Omar Marques | Lightrocket | Getty Pictures

Robinhood shares are heading for a brutal weekly loss because the once-red-hot trades in bitcoin and AI shares that powered its development lose momentum.

The favored brokerage platform slipped greater than 3% Friday, extending a punishing decline. The inventory tumbled 10.1% within the prior session and is now down 16% up to now this week. November alone has erased practically 30% of its market worth.

The newest slide displays a pointy reversal within the risk-hungry funding exercise Robinhood depends on. The corporate’s core enterprise is intently tied to retail buyers pouring into speculative corners of the market, notably cryptocurrency and buzzy synthetic intelligence shares.

These trades helped gas a resurgence in Robinhood income and person engagement earlier this 12 months as bitcoin hit contemporary highs and something tied to synthetic intelligence soared. However the current rout in crypto and high-growth tech inventory leaders is exposing Robinhood’s sensitivity to sentiment swings.

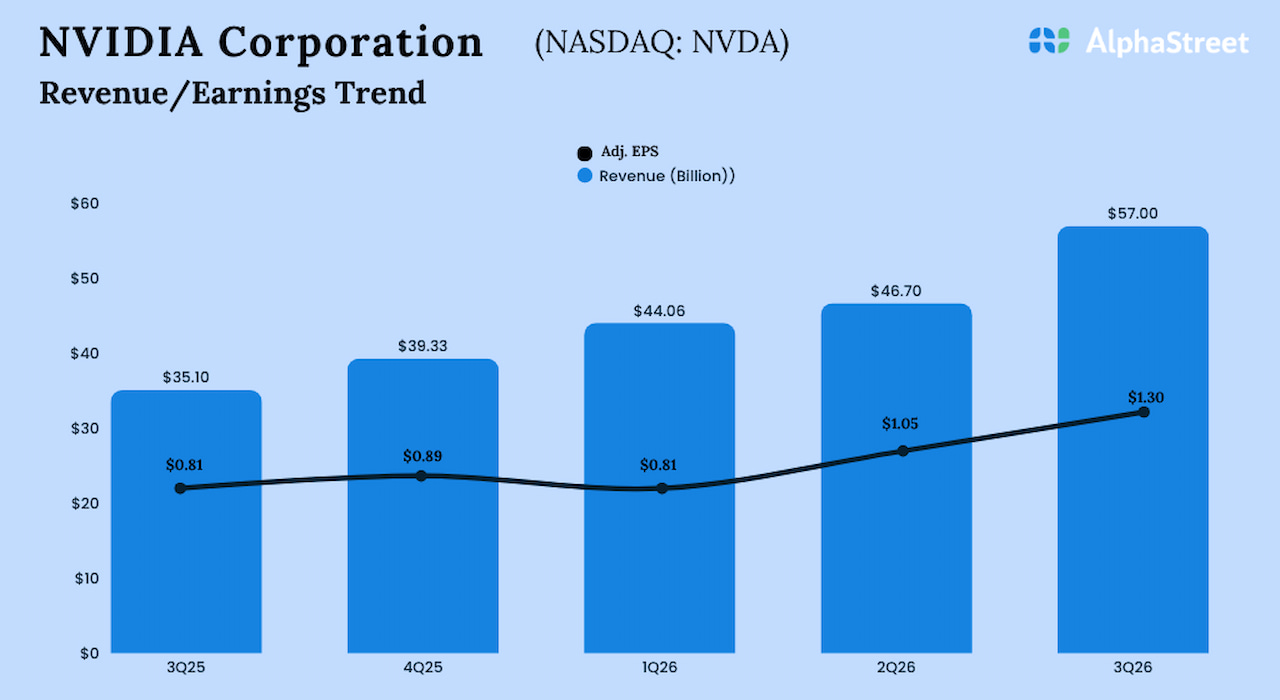

Bitcoin has fallen about 12% this week alone, hitting a contemporary low of $80,548.09 on Friday, the bottom degree since April. Shares of AI enabler Nvidia are down 5% this week.