mysticenergy/iStock via Getty Images

Saturn Oil & Gas Inc. (OTCQX:OILSF, TSXV:SOIL:CA, [[SOIL.R:CA]]) is a growing Canadian energy company with an attractive portfolio of low-decline assets in the Saskatchewan region of Canada. These assets offer a vast array of long-term, economically viable drilling prospects across various zones (more than 15 years of drilling inventory). In this first look at the company, I am aiming to uncover their potential, as well as discuss their current operations and future outlook.

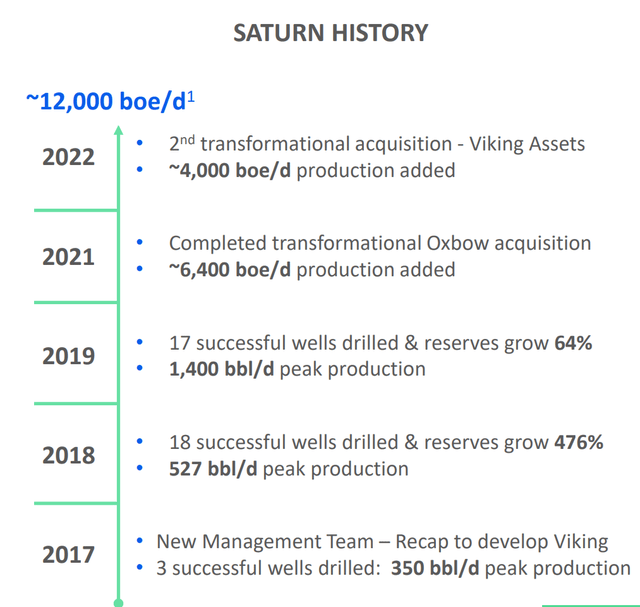

Growing through acquisitions

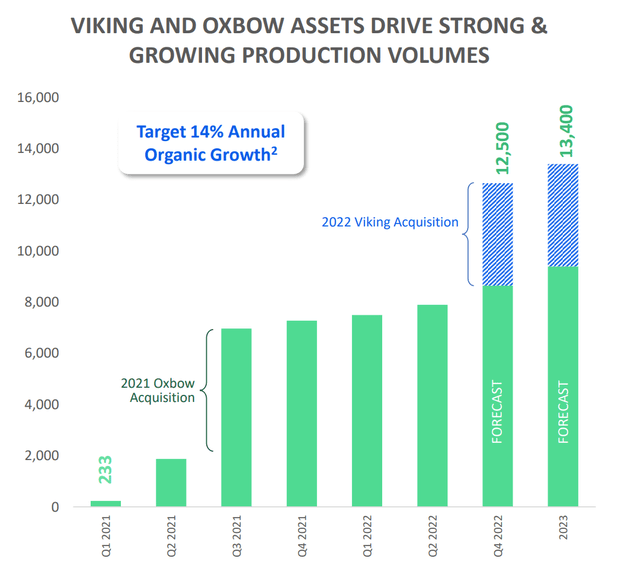

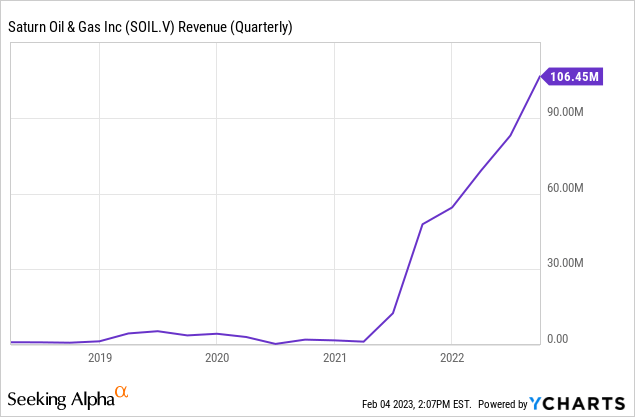

Currently, the company is generating daily 12.5K barrels of oil equivalent daily (boe/d). Most of this growth came from the two acquisitions the company made in the last few years.

- Viking Acquisition closed in July 2022 at a price of C$240M with a combined proved and probable (P+P) reserves of 13.5Mmboe. This was highly accretive on Cash flow per share basis for the next quarter. New hedges entered at that time secured attractive forward oil prices at 17-21% above the current market

With their next asset acquisition Oxbow completed in 2021, they added 6400 boe/d of production. From this acquisition they are able to realize multiple low-risk drilling opportunities and obtained a large land position of 290,000 acres. They also inherited 2500 km of pipeline network which would provide them the flexibility to maintain production growth and generate free cash flow

With WTI oil prices at 95USD, the acquisition of Viking is projected to yield a 200% return on investment, while Oxbow is expected to deliver a 325% return on investment. Both investments are expected to provide a payout within 8 months.

Company’s Investor Presentation

Their most recent acquisition Ridgeback resources was announced at the end of January 2023 for $525M. The price paid for this acquisition sheds much light on the company’s strategy of acquiring value assets on the cheap. Apollo and Blackstone had formed Ridgeback in 2016 to buy bankrupt Canadian oil producer Lightstream Resources for C$1.35B (The two firms were among the largest bondholders of Lightstream). Fast forward to this year, Saturn reached an agreement for half of the original value, covering most of Ridgeback’s assets (Ridgeback had previously sold its 2,500 boe/d to another buyer).

Through this acquisition, Saturn expects to add 17,000 boe/d of production with a P+P reserves of 99.4 Mmboe. The new Ridgeback assets are adjacent to the company’s existing assets in the Oxbow area providing some synergies to their combined production. Through this transformative acquisition, the company expects to exit the first quarter of 2023 at approximately 30,000 boe/d (double of their current production)

Future growth

While most of their previous growth was fueled by acquisitions, Saturn plans to achieve their next wave of growth organically. As of December 2022, their plan was to dedicate 50% of their cashflow to production growth projects. With multiple acquisitions under their belt, it only makes sense for them to exploit the assets they have to the full extent. Their guidance from December 2022 points to at least 14% annual organic production growth and it remains to be seen how well the company expects to grow their latest acquisition from this year.

December 2022 Investor Presentation

How will they handle their debt?

As an energy operator in their early stages of expansion, the company took on a lot of debt to fund its purchases. While these purchases helped them increase their throughput and subsequently their revenues, we have to also see how much of an effect it had on their balance sheet and how they are planning to address it. The CEO has also said that since they have well crossed the 20000 boe/d threshold, their next focus is to grow the business, repay the debt and return cash to shareholders.

As of the latest quarter financials that are available, their net debt stands at $250M. Management’s commitment was to reduce their debt and achieve zero net debt by Q3 2024. Their plan to achieve this was by committing 50% of their cash flows to paying down their debt.

The latest acquisition changes this and puts their Year-end debt at $345M (more than twice their current market cap). Their new commitment is to paydown all of their debt and be 100% debt free in less than 3 years (The new acquisition comes with more cashflow which would again be redirected towards debt repayment). Their confidence to pay down the debt comes from the fact that they have hedging in place for the next four years for $1.3B of gross revenue which guarantees a net revenue of $850M (Average hedging price of approximately $88). In effect, this underscores the company’s strategy of acquiring high value assets with a high return on investment that essentially pays for itself in a short period of time.

Valuation

Saturn is still in its early stages of growth and most indicators are not reliable to accurately value an early stage oil and gas company. When you consider the assets it has acquired compared to the debt and equity financing it raised, its book value is less than 1, which suggests that it is quite undervalued. Additionally, in a recent statement post its acquisition of Ridgeback, the company’s CEO John Jeffrey said that the company is valued at only about one year’s free cash flow. This is a further indicator that the market is severely undervaluing the stock.

High risk high reward play

If you’re thinking of investing in a micro-cap commodity company, here’s a friendly warning: it’s not for the faint of heart. The cyclical nature of the industry can wipe out all your gains even when positioned for the long term. The facts below paint a pretty bleak picture.

More than 100 oil and gas companies declared bankruptcy in 2020

Covid-19 had a disastrous effect on demand while supply could not be turned down that fast. This in turn hurt all of the big cap companies and destroyed multiple smaller cap companies.

150 bankruptcies during the oil bust of 2015-2016

OPEC influences oil prices through regulating the supply of oil. There is some belief that the decline in oil prices from 2015 to 2016 was deliberate on the part of OPEC, as they flooded the market with oil in an effort to harm the U.S. shale oil industry. It is possible that OPEC may use similar tactics in the future.

The great recession had rolling effects on the industry much after 2010

Recessions have historically been bad for the oil industry as they kill the necessary demand which affects the oil prices. This time will probably be no different.

From my own personal experience of exposure to mid-cap oil companies, I had completely lost my investment during the oil bust of 2015-2016. I tried to apply the main lessons I learnt during that time to this investment –

- Look at its debt positioning, its long-term positioning and its valuation

- Its biggest area of concern is debt but the company’s hedging puts it at a high level of confidence to get rid of its debt and avoid a worse case scenario (bankruptcy)

- Its long-term positioning of reinvesting its cashflow to grow the business and returning money to shareholders aligns well with what I am expecting from a business

- Its discounted valuation is probably a result of the recent decline in oil prices and its relatively small size, which may have caused it to be overlooked.

I will be initiating a very small position into Saturn and expect to hold it over the next couple years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.