Anna Richard/iStock via Getty Images

Introduction

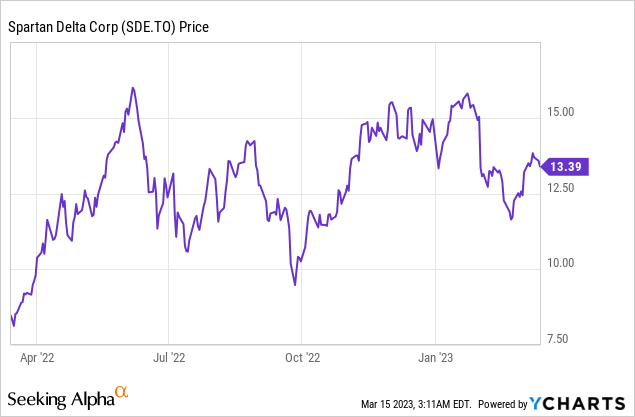

Spartan Delta (TSX:SDE:CA) (OTCPK:DALXF) is probably one of the most exciting stories in the past three years. An experienced management team which sold its previous three oil and gas companies took control of gas-producing assets in 2020 from a company that went bankrupt and used that as a platform to build a substantial natural gas producer with an anticipated production rate of in excess of 80,000 barrels of oil-equivalent per day in 2023. In this article, I will dig a bit deeper into the 2023 guidance and the recently published reserves update to see what shareholders and investors can expect this year.

The guidance for 2023 remains unchanged, but the natural gas price needs to cooperate

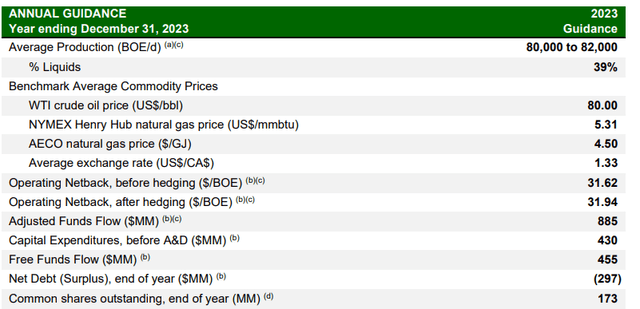

Spartan Delta hasn’t updated its 2023 guidance since posting the initial guidance in November. As a reminder, the company plans to have an average production rate of 80,000-82,000 boe/day of which about 61% is natural gas.

Spartan Delta expects to generate C$885M in adjusted funds flow while it will spend C$430M on capex which should result in a free cash flow result of C$455M. As there are currently 171.4M shares outstanding (Spartan Delta expects to end 2023 with 173M shares outstanding), this would represent a free cash flow result of C$2.65 per share, indicating the company is trading at just 5 times the anticipated free cash flow.

Spartan Delta Investor Relations

There is one (important) caveat here. The commodity prices used by Spartan Delta for this guidance are quite ‘optimistic’. Using a Henry Hub price of US$5.31 and an AECO natural gas price of C$4.50 is substantially higher than the current prices. The AECO natural gas price is currently trading at just C$3.50 after averaging just C$2.50 in February while Henry Hub is currently at US$2.60 while the futures market indicates a price of US$3.90 for delivery in December. Of course, I realize this can change pretty fast but I do expect Spartan Delta to tone down its expectations for the entire financial year when the company publishes its Q1 report.

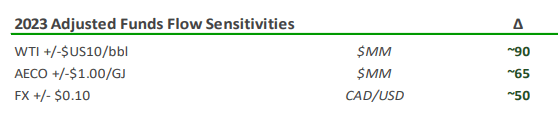

Spartan Delta sells its natural gas on the AECO market (in Q4 its sales mix was 50/50 based on the AECO 5A and 7A pricing levels), and the company presentation shows a sensitivity analysis about what happens when you use a lower natural gas (and oil) price.

Spartan Delta Investor Relations

So if I would use an average oil price of US$70/barrel and an average natural gas price of C$3.50, the adjusted funds flow would decrease by approximately C$155M. That’s a relatively small difference, thanks to the expanded hedge book.

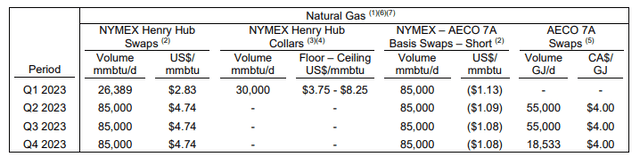

Spartan Delta Investor Relations

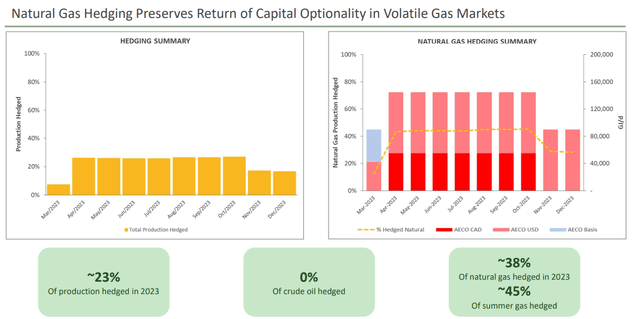

About a third of the 2022 production has been hedged at a Henry Hub price of US$4.74 while the swaps for the AECO exposure were locked in at US$1.09. This means the net realized price for those 85,000 mmbtu/day is approximately US$3.65 and at the current exchange rate this represents approximately C$5 in Canadian Dollars. An additional 55,000 GJ/d was hedged at C$4/GJ from Q2 on which means about half the production rate is hedged at a weighted average of C$4.60. and that explains why the sensitivity analysis results in a decrease of just C$65M in case the AECO price trades at just C$3.50 throughout the year. The currently hedged volumes throughout 2023 represent about 38% of the anticipated average natural gas production.

Spartan Delta Investor Relations

Assuming the average realized oil price is US$70 and the average realized (unhedged) natural gas price is C$3.50 this year, the net free cash flow would drop to C$300M which of course still is a very respectable result, considering the C$430M in anticipated capex also includes growth initiatives as Spartan Delta expects to increase its production rate by a mid-single digit percentage per year.

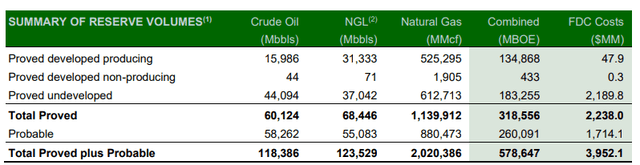

And that growth is underpinned by the updated resource and reserve calculation. As of the end of 2022, the total amount of reserves came in at almost 580 million barrels of oil-equivalent, of which approximately 60% consists of natural gas.

Spartan Delta Investor Relations

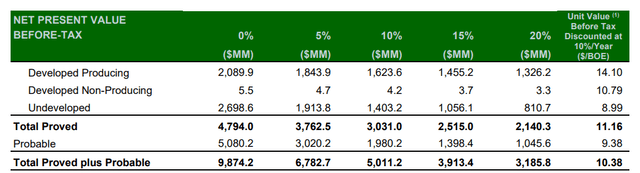

The company also provided the summary of the PV-10 calculations. While the more detailed calculations and results will be published in the Annual Information Form which should be filed before the end of this month, Spartan Delta has already published the summarized results of the pre-tax value of the reserves.

Applying a 10% discount rate, the pre-tax PV10 value is C$5B. And even if you would use a discount rate of 20%, the 2P reserves have a pre-tax value of C$3.2B.

Spartan Delta Investor Relations

You could also apply a mix whereby you use a 10% discount rate for the PDP reserves (proved developed producing) and 15% or 20% for the other reserve classifications. If I would use a 15% discount rate for the undeveloped proved reserves and a 20% discount rate for the probable reserves, the pro-forma pre-tax present value of the cash flows would be C$3.72B. On an after-tax basis this should for sure exceed C$2.5B and thus have a value north of C$15/share. I’m looking forward to seeing the official after-tax results but it is clear the current share price is underpinned by the value of the reserves. Using the standard 10% discount rate, the pre-tax NPV10% per share is almost C$30.

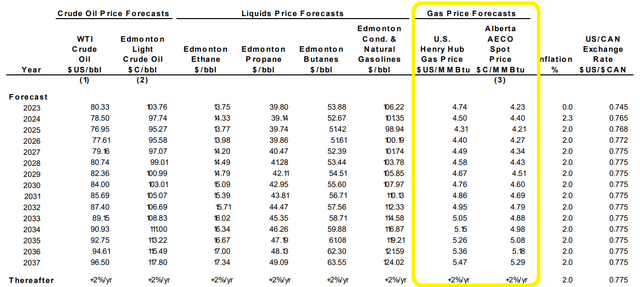

The only caveat here is that the value of the reserves was calculated using relatively strong natural gas prices. But if Spartan Delta continues to hedge a portion of its output during an era of temporarily high prices, the prices used below may not be unreasonable.

Spartan Delta Investor Relations

Investment thesis

Spartan Delta still is my largest position in the natural gas space. I am happy to see the company has finally started to hedge some of its natural gas production rate and those hedges will likely be quite valuable this year. I like the strong balance sheet (which should contain a net cash position by the end of this year), the PV10 calculation and the strong reserve basis. Based on the anticipated production rate for this year, the Reserve Life Index is approximately 19 years based on the 2P reserves.

The company is also still working on its ‘strategic review’, and as this management has sold its previous three companies, I’m not sure Spartan Delta will still be around by the end of this year.

I have a long position in Spartan Delta and wouldn’t mind adding on additional weakness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.