Andrii Yalanskyi/iStock by way of Getty Pictures

A typical chorus the “yield chasers” discover themselves defending is “what good is a ten% yield if the value declines 15% annually?” or one thing to that have an effect on. Everybody’s funding scenario and objectives are distinctive; take for instance the “reverse mortgage” whereby householders get to remain of their dwelling however lose fairness worth annually (not completely dissimilar to the yield chaser chorus described above). What’s extra, this example is definitely most popular by some buyers, and it could change into an correct hindsight description of an funding in Rithm Capital (NYSE:RITM) 5 years down the street. On this report, we clarify why mortgage REIT Rithm Capital is an unattractive and systemically unimportant funding, after which provide two more-important big-dividend REIT options that we consider are price contemplating. We conclude with our robust opinion on investing.

Rithm Capital, Yield: 10.0%

Rithm Capital

Previously often called New Residential Funding Corp (NRZ), Rithm Capital is a big-dividend mortgage REIT that ought to be prevented by most buyers. Its stability sheet consists of a hodgepodge of difficult-to-manage legacy mortgage-related property which might be of little significance to the monetary system, its CEO has a historical past of questionable habits, the enterprise simply misplaced its credible exterior administration crew, and its alternatives are restricted going ahead. It is principally dying cash strolling, as we’ll clarify beneath.

Rithm Historical past

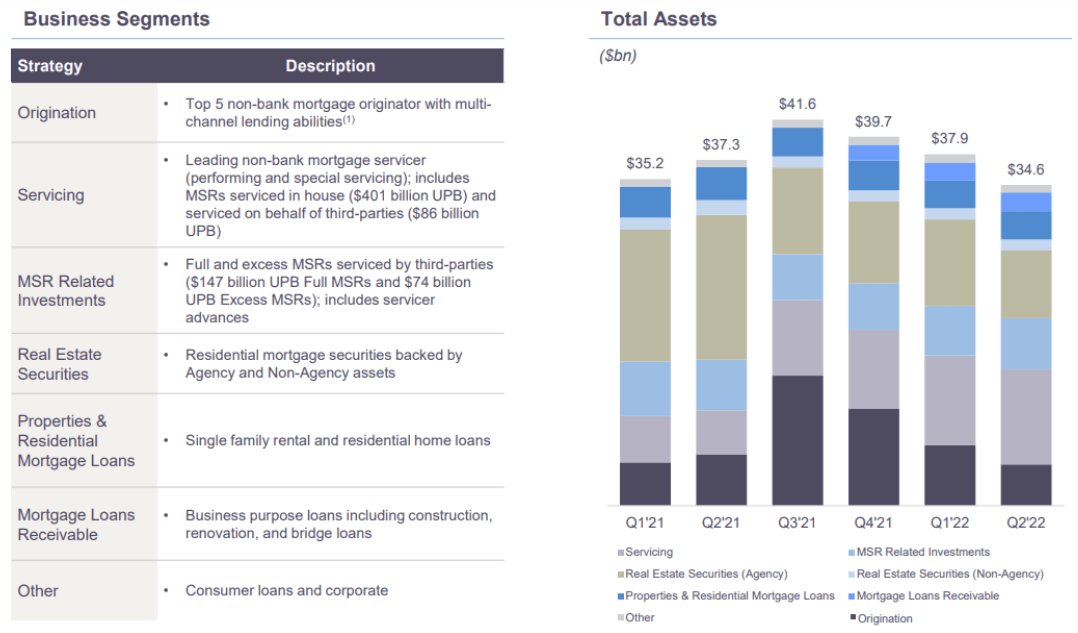

To supply some historical past, Rithm was initially based across the time of the 2008-2009 monetary disaster. It was a cleverly opportunistic enterprise that benefited from the mortgage-related misery of the disaster. Particularly, it first owned Mortgage Servicing Rights (which grew to become unexpectedly vital when the housing bubble burst) after which Extra Mortgage Servicing Rights. In truth, it nonetheless owns many of those property on its stability sheet, however the large development and really high-yield alternatives on this asset class (that emerged throughout/after the monetary disaster) is now lengthy gone. And for the reason that alternatives have been already gone, Rithm has been greedy for brand spanking new alternatives (none of that are almost as enticing as those that existed shortly after the 2008-2009 monetary disaster started). And consequently, Rithm’s stability sheet now consists of a hodgepodge of mortgage-related property which might be dangerous and arduous to handle, reminiscent of these within the graphic beneath.

Rithm Investor Presentation

Fortress Simply Dumped Rithm

As a testomony to the challenges and unattractiveness of Rithm’s enterprise and stability sheet, the corporate simply obtained dumped by its exterior administration agency, Fortress Funding Group (FIG). And whereas Rithm tries to spin this as a terrific alternative to turn out to be internally managed (thereby decreasing bills and eradicated conflicts of curiosity), it is actually simply a sign that the corporate’s future isn’t notably shiny. CEO Michael Nierenberg tries to place a optimistic spin on it as follows:

“We have now modified dramatically since our inception, from an proprietor of MSR property to an organization with complementary working firms and a novel portfolio of investments. The brand new identify and model assist distinguish us from our working firms, together with Newrez, and replicate our tradition, crew and ambitions for development past residential mortgages.”

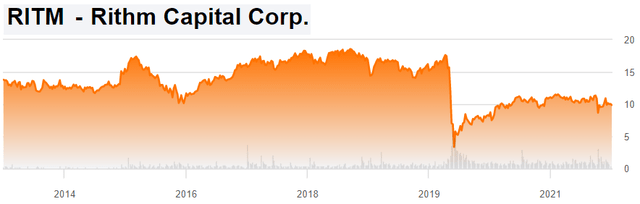

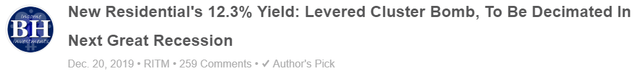

In plain English, the corporate is waiving the white flag and now attempting to make use of shareholder capital to provide you with different choices. And for perspective, right here is how the corporate’s share worth has carried out (keep in mind it only recently modified its identify from New Residential to Rithm Capital) since its dangerous property obtained wrecked (and dividend decimated) when the liquidity turmoil of early 2020 hit (as we warned about on the finish of 2019).

Looking for Alpha Looking for Alpha

Rithm CEO Contributed to Bear Stearns Demise

When you keep in mind again to the misery of the 2009-2008 monetary disaster, it was largely set off when Wall Road financial institution, Bear Stearns (adopted by Lehman Brothers), collapsed. And a glance beneath the hood reveals Rithm’s present CEO (Michael Nierenberg) labored at Bear Stearns and his dangerous habits contributed very considerably to the collapse. And for reference, right here is extra colour on what Nierenberg has been as much as recently.

Rithm’s Belongings: NOT Systemically Vital

When the COVID pandemic broke out, Rithm was damage badly due to its dangerous stability sheet property. Critically vital to notice, the fed was working time beyond regulation to bail out the monetary markets right now (by shopping for every kind of property to pump liquidity into the system), however they have been NOT bailing out Rithm’s numerous and unique MSRs. The Fed was shopping for Company Mortgage Backed Securities (Company MBS) hand over fist (to the good thing about different mortgage REITs, however not a lot Rithm). Rithm was really attempting to purchase Company MBS right now to offset a number of the MSR threat (because the quote from CEO Michael Nierenberg beneath explains), but it surely was too little too late as the shortage of liquidity and e-book worth injury had already been executed.

As we take into consideration the funding portfolio going ahead, one of many areas that we have been targeted on, we have added company securities to offset a few of our MSR portfolio.

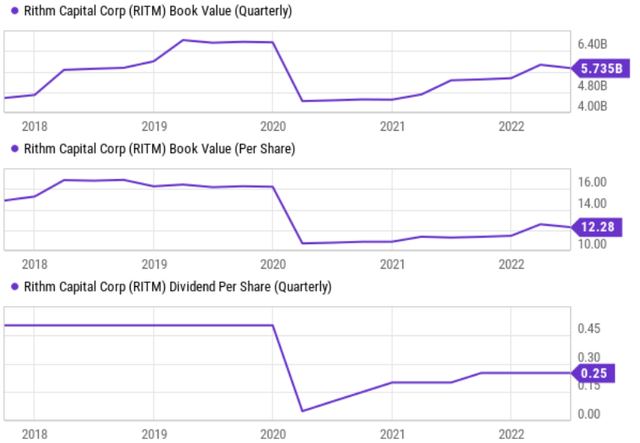

For reference, here’s a have a look at what occurred to the e-book worth and the dividend.

YCharts

2 Higher Huge-Dividend Alternatives

In our view, Rithm is solely dying cash strolling, whereby it is only a matter of time earlier than some localized market turmoil and threat drives it into misery and extra e-book worth declines. After all it might pull a rabbit out of its hat and put itself on a path to miraculous restoration and positive factors, however that appears unlikely. Investing in Rithm isn’t a lovely threat in our view (whatever the massive dividend yield). As a substitute, we provide two higher (and extra systemically vital) big-dividend alternatives beneath.

Annaly Capital (NLY) Most well-liked, Yield: 7.2%

Like Rithm, Annaly can be a mortgage REIT. Nevertheless, in contrast to Rithm, Annaly’s stability sheet property are extra systemically vital as more and more demonstrated by the Federal Reserve’s clear dedication to supporting them. Particularly, the overwhelming majority of Annaly’s stability sheet property (~71%) are Company MBS, that are primarily backed by the federal government. For instance, the fed purchased large portions of Company MBS rapidly when the pandemic was hitting with a view to pump liquidity into the system.

Nevertheless, within the case of Annaly, it’s really the popular shares (e.g. (NLY.PF) that we desire (not the widespread). The popular shares are greater within the capital construction and have much less worth volatility. Additionally, they commerce at a small low cost to their $25 redemption worth (in contrast to the widespread shares which at present commerce at massive premium to their e-book worth). We just lately wrote up Annaly most popular shares in additional element on this report (which by the way additionally contains a number of extra high concepts and an information dump on over 200 big-dividend most popular shares).

Medical Properties Belief (MPW), Yield: 7.3%

Though it is a property REIT (not a mortgage REIT), Medical Properties Belief is one other big-dividend REIT that we like greater than Rithm. And one of many causes we like MPW is as a result of its property (hospital actual property) is systemically vital (in contrast to most of Rithm’s stability sheet property).

Particularly, MPW owns the actual property that’s at present occupied and operated by hospitals which might be extraordinarily vital to the communities through which they function. The fundamental enterprise mannequin is that MPW gives important capital to hospitals by shopping for their actual property, and it is a win-win as a result of it provides MPW possession of vital hospital properties, and its provides the hospital operators entry to capital to allow them to enhance their operations. We just lately wrote up MPW in nice element in our report: “Medical Properties Belief: 50 Huge-Dividend REITs Down Huge.”

The Backside Line

Each investor has their very own particular person objectives and tolerance for threat. For instance, some buyers place such a excessive worth on massive dividends that they do not thoughts when the share worth deteriorates over time. In our judgement, that’s probably what’s going to occur with Rithm Capital over time. It would preserve paying massive dividends whereas its share worth will fall (sure, there can be ups and downs, however we anticipate the long-term development can be constant share worth declines).

In contrast to Rithm, each Annaly Capital and Medical Properties Belief personal property which might be vital to the functioning of society (MPW owns vital hospitals and NLY owns largely Company MBS that helps help the residential mortgage market so individuals can have houses to reside in).

On the finish of the day, you want to determine what investments and funding technique works for you. Disciplined, goal-focused, long-term investing is a successful technique.