Spirit Airways on Monday rebuffed an acquisition provide from JetBlue Airways, saying that the proposal was unlikely to be accredited by regulators.

In a letter to JetBlue, Spirit executives mentioned that they’d decided that JetBlue’s acquisition provide can be unlikely to be accredited so long as that airline’s lately introduced partnership with American Airways was in impact. A latest communication from JetBlue “makes clear” that the airline just isn’t prepared to finish that partnership, often known as the Northeast Alliance, Spirit mentioned within the letter. The Justice Division and a number of other states have sued to dam the JetBlue-American partnership, arguing that it’s anticompetitive.

In a press release, the chairman of Spirit’s board, Mac Gardner, mentioned that the corporate stood by its plan to merge with Frontier Airways, a deal that predates JetBlue’s provide and which Spirit argued represents the most effective pursuits of long-term shareholders.

“After an intensive evaluation and intensive dialogue with JetBlue, the board decided that the JetBlue proposal entails an unacceptable degree of closing threat that might be assumed by Spirit stockholders,” Mr. Gardner mentioned. “We consider that our pending merger with Frontier will begin an thrilling new chapter for Spirit and can ship many advantages to Spirit shareholders, group members and friends.”

Spirit and Frontier, each low-fare airways, had introduced a plan to merge in February. Then, JetBlue stepped in with a much bigger provide for Spirit final month. Each offers would face scrutiny from Biden administration regulators, who’ve expressed extra skepticism about consolidation than their predecessors.

Some analysts contend that Spirit and Frontier are higher suited to merge as a result of they function below the same “extremely low-cost” enterprise mannequin however have extra intensive flights in numerous elements of the US. A JetBlue-Spirit mixture might be tougher to tug off as a result of the airways’ enterprise fashions are fairly completely different. However the deal may enable JetBlue to extra successfully compete in opposition to the nation’s 4 dominant airways.

Spirit mentioned that regulators would doubtless be “very involved” with the prospect that JetBlue’s provide would lead to increased prices, and subsequently increased fares for shoppers. For instance, Spirit mentioned that changing Spirit’s planes, that are densely full of seats, to JetBlue’s roomier configuration would lead to increased costs.

In its response on Monday, JetBlue mentioned it will provide to divest Spirit’s property in New York and Boston, two markets that regulators have expressed concern about of their lawsuit looking for to strike down the Northeast Alliance. JetBlue additionally argued that each its provide and the Frontier deal shared “the same regulatory profile,” however that Frontier has not supplied to divest property or pay a breakup payment. JetBlue additionally mentioned that the worth of Frontier’s cash-and-stock deal has light due to that airline’s falling inventory value.

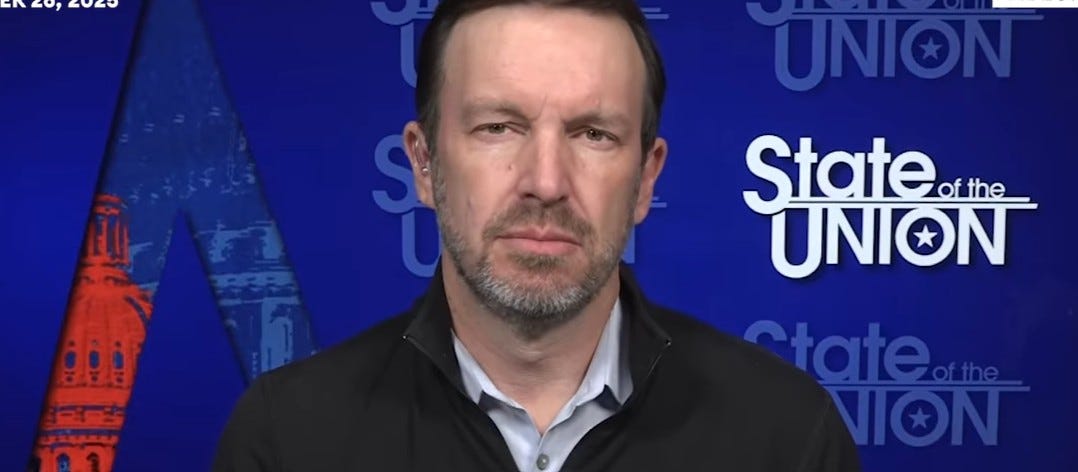

“Spirit shareholders can be higher off with the knowledge of our substantial money premium, regulatory commitments, and reverse breakup payment safety,” JetBlue’s chief government, Robin Hayes, mentioned in a press release on Monday.

JetBlue accused Spirit of getting did not grant it ample entry to knowledge concerning the low-cost service’s enterprise whereas requesting “unprecedented commitments” from JetBlue.