MF3d

NOTE: For investors new to this stock and the condition of heart failure (“HF”), I encourage you to listen to the Key Opinion Leader (“KOL”) webcast from September 29, 2020. While the physicians that joined President and CEO John Tucker in the webcast— Dr. Nihar Desai (Yale School of Medicine) and Dr. Dan Bensimhon (Cone Health)— are paid consultants of SCPH, it does not invalidate the points they make, nor the validity of the investment opportunity. The slides from the December 3, 2020 Evercore ISI Virtual HealthCONx Conference presentation (download here) are also helpful in understanding the investment thesis (unfortunately, the webcast for this event is not currently active). The majority of the content in this article is supported by what was discussed at these two events.

It has been a long wait of 4+ years for investors in scPharmaceuticals (NASDAQ:SCPH). The first CRL for lead drug candidate FUROSCIX was received in June 2018, and then a second CRL was received in December 2020. But finally, before the market opened on Monday, October 10, the company announced that FUROSCIX had gotten a thumbs up from the FDA.

Though FDA approvals are usually expected to boost the stock price, this stock has been volatile in the days immediately following the approval announcement. On the Monday that the announcement was made, it finished down about 14%, before jumping up over 30% on Tuesday. Other than a possible “buy the rumor, sell the news” explanation, I think the main reason the stock was down on Monday was because of the new $100M debt financing agreement that was announced alongside the FDA approval.

However, I think the market overreacted to the news of the new debt facility.

If we look at the 2Q22 10-Q filing (pg 10), we can see that the existing “2019 Loan Agreement” was at an interest rate of the higher of (i) LIBOR plus 7.95% or (ii) 10.18% (this loan agreement was for up to $20M, and as of June 30, there was $12.5M drawn, which will be repaid in full using the new debt facility). The new $100M debt agreement with Oaktree Capital Management bears interest at the 3-month secured overnight financing rate (SOFR) plus 8.75%, and the interest rate is capped at 11.75%. Considering the fact that we are in a much higher interest rate environment compared to 2019, the new terms do not seem so unfavorable.

The market might also have been disappointed because the new financing agreement confirmed that SCPH will not partner to commercialize FUROSCIX, but instead will commercialize on its own. It always adds an additional risk factor when a biotech that has been specializing in R&D for several years decides to build out its own salesforce rather than partner with an established pharmaceutical company and simply collect a royalty from net sales of its drug. If it goes well for SCPH, then they will end up keeping all of the net sales rather than just a percentage from a licensing agreement. But if it doesn’t go well, it can be an expensive undertaking, as SCPH will bear all of the commercialization costs on its own.

This late in the process, however, I don’t think it should come as a surprise that SCPH did not find a partner to market FUROSCIX. Management has made comments during presentations at conferences over the past few years that discussed the salesforce size they thought would be required to reach a majority of the target patients, and I think these statements indicated a likelihood that they would commercialize on their own.

What I think is most useful for investors to focus on at this point is not the stock price volatility, but rather the compelling market opportunity for FUROSCIX.

2020 Evercore ISI HealthCONx Conference Presentation

2020 Evercore ISI HealthCONx Conference Presentation

Congestive heart failure (also known simply as heart failure) occurs when a patient’s heart is unable to pump blood as forcefully as it should, often causing blood back-ups. Fluid build-up can leak out of blood vessels and swell into other tissues (known as edema, or swelling due to water retention). If there is fluid build-up in the lungs, it can cause shortness of breath and difficulty breathing. Patients can also experience symptoms such as swelling of the belly and overall weight gain.

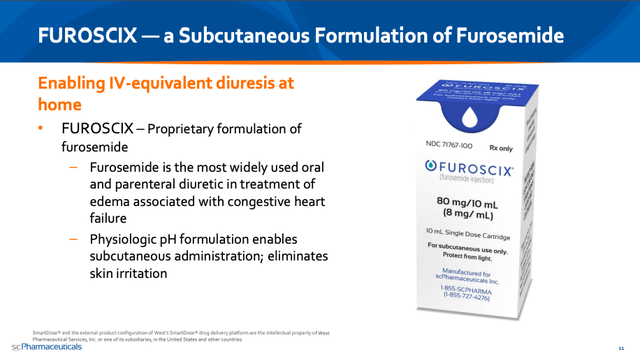

To treat this excess fluid build-up, the medical community has for decades turned to diuretics, which are compounds that increase urine flow. There are three main types of diuretics (loop, thiazide, and potassium-sparing), categorized by their mechanism of action. Of the loop diuretics, furosemide (which goes by the brand name Lasix) is the most commonly prescribed oral and parenteral treatment.

At prior events, the SCPH CEO has explained that in the US, there are 6.5M HF patients taking oral Lasix as a maintenance therapy, and that most of them are doing just fine. However, every year, there are approximately 4M instances in which oral Lasix is not enough, as the patients do not see a reduction in swelling in their extremities and body weight.

When this occurs, cardiologists tend to double the oral dose, and sometimes even prescribe Zaroxolyn (metolazone), which is a thiazide diuretic. Unfortunately, Zaroxolyn can come with some unfavorable side effects, such as damage to the kidneys.

For some patients placed on a new course of treatment, the swelling recedes, and in due time, they can go back to their original oral Lasix maintenance therapy. For patients that do not see a reduction in swelling, their physician will likely decide that they are in need of an even stronger diuretic. This almost always means a treatment of IV Lasix, which requires either a trip to a medical facility or a home visit by a health care practitioner.

The benefit that IV Lasix has over oral Lasix, and the reason it is used as a treatment of last resort, is that it offers 100% bioavailability. Bioavailability is simply how much of an administered substance is able to be absorbed by the circulatory system and reach its target area. The higher the bioavailability, the more effective a drug tends to be.

This YouTube video (Pharmacology – Loop Diuretics – Furosemide (Lasix) IV in Heart Failure – Dr. Busti) does a good job explaining why oral diuretics are just not enough in certain high-risk HF patients. While I encourage you to watch it in its entirety, if you fast forward to minute 9:00, there is a table that shows the bioavailability of oral Lasix to be only 50%-70% in a normal patient. This means that 30%-50% of the dose never even makes it to its intended targets—and this is in normal patients, with the bioavailability decreasing depending on the health severity of the patient.

What investors should take from all of this is that for high-risk HF patients, medical providers cannot take the risk of continuing to go with oral Lasix, and instead need something that guarantees 100% bioavailability. This has always meant IV Lasix—until now.

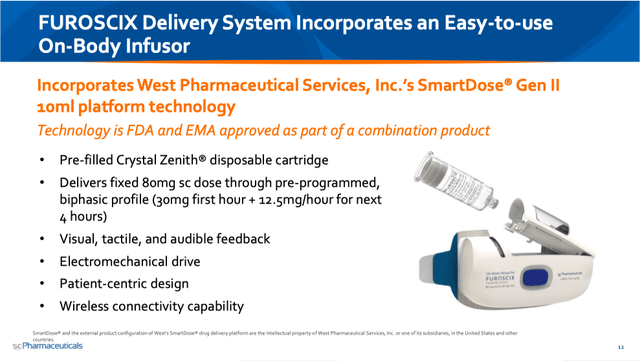

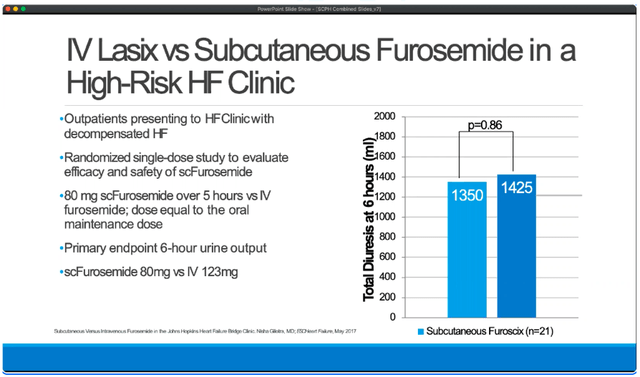

What SCPH has been able to show is that FUROSCIX (a subcutaneous administration of furosemide) is bioequivalent to IV Lasix, in that it offers the same amount of fluid reduction over the course of 6 hours.

KOL webcast (14:30)

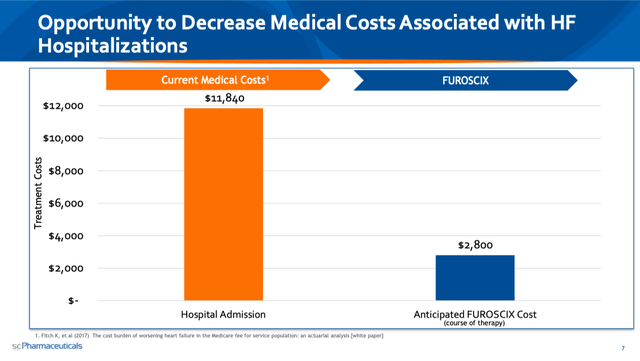

And the reason this is very meaningful is because in addition to being incredibly effective, administering IV Lasix is incredibly expensive. As you can see in the slide below, a course of therapy of FUROSCIX that a patient can self-administer at home via subcutaneous administration would cost a bit less than 25% of what current Medicare hospital admission costs are for worsening HF patients.

2020 Evercore ISI HealthCONx Conference Presentation

As of market close on Wednesday, October 19, SCPH had a market cap of $148M. I calculate a fully diluted market cap of $177M, but in the grand scheme of things, this difference is trivial. The market opportunity that SCPH is going after is $5B+. Obviously, if they succeed in getting FUROSCIX to be used as a standard of care before IV Lasix, then the upside is many, many multiples higher.

Unlike other microcap biotechs, the risk with SCPH has nothing to do with drug safety, drug efficacy, or drug approval. FUROSCIX has shown itself to be bioequivalent to IV Lasix, which has been used safely and effectively for decades. The two CRLs related to things like a human factors study, device modifications, and pre-approval inspections at manufacturing facilities—all items that were adequately addressed in due time. And with the FDA approval behind us, the risk of rejection is also not present. The $100M debt financing they recently announced gives them cash to commercialize with, so the chances of an equity raise in the near future seem very low (as of June 30, they had $56M in cash and cash equivalents, and the expected net loss for the year was $46M). The main risk here is simply whether the medical community accepts FUROSCIX as a paradigm shift in how high-risk HF patients are treated.

Medical providers, like people in any other profession, can be quite resistant to change. But I think the potential for cost savings—without sacrificing patient well-being in any way—will be too great for providers to ignore long-term. Because of this, I think FUROSCIX will do very well, and so SCPH is a Buy.