Solana (SOL) has been on a rollercoaster journey of late, with its its worth seeing erratic shifts and even retreating in lots of cases.

Associated Studying

For Solana, the sharp swings out there have offered a troublesome image; however, specialists nonetheless have optimism. They see this as a passing part even with the downward pressures. The altcoin’s technical developments level to an fascinating future.

On the time of writing, SOL was buying and selling at $150, down 6.2% and 17.1% within the every day and weekly frames, knowledge from Coingecko exhibits.

Even inside the turmoil, the current buying and selling quantity of $9.80 billion over the previous 24 hours demonstrates a notable diploma of exercise and investor curiosity.

Technical Indicators And Bullish Patterns

Ali Martinez, a well-known crypto analyst, lately talked about Solana’s potential return, which makes sellers and consumers very .

Martinez’s research signifies on Solana’s 4-hour chart a bullish megaphone sample growing. This pattern, which exhibits rising volatility, often comes earlier than important worth will increase.

I do know, the dip retains dipping!

Nonetheless, #Solana is likely to be forming a bullish megaphone on the 4-hour chart. The current correction to the 61.8% Fibonacci stage and oversold RSI recommend it may very well be a great time to purchase $SOL.

Think about putting your stop-loss round $156-$154 and… pic.twitter.com/ylnaPAf2EV

— Ali (@ali_charts) August 1, 2024

One of many most important indicators that would validate Solana’s constructive outlook is the digital asset’s adaptation to the 61.8% Fibonacci retracing stage. Extremely vital in technical evaluation, the Fibonacci retrace aids within the estimation of possible assist and resistance ranges. Particularly the mentioned stage is seen as a tipping level when regular market fluctuations are anticipated.

To scale back danger, Martinez recommends establishing a stop-loss order between $156 and $154, subsequently guaranteeing that, ought to the worth fall to this predefined stage, holdings are immediately liquidated. This method seeks to attenuate potential losses and set buyers to revenue from the anticipated growing pattern.

Conversely, Martinez’s take-profit goal is from $200 to $259, subsequently offering a big revenue margin for these prepared to barter the current dynamics of the market with measured dangers.

Lengthy-Time period Prospects And Strategic Positioning

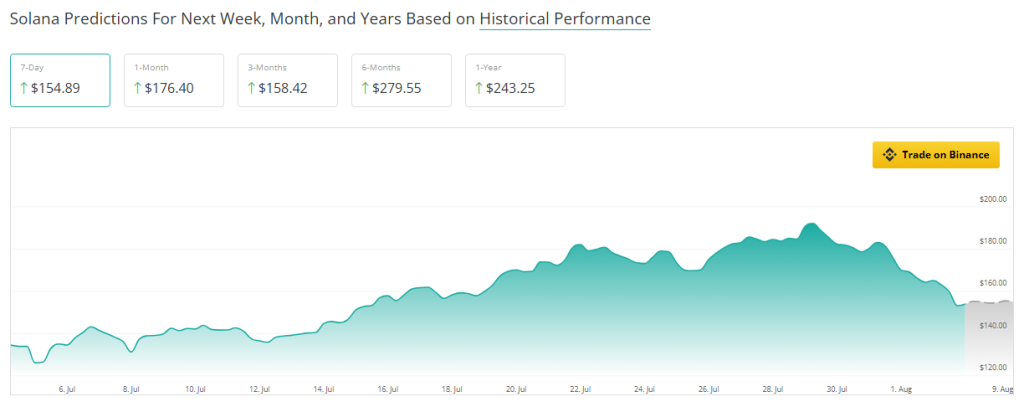

Though the marketplace for cryptocurrencies is inherently unstable, Solana’s long-term prospects are very shiny. SOL is promoting at a 14.59% low cost to its anticipated estimate for the following month based mostly on knowledge from the crypto prediction software CoinCheckup. This underperformance factors to potential undervaluation, thereby providing buyers prepared for a comeback a window of alternative.

From what CoinCheckup can inform, costs will go up by 2.91 % over the following three months. That is the beginning of a therapeutic time. Though this projected rise is small, it units the stage for greater ones.

Associated Studying

Issues are wanting up for Solana: prediction knowledge present it’s poised to rally 80% over the following six months. This projection might be based mostly on the notion that the community will enhance, extra individuals will use it, and the market shall be rising.

Featured picture from Chainalysis, chart from TradingView