 when my final article was revealed. Though the inventory underperformed the S&P 500 (SPY), which gained about 31% in the identical timeframe, I’ll present an replace on the enterprise within the following article and reply the query as soon as once more if Stanley Black & Decker is an efficient funding proper now.

Quarterly Outcomes

On July 30, 2024, Stanley Black & Decker reported second quarter outcomes and income declined as soon as once more from $4,159 million in Q2/23 to $4,024 million in Q2/24 – leading to a 3.2% year-over-year decline. And in comparison with $1.18 in earnings per share in the identical quarter final yr, the corporate reported a loss per share of $0.07. Solely free money movement elevated from $196 million in the identical quarter final yr to $486 million this quarter leading to 148% year-over-year progress.

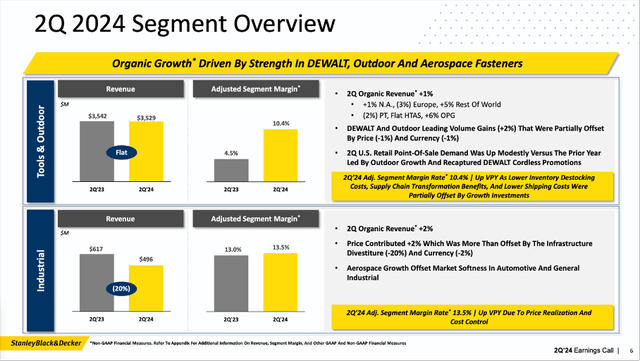

Stanley Black & Decker Q2/24 Presentation

The corporate is reporting in two segments. The Instruments & Outside phase is the biggest phase among the many two and generated $3,528.7 million in income (virtually 88% of whole income on this quarter). And whereas income for the phase declined barely (0.4% year-over-year), working revenue elevated from $102.0 million in the identical quarter final yr to $316.1 million this quarter. Nonetheless, it was moderately the identical quarter final yr which was the outlier.

The second phase – Industrial – generated $495.7 million in income leading to a 19.6% year-over-year decline. The phase revenue additionally declined from $71.6 million in the identical quarter final yr to $66.8 million this quarter.

Steadiness Sheet

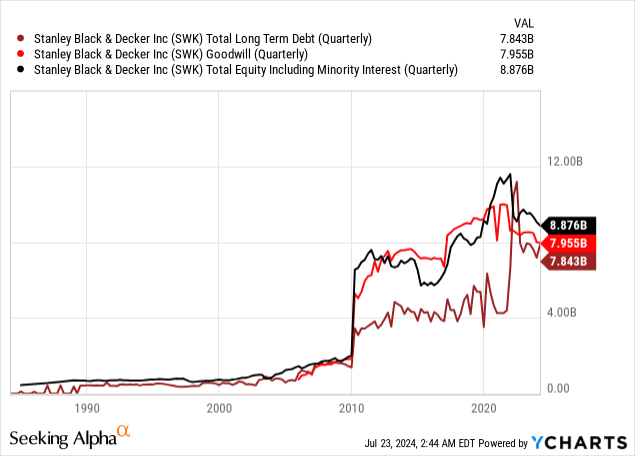

In my final article, I additionally talked about that the stability sheet was actually not excellent for Stanley Black & Decker, and subsequently we take one other look. On June 29, 2024, the corporate nonetheless had $492.2 million in short-term borrowings, $500.1 million in present maturities of long-term debt in addition to $5,602 million in long-term debt on the stability sheet leading to $6,594 million in whole debt.

When evaluating the entire debt to whole shareholder’s fairness of $8,722 million we get a debt-equity ratio of 0.76, which appears acceptable. Nonetheless, this metric may be a little bit bit deceptive. First, an enormous a part of the corporate’s property is goodwill and different intangibles of $11,802 million (this time, Stanley Black & Decker didn’t disclose goodwill numbers). Final quarter, goodwill was $7,955 million and this isn’t an asset we wish to see on the stability sheet.

Second, we should always moderately evaluate the entire debt to both the working revenue or free money movement to see how lengthy it’s going to take the enterprise to repay the excellent debt. Free money movement in addition to working revenue have been round $800 million within the final 4 quarters, and subsequently it will take a little bit greater than 9 years to repay the excellent debt – that is too lengthy to be acceptable.

We will level out that Stanley Black & Decker has $318.5 million in money and money equivalents on the stability sheet, which can be utilized to scale back debt. Moreover, we are able to make the argument that Stanley Black & Decker can generate a bigger quantity of free money movement and working revenue once more. In optimistic eventualities, quantities of $1.5 billion yearly appear life like, after which it will take about 4 years to repay the excellent debt – a suitable metric.

Summing up, the stability sheet of Stanley Black & Decker is actually not excellent, and debt ranges are a bit excessive, however there may be additionally no purpose to be actually nervous. And administration said as soon as once more over the past earnings name and in its shows that decreasing debt stays one of many high priorities.

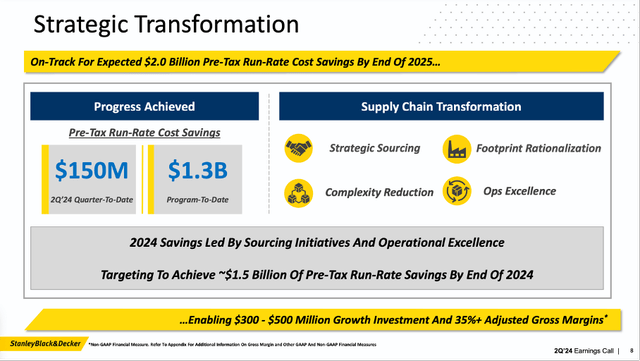

Value Discount and Gaining Market Shares

Other than specializing in decreasing debt ranges, administration can also be centered on its value discount program. Through the earlier earnings name, administration said that the associated fee discount program stays on observe for an anticipated run charge financial savings of $1.5 billion by the tip of 2024. By the tip of 2025, the anticipated run charge is even $2 billion. Through the earnings name, administration commented:

I wish to spotlight the progress we have made alongside our transformation journey within the first quarter. We achieved roughly 145 million pre-tax run charge value financial savings within the interval, bringing our mixture financial savings to roughly 1.2 billion since program inception. As we focus our portfolio, streamline our enterprise construction and rework our operations, our groups are actively figuring out and prioritizing alternatives to additional optimize our value construction.

And naturally, attempting to chop prices is nothing unhealthy, and each enterprise ought to continually assess the place it may decrease prices and get monetary savings. However in my subjective expertise, it’s by no means signal when an organization is very specializing in value discount applications. It often means the corporate is struggling and probably not capable of develop its high line. As a response to a struggling enterprise, administration is usually specializing in value reductions and is specializing in these value discount applications in its shows and earnings calls. After all, this doesn’t imply that value discount applications are a foul concept, however each time a enterprise is focusing a lot on value discount, it may make sense to concentrate to high line progress and the way properly the enterprise is performing in any other case. As a result of typically when a enterprise is specializing in value discount it’s attempting to shift the main focus away from issues on different fronts. The fee discount applications are sometimes supposed to display that administration is doing no matter it may well to gasoline backside line progress once more.

Stanley Black & Decker Q2/24 Presentation

However administration shouldn’t be solely attempting to chop prices to enhance its backside line, it is usually optimistic about gaining market shares, which is an efficient signal that the corporate will even have the ability to develop its high line once more within the years to return. Through the earlier earnings name, administration said:

Our long-term success might be pushed by improved profitability, coupled with constant market share beneficial properties. We consider our share place in instruments is now steady to rising. For instance, our 2023 point-of-sale knowledge in instruments carried out higher than the class common throughout the North American residence facilities, which was led by our iconic DEWALT Skilled model. We’re additionally serving our clients higher by delivering improved fill charges, incomes the suitable for extra exercise throughout our manufacturers. Retailers are recognizing this efficiency.

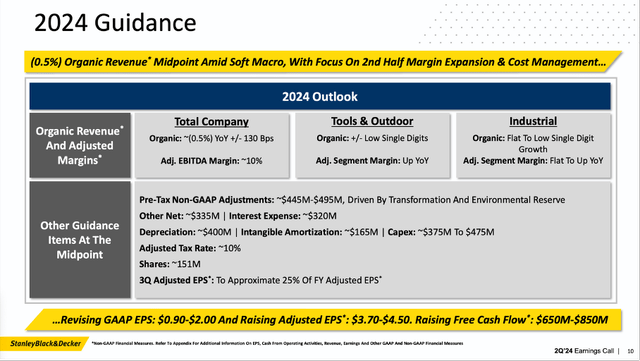

Steerage and Development

However we additionally should level out that over the past earnings name, I moderately had the sensation that administration focusing much less on its value discount program (which continues to be ongoing) and moderately on different matters once more. That is additionally mirrored by administration with the ability to replace its 2024 steering and GAAP earnings per share are actually anticipated to be in a spread of $0.90 to $2.00. The earlier steering was from $1.60 to $2.85, and the corporate subsequently lowered its steering for this merchandise. Nonetheless, when wanting on the adjusted earnings per share, Stanley Black & Decker raised its decrease finish of the steering from beforehand $3.50 to now $3.70. The higher finish of the steering stays at $4.50. And free money movement steering was additionally raised from $600 million to $800 million within the earlier steering to a spread of $650 million to $850 million now. It’s attention-grabbing to see that the vary for GAAP in addition to non-GAAP earnings per share could be very broad indicating that administration has difficulties to supply a narrower steering.

Stanley Black & Decker Q2/24 Presentation

And for the following few years, analysts are fairly optimistic and count on excessive double-digit progress. Nonetheless, it’s going to take the corporate a couple of extra years to realize comparable earnings per share once more as in fiscal 2022.

Technical Chart

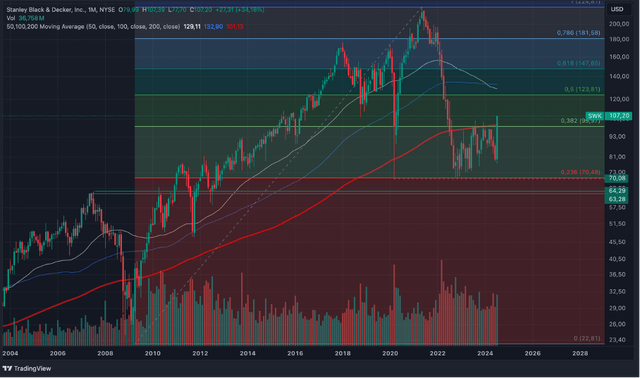

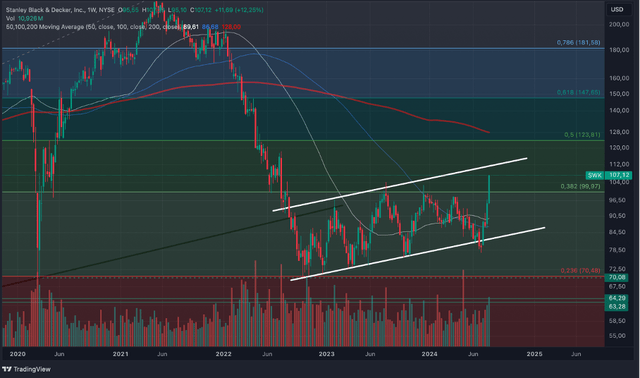

When wanting on the chart in the previous couple of weeks, we see the inventory rallying from about $77 firstly of July to about $102 on the time of writing, leading to a rise of 33% in about one month. And it looks like the earnings launch added gasoline to the fireplace, and we might be fairly optimistic that the inventory might need discovered its backside.

Stanley Black & Decker Month-to-month Chart (Writer’s work created with TradingView)

Nonetheless, when zooming out and searching on the month-to-month chart, the inventory nonetheless appears to be caught in a corrective sample that may be interpreted as a bearish flag and such a chart sample is moderately indicating decrease inventory costs to return. If the pattern continues, and we see a second downward wave we’d additionally see a lot decrease inventory costs within the coming quarters. After all, it is usually potential for the inventory to interrupt out to the upside however talking in possibilities an extra decline appears extra doubtless. And I do not know if the second quarter outcomes, which have been stable however nonetheless not so nice, are sufficient to show sentiment round.

Stanley Black & Decker Weekly Chart (Writer’s work created with TradingView)

We will make one counterargument right here. In late June 2024, we noticed the inventory attempting a false breakout. When connecting the lows of the present flag patterns, the inventory tried to interrupt out to the draw back, but it surely failed and a rally adopted. This may be seen as moderately bullish and would communicate for greater inventory costs. After all, the inventory has to beat the above-mentioned resistance ranges first.

Intrinsic Worth Calculation

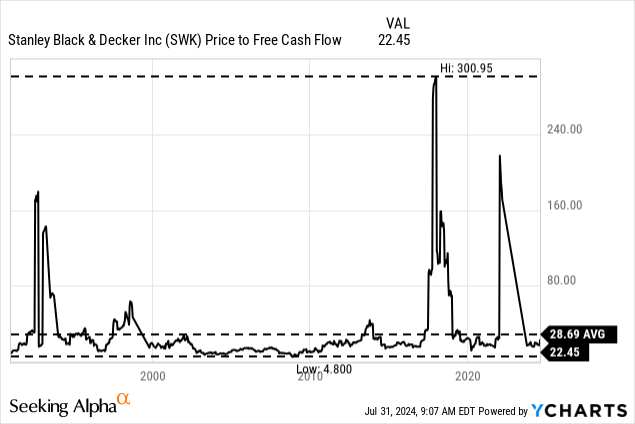

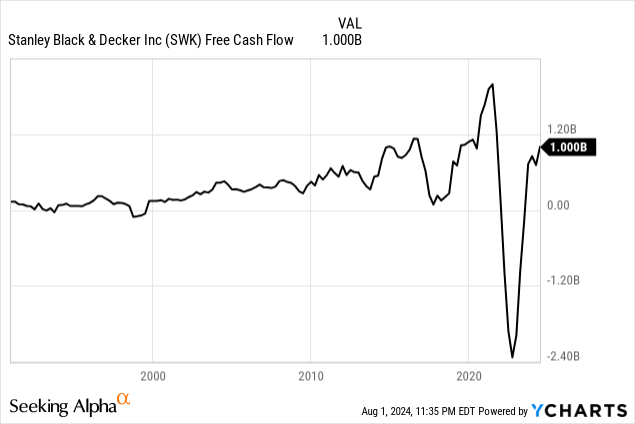

A final step, which is nearly at all times included in a sound evaluation is the calculation of an intrinsic worth. I typically take a look at the P/E and P/FCF ratios within the final ten years to get a sense for which valuation multiples the inventory is buying and selling proper now and for which valuation multiples it traded previously. However because the trailing twelve months earnings per share have been unfavourable for a number of months now, we will not calculate an affordable P/E ratio. And proper now, the inventory is buying and selling for 22.5 occasions free money movement, however when wanting on the chart it has fluctuated wildly previously many years, and it’s tough to attract affordable conclusions.

As an alternative, we calculate an intrinsic worth by utilizing a reduction money movement calculation. In my final article I calculated with moderately optimistic assumptions and used the corporate’s personal long-term targets. Administration was anticipating EPS to develop 10% over the long term. Nonetheless, within the final ten years, Stanley Black & Decker grew income solely with a CAGR of three.67%. After all, the final ten years have been perhaps not consultant for Stanley Black & Decker as the corporate may develop with a lot greater charges previously, and not less than for fiscal 2025 and 2026, analysts expect extraordinarily excessive progress charges.

At this level, I’d calculate 6% progress for the following ten years, which appears to be the midpoint between the precise progress charge within the final ten years and the optimistic assumptions of administration. And I will even take the free money movement of the final 4 quarters as a foundation (which was $1,000 million) and as it is a moderately low quantity because of the struggling enterprise in the previous couple of years, it appears life like for the enterprise to develop with a a lot greater tempo within the subsequent few years (this might principally be a reversion to the imply). Moreover, we’re calculating with a ten% low cost charge and 150.9 million shares excellent. Calculating with these assumptions results in an intrinsic worth of $165.67, and we may name the inventory undervalued at this level.

Conclusion

In my final article, I wrote that the inventory may go decrease (and it did go decrease within the meantime). And I additionally wrote above that – from a technical perspective – the inventory may also decline decrease as the present chart sample might be interpreted as a bearish flag. However, I’d be moderately bullish at this level as I see indicators of the enterprise turning round.

Not solely is the corporate most probably undervalued from a basic perspective, however administration additionally raised its steering, which is a constructive signal. And from a technical perspective, we’d have witnessed a false breakout on the decrease finish of the bearish flag, which resulted in a rally to the upside – a rally that might proceed within the coming months.

One technique right here could possibly be to attend for the inventory to interrupt out above $115 to $120 (the vary the place most resistance ranges presently might be discovered). As soon as the inventory manages to maneuver greater, we might be extra bullish and doubtless have extra affirmation {that a} backside was discovered for the inventory. After all, we additionally should pay the next worth for the inventory, however that’s the trade-off everyone has to make for him- or herself.