allanswart

Just over six years ago I wrote my first article on Shopify (NYSE:SHOP), and my third on Seeking Alpha, where I described the company as a unique opportunity to invest in the determination of man to succeed in the advent of the internet. Shopify remains a company in a class of its own, it always has been. The underlying business operations have been geared to ride the rising tide of commerce, at first from the internet, with the initial narrative being that the global population was increasingly out of touch with the brick-and-mortar retailing that came to define their cities and towns in the decades prior. But Shopify is essentially a call option on the growth of both online and brick-and-mortar commerce. The current malaise is mainly due to the poor state of the economy with large online marketplaces like Amazon (AMZN), Etsy (ETSY), and Coupang (CPNG) also realizing a substantial pullback of their common shares year-to-date as well as a softening of topline growth.

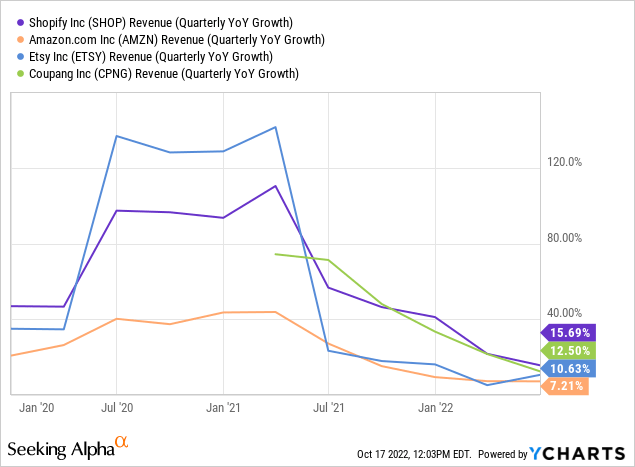

Shopify’s growth for its last reported quarter at 15.7% was higher than Amazon, Etsy, and Coupang. These were all companies that just a few quarters priors were reporting materially higher revenues due to the unique trading conditions created by the pandemic. Growth has essentially normalized back to what would have been the trend, excluding the period of stay-at-home orders that saw growth go gangbusters. However, the current realized growth has been weakened by the economic environment.

The Bulls Will Win Out In The Long Term

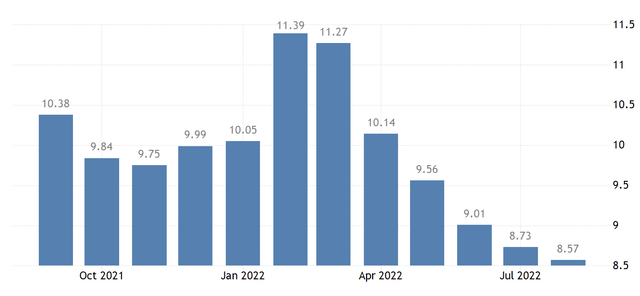

Consecutive macroeconomic blows have disrupted the global economy and created the conditions for a collapse in consumer confidence and real incomes. For example, wages in the US increased by 8.57% year-over-year in August, the slowest growth in a year.

Trading Economics

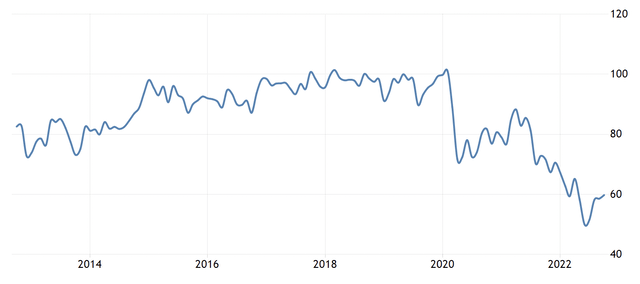

Further, when you adjust these growth figures for inflation figures still running hot, then you get almost negative real wage growth. This has drastically affected consumer confidence, which is languishing near record lows.

Trading Economics

The latest consumer sentiment figures from the University of Michigan rose to 59.8 for October, 9.8 points above the all-time low reached in June. To be clear here, consumer confidence just a few months ago fell to its lowest level since records began. This was worse than the 2020 pandemic, the 2008 financial crisis, the 2001 dot com crash, and the 1973 Arab oil embargo. Whilst, inflation is expected to fall to around 2.5% towards the end of the calendar year 2023, there is still material uncertainty around the state of the global economy.

The macroeconomic shock from supply chain disruptions, high energy prices, and continued decline in real wages has left households in a state of paralysis. As a result, household discretionary spending has been cut back to lows. This is the picture reflected across most developed economies around the world. Things are bad and Shopify is fully exposed to its gyrations. Hence, with the current terrible economic backdrop expected to persist until the second half of next year, I don’t expect Shopify to report the type of revenue growth that its shareholders expected for a while. But the company is still chasing a total addressable market worth $160 billion.

This Retracement Is Temporary

Shopify’s current affliction is slow growth against a valuation that whilst pulled back from its highs, would still pose issues to a value-based investor. The company has been and will always be in an elite category of firms that were pioneers and eventually came to dominate their respective markets. The reason growth has slowed markedly is multifaceted due to year-on-year comps from the extremes of the pandemic and now the bad economic backdrop. And whilst there are a number of competing platforms, none have the scale and breadth of Shopify, with most also suffering to offer the same level of functionality.

At its current stock price, Shopify has essentially wiped out over three years of capital gains. This could open up an opportunity to start accumulating shares once the economic tide turns back in the company’s favour. Yes, growth has slowed, but it has slowed for everyone and Shopify is still growing faster than its peers.

The company is building the infrastructure for commerce. One that powers millions of websites and processes billions in gross merchandise value a year.

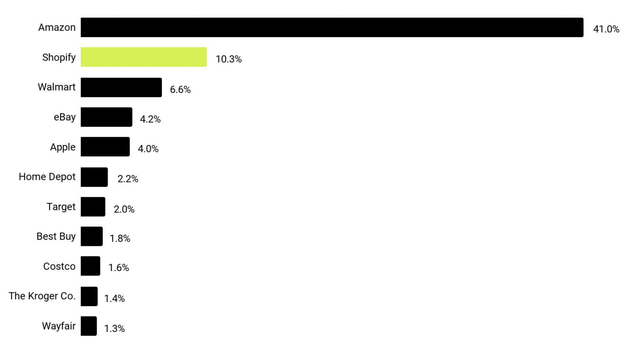

Shopify

Shopify sits just below Amazon, with its share of US retail eCommerce sales for 2021 at 10.3%. This underlies the company’s strong positioning and strength. Critically, Shopify is mission-critical software for millions of businesses that use its platform to support their livelihoods and ambitions. Hence, whilst the global economic conditions are likely to keep the bulls on the backfoot for longer than they would have desired, the longer-term bull case is clear. Shopify is an analogue to global commerce and fully reflects its underlying drivers. Once the headwinds dissipate at some point, the company will be able to ride its strong share of the market upwards.