Keith Tsuji/Getty Images Entertainment

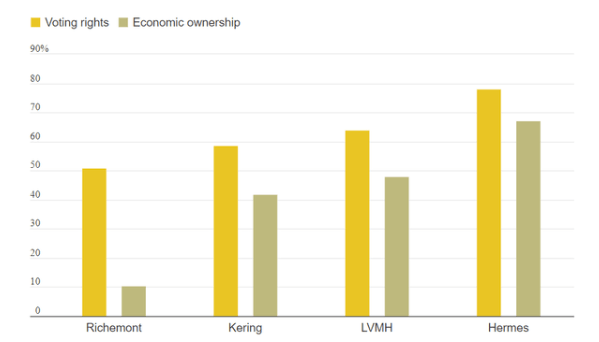

Here at the Lab, we initiated Compagnie Financière Richemont (OTCPK:CFRHF) (OTCPK:CFRUY) analyzing Bluebell Capital Partners’ activism involvement against the Rupert family (Richemont’s main shareholder). As a reminder, in detail, Richemont’s equity capital includes 522 million A shares with a face value of CHF 1 each and as many B shares with a face value of 10 cents. This mechanism leads the Rupert family to have 9-10% of the total capital with over 50% of the voting rights. As we can see from the snap below, this represents the highest disproportion in equity control compared to the other luxury players.

Voting rights vs economic ownership

There is a piece of recent news that is worth deeper consideration – Richemont is preparing a dual listing. Last week, the Swiss holding company announced its intention to end its depositary receipts program in South Africa and to list its type A shares on the Johannesburg Stock Exchange. The one in the South African capital will be a secondary listing after the Zurich one.

So far, the company has operated a depositary receipts program in South Africa through its subsidiary Richemont securities. With the new structure, the depository receipts will be traded on the Johannesburg stock exchange and can be traded for A shares at a ratio of ten depository receipts to one A share. Richemont said in an official statement:

These depository receipts were originally created and issued to facilitate dealings between South African investors and the company, in accordance with the exchange control requirements in effect at the time.

However, the depositary receipt program is no longer needed for this purpose, as Richemont’s A shares can now be listed, as a secondary listing.

The proposed termination of the depositary receipts program would provide greater flexibility for the company’s shareholders, facilitating cross-border trading of Richemont’s A shares between investors on the JSE and the Swiss exchange. According to our analysis, this streamlined structure would also reduce admin costs and complexity. Achievement of these objectives requires the cancellation of the Depositary Receipts program and, should the holders approve the termination of the program and Richemont obtains other relevant regulatory approvals, the Depository Receipts holders will receive one A share free of charge in exchange for ten depositary receipts in their possession, and the A shares will be listed on the JSE as a secondary listing. This conversion won’t lead to any A shares interruption and for current investors, their position won’t be affected.

Richemont’s deadline for voting is programmed for April 3rd, while the listing of the A shares and A warrants on the Johannesburg exchange is scheduled for April 19th. Here at the Lab, we were not particularly enthusiastic about Bluebell’s involvement; however, their investment was just 0.2% of the total capital. Last time, we concluded that corporate governance issues could not be unnoticed, and today, double checking Richemont’s main shareholders, Bluebell Capital Partners is not there.

LVMH follow-up

There is a rumor circulated by the Swiss press about LVMH’s intention to get its hands on Richemont! And this is a gossip that the fashion & luxury sector and a few of our readers were asking our team. As you know, we are usually not providing any comment on mega-acquisitions; however, it is no news that LVMH has recently decided to expand its influence in the luxury jewelry market. After completing a record deal for the acquisition of Tiffany & Co, we are sure that the French company would be interested in expanding its roster already populated by Bulgari and Chaumet.

As already mentioned, Richemont is currently the fourth largest company in the luxury world, and in addition to Cartier, manages brands such as IWC, Van Cleef & Arpels, and Buccellati. However, to buy Richemont, LVMH would have to pay at least €100 billion, considering a 30% premium. It would be a price equal to 18x the company’s EBITDA, a value which is higher than the average of luxury peers (17.4x), and also higher than Tiffany’s recent acquisition (14.4x). In our view, there are three major hurdles to making the deal. The first concerns LVMH’s intention to raise the necessary debt for the closing. Secondly, LVMH should convince Johann Rupert to make this happen, and most importantly, the French player would have to wait for international antitrust agencies’ authorization.

Conclusion and Valuation

Cross-checking the latest watch report, Swiss February exports were up 12% on a yearly basis (after a plus 9% in January). Compared to the pre-COVID-19 area, we are up by an additional 27% and 14% in February and January, respectively. China continues to improve and US and Europe trends remain strong. In our last analysis, we concluded that Richemont was still trading at a 27 P/E ratio, in line with its historical average. For this reason, having commented on its latest numbers and with a positive view on Jan-Feb data, we confirmed our EPS 2023 estimates of €4.5, implying a price target of CHF 115 per share ($12.5 in ADR). Therefore, we maintain an equal weight.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.