Deagreez

This article was published on Dividend Kings on Wednesday, June 7th.

—————————————————————————————

I’ve been asked by some readers and Dividend Kings members what my favorite single-ticker retirement solution is. In other words, if you could buy just one stock and own it for the rest of your life, what would it be?

- SCHD: If I Could Only Own One High-Yield Blue-Chip Forever, This Would Be It.

- VIG: If I Could Only Own One Dividend Blue-Chip Forever, This Would Be It.

The answer depends on what your goals are. If you’re looking for a safe high-yield that grows yearly, Schwab U.S. Dividend Equity ETF™ (SCHD) is the gold standard “risk-free” option.

That’s because it holds 100 of the world’s best high-yield blue chips. They can’t all go to zero, and if they ever did, the world has ended, and we’ll be too dead to care.

For the best dividend growth exchange-traded fund (“ETF”) overall, it’s hard to beat Vanguard Dividend Appreciation Index Fund ETF Shares (VIG), the gold standard of aristocrats and future aristocrats. You basically own a wide moat Ultra SWAN aristocrat portfolio that is even lower risk than SCHD.

That’s because it consists of 314 of the world’s best dividend stocks.

But what if you’re someone looking for maximum total returns? Then there is one even better option, and that’s Schwab U.S. Large-Cap Growth ETF™ (NYSEARCA:SCHG).

Let me show you why – gun to my head if I had to own just one stock forever, with the goal of safely making the largest possible pile of cash (to give to charity naturally) – SCHG would be it.

SCHG: The Gold Standard Of Growth ETFs

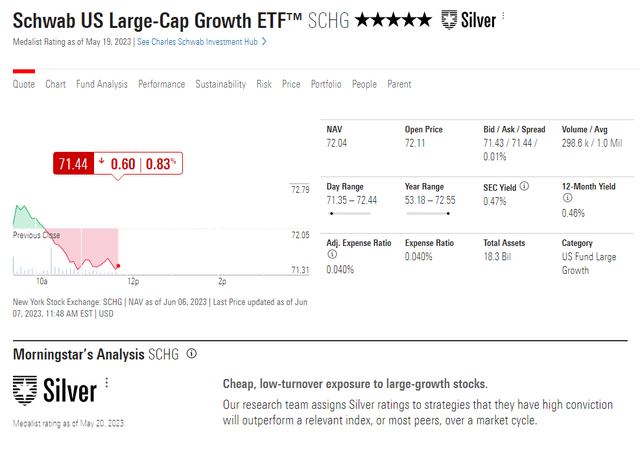

Morningstar

SCHG has a 5-star rating indicating its historical returns are in the top 20% of its peers. Its silver rating indicates that Morningstar is confident that its underlying strategy will keep outperforming its peers over the long term.

Schwab U.S. Large-Cap Growth ETF SCHG constructs a market-cap weighted portfolio of fast-growing U.S. large-cap stocks with a low fee. Despite being top-heavy, the fund broadly represents the large-growth opportunity set and comes with a fee advantage that should translate into sound peer-relative performance…

The fund replicates the Dow Jones US Large-Cap Growth Total Stock Market Index, which selects faster-growing large-cap stocks and weights them by market cap…

The fund’s minuscule fee, a broad representation of the available opportunity set, and low cash drag have provided it with a competitive edge over its peers. The fund outperformed the category average by 2.75 percentage points annualized over the past ten years through April 2023.” – Morningstar.

SCHG’s power lies in two simple facts. First, its expense ratio of 0.04% is practically free and 5X lower than Invesco QQQ Trust ETF (QQQ) and 3X less than Invesco NASDAQ 100 ETF (QQQM), the low-cost QQQ equivalent.

But most important for a growth-focused strategy is the fact that it has the best-diversified growth selection screen I’ve ever seen.

One that’s so simple it’s obvious as soon as you hear it.

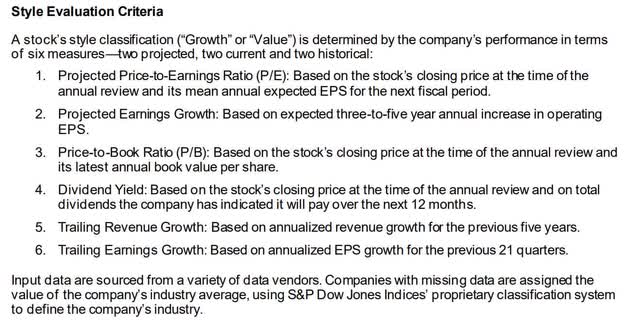

SCHG’s index basically screens for the 50% fastest-growing stocks in the S&P 500 Index (SP500).

S&P

What’s more, it uses S&P’s estimated 3 to 5-year forward growth estimates to determine the rankings of the fastest-growing companies.

Many growth stocks use a 12-month trailing strategy, but that can result in the inclusion of companies that had one great year but whose future growth prospects might suck.

Look no further than Peloton Interactive, Inc. (PTON) and how it had explosive growth in the Pandemic but has been crashing ever since for an example of this.

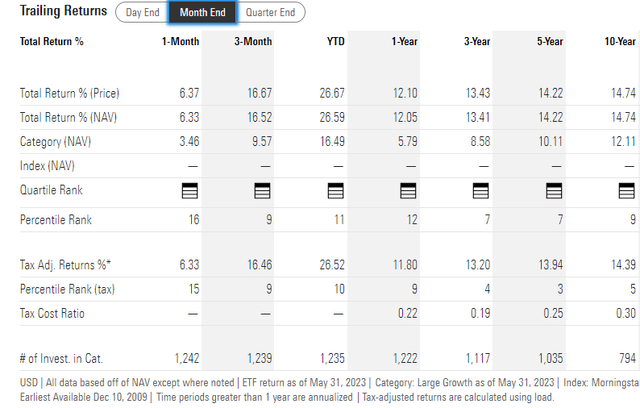

Morningstar

Over the last ten years, SCHG has delivered 14.7% annual returns and 14.4% adjusted for taxes, a very low tax-cost ratio of 0.3%

That puts it in the top 5% of growth funds in terms of tax-adjusted returns. Owning this kind of explosive growth, represented by the world’s best wide moat high growth blue-chips, for almost no cost? Sign me up.

A Diversified World-Beater Portfolio

Naturally, you might be wondering why I like SCHG more than QQQM for the pure growth portion of your portfolio.

The answer is twofold.

First, The NASDAQ 100-Index (NDX) is NOT a growth portfolio, at least not by design.

It’s just the 100 biggest companies trading on the Nasdaq stock exchange.

SCHG actively screens for maximum future growth as estimated by S&P.

That’s why over the next three years, SCHG is expected to grow significantly faster than QQQM.

- FactSet SCHG growth consensus: 16.8% CAGR

- QQQM growth consensus: 14.7% CAGR

- S&P 500 consensus: 8.4%.

Sure, the Nasdaq is expected to deliver amazing growth through 2025 but SCHG’s superior screening strategy is even better, literally double the growth consensus of the S&P 500.

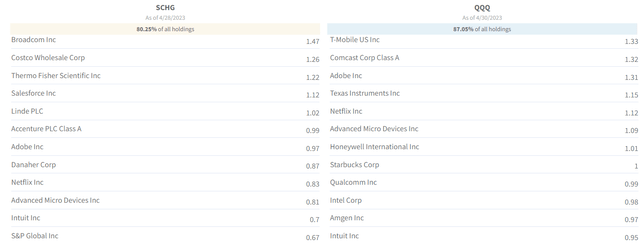

And this brings me to the other reason SCHG is superior to QQQM, the companies it owns.

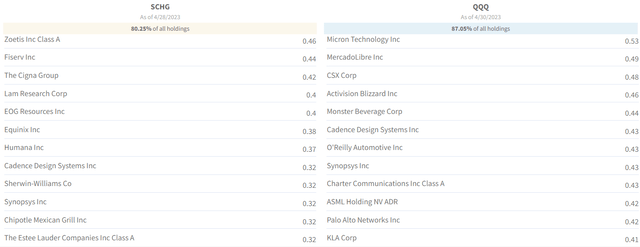

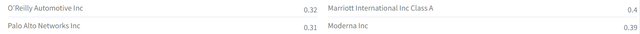

fundvisualizer fundvisualizer fundvisualizer fundvisualizer fundvisualizer

Do you know why the Nasdaq 100 doesn’t own UnitedHealth (UNH), Mastercard (MA), or Lowe’s (LOW)? Because they trade on the NYSE. It’s like excluding companies headquartered in CA because you only want to own companies with East Coast headquarters.

It’s nonsensical, but that’s how the Nasdaq 100 is built.

fundvisualizer

Both SCHG and QQQM are highly concentrated in tech, communications (GOOG, META, NFLX), and consumer cyclical (AMZN, TSLA).

SCHG is 68% big tech, and QQQM is 80% big tech.

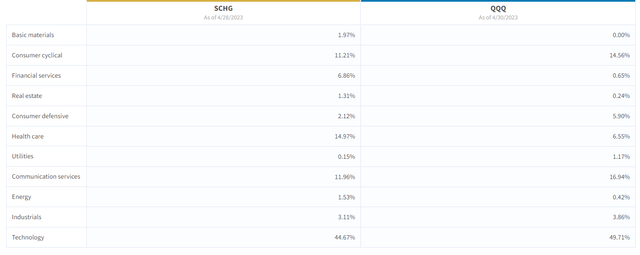

SCHG: Impeccable Fundamentals

Morningstar

SCHG’s moatiness is off the scales; the only wide moat ETF is VanEck Morningstar Wide Moat ETF (MOAT), literally made up entirely of wide moat companies (per Morningstar’s ratings).

The balance sheets are a fortress. What to know why this is an A- rated portfolio for financial strength?

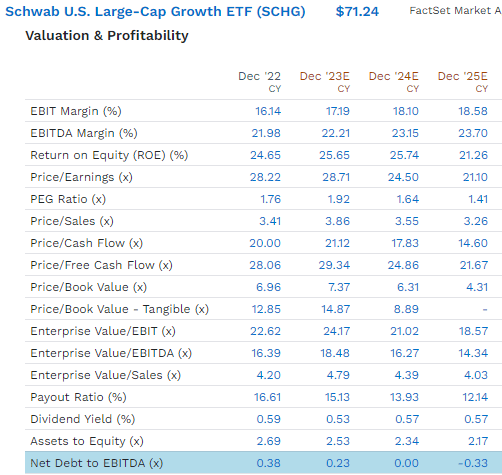

FactSet Research Terminal

In 2024, these companies are expected to have zero net debt, and in 2025 they are expected to have more cash than debt.

That’s not just strong; that’s effectively bankruptcy and recession-proof.

Nothing short of a nuclear bomb could kill these companies, and that’s a 2.5% risk, according to Goldman Sachs.

Morningstar

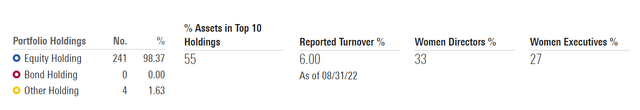

Super low turnover. If you like core ETFs where you know what you’ll own in any given year, this is one of the best you can find. That’s why the tax cost ratio is very low, 0.3%.

Historical Returns Since 2010

Portfolio Visualizer Premium

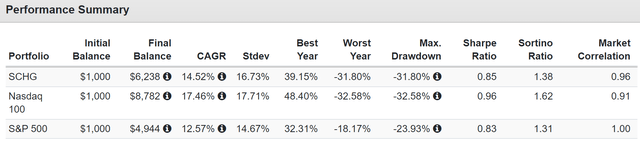

The Nasdaq has been unbeatable over the last 13 years because of luck, not design.

Its more concentrated portfolio of pure Nasdaq-listed companies, excluding growth powerhouses like MA, LOW, and UNH, didn’t hurt it.

But as I just showed you, SCHG’s actual growth screening strategy is expected to deliver 2% superior returns in the coming three years.

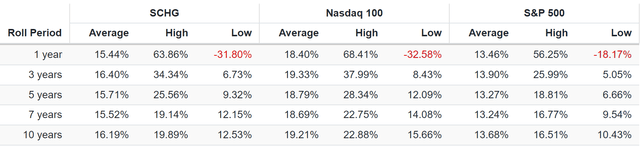

Long-term analysts expect SCHG to deliver 14.7% long-term returns, very similar to the last 13 years.

Portfolio Visualizer Premium

You can see the power of screening for the top 50% of fastest-growing companies in the S&P 500.

2% faster growth even in a raging bull market.

Risk Profile: Why SCHG Isn’t Right For Everyone

No ETF is perfect (or any individual company).

You need to know some key downsides to SCHG before buying it.

SCHG Annual Growth Rates

FactSet Research Terminal

SCHG isn’t a good ETF if your focus is yield (0.5%) or dividend growth yearly.

If you need dividend dependability, then VIG and SCHD are much better options.

In fact, I recommend owning SCHG in combination with VIG and SCHD to smooth out the annual dividends.

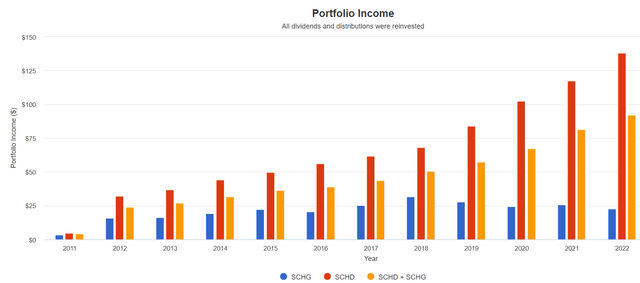

Portfolio Visualizer Premium

There’s the power of high-yield + fast growth: better and smoother income than SCHG alone and better returns than SCHD alone.

- SCHG + SCHD: 14.4% annual dividend growth

- SCHG: 3.7% annual dividend growth

- SCHD: 15.7% annual dividend growth.

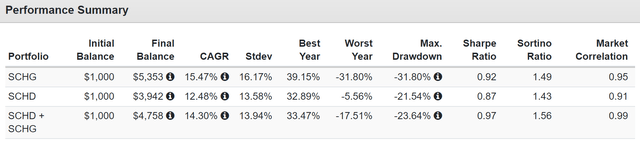

Total Returns Since 2011

Portfolio Visualizer Premium

Note how compared to SCHD on its own, you get better returns, slightly smaller declines, and lower volatility.

That’s why you get the best negative-volatility adjusted returns (Sortino ratio) when combining value and growth.

Finally, we can’t forget that SCHG is basically a diversified tech ETF. That means when tech is out of favor, such as in 2022, it’s going to be tough sledding.

And, of course, we can’t forget about valuation.

SCHG Historical Valuations

| Year | PE |

| 2010 | 17.87 |

| 2011 | 15.71 |

| 2012 | 15.63 |

| 2013 | 19.45 |

| 2014 | 21.17 |

| 2015 | 18.54 |

| 2016 | 22.29 |

| 2017 | 25.74 |

| 2018 | 21.76 |

| 2019 | 26.23 |

| 2020 | 42.24 |

| 2021 | 32.86 |

| 2022 | 28.22 |

| 2023 | 28.71 |

| 2024 | 24.50 |

| 2025 | 21.10 |

| 13-Year Average | 24.03 |

| 13-Year Median | 24.06 |

| 10-Year Average | 26.11 |

| 10-Year Median | 25.74 |

| 5-Year Average | 30.00 |

| 5-Year Median | 28.465 |

| 12-Month Forward | 26.36 |

| Historically Overvalued | 9.56% |

(Source: FactSet Research Terminal.)

SCHG historically trades at 24X earnings, and today trades at 26.4. That’s a 10% historical premium.

That isn’t bubble levels of overvaluation, but remember, we’re heading into a recession, and stocks are expected to fall 22% to 30% in the coming months.

SCHG is historically 23% more volatile than the S&P, meaning a 27% to 37% decline for SCHG might be coming.

Bottom Line: SCHG Is The Gold Standard Of Secure High-Growth ETFs

If you want to own a true “set it and forget it” single ticker portfolio, gold standard ETFs are the only safe way to do it.

That’s because you’re never investing in a single company, which can fail, but in a strategy.

The S&P 500 is just the 500 biggest U.S. companies – long-term fundamental risk-free.

SCHD is the 100 best high-yield blue-chip. – long-term fundamental risk-free

VIG is the 314 best aristocrats and future aristocrats – long-term fundamental risk-free.

And if your goal is pure risk-free growth? Then the fastest growing half of the S&P is the best long-term fundamental risk-free way to get that.

- fundamental risk of losing money over time is zero

- as long as you don’t become a panic seller for emotional or financial reasons.

ETFs are perfect for anyone who just doesn’t like stock picking. You’re investing in a strategy, not a stock.

A high-yield blue-chip might falter, but SCHD never will.

A hyper-growth stock might implode, but SCHG will always own the fastest-growing half of the S&P.

A dividend aristocrat might pull a General Electric (GE) and cut its dividend, but VIG will naturally screen that out within a year.

ETFs are the ultimate single ticker retirement solution because it’s the only safe way to gain exposure to your preferred investing strategy in a diversified manner.

At the moment, the AI tech bubble has sent SCHG to a 10% historical premium.

Given the high risk of a recession later this year, and thus negative earnings growth and a 23% to 30% market correction, a high volatility portfolio of overpriced growth stocks is not a prudent buy right now.

But when the downturn comes? SCHG is well worth having on your watchlist (as it is for my family’s fund) to buy with both hands.

Which is why, if someone wants to know my top recommendation for anyone who doesn’t want to pick stocks but wants just one ticker to own forever to maximize returns? SCHG is the ultimate solution for such a goal.