TomasSereda/iStock through Getty Photographs

Freeport-McMoRan Inc. (FCX) engages within the mining of mineral properties in North America, South America, and Indonesia. The corporate primarily explores for copper, gold, molybdenum, silver, and different metals, in addition to oil and fuel.

The corporate additionally operates a portfolio of oil and fuel properties primarily positioned in offshore California and the Gulf of Mexico. As of December 31, 2020, it operated roughly 165 wells.

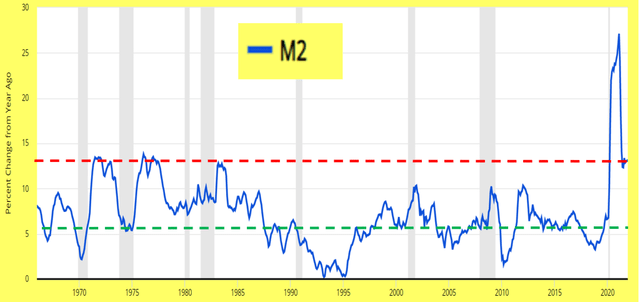

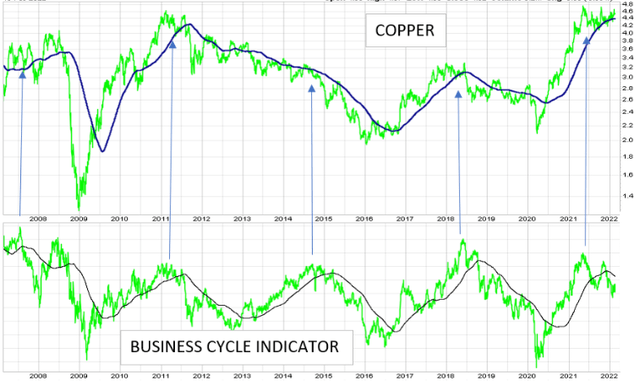

St. Louis Fed, The Peter Dag Portfolio Technique and Administration

Traders haven’t adopted the cash provide and its development as a result of inflation has not been a serious concern from the newest Nineteen Eighties till lately. Progress in M2 has been shut to five%-6% on common in that interval, thus accommodating strong financial development with low inflation.

Nonetheless, within the Seventies M2 development has been rising effectively above its 5%-6% common. The end result has been, then and now, rising inflation.

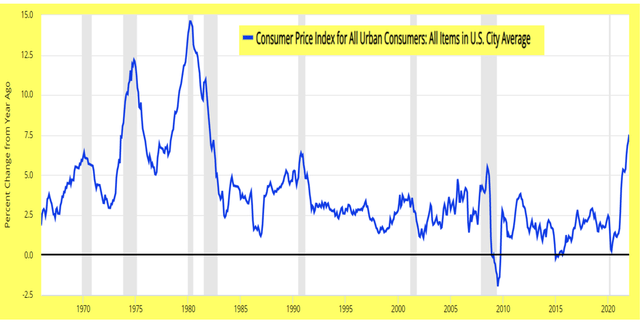

St. Louis Fed, The Peter Dag Portfolio Technique and Administration

The principle downside of rising inflation is it causes a decline in customers’ spending energy. It’s no coincidence actual disposable earnings has been declining since March 2021. Though retail gross sales are nonetheless rising at a speedy clip (+13.0% y/y), the impression of rising inflation is being felt in a serious approach.

Client sentiment of the College of Michigan survey has declined to ranges not often seen in additional than 60 years. Every time it was related to a recession.

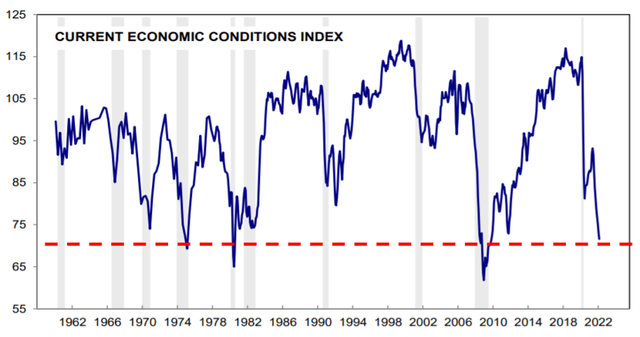

College of Michigan

The enterprise cycles of the Seventies present an essential sample. Rising inflation is all the time adopted by a recession and the upper inflation goes the extra extreme the recession is more likely to be.

The Fed should decelerate the expansion of M2. They don’t have any choice in the event that they need to tame inflation. Sadly they’re in a field (see my article right here). The enterprise cycle, in the meantime, is declining because the forces of recession preserve rising. The chance of slower development in demand and quickly rising inventories will create imbalances forcing enterprise to decelerate manufacturing. The stock/gross sales ratio is already rising for wholesalers and general enterprise.

Slowing down manufacturing implies decrease necessities for labor, commodities (reminiscent of copper, different metals, lumber, crude oil), and borrowing wanted to enhance or broaden capability.

StockCharts.com, The Peter Dag Portfolio Technique and Administration

The above chart exhibits the worth of copper within the higher panel and the enterprise cycle indicator as revealed in actual time from market information from The Peter Dag Portfolio Technique and Administration.

The decline in our enterprise cycle indicator displays a weakening financial system. The graphs additionally present copper costs weaken when the enterprise cycle indicator declines and rise when the enterprise cycle indicator rises.

Proper now, the enterprise cycle indicator is declining and is more likely to proceed to say no as greater inflation retains eroding customers’ buying energy and enterprise is compelled to cut back manufacturing to manage inventories. The end result is decrease copper costs forward.

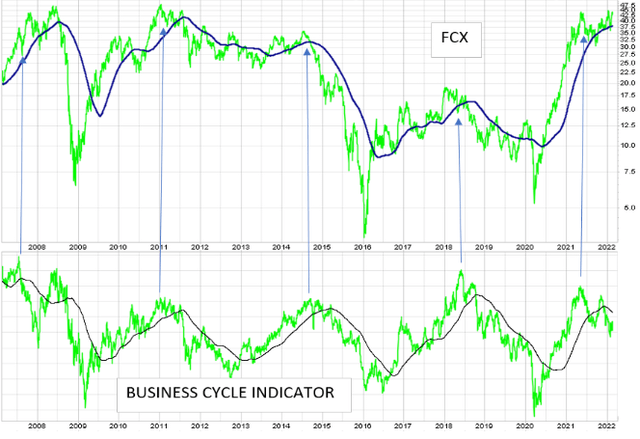

StockCharts.com, The Peter Dag Portfolio Technique and Administration

The above chart exhibits the costs of FCX within the higher panel. The decrease panel exhibits the enterprise cycle indicator. The weak spot within the enterprise cycle indicator factors to decrease costs for FCX.

Key takeaways

- The speedy development of M2 – wanted to finance COVID-19 stimulus packages – is fueling inflation.

- Inflation will proceed to erode buying energy, inflicting depressed ranges in customers’ sentiment.

- The slowdown in demand is already indicating inventories are rising too quickly as mirrored by the rising stock/gross sales ratio.

- The wanted stock adjustment will trigger manufacturing to decelerate.

- The weak spot in manufacturing will trigger copper and different commodities to say no, making FCX unattractive.