As of early March, the Division of Authorities Effectivity (DOGE) studies financial savings exceeding $100 billion, attributed to the:

Mixture of asset gross sales, contract/lease cancellations and renegotiations, fraud and improper fee deletion, grant cancellations, curiosity financial savings, programmatic modifications, regulatory financial savings, and workforce reductions.

Ignoring the potential for recession and monetary disaster, which the Federal Reserve would deal with with a multi-trillion-dollar financial inflation, if DOGE maintains its present financial savings charge and the Trump gold card generates extra income, we are able to contemplate the right way to make the most of these financial savings.

Roughly sixty years in the past, in What You Ought to Know About Inflation, Henry Hazlitt famous the abundance of speeches advocating for elevated federal expenditures or taxes. He then writes:

However I’ve but to see an article that discusses how we may start and enhance an annual reimbursement of the debt in proportion to the rise in our gross nationwide product.

One situation is direct debt discount. Assuming the US authorities can selectively repay any debt holder at its discretion, the query turns into, which debt holder needs to be paid first?

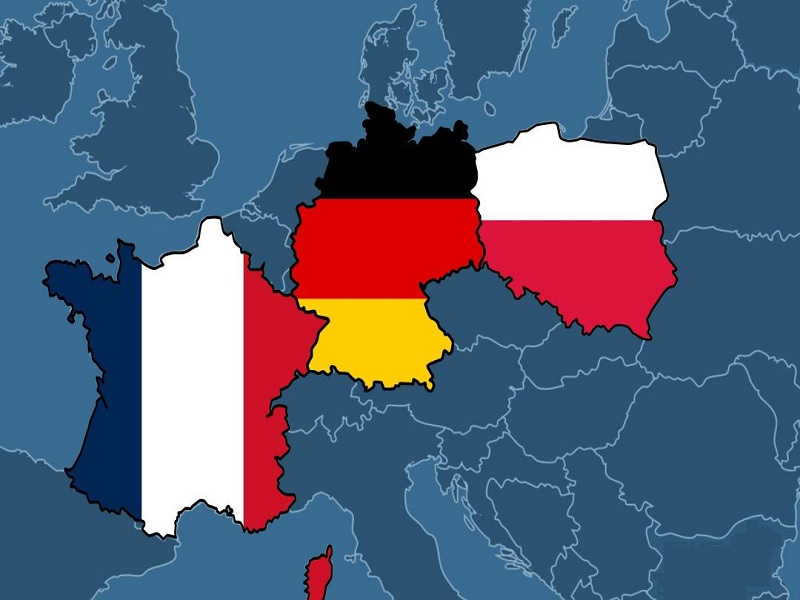

See beneath for the checklist of overseas debt holders as of December 2024, per Statista.

It’s outstanding that, inside two months of operation, DOGE has generated adequate financial savings to completely repay the debt owed to Mexico or Germany. Ought to this tempo proceed, the US authorities may doubtlessly settle its obligations to Switzerland, France, or the northern nation of Canada.

Nonetheless, the ramifications could be important. Repaying China, as an example, may cut back overseas dependency, however it could concurrently present China with a considerable inflow of dollars, almost 800 billion of them.

What they’ll do subsequent is anybody’s guess, however the $700+ billion in US debt China at present holds could also be indicative of some danger urge for food. They may even flip round and purchase extra debt, like a kind of refinancing.

However, this return of capital may empower the Chinese language authorities to aggressively purchase American shares, company bonds, cryptocurrency, or land. Even not directly, by funding Chinese language residents’ actual property purchases, they may achieve important US holdings… Sarcastically, the complete situation seems detrimental to American pursuits.

Concerning home US debt holders, Visible Capitalist reveals the whole was round $26 trillion as of 2023.

Full reimbursement would flood pensions, funds, and banks with money, forcing them to reinvest. However what would they purchase, if not US debt?

Lastly, there’s the Federal Reserve’s $4.3 trillion US treasury holding.

Any debt discount paid to the Federal Reserve would equate to deleting that quantity on the Fed’s stability sheet, sending it again to the ether. The debt would shrink, and the present and future curiosity value financial savings might be important.

Paying off overseas, home, or Federal Reserve debt holders presents a paradox: handing over huge sums to those that worth holding that debt. Possibly that’s why Henry Hazlitt remarked that he’d by no means seen an article on debt reimbursement.

It’s troubling as a result of debt is definitely created, however troublesome to extinguish. Maybe the only answer is finest. Relating to authorities motion, the reply stays the identical: do nothing.

Ought to the US authorities miraculously obtain a year-end surplus, direct debt reimbursement is perhaps pointless. As an alternative, it may concentrate on lowering expenditures and stopping future debt will increase. Over time, debt necessities would lower, resulting in a decreased provide of recent debt. This might affect elements like credit score scores and lending charges.

The USA is fortunate and good in some ways, however in a world of ever-increasing uncertainty and financial inflation, a US authorities that spends lower than it takes in would solely get stronger and keep its de facto gold commonplace by being the cleanest shirt within the soiled pile.