Published on November 30th, 2022 by Nikolaos Sismanis

Founded in 2003, Scion Asset Management, LLC is a private investment firm led by investing guru Dr. Michael J. Burry.

Scion Asset Management has become increasingly popular due to Dr. Burry’s ability to identify undervalued investment opportunities around the world. The fund only has four clients. It charges an asset-based management fee that can be as high as 2% per year, while it may also take up to 20% of the value of the appreciation from each client’s account.

The fund has around $291.7 million in assets under management (AUM), $41.3 million of which is allocated to the firm’s public equity portfolio. Scion Asset Management is headquartered in Saratoga, California.

Investors following the company’s 13F filings over the last 3 years (from mid-November 2019 through mid-November 2022) would have generated annualized total returns of 39.5%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 10.2% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Scion Asset Management’s current 13F equity holdings below:

Keep reading this article to learn more about Scion Asset Management.

Table Of Contents

Scion Asset Management’s Fund Manager, Michael Burry

Michael J. Burry is known by most as the “Big Short” investor due to the eponymous movie revolving around himself and his story during the days of the Great Financial Crisis, a role played by Christian Bale. However, Dr. Burry has a much broader track record in the investing world.

After attending medical school, Dr. Burry left to start his own hedge fund in 2000. He had already built a reputation as an investor at the time by exhibiting success in value investing. Specifically, his picks were published on message boards on the stock discussion site Silicon Investor back in 1996, with their returns being outstanding! In fact, Dr. Burry had showcased such great stock-picking skills that he drew the interest of companies such as Vanguard, White Mountains Insurance Group, and renowned investors such as Joel Greenblatt.

Nevertheless, it is Dr. Burry’s legendary plays prior to the Great Financial Crisis and the massive returns that followed that pushed his name into the international spotlight. Particularly, in 2005, Dr. Burry started to concentrate on the subprime market. Based on his analysis of mortgage lending practices utilized in 2003 and 2004, he accurately forecasted that the real estate bubble would come tumbling by 2007.

His analysis resulted in him shorting the market by convincing Goldman Sachs and other investment firms to sell him credit default swaps against subprime deals he saw as weak. Interestingly enough, when Dr. Bury had to pay for the credit default swaps, he experienced an investor revolt, as some investors in his fund feared his prophecy was inaccurate, requesting to withdraw their funds. Ultimately, Burry’s analysis proved right. Not only did he make a personal profit of $100 million, but his remaining investors earned more than $700 million.

To illustrate how successful Dr. Burry’s picks were from Scion Asset Management to the Great Financial Crisis, the hedge fund recorded returns of 489.34% (net of fees and expenses) between its inception in November 2000 to June 2008. In comparison, the S&P 500 returned just under 3%, including dividends, over the same period.

Michael Burry’s Investment Philosophy & Strategy

Michael Burry’s whole investment philosophy can be summed up to the concept of “Value Investing”. He has stated more than once that his investment style is based on Benjamin Graham and David Dodd’s 1934 book Security Analysis. In his words: “All my stock picking is 100% based on the concept of a margin of safety.”

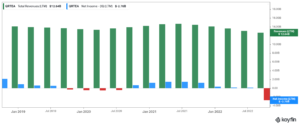

Dr. Burry does not differentiate between small-caps, mid-caps, tech stocks, or non-tech stocks. He only looks for the undervalued elements in them, regardless of their sector and class. Precisely because he doesn’t focus on a specific industry and because the essence of financial metrics shifts by industry and each company’s place in the economic cycle, Dr. Burry utilizes the ratio of enterprise value (EV) to EBITDA when researching investment ideas.

Accordingly, he disregards price-to-earnings ratios to dodge being deceived by a company’s stated metrics which can be misleading based on the underlying state of the economy and macros that may benefit or harm the company at a given point in time. Rather, he pays attention to off-balance sheet metrics and natural, free cash flow.

Scion Asset Management’s Noteworthy Portfolio Changes

During its latest 13F filing, Scion Asset Management executed the following notable portfolio adjustments:

Noteworthy new Stakes:

- Qurate Retail Group Inc Class A (QRTEA)

- CoreCivic Inc. (CXW)

- Aerojet Rocketdyne Holdings, Inc. (AJRD)

- Charter Communications Inc (CHTR)

- Liberty Latin America Ltd Class C (LILAK)

Noteworthy new Sells:

Scion Asset Management’s Portfolio & 10 Largest Public Equity Investments

Scion Asset Management’s public-equity portfolio is heavily concentrated. The portfolio numbers only six equities, with The GEO Group accounting for 37.4% of its holdings. In fact, apart from The GEO Group, which was Scion Asset Management’s only publicly-traded holding in Q2 2022, all other five holdings are entirely new and were added to the portfolio in Q3 2022.

Source: 13F filing, Author

The GEO Group, Inc. (GEO) & CoreCivic, Inc. (CXW)

Private prison giants The GEO Group and CoreCivic collectively account for 54.2% of Scion Asset’s management public equity holdings.

The GEO Group is a specialty REIT that owns, operates, and manages correctional, detention, and reentry facilities in the US, UK, South Africa, and Australia. The portfolio is made up of a total of 102 facilities, including 82,000 beds. More than 90% of the beds are located in the US. The company’s operating income can be divided into three segments: US Secure Services, Electronic Monitoring and Supervision Services, Reentry Services, and International Services. They contribute around 66%, 13%, 11 and 9% of total revenues, respectively.

CoreCivic’s operations are quite similar, with the REIT owning and operating 45 correctional and detention facilities with a total design capacity of approximately 68,000 beds. It also owns and operates 24 residential reentry centers and eight properties for lease to third parties and used by government agencies, totaling 1.8 million square feet.

Both companies are currently facing heavy challenges, including all major banks cutting ties with private prisons and President. Biden’s orders, which directed the attorney general not to renew Justice Department contracts with privately operated criminal detention facilities. That said, both companies have navigated these challenges quite competently, which, combined with their deep-value characteristics, explained why Dr. Burry has heavily betted on them.

Specifically, both companies have suspended their dividends, which has allowed them to deleverage rapidly. As a result, they will soon be able to self-fund their growth and overall operations. Additionally, they have been utilizing loopholes through third parties, which essentially still allow them to deal with federal agencies.

Dr. Burry increased Scion’s position in The GEO Group by 302%, with the fund now owning around 1.64% of the company’s outstanding shares. The position in CoreCivic was just initiated, with the fund now owning around 0.6% of the company’s outstanding shares.

Qurate Retail, Inc. (QRTEA)

Qurate offers a wide range of consumer products, mainly via merchandise-focused televised shopping programs. The company also operates as an online retailer selling apparel for all, amongst other products, such as home, accessories, and beauty products. Despite Qurate generating revenues close to $14 billion per annum, the company is currently valued at just $919 million due to experiencing prolonged challenges when it comes to generating sustainable profits. The company is also heavily indebted, with $6.6 billion in long-term debt overloading the balance sheet.

Nevertheless, Dr. Burry likely sees value in this distressed equity story, resulting in him initiating a position in the stock. Scion Asset Management now owns 1.31% of Qurate Retail’s outstanding shares.

Aerojet Rocketdyne Holdings, Inc. (AJRD)

Aerojet Rocketdyne develops and manufactures aerospace and defense products and systems, which it provides to the Department of Defense, the National Aeronautics and Space Administration, and aerospace and prime defense contractors. Nasa’s Orion Main Engine is also been powered by Aerojet’s technology. With the ongoing war in Ukraine benefiting defense companies these days and funding toward space exploration growing, the company is ideally positioned in the current market landscape. Nevertheless, Aerojet’s net margins remain rather thin.

Aerojet is another one of Scion’s brand-new holdings, accounting for 13.7% of the fund’s public equity holdings.

Charter Communications, Inc. (CHTR)

Charter Communications is a broadband connectivity and cable operator company serving residential and commercial customers across the United States. The company’s subscription-based video services include video on demand, high-definition television, and pay-per-view services. Charter also offers Internet and WiFi services.

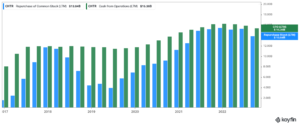

Due to the nature of telecommunication products and services, Charter Communications is a highly profitable business whose revenues are mostly recurring. Unlike most of its peers, Charter does not pay dividends. Instead, the company deploys the majority of its free cash flows to repurchase its own shares. Since 2016, Charter Communications has reduced its share count by 42.7%.

Scion initiated a position in Charter Communications in Q3 2022. The stock now accounts for 8.2% of the fund’s portfolio.

Liberty Latin America Ltd. (LILAK)

Liberty Latin America provides operates TV networks in Latin America through its C&W Caribbean and Networks, C&W Panama, Liberty Puerto Rico, VTR, and Costa Rica segments. The company also owns a sub-sea and terrestrial fiber optic cable network.

Liberty LA appears to be another deep-value case that fits Dr. Burry’s investing criteria. The company generates revenues of nearly $5 billion yet trades at a market cap of nearly $1.7. However, the company has a hard time recording meaningful profits. It’s also heavily indebted, featuring a long-term debt position of $7.6 billion.

Nevertheless, with free cash flow improving lately, Liberty Latin America may be a deep-value opportunity worth checking out.

Liberty Latin is Scion Asset Management’s smallest holding. The stock occupies only 2.7% of the fund’s portfolio.

Final Thoughts

Following the massive triumph he experienced by successfully predicting the crisis of 2007-2008, Dr. Michael Burry has grown into a living legend in the world of finance. His solemn investing philosophy has resulted in outsized market returns over the past few years, beating the S&P 500 by a wide margin.

While Scion Asset Management’s portfolio lacks diversification, its holdings come with characteristics that reflect Dr. Burry’s principles. Nevertheless, most stocks in the fund seem to be bearing their fair share of risks. Thus, be mindful and conduct your own research before allocating your hard-earned money to any of these names.

Additional Resources

See the articles below for analysis on other major investment firms/asset managers/gurus:

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].