gerenme/E+ via Getty Images

Robust results for American industrial automation giant Rockwell Automation (NYSE:ROK) on the back of an improving supply chain environment. Optimistic medium term prospects, thanks to reshoring trends in the U.S., rising electric vehicle adoption, and emerging market opportunities.

Solid Q2 2023: revenues and organic sales up driven by growth across all segments, overall margins up

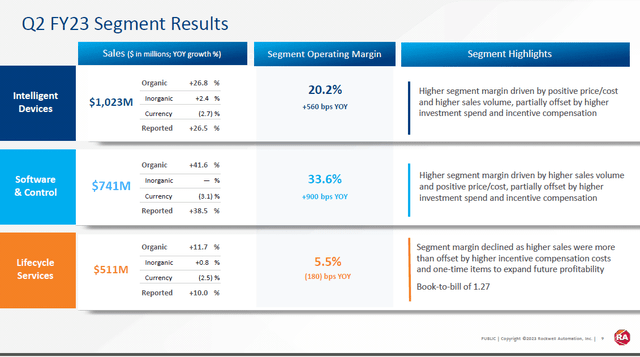

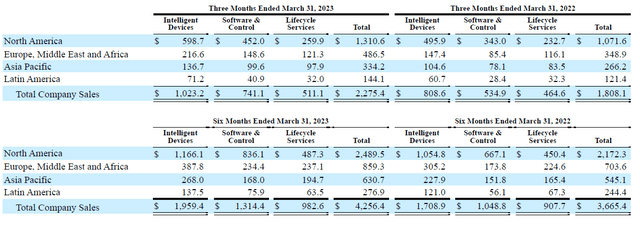

Rockwell Automation reported a solid Q2 2023 (quarter ended March 2023), with reported revenues up 25.8% YoY and organic sales up 27.3% YoY. All segments reported revenue growth.

Intelligent Devices (the company’s biggest segment by revenues), which sells a variety of products to help customers automate their operations including power control, motion control, safety devices, and sensing devices among others saw revenues rise 26% YoY to USD 1 billion.

Software & Control (the company’s second-biggest segment by revenues), which offers a portfolio of software solutions related to production automation and operation, saw revenues jump 38.7% YoY to USD 741 million.

The final and smallest segment, Lifecycle Services, which offers consulting services and value-added solutions such as automation and information programs, field services including on-site support, and workforce services including training and learning services saw revenues rise 10% YoY to USD 511 million.

Segment profits rose 71% YoY to USD 484 million from USD 283.4 million the same quarter a year earlier. Intelligent Devices segment profits rose to USD 206.9 million up 75% YoY, Software & Control segment profits nearly doubled to USD 249 million, and Lifestyle Services segment profits dipped 17% YoY to USD 27.9 million.

Rockwell Automation 10-Q, Q2 2023

Segment margins rose to 21.3% up 560 basis points. Intelligent Devices segment margin rose 560 basis points to 20.2%, Software & Control segment margin was up 900 basis points to 33.6%, while Lifestyle Services segment margin declined 180 basis points to 5.5%. Margin expansion was driven by volume growth reflecting and improving price/cost, offset by incentive compensation costs among others.

Rockwell Automation Q2 2023 investor presentation

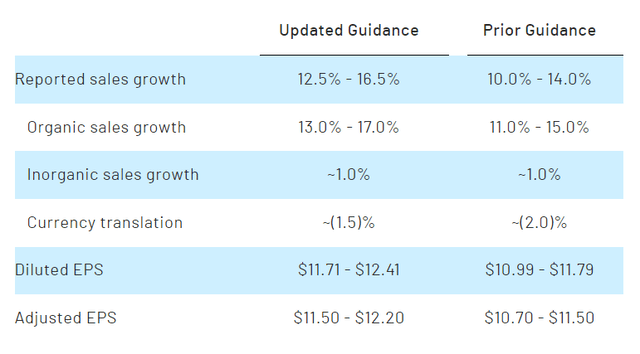

An improving supply chain environment (and therefore better component availability) which enables them to deliver their order backlog could help support near term performance. Management increased their guidance, with full year reported sales growth projected at 12.5% – 16.5% (from 10% – 14% previously), and organic sales growth of 13% – 17% (from 11% – 15% previously). Diluted EPS is expected to be USD 11.71 – USD 12.41 (from USD 10.99 – USD 11.79 previously).

Rockwell Automation

Positioned to profit from reshoring in the U.S.

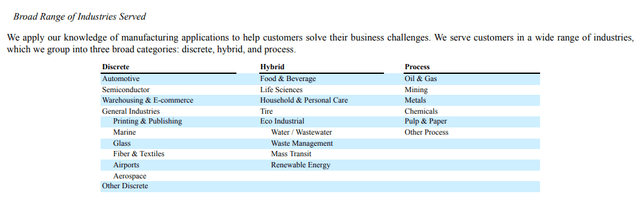

Looking further ahead, America’s CHIPS and Science Act, and the Inflation Reduction Act is spurring significant investments into manufacturing in the U.S., across a variety of sectors including renewables, semiconductors, electric vehicles. Since the bills have passed, U.S. companies have committed over USD 200 billion in new manufacturing projects, with the largest investments in semiconductors and cleantech. Rockwell Automation, whose hardware and software offering helps manufacturers automate and optimize their operations, serves a wide breadth of industries and is well placed to capitalize on the long term opportunity.

Rockwell Automation 10-K, FY 2022

Recent contract wins announced since late last year include a project by First Solar (FSLR) for a USD 1 billion solar panel factory, a contract for Hyundai’s (OTCPK:HYMLF) (OTCPK:HYMTF) USD 5.5 billion battery plant in the U.S., and a contract with Ford (F) for the latter’s new electric vehicle and battery production facilities in the U.S.

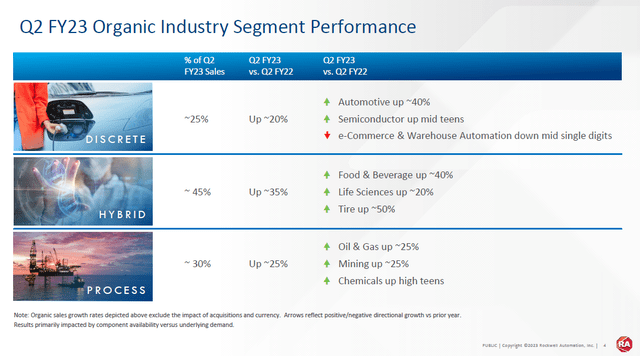

Long term tailwinds from electric vehicles

Automotive has been a meaningful driver of organic sales for Rockwell Automation for FY 2023 so far with automotive sales growing by double digits in both quarters of FY 2023 (~25% in Q1 2023 and ~40% in Q2 2023).

Rockwell Automation Q2 2023 investor presentation

Unlike traditional drivetrain operations which Rockwell Automation doesn’t directly serve, EV production is more suited to assembly line operations, aspects of which could be served by Rockwell Automation’s product and service offering. Electric vehicle adoption is gaining momentum (EV sales are expected to jump 35% this year), and with electric vehicles accounting for just a fraction of the world’s car fleet (estimated at around 2.2%), there is ample runway for growth presenting a meaningful long term tailwind for the company.

Positioned to capitalize on opportunities in emerging markets

Certain emerging economies are seeing robust economic growth and growing investments into manufacturing and digital transformation. Rockwell Automation with its broad worldwide presence is well placed to capitalize on long term opportunities in these markets.

Rockwell Automation 10-Q, Q2 2023

Notable emerging market opportunities include India and Vietnam. India, projected to emerge as the world’s number three economy by 2030, is a significant opportunity; the government is aiming to make India a manufacturing hub, and policy initiatives appear to be generating results with a number of multinationals announcing massive manufacturing investments into the country. Apple (AAPL) is planning a USD 700 million facility in India, Cisco (CSCO) is expanding its manufacturing capabilities, and Tesla (TSLA) is proposing to set up a factory too. South Korean car company Hyundai is investing USD 2.5 billion in manufacturing facilities in India, its biggest manufacturing hub outside South Korea. The opportunity should drive demand for hardware and software to optimize manufacturing efficiency and productivity, a long term opportunity for Rockwell Automation who has a solid presence with 40 years of operations in the country.

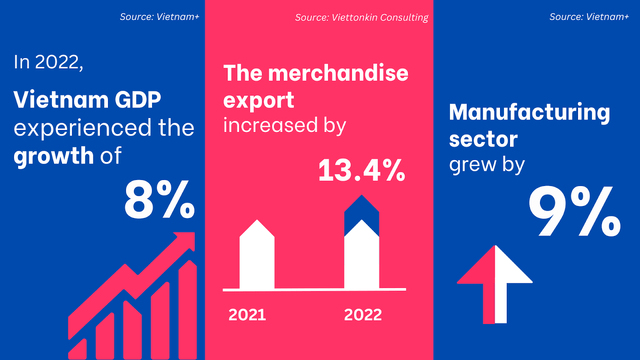

Meanwhile in Vietnam, Rockwell Automation is looking to achieve double digit growth rates and double its market share by 2025, with further ambitions to boost its presence in Southeast Asia to capitalize on opportunities in the industrial automation and process control space. Fueled by a number of structural drivers including surging FDI inflows as a result of growing adoption of a China+1 strategy as well as a robust domestic economy and growing exports, Vietnam’s manufacturing sector is on the rise and prospects are optimistic.

Source of Asia

Risks

The industry is competitive and Rockwell Automation is up against strong competitors jostling for a share of the growing industrial automation and digital transformation market, including Emerson Electric (EMR), Schneider Electric (OTCPK:SBGSF), ABB (OTCPK:ABBNY), and German industrial giant Siemens (OTCPK:SIEGY) among others. Siemens, which reported a solid quarter is a particularly strong competitor; both Siemens and Rockwell Automation have a broad portfolio of industrial automation hardware and software offerings, a wide geographic presence worldwide (including in emerging economies like India where Siemens has operated for over a 100 years) and a strong brand reputation; both Rockwell Automation and Siemens were named as leaders in Gartner’s Magic Quadrant for Manufacturing Execution Systems (MES).

Engineering.com

Siemens is considerably larger than Rockwell Automation (revenues of EUR 71.9 billion or around USD 80 billion for Siemens versus USD 8.3 billion for Rockwell) which brings scale economies and bigger budgets for promotion and R&D etc. Siemens’ R&D expenses are more than ten times bigger than Rockwell’s (around EUR 5.59 billion for Siemens versus USD 440.9 million for Rockwell) and Siemens’ R&D intensity is higher than Rockwell’s as well (about 5.6% of revenues for Rockwell versus 7.7% of revenues for Siemens).

Conclusion

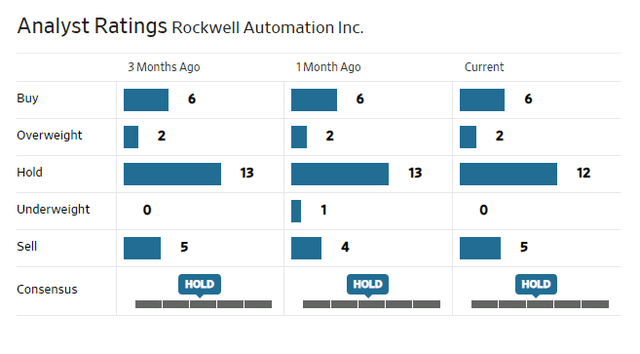

Analysts are mostly neutral on the stock.

WSJ

Rockwell Automation’s P/E of 24.4 is considerably higher than rivals. Any upside is likely priced in and the stock could be viewed as a hold. .

Forward P/E | |

Rockwell Automation | 24.39 |

Siemens | 14 |

Emerson Electric | 19.7 |

ABB | 21 |