Lorena Ledesma/iStock via Getty Images

Investment Thesis

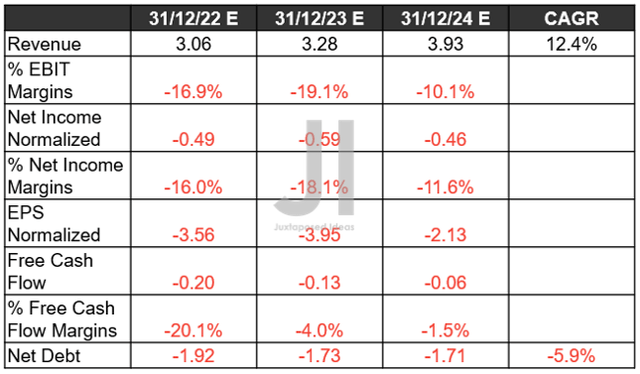

ROKU Projected Revenue, Net Income (in billion $)%, EBIT %, and EPS, FCF %, and Net Debt

S&P Capital IQ

It is evident that the management’s bearish commentary has had market analysts catastrophically slashing Roku’s (NASDAQ:ROKU) FY2024 top and bottom line growth by -31.05% and -1,533%, respectively, since our previous analysis in July 2022. That is overly drastic, since market-wide sentiments have substantially improved since the blood-bath recessionary fear levels in June and October 2022, with the S&P 500 Index also recording an impressive 13.96% recovery thus far.

However, we are confident that things will turn around sooner or later, due to the robust performance metrics thus far. ROKU reported an excellent YoY growth of 15.95% and 9M in active accounts by FQ3’22, with total streaming hours also expanding by 21.66% and 3.9B hours YoY at the same time. Most notably, the company’s Average Revenue Per User (ARPU) increased by 10.34% and $4.15 YoY in the latest quarter, despite the rising inflationary pressures.

Nonetheless, we admit that ROKU’s profitability remains a dream over the next few years, potentially triggering more sideways action for its stock performance before the Feds truly pivot and macroeconomics improves. Only time will tell.

ROKU Boasts A Highly Strategic & Prudent Balance Sheet

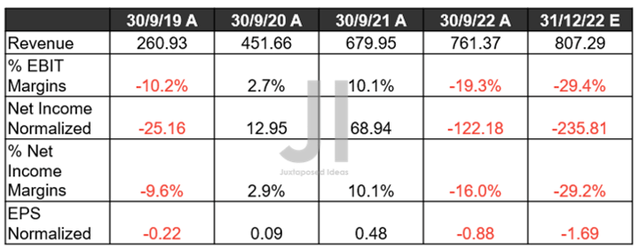

ROKU Revenue, Net Income (in million $) %, EBIT %, and EPS

S&P Capital IQ

In its recent FQ3’22 earnings call, ROKU reported excellent YoY revenue growth of 11.97% to $761.37M. However, the company continues to report a lack of profitability due to many factors. The rising inflation has impacted its gross margins by a noticeable -6.6 percentage points YoY, further worsened by its growing operating costs by 8.18% QoQ and 70.73% YoY. Thereby, naturally impacting its margins, with its EPS declining tremendously by -7.31% QoQ and -283.3% YoY.

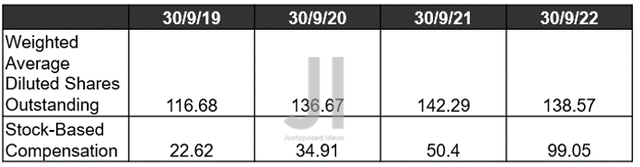

ROKU Share-Based Compensation (in million $) and Share Dilution

S&P Capital IQ

Over the last twelve months (LTM) alone, ROKU also reported elevated Stock-Based Compensation (SBC) expenses of $309.7M, indicating a massive increase of 79.82% sequentially. Thereby, contributing to the company’s lack of profitability. However, we must also highlight that there has been minimal share dilution of 16.30% by FQ3’22, since its IPO in September 2017. Thereby, indicating the management’s controlled SBC expenses thus far.

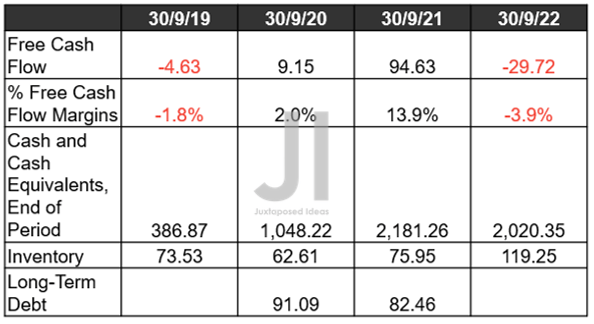

ROKU Cash/ Equivalents, FCF (in million $) %, Inventory, and Debt

S&P Capital IQ

ROKU’s lack of Free Cash Flow (FCF) generation is also attributed to its growing capital expenditure of $108.34M over the LTM, increasing by an aggressive 315.03% sequentially. However, its balance sheet remains robust, with cash and equivalents of $2.02B, accounts receivable of $758.93M, and inventory of $119.25M, preserving the company’s immediate liquidity in the face of uncertain economic conditions.

Furthermore, ROKU boasts zero long-term debts, which is impressive given its lack of sustained profitability and elevated Capex. The management’s strategic choice in outsourcing their manufacturing to contract manufacturers has proved highly prudent, since it need not spend elevated amounts of capital on physical assets or internal warehousing, as the latter is also contracted to third parties. This has led to its minimal net PPE assets of $807.2M on FQ3’22, against other hardware companies.

In addition, ROKU need not carry elevated levels of inventory as products are normally shipped directly to retailers, wholesale distributors, and consumers. Therefore, we are not overly concerned about its lack of profitability, since it is only a matter of time and a prudent reduction in its operating expenses moving forward.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Roku: The Potential Winner In Streaming Wars – Volatile Battle Ahead

So, Is ROKU Stock A Buy, Sell, or Hold?

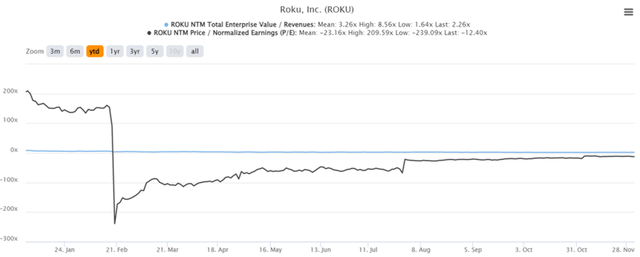

ROKU YTD EV/Revenue and P/E Valuations

S&P Capital IQ

ROKU is currently trading at an EV/NTM Revenue of 2.26x and NTM P/E of -12.40x, massively discounted from its 5Y mean of 9.22x and -324.36x, respectively. Otherwise, still under-valued based on its YTD mean of 3.26x and -23.16x, respectively.

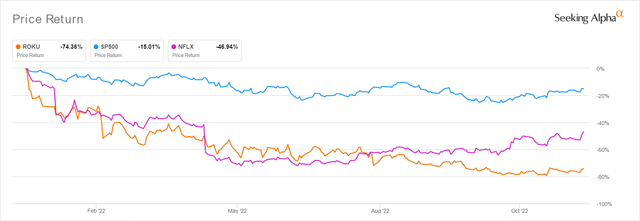

ROKU YTD Stock Price

Seeking Alpha

The ROKU stock is also trading at $59.78, down -77.53% from its 52 weeks high of $266.05, though at a premium of 34.33% from its 52 weeks low of $44.50. Due to the downgraded FQ4’22 guidance, consensus estimates have also slashed their price target to $56.78, indicating minimal upsides from current prices. Naturally, since the company remains unprofitable through FY2025, the sell-off is somewhat expected, since more uncertainties remain on the horizon through the Feds’ interest hikes in 2023. However, we reckon that this pessimism is overly done, given the factors discussed above.

Moving forward, 79.4% of market analysts expect the Feds to pivot as early as December with a 50 basis points hike instead, as observed with the Bank of Canada’s recent moderation in October. Even if Powell did not execute as expected and delivered the fifth consecutive 75 basis points hike due to an elevated November CPI report, the pessimism is already overbaked, even if terminal rates were raised to over 6%. Thereby, indicating an improved risk/reward ratio for those looking to add more.

Consequently, ROKU stock is rated a Buy at the mid $50s for an enhanced margin of safety, though investors with a higher risk tolerance may also consider it at current levels.