Oselote

Introduction

On November 7, Canada’s SilverCrest Metals (NYSE:SILV) (TSX:SIL:CA) declared commercial production at its Las Chispas mine in Mexico thus joining the ranks of major silver miners. The project is now de-risked and just over two weeks ago the company also unveiled a new $120 million senior secured credit facility. With silver prices rising over the past few months, I think that the 20% increase in the market valuation of SilverCrest since the start of November is well justified. However, the company now has an enterprise value of over $900 million which is significantly higher than the net present value (NPV) of Las Chispas at today’s metal prices. I think this could be a good time to take profits. Let’s review

Overview of the business and financials

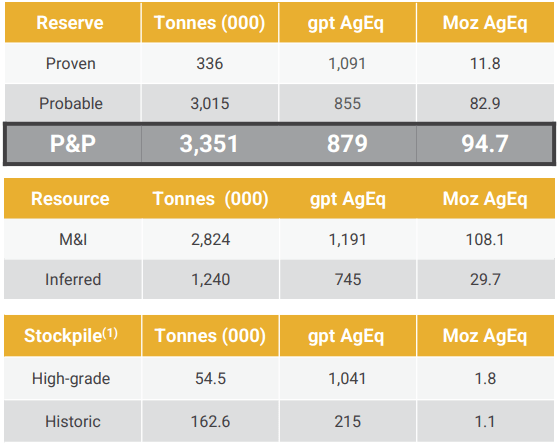

The main asset of SilverCrest Metals is the Las Chispas mine in the state of Sonora, which is among the highest-grade primary silver projects in the world with proven and probable reserves at 879 g/t per ounce of silver equivalent.

SilverCrest Metals

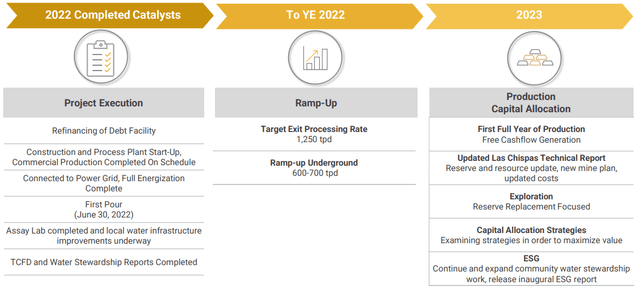

The company managed to bring this deposit from discovery to production in less than seven years and considering many precious metals mines take well over a decade to enter the production stage, I consider this to be an impressive achievement. Construction of the processing plant at Las Chispas started in February 2021 and was completed on time and on budget in May 2022, which is also not common.

The commissioning period was between September and October and the processing plant’s daily tonnage and metallurgical recovery were ahead of the 2021 feasibility study ramp-up projections as it processed 62,146 tonnes of ore for an average of 1,019 tpd and the metallurgical recovery averaged 96.7% AgEq. The underground mine is also progressing well with its ramp-up and the aim is to end 2022 at a rate of 600 to 700 tpd. The plant design throughput of 1,250 tpd is expected to be reached before the end of 2022.

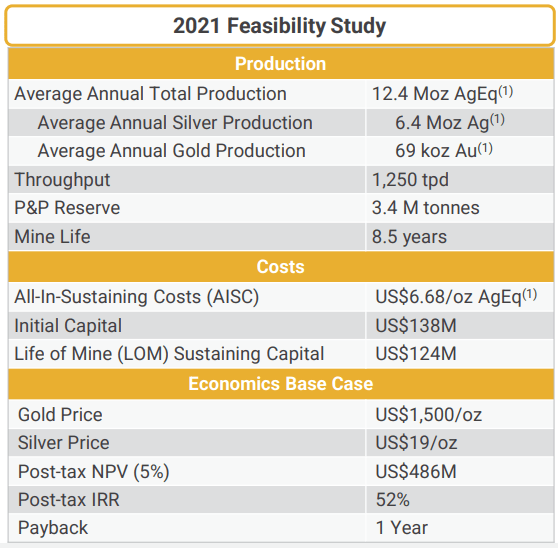

Looking at the key results from the 2021 feasibility study, you can see that Las Chispas is a major global silver mine with an annual production of over 12 million ounces of silver equivalent. Thanks to the bonanza grades, the project is expected to be profitable even if silver prices crash as the estimated average all-in sustaining costs (AISC) over the full years of production (2023-2029) is just $6.68 per ounce of silver equivalent.

SilverCrest Metals

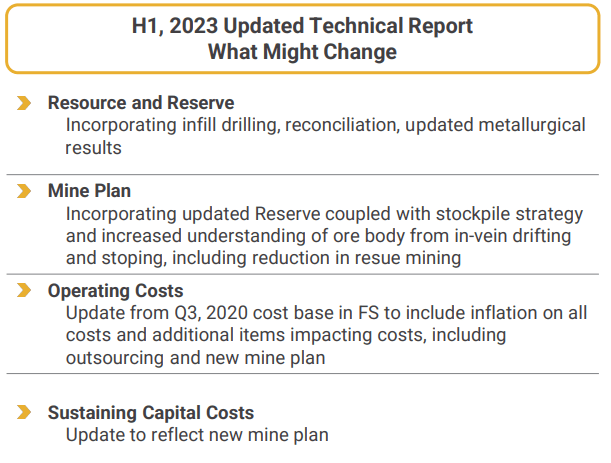

One concern of mine is that the life of mine is somewhat short, but this is likely to change over the coming years as just 15 of more than 45 known veins are currently included in the reserve estimate. SilverCrest is already working on an updated technical report scheduled for release in the first half of 2023 which will include additional exploration drill results, initial stope delineation drill results as well as updated metallurgical results. It’s possible that we’re just a few months away from a significant extension of the life of mine. However, the updated technical report will also include updated operating and sustaining capital costs to reflect the impact of inflation and this is likely to boost AISC, possibly above $8 per ounce of silver equivalent over the full years of production.

SilverCrest Metals

While the exploration potential at Las Chispas seems compelling, I’m concerned that there are few catalysts left for the market valuation of SilverCrest now that the mine has reached commercial production. The improved reserves should be countered by higher costs and the company is already starting to look expensive from a fundamentals standpoint.

SilverCrest Metals

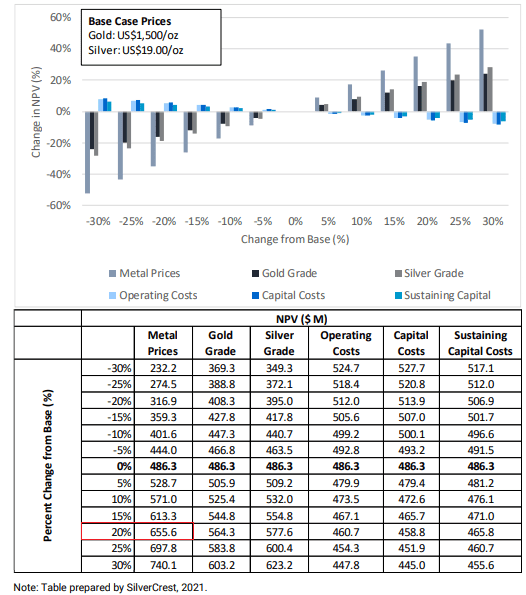

Following the refinancing of the debt at the end of November, the company has about $50 million in cash and about $70 million undrawn under its revolving facility. The total debt is also close to $50 million which means that the enterprise value of SilverCrest is pretty much equal to its market capitalization, which stands at $911.7 million as of the time of writing. Looking through the 2021 technical report, we can see that the NPV of Las Chispas at today’s silver and gold prices of $23 per ounce and $1,785 per ounce, respectively, is only about $650 million.

SilverCrest Metals

In my view, SilverCrest investors have to rely on silver prices continuing to increase for the valuation of the company to surpass the current levels and this seems dangerous. Silver prices are notoriously volatile, and rising interest rates usually put pressure on demand. While silver is used by some investors to hedge against inflation, higher interest rates increase the opportunity cost of holding non-interest-bearing assets.

Trading Economics

Overall, I think that the management of SilverCrest has done a great job so far and this is reflected in the share price. However, there are several silver mining companies on the market that seem to offer a better bang for the buck. For example, Silvercorp Metals (SVM) and Avino Silver & Gold Mines (ASM) which I’ve covered here and here, respectively.

Investor takeaway

Las Chispas is among the highest-grade and lowest-cost silver mines in the world today and SilverCrest is among the best investments in the entire mining space over the past decade, with its share price rising by a factor of 50x since 2015. I think that what the company has achieved is impressive, but the upside potential looks limited as commercial production has been reached and the new technical report is expected to include cost inflation.

SilverCrest is trading at a significant premium to the NPV of Las Chispas and I think this situation is unsustainable. There are several companies in the silver mining space that look like better value plays at the moment.