jetcityimage

Dear readers/followers,

Today is the time to start looking into Siemens Healthineers (OTCPK:SEMHF), and present to you my basic thesis on this company and where it is going. Siemens Healthineers has seen significant share price pressure over the past few years since 2021 and is currently trading firmly below its normalized premium.

In this article, I will “deconstruct” the company for you, show you what it does, where it makes its money, and why it could be a suitable investment for your long-term goals.

At least, in theory.

Let me show you what I mean.

Siemens Healthineers – Long-term appeal in the Healthcare Equipment sector

The former name of what is now called Siemens Healthineers was once the sectors of Siemens Healthcare, Medical Solutions, and Medical systems. All of these were once part of the massive conglomerate Siemens (OTCPK:SIEGY), which I extensively cover on the site, and also own shares in. I’ve recently sold many of my shares in Siemens over a €150/share native share price at a very nice profit.

Healthineers IR (Healthineers IR)

My position in Healthineers meanwhile is very modest.

Healthineers is primarily a medical device company and the parent company for a large number of medical patents and technologies. The various arms and spin-offs have different relationships with its former parent company Siemens, but Siemens has chosen to keep very tight reins on Healthineers – 75% of the outstanding shares are owned by the company. The company was “Medical Solutions” back in 2001, then changed back to healthcare in ’08, before being rebranded as Healthineers in -16.

This company has a global workforce of over 60,000 employees and generates over €20B in annual revenues, revenue that by the way is estimated to grow year-over-year to €25B by 2025 at a growth rate of about 5%, with EPS about the same pace (Source: S&P Global). The company manages a 9.4% net income on that €21.7B Revenue, managing to keep COGS to around 62.5%, with operating margins of over 12%, RoE of close to 11%, and RoIC of above 5.27%.

This is impressive, because all of these metrics are better than most of their peers in Medtech, and being better than the average is the first thing I look for when I look at a company.

Healthineers IR (Healthineers IR)

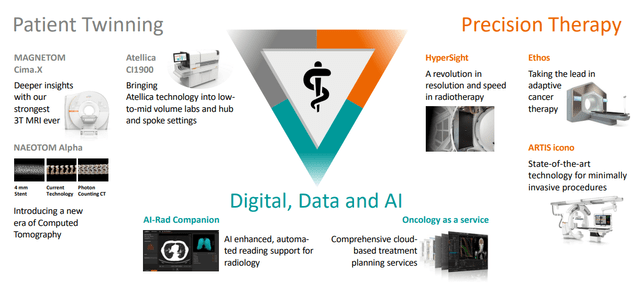

Healthineers is active in a number of areas, including:

- Imaging

- Diagnostics

- Varian

- Advanced Therapies

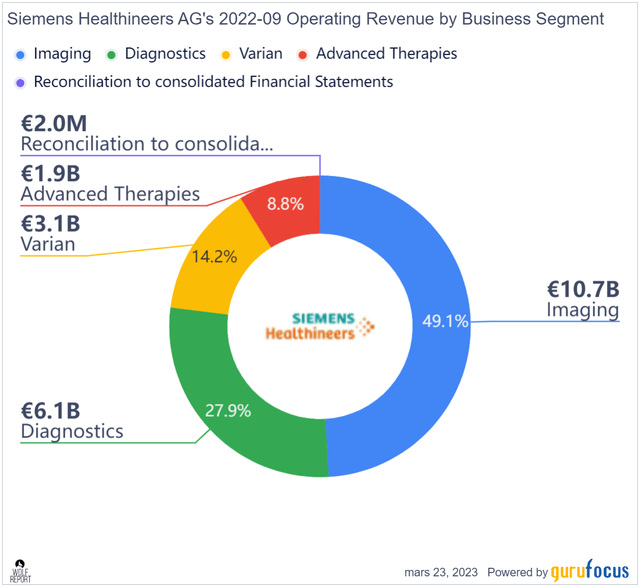

Almost 50% of the company’s operating revenue comes from Imaging, which makes Healthineers primarily an imaging company, with 28% from Diagnostics, 14% from Varian, and the rest split between Advanced therapies and various reconciliations. Varian is an American business with a strong focus on radiation oncology and software, including things like linear accelerators – Varian itself was acquired by Healthineers back in 2021, but the company continues to operate independently.

Siemens Healthineers (Gurufocus)

The company has also initiated partnerships with Atrium Health, with Atrium Purchasing over $200M in equipment and services from both imaging, from Varian, and the company’s advanced therapies portfolio. The company will assist Atrium in modernizing and jointly improving patient outcomes, efficiency, treatment quality, and cost reductions.

Healthineers is a company that’s active across the world in a myriad of healthcare segments. It’s a resilient company with proven fundamentals and an excellent track record.

Its fundamentals can be described in many ways, and exemplified across the board. I track things like credit rating, but it obviously only begins there. Healthineers doesn’t have its own credit rating but mostly piggybacks on Siemens, which is A+/A1 rated. Healthineers has an extremely low debt ratio, at 0.04x to Equity, as well as 0.16x to EBITDA, which is better than most of its peers, even if it’s higher than where it has been previously. Interest coverage is of no worry here.

The company’s dividend is low – at around 1.9%. It’s not as though MedTech companies have massively attractive yields overall, but the company is still better than most of the industry, and this is close to a 2-year high for Healthineers.

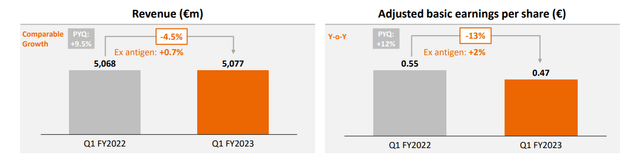

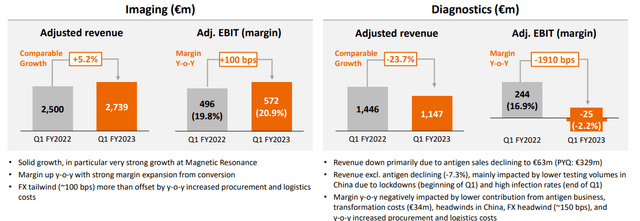

The company is in a downward spiral at this time, and this comes from a number of reasons – but most of them interlinked – costs. The company saw revenue and EPS decline during the 1Q23 period, which is the latest period we have…

Healthineers IR (Healthineers IR)

…and the reason for these declines is volume/mix, supply issues, certain business segments being lower, lockdowns still comparing unfavorably, increased logistic costs, transformation costs, and increased procurement costs. It’s costs, costs, and costs, clearly speaking. While the various segments, especially imaging, continue to contribute strong sales and stable revenues, diagnostics is really stealing the show here, and not in a positive way.

Healthineers IR (Healthineers IR)

Advanced therapies are negative, but not as bad as Diagnostics. Aside from looking at the profitability metrics compared to peers, we can also put it through a historical lens – and that’s where we find flaws. OM was once over 15%, RoE has a 10-year average of almost 20% – so the company’s current numbers, while impressive on a comp basis, are not impressive when you look at what the company has managed before. Another metric I now look closer at is the ROIC relative to the company’s WACC. If the former is greater, that means that Healthineers are managing to create value from the company’s projects – with the opposite meaning that the company is a value destroyer.

I don’t invest in long-term value destroyers. A year or a few years is fine, and certain companies have WACC issues during the medium term, such as cement companies, which I do invest in. But if it becomes a trend, I am no longer interested.

For Healthineers, the company has seen many of its profit-related metrics turn down. This includes the WACC : ROIC relationship, which is more or less break-even at this point, and down from a positive variance of 9% back in 2015, steadily decreasing as WACC has increased and costs have mounted. This goes hand in hand with the company’s lower margins, RoE, and other metrics, and it explains in part why the share price has been punished. The company has also been somewhat dilutive in terms of shares, issued in 2020-2021.

However, none of these drawbacks makes Healthineers a “bad” company. It has the hallmarks of a qualitative business, including:

- Still among the best profitability in the sector

- Excellent leverage and interest coverage, with no trouble refinancing even if interest costs rise.

- An average Piotroski F-score of around 6 on the medium, indicates a relatively high financial position, with the reason it’s inching down towards being the margin pressures all companies are currently under.

- One of the best positions in the industry in terms of its portfolio, with very few companies being able to measure up.

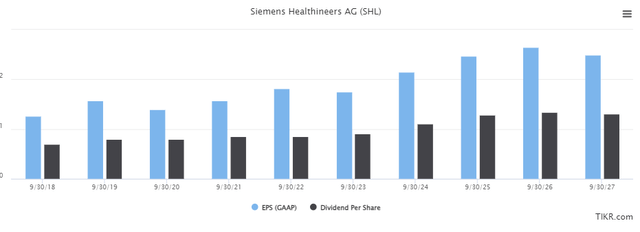

The company’s forecasts are also positive. I’ve pulled forecast data from a number of sources, and they all more or less concur with my own conclusion. Healthineers will see revenue growth based on volume growth. The company is growing. This in turn will likely result in EPS growth. Where we disagree is the degree of that earnings growth. Some analyst averages call for a relatively high rate of growth, like S&P Global.

Healthineers Forecast (TIKR.com)

For me, I would impair these forecasts somewhat – especially in terms of earnings, and would say that as far as valuation goes, the following thesis should be considered more relevant.

Healthineers Valuation – There are some like Healthineers, but this one is qualitative, and not expensive.

When we look at overall valuation, we look at a large number of different perspectives. First, let’s make one thing clear. Healthineers “plays” in a field with some very strong names, including but not limited to Abbot (ABT), Medtronic (MDT), Stryker (SYK), Boston Scientific (BSX), and a few others. Those are named in the order of their market capitalization, where Healthineers is in 5th place with around $62B. I own several of those businesses, and my position is the largest in MDT. If called to compare, I would call ABT and SYK more qualitative in terms of their fundamentals and business, but the problem is also that both companies typically trade at a much higher valuation, requiring significantly more discount before they become attractive.

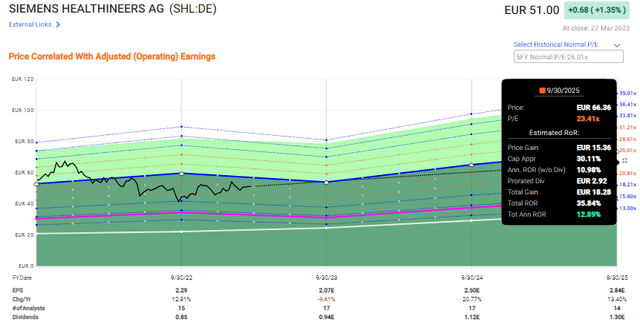

From a peer perspective, Healthineers is a very attractive potential due to how cheap relative to its usual premium it has become. The current native share price for SHL, its native share of €51/share, is a normalized P/E of close to 22x, compared to a usual P/E of 26-28x.

Based on average adjusted earnings growth of high single digits for the next few years, this brings us to a double-digit potential upside for the company even on a 22-24x P/E, which is below its usual “par”, so to speak.

F.A.S.T graphs SHL upside (F.A.S.T graphs)

Realistic? I would say so. We have 16 analysts following the company who would definitely agree with this as well. They give the company a range starting at €49 and going up to €67, with an average of €59, which implies an upside of 16.1% at this particular time. Out of 16 analysts, 13 are at a “BUY” or equivalent. This, to me, coupled with what you use above, implies a high rate of conviction for me.

I don’t see any particular potential downturns that could impact the company further than it already has. We’re already in margin decline territory, and the company has been priced accordingly.

The company unfortunately isn’t as bottom-cheap as it was only a few months back – so this article might be a bit late for some more extreme bargain-hunters – but I definitely still see the company as having a significant amount of value to offer at this valuation.

Above all, and similar to ABT and SYK, which I also own to some smaller extent, and MDT which I own a significant stake in, Healthineers offers you safety.

Despite challenges, the company’s revenue typically comes in like clockwork, and it’s apt at generating not only operating cash flows but FCF and net as well. It’s only in the latest year that the company has been seeing trouble in its profitability. Baxter (BAX) is another good example of what might happen to a company – that’s in worse shape – when something like this occurs.

Based on what I show you above, and based on combined valuation methods including peer averages, forecasts, and its historical returns of 13.3% for the 3-year period, which is as close to as much data as we have given the company’s relative youth as its own company, I go in here with a high conviction.

Medtronic might be the cheaper alternative in terms of premium upside – but Healthineers has more qualitative profit margins and foundations. All of the top companies in the segment here are worth looking at, and next to MDT, I view Healthineers as being a superb choice here.

My introductory PT for Healthineers comes to €56/share for the native, noting a high upside given the company’s quality.

I would characterize Healthineers as “undervalued” here. The following thesis applies.

Thesis

- Healthineers is among a class-leading group of companies in the medtech/equipment sector. While not the most profitable nor the most qualitative, nor the highest yield available, it nonetheless presents an appealing thesis with potential for a double-digit upside at a parent’s credit safety of A+/A1. This is worth noting and worth considering.

- I give the company a rating of “BUY” due to the aforementioned combinations of fundamental stability, strength, peer/comp appeal and relative upside in an uncertain world. What challenges there are, i believe Healthineers will master.

- My PT is €56/share for the native.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won’t call the company “cheap”, but it fulfills every single other metric i look for.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.