Key Takeaways

- Solana and Terra have seen their market worth drop by greater than 23% over the previous week.

- Each Layer 1 tokens are actually sitting at make-or-break factors that can decide their fates.

- A break of assist or resistance may end in a major transfer for each property.

Share this text

Solana and Terra have reached important assist areas after incurring important losses over the previous week. Nonetheless, shopping for stress is but to select up for each property.

Solana and Terra Attain Essential Factors

Solana and Terra have discovered necessary assist ranges.

The Layer 1 tokens seem like buying and selling at make-or-break factors after retracing by greater than 23% over the previous week.

Solana is at the moment testing the higher boundary of the parallel channel that developed on its four-hour chart. Buying and selling historical past exhibits {that a} rejection has occurred each time SOL has surged to this resistance trendline, main costs to drag again to the channel’s decrease edge.

An analogous market response may see the Layer 1 token slice by the $108 assist degree and retrace 10% towards the channel’s decrease trendline at round $100.

Nonetheless, as Solana has examined the channel’s higher boundary 3 times since Mar. 5, resistance may very well be weakening. SOL’s present value ranges are important as a result of a decisive four-hour candlestick shut above $115 may invalidate the pessimistic outlook. Breaching the essential provide wall may end in an upswing to $124.

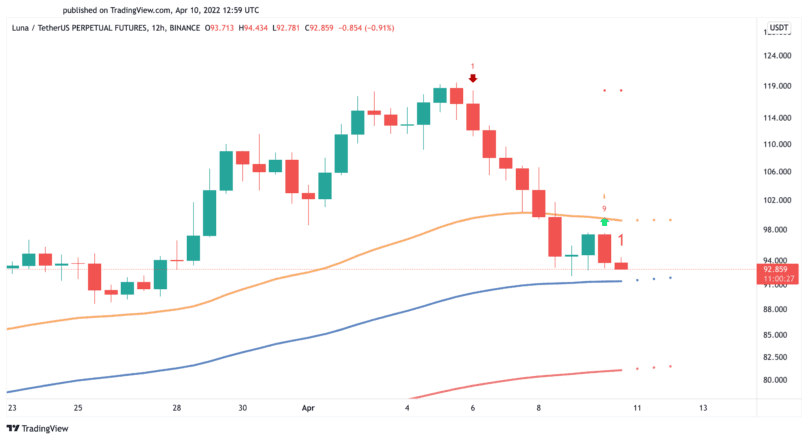

Terra’s native token can also be sitting at a pivotal level on its development. The Tom DeMark (TD) Sequential indicator lately introduced a purchase sign within the type of a crimson 9 candlestick on LUNA’s 12-hour chart. The bullish formation anticipates a one to 4 candlesticks upswing, however shopping for stress has not but picked up.

The 100-hour exponential transferring common at $91 inside this timeframe is the one degree of assist stopping LUNA from dropping additional. In the meantime, the 50-hour exponential transferring common at $100 is performing as resistance, rejecting any upward value motion. Solely a 12-hour candlestick shut exterior of this value pocket can decide whether or not the optimistic thesis introduced by the TD setup could be validated.

As a result of ambiguous outlook, merchants shall be trying to train persistence across the present value ranges. A decisive shut above resistance may catapult LUNA to $110, whereas a breach of assist may end in a downswing to $82.

Disclosure: On the time of writing, the writer of this piece owned BTC and ETH.

Share this text

Stand up to $600 in AVAX or LUNA

With our purpose of bringing the subsequent 100 million individuals to crypto, Celsius is all the time trying to present the most effective experiences and alternatives for our group. This consists of in search of…

OpenSea Teases April Drop Date for Solana NFTs

NFT market OpenSea has alluded to an April launch date for its Solana NFT assist. Such assist would place OpenSea in direct competitors with Magic Eden, the present chief in…

Thousands and thousands Misplaced as Solana DeFi App cashio Suffers Hack

The Solana stablecoin protocol cashio has suffered an exploit main to a whole collapse of its flagship stablecoin, CASH. cashio Hacked for Thousands and thousands cashio, a stablecoin protocol on Solana, has…

Terra’s Bitcoin Spree May Assist LUNA Moon

The Luna Basis Guard (LFG) lately introduced plans to build up billions of {dollars} value of Bitcoin to stabilize UST. Terra’s LUNA now appears primed for brand spanking new highs, however it should…