Matt Winkelmeyer/Getty Images Entertainment

The day after the release of its Q3 2023 results, the market reacted by pummeling Salesforce, Inc. (NYSE:CRM) shares by about 8 percent. This was an entirely unexpected result given that both reported revenues and EPS exceeded analysts’ expectations. In this article I will discuss the reasons for this collapse and the main themes that characterized CRM’s quarterly report.

Bret Taylor will leave Salesforce at the end of the fiscal year

Bret Taylor will no longer be co-CEO of Salesforce as of January 31, and this was probably the worst news of the entire quarterly report. CEO Marc Benioff’s words during the earnings call were of absolute sadness, and he repeatedly implied that Salesforce has lost a key figure:

And I’ll tell you, for me, this has been a feeling of tremendous loss. I’m experiencing that right now. You can probably hear it in my voice. It makes me think of all the great people that we have actually lost in the company over the time as well, so many great leaders of our industry, but especially now with Bret. This is just really hard for me, and I’m extremely sad to see him go. I know he has created two great companies. I know he wants to go create a third great company. And you can’t keep a wild tiger in a cage.

The reason behind the decision made by Bret Taylor seems to be purely motivational in nature, as it appears that he is no longer enthusiastic about the idea of running a company as important as Salesforce.

I really do feel that now is the right time for me to return to my entrepreneurial roots, particularly given the technology landscape and the economy going through such tectonic shifts. Salesforce has never been stronger, and I’ve never been more confident in the future of the company.

So, apparently, there were no problems with either the company or Marc Benioff; it was simply a personal choice. There is, however, an additional aspect to consider.

Bret Taylor joined the company in 2016, which is when Salesforce bought his company Quip. Since then, he has climbed the ranks very quickly until he became co-CEO in November 2021. After not even a year, he decided to leave the company, and the same dynamic happened to previous Co-CEO Keith Block. Basically, in just 3 years, 2 Co-CEOs decided to leave their positions.

But why does Marc Benioff continue to favor a Co-CEO? The reason, as he stated, relates to the fact that with a Co-CEO he has more time for his other interests. Having a Co-CEO allows him more time for philanthropy, investing in new companies, and cultivating his passions. Marc Benioff, in addition to being CEO and co-creator of Salesforce, is a person full of interests and influential globally; therefore, my impression is that he is looking for his perfect replacement to lead Salesforce and reduce his commitments. The problem is that, to date, co-CEOs keep stepping down and the market is concerned about who will lead this company in the future. I don’t doubt that Marc Benioff can continue to do an excellent job, but I would be surprised if he remains at the helm of Salesforce for another 5-6 years.

Overall, there are objective concerns related to management, but in my opinion we should not overshoot with negativity. The company is improving rapidly year after year and has never been stronger than it is today. Salesforce continues to be by far the best customer relationship management (CRM) firm in the world, and market share continues to increase, as does revenue. Although the last 3 years have been turbulent for co-CEOs, the data are on Marc Benioff’s side.

Salesforce Revenue growth slowing down

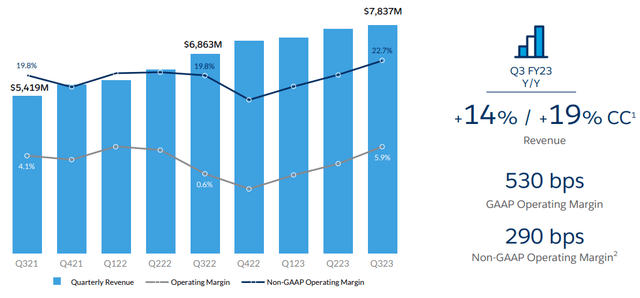

Another issue that has probably raised some concerns is related to lower revenue growth than previous years. Compared to Q3 2022, revenues increased by 14%, whereas they used to grow at a rate of 20-25%. In my view, I do not see how this is a problem for two reasons:

- If we had not considered the negative effect of the exchange rate, the growth would have been 19%, so very close to the growth rate in the past.

- Macroeconomic conditions have totally changed since last year, so it is natural that the company is growing less. In any case, growing in these market conditions by 19% Y/Y CC for a company that generates $30 billion in revenues does not seem to me a negative result at all.

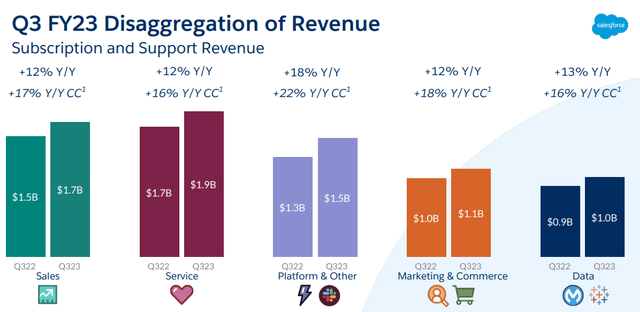

Salesforce Q3 2023

Revenues in every Salesforce segment experienced double-digit growth even with an extremely unfavorable exchange rate. In addition, improvement occurred in all geographic areas.

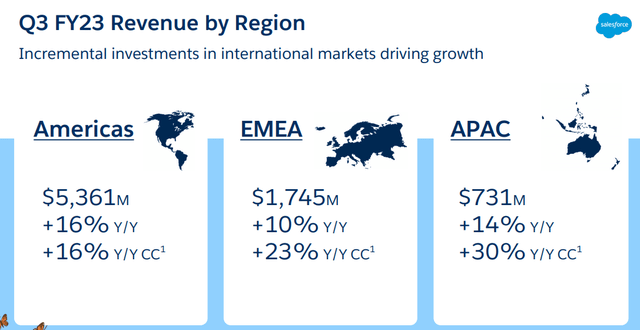

Salesforce Q3 2023

Not considering the unfavorable exchange rate, the EMEA and APAC regions achieved growth of 23% and 30%, respectively. More and more foreign companies are using Salesforce. However, the strong growth was also in the Americas, with an excellent 16%.

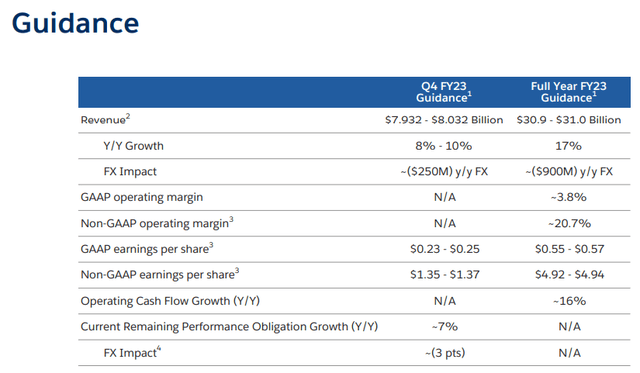

Finally, the guidance remains unchanged and overall positive considering all the difficulties this 2022 has reserved.

Salesforce Q3 2023

Focus on profitability

As previously anticipated, Salesforce is now a more than established company given that it generates annual revenues of $30 billion and is the absolute leader in its field. After just over 20 years since its inception, the needs of shareholders are beginning to change, and this seems to be the time when the company will start focusing more on margins than growth. This does not mean that it will stop growing, but that it is important to curb spending and investment to improve margins that are currently too low. Marc Benioff has been clear about this:

We are in a moment here where one of our goals, strong goals, as you can see by these results is to increase our operating margin. And we’re not going to do anything that’s going to prevent that increased momentum. And as a shareholder myself, that’s my thought every single day.

Salesforce Q3 2023

The data suggest that this process of improving the operating margin has already been put in place, and I expect that in the next 3-4 years it can be consolidated.

However, the improvement in operating margin is not the only aspect that is transforming this company; in fact, the perception regarding shareholder dilution has also changed:

We also realize we want to reduce dilution. That’s also why we’re doing our stock buyback. And we’ve talked about that extensively. It’s been extremely important, I think, that we bought back a considerable amount of stock during the quarter, that we, I think, set a goal that we’re going to buy back about $10 billion.

In Q3 2023, 11 million shares have already been repurchased with a value of $1.70 billion. Personally, I think the decision to make such an aggressive buyback at this stage is more than reasonable: Salesforce’s per-share price has more than halved from its all-time high and is currently undervalued in my opinion.

Overall, it is clear that Salesforce is maturing as a company and is headed for a different phase of the business cycle than we are used to. This quarterly report has set the stage toward a new Salesforce focused on rewarding its shareholders and having consistent and, most importantly, the highest possible profit margins. It is a process that will take years to complete, but it is inevitable when a company reaches this kind of magnitude. Growth should continue to be there, of course, but it is obvious that the larger the company gets, the more difficult 20% growth per year becomes. Some doubts about management remain, but in my opinion, until Salesforce completes this transformation process, Marc Benioff will still be an important pillar for this company.