mixetto

Saga Communications (NASDAQ:SGA) is a company I’m following closely. The original thesis was posted in February 2021 and worked well since the market offered various opportunities to exit with a good return.

At the time, in the middle of the Covid crisis, with companies initially cutting marketing budget to minimise expenses, SGA was trading at $20-$22 per share or at 5-6x normalised FCF by taking into consideration the $38m net cash position. Based on operational consistency, cash flow generation and clean balance sheet, the initial thesis was making the case that SGA was worth $38 per share.

Two challenging years later, the operational story remains broadly the same. After losing 22% of sales in FY20, top line grew by 13% and 6% in FY21 and FY22 respectively. FY22 sales were almost at 94% of the pre-COVID level. GP% also dropped to 14.8% in FY20 and slowly recovered to 23.8% in FY22 (v 24.7% in FY19). SGA reported $15m and $17m (excluding payments related to CEO’s death) in operating profits in FY21 and FY22 respectively, which were translated into $15m and $14m (excluding payment impact) in FCF. Over the last two years, management distributed $22m in dividends, paid down the $10m of debt with the cash balance remaining at $37m (March 2023). Not bad for a radio business right?

… We’ve grown, as you will see in a moment, substantially over the last several years and are continuing to grow. In 2022, our total interactive revenue was $7.9 million around numbers. That represents a 25% lift over 2021 and a 209%, and over 200% lift over 219% and make it a little helpful — more helpful to break out some of these categories of digital revenue.

Our streaming revenue was at a little over $3 million for the period, up 56% over 2021 and up 700% over 2019. Content sponsor was basically flat over ’21. It was at $2.69 million, up 41% over 2019. And targeted display represented $1.9-plus million, was up 27% over 2021 and again, 70% over 2019. So that gives you a sense, about the health and growth of the digital space from a year-over-year standpoint and a quarter-over-quarter standpoint. – FY22 Earnings Call

Management expects OpEx to increase 3.5-4.5% in FY23 as compared to FY22. This includes additional sales commissions, music license fees based on revenue growth and inflationary pressure. Tax is expected at 28-30% with a deferred tax rate of 3.6% going forward. Based on the last 10-year history, business required a capex of $4-$5m per year. All things considered, I remain confident about the company’s ability to generate $14-$15m in normalised FCF going forward.

When other broadcasters and other companies like even including SiriusXM, I read recently, are all swimming in debt and offloading valuable employees. Saga is reinvesting in our people and our enterprise – FY22 Earnings Call

Radio Resiliency

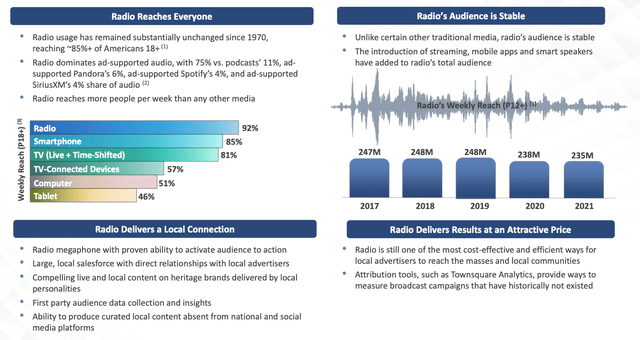

What I was surprised to learn over the last two years is how stable the radio business is. Radio usage has remained unchanged since 1970 reaching 85-90% of Americans over 18 years old and was 5% of all adverting dollars spent in 2021 in the US! Apparently the introduction of streaming, mobile apps and smart speakers have helped the radio industry and kept the audience remarkably stable. Doesn’t sound like radio is dead to me. More like a mature, stable and cash flow generative business.

Townsquare (TSQ) Investor Presentation

New Dividend Policy

In January 2023, SGA board adopted a new variable dividend policy with the goal to increase shareholder returns. Under the new policy, in addition to any quarterly and special dividend, the company will declare an additional dividend in the 2Q of each year of 70% of the proceeding year’s annual FCF, net of acquisitions closed, special and quarterly dividends declared, debt pay downs and share buybacks. Quarterly dividends also increased from $0.20 per share to $0.25.

We are very pleased that our strong capital position and operating performance allowed us to declare another regular quarterly cash dividend and a special cash dividend. We are excited to continue our commitment to provide a meaningful cash return to our shareholders through the declarations of these dividends. In addition, we have made tremendous progress during what has been a period of transition for our Board of Directors and executive management team. Our sustained financial strength has put us in a position to meet operational goals and to support efforts to return value to our shareholders – Christopher Forge, President and CEO in December 2022

Recent Developments & Buyout Potential

In December 2022, SGA announced the passing of the founder, Chairman and CEO Ed Christian. Christian founded the company in 1986 and has fostered its growth to owning 79 FM radio stations, 35 AM radio station and 80 translator stations in 27 markets. Christian was a well-respected figure in the broadcast industry, with passion and vision about the industry.

As a result of Ed Christian’s passing, the company was required to make several payments to his estate as outlined in his employment agreement. These expenses were accrued in 3Q22, increasing the reported G&A costs by $3.8m.

In December 2022, the BoD announced a quarterly cash dividend of $0.25 per share and a special cash dividend of $2.00 per share, as a result of the new dividend policy described above.

In the meantime, as a result of all these changes and announcements, the board received and rejected a confidential, unsolicited, and non-binding offer under two separate transaction structures.

- A cash buyout offer in the range of $30-$33 per share for all outstanding shares

- A merger with shareholders receiving $12.47 per share in cash and 83.1% ownership in the combined group, assuming the offeror’s existing debt.

Apparently, the offeror did not provide sufficient evidence of its ability to obtain the required financing under either structure hence the offer was rejected by the board. However, the board announced that it will continue to formally review and evaluate all opportunities to enhance shareholder value. In essence, the offer was rejected because it was insufficient not because the Company is not for sale.

Ed Christian was the heart and soul of the Company. I prompt you to read the earnings call transcripts and you will probably feel the same. I have no doubt that he built a strong team able to continue his legacy but selling is definitely on the table.

Investment Thesis

All things considered, the investment thesis is again based on the company’s ability to generate a $14-$15m FCF per year which could imply a value north of $35 per share, offering 60% upside potential. However the thesis has been sweetened by a $1.00 per share dividend or c. $6m per year plus 70% of the remaining FCF or an extra $6-$7m per year (excluding SBB, M&A or special dividends) for a total dividend of $2 per share. So an investor is getting a 10% return waiting for the market or an acquirer to close the valuation gap. This opportunity comes with no debt and a very consistent operating history. Happy to take that…