Govt Abstract

In response to Federal Reserve Chair Jerome Powell, the Fed’s versatile common inflation focusing on (FAIT) framework performed no function within the post-pandemic inflation surge, and officers acted swiftly as soon as inflation proved demand-driven. This paper reveals Powell’s claims are usually not supported by the proof. The rise within the value degree was pushed by a surge in nominal spending. Fed officers have been gradual to acknowledge the issue and waited six months after acknowledging it to meaningfully tighten coverage. Removed from irrelevant, FAIT helps clarify why the worth degree stays elevated right now. The paper concludes by evaluating different frameworks and arguing that the Fed ought to undertake both a nominal spending goal or a symmetrical common inflation goal.

Key Factors

- Publish-pandemic inflation was demand-driven — a results of financial coverage not provide constraints, “greedflation,” or fiscal coverage. The persistent rise within the value degree was not an exogenous shock, however the results of extreme financial lodging that fueled a pointy surge in spending. Opposite to some in style views and remarks by Federal Reserve Chair Jerome Powell, provide constraints, company “greed,” and financial coverage can not clarify the magnitude, timing, or length of the inflation.

- The Fed misdiagnosed the post-pandemic inflation downside and responded too slowly. All through 2021, Fed officers continued to view inflation as transitory and supply-driven, at the same time as proof on the contrary mounted. They delayed tightening till March 2022 and proceeded cautiously thereafter, permitting inflation to overshoot their very own projections — which have been already properly above the Fed’s acknowledged two-percent goal.

- Versatile common inflation focusing on (FAIT) contributed to the issue. FAIT, the Fed’s financial coverage framework adopted in 2020, inspired the Fed to tolerate above-target inflation so as to make up for previous inflation undershoots, however provided no mechanism to offset overshoots. This asymmetry nearly assured tolerance of upper inflation and a everlasting rise within the value degree — and undermined the Fed’s credibility.

- The Fed’s FAIT framework weakens long-run value stability. By failing to stabilize the worth degree or anchor inflation expectations round a predictable path, the FAIT framework will increase the dangers of long-term contracting and erodes confidence within the Fed’s capacity to ship financial stability.

- Reforming the framework is crucial to make sure value stability. The paper evaluates 4 options and recommends nominal spending focusing on as the best choice for reaching value stability and bettering communication. A symmetric common inflation goal is proposed as a viable second-best.

1. Investigating the Fed’s Concentrating on Framework

At a January 2025 press convention, Federal Reserve Chair Jerome Powell (2025) claimed that the Fed’s versatile common inflation focusing on (FAIT) framework didn’t contribute to the post-pandemic inflation surge. As he put it:

There was nothing average concerning the overshoot. It was an exogenous occasion. It was the pandemic and it occurred and, you recognize, our framework permitted us to behave fairly vigorously. And we did, as soon as we determined that that’s what we should always do. The framework had actually nothing to do with the choice to — we appeared on the inflation as — as transitory and — proper as much as the purpose the place the information turned in opposition to that. [W]hen the information turned in opposition to that in late ‘21, we modified our — our view and we raised charges lots. And right here we’re at 4.1 % unemployment and inflation means down. However the framework was extra irrelevant than anything — that a part of it was irrelevant. The remainder of the framework labored simply advantageous as — as we used it — because it supported what we did to convey inflation down.

In response to Powell, the short-term rise in inflation was past the Fed’s management.[1] He argued that the framework didn’t inhibit the Fed’s response; quite the opposite, it supported the Fed’s efforts to rein in inflation. In Powell’s account, the Fed responded appropriately and aggressively as quickly as the information indicated that inflation was demand-driven. This paper challenges that account.

The next part argues that the rise in inflation (and, consequently, the rise within the value degree) was not exogenous, however was pushed by excessively free financial coverage, which fueled a surge in nominal spending. Though Powell is unclear about what he means by “exogenous,” his clarification echoes a number of in style narratives that attribute the post-pandemic inflation to exterior elements — reminiscent of provide constraints, greedflation, and expansionary fiscal coverage.[2] None of those explanations withstands scrutiny. After evaluating every in flip, the proof overwhelmingly factors to a demand-driven inflation surge attributable to financial lodging (retaining rates of interest low, rising the cash provide, or each).

As mentioned in Part 3, the underlying downside was the Fed’s delayed response to a constructive mixture demand shock of its personal making. The Fed’s December 2021 projections clarify that officers anticipated inflation to fall within the closing months of 2021 with none change within the stance of financial coverage, suggesting they continued to view inflation as transitory — regardless that Powell had retired the time period weeks earlier. In brief, Fed officers considered inflation as provide pushed as late as December 2021 and, because of this, failed to regulate coverage accordingly. This distinction issues: if the post-pandemic inflation surge was primarily supply-driven, there was little the Fed may have executed to scale back it with out inflicting different issues; if, then again, it was demand-driven, circumstances known as for tighter financial coverage to rein in extreme spending within the economic system.

Part 4 reveals that, opposite to Powell’s declare, the Fed didn’t change its coverage stance when the information turned in opposition to the transitory supply-side story within the again half of 2021. The Fed didn’t start elevating the federal funds charge goal till March 2022 — three months after Fed officers publicly acknowledged the demand-side nature of inflation. Even then, officers proceeded cautiously, regardless of inflation surging previous their projections in the course of the early months of 2022. Certainly, it was not till July 2022 that Fed officers lastly took extra aggressive motion.

Part 5 argues that FAIT is much from “irrelevant” to understanding the Fed’s delayed response to the post-pandemic inflation surge. Its adoption in August 2020 marked a transparent shift from the Fed’s earlier inflation-targeting regime, formally launched in 2012. Whereas the sooner framework emphasised a symmetric two-percent inflation goal (a stance the Fed clarified in 2016), FAIT launched an specific dedication to make up for previous shortfalls, permitting inflation to reasonably overshoot the goal following durations of undershooting.[3] In observe, nonetheless, the Fed’s implementation of FAIT was uneven: it invoked the framework to justify continued lodging in 2021 however made no effort to offset subsequent above-target inflation with below-target inflation.[4] This asymmetry inhibited the Fed’s response in two methods. First, it gave officers a rationale for delaying tightening, since average overshooting was per the framework’s backward-looking logic. Second, it discouraged the pursuit of a superior goal — stabilizing the worth degree — by making no provision for correcting upward drift as soon as inflation took maintain.

Lastly, Part 6 discusses a number of proposed options and revisions to the present framework. A few of these options — reminiscent of symmetric common inflation focusing on and nominal GDP degree focusing on — seem extra prone to promote value stability and scale back the danger of comparable failures sooner or later. These choices are provided to supply Fed officers and others curious about financial coverage with a contemporary perspective on the present framework and recommend methods it is perhaps revised to strengthen financial stability.[5]

2. What Drove the Publish-Pandemic Rise within the Value Degree?

The worth degree has risen considerably since January 2020 (see Determine 1). To grasp why — and to evaluate Chair Powell’s declare that this rise was “exogenous” — it’s useful to look at how the private consumption expenditures (PCE) value index, the Fed’s most well-liked measure of inflation, advanced throughout this era. The paper begins by reviewing the trajectory of the worth degree, then evaluates three in style, however in the end unconvincing, explanations for the post-pandemic inflation surge, and eventually presents a extra compelling different: a surge in nominal spending fueled by overly accommodative financial coverage.

2.1. The Trajectory of the Value Degree: 2020–2024

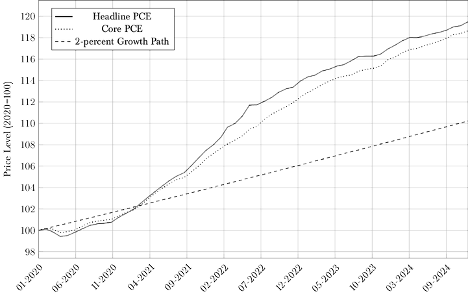

Determine 1 plots each headline and core private consumption expenditures (PCE) indices from January 2020 alongside the Fed’s two-percent goal development path, providing a transparent view of when — and by how a lot — the worth degree diverged from the Fed’s goal. Because the determine makes clear, each headline and core PCE inflation initially fell beneath the Fed’s goal, however the decline was temporary. By March 2021, the worth degree had absolutely returned to the goal path, and within the months that adopted, surged previous it.

Determine 1: Headline and Core PCE Value Indices

Between January 2020 and September 2021, annual headline and core PCE inflation averaged 3.1 and a couple of.9 %, respectively — however over the subsequent 9 months, they accelerated sharply, averaging 7.7 and 5.6 %.[6] Inflation started to average after mid-2022. Headline PCE inflation averaged 3.2 % between June 2022 and June 2023, and for 2024, it averaged 2.5 %. Over the identical durations, core PCE inflation averaged 4.3 and a couple of.8 %, respectively.

Nonetheless, by December 2024, the headline PCE value index was 8.4 proportion factors above the place it could have been had the Fed persistently met its two-percent inflation goal. Whereas inflation charges have come down from their 40-year highs, the worth degree stays completely elevated relative to its goal path. What brought about the worth degree to diverge so persistently from the Fed’s goal?

2.2. Three Unsatisfying Explanations

Powell’s remarks recommend that he and different Fed officers view the rise within the value degree as outdoors their management. Take into account three in style however in the end unconvincing explanations for the inflation surge — company greed, expansionary fiscal coverage, and provide constraints — all of which may plausibly align with Powell’s description of the post-pandemic surge as “exogenous.” To be clear, this isn’t to recommend that these elements performed no function within the rise within the value degree; reasonably, none of those explanations accounts for the timing, magnitude, and persistence of the inflation surge, indicating that another clarification is critical.

2.2.1. Issues with the “Greedflation” Rationalization

As the worth degree started to rise following the pandemic, many commentators on the political left attributed the surge in inflation to rising company income, arguing that corporations exploited provide disruptions and powerful demand to extend costs properly past their value will increase. Sen. Elizabeth Warren (D-MA), for instance, tweeted in April 2022, “Companies have discovered they’ll use inflation as cowl to not solely go alongside their very own elevated prices to shoppers, but in addition to cost gouge to spice up their revenue margins.” Echoing this sentiment, former Sen. Sherrod Brown (D-OH) remarked in 2023 that “company executives […] fake they’re making ‘powerful selections’ about costs whereas reporting file revenue will increase quarter after quarter” and urged that “this profiteering” was “one of many greatest drivers of inflation.”

Whereas it could be tempting to dismiss these feedback as mere political rhetoric, some economists have developed extra formal variations of the greedflation view. Lorenzoni and Werning (2023), for instance, argue that inflation arises from battle: totally different financial brokers have incompatible aims over relative costs, and every workouts solely partial or intermittent management over the costs they set. Of their staggered-pricing mannequin, every agent raises costs each time it has the chance. The result’s that regardless that relative costs stay unchanged, the cumulative value will increase pushed by this battle generate a “normal and sustained inflation in all costs.”[7]

Weber and Wasner (2023) provide one other model of this argument. When an exterior shock causes enter prices to rise, they contend, corporations with market energy can successfully collude to lift their costs.[8] Provided that “all corporations wish to shield their revenue margins and know that the opposite corporations pursue the identical objective,” Weber and Wasner preserve, “they’ll improve costs, counting on different corporations following go well with.” Furthermore, if bottlenecks create short-term market energy, they argue, corporations can “hike costs not solely to guard however to extend income.” In different phrases, when short-term bottlenecks create further market energy, corporations would possibly increase their markups — not merely passing on greater enter prices, however rising income as properly.

The greedflation clarification offers incumbent politicians with a handy scapegoat, so it’s no shock that they like it to different, extra standard explanations. There are, nonetheless, a number of issues with this view. For one, it’s inconsistent with primary value idea (Hendrickson 2024). Corporations can not increase costs with out risking a lack of clients. Increased enter prices scale back revenue margins. It follows {that a} rise in a agency’s markup implies one among three issues. First, the agency might have initially set its value too low and later corrected it. Second, it could have raised its value too excessive and didn’t make some worthwhile gross sales. Third, it could have skilled a rise in demand, permitting it to cost extra with out shedding clients. The primary two instances suggest that corporations weren’t maximizing income earlier than the pandemic, which, whereas potential, appears unlikely. Within the third case, the upper demand — not greed — explains the rise in markups.[9]

One other downside with this view is that it assumes market energy operates primarily by elevating costs by way of limiting output. Whereas such a mechanism is theoretically believable, it can not account for the dimensions of the post-pandemic inflation with out implying an implausibly giant contraction in mixture output development.[10] But even setting that situation apart, the empirical file is inconsistent with the greedflation narrative: output was rising alongside inflation, not falling, in the course of the interval in query, which means that the noticed rise in markups was largely pushed by stronger demand, not an increase in market energy (See Determine 2).

2.2.2. Issues with the Expansionary Fiscal Coverage Rationalization

One other frequent clarification for the post-pandemic inflation — in style on, although not unique to, the political proper — is that it was pushed by expansionary fiscal coverage. The federal authorities sharply elevated spending to mitigate the financial fallout of the pandemic and the accompanying restrictions on financial exercise. Congress approved $3.3 trillion throughout 5 reduction payments handed in 2020 and a further $1.8 trillion in 2021. As Romer (2021) observes, these measures “ran the gamut from extremely helpful and applicable to largely ineffective and wasteful.” Importantly, policymakers made no point out of upper future taxes to offset these expenditures. Because of this, mixture demand rose: households and corporations, anticipating greater present and future revenue however no offsetting tax burden, elevated their spending. That rise in nominal spending, in flip, put upward strain on costs.[11]

There’s actually benefit to this view. Certainly, the underlying reason behind excessive and hyperinflation is usually reckless fiscal coverage (Sargent 1982). Nonetheless, some proponents of the fiscal clarification state it in a means that successfully — if not all the time deliberately — absolves the Fed of any culpability. Expansionary fiscal coverage solely boosts mixture demand if the Fed accommodates it.[12] An increase in deficit spending by the federal authorities pushes rates of interest greater. If, in response to greater rates of interest, the Fed adjusts its coverage charge upward, personal spending will decline to offset the rise in public spending, leaving mixture demand unchanged. The federal authorities’s fiscal response to the pandemic might have made the Fed’s job harder, however it can not, by itself, clarify the rise in inflation that adopted; that end result required financial lodging. On this case, reasonably than elevating rates of interest to offset the inflationary strain of upper deficit spending, the Fed held charges close to zero and continued large-scale asset purchases — insurance policies that exacerbated, reasonably than countered, the fiscal stimulus and allowed mixture demand to surge.

2.2.3. Issues with the Provide-Constraint Rationalization

Probably the most believable interpretation of Powell’s place — and maybe probably the most extensively accepted clarification for the inflation surge — is that pandemic-induced provide constraints brought about the worth degree to rise. COVID-19 and the ensuing restrictions on financial exercise sharply curtailed the economic system’s capacity to supply items and companies in 2020. Though most individuals returned to work as governments relaxed these restrictions, provide chain disruptions lingered, constraining productive capability by way of a lot of 2021.[13]

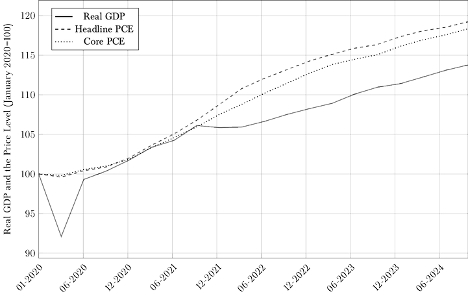

The availability-constraint clarification is easy: the pandemic decreased mixture output (measured as actual GDP), rising the shortage of products and companies, which in flip drove up costs. Whereas theoretically sound — and certainly, fairly intuitive — this clarification faces two basic issues. First, the timing is off. The sharpest contraction in output occurred in 2020, but costs rose by lower than two % on common over the primary 12 months of the pandemic. Inflation didn’t start to rise in earnest till the economic system had largely recovered from the preliminary provide disruptions, as proven in Determine 2, which plots actual GDP alongside each the headline and core PCE value indices. When inflation accelerated, output and the worth degree have been rising collectively — not shifting in reverse instructions, as one would anticipate following an opposed provide shock, which tends to scale back the economic system’s productive capability, resulting in decrease output and better costs on account of elevated shortage.[14]

Determine 2: The Path of Actual GDP and the Value Degree

The second, and extra basic, downside with the supply-constraint view is that it can not account for the everlasting rise within the pattern value degree. In the usual mixture demand and provide framework, short-term provide shocks trigger short-run deviations in output and costs however go away the long-run value degree path unchanged. For a given charge of mixture demand development, the worth degree rises quickly when output falls beneath potential, however returns to pattern as output recovers. By the top of 2024, actual GDP had almost returned to its pre-pandemic development path, but the worth degree remained properly above its two-percent goal path. In brief, the persistence of an elevated value degree is inconsistent with a purely supply-driven clarification.

To make certain, provide disruptions possible contributed to the surplus inflation noticed for the reason that begin of 2020. The query is, by how a lot? Whole spending within the economic system — i.e., nominal GDP or nominal revenue — grew at a median annual charge of 4.1 % over the five-year interval previous the pandemic. Throughout that point, actual GDP — inflation-adjusted output — grew by 2.5 % per 12 months, whereas inflation — as measured by the GDP deflator — averaged 1.5 %. From the beginning of 2020 to the top of 2024, actual GDP development averaged simply 2.3 %. With no change in complete spending, nominal GDP would have continued to develop at its pre-pandemic tempo, and the slowdown in actual GDP development would have pushed the typical inflation charge up modestly — to round 1.7 % per 12 months. In actuality, nonetheless, the GDP deflator grew at a median charge of three.9 % over the identical interval. Therefore, solely about 10.3 % of the noticed extra inflation will be attributed to decreased output — whether or not on account of pandemic-related provide constraints or, as mentioned earlier, rising market energy.[15]

2.3. The Actual Drawback Was Nominal

Whereas the Fed carried out financial coverage fairly properly in 2020 — particularly given the peculiarities of the COVID-19 contraction — it was caught off guard when mixture demand picked up in 2021 (Cachanosky et al. 2021). Nominal GDP, which had grown at a median annual charge of 4.1 % within the quick pre-pandemic interval, surged by 10.7 % from 2021:Q1 to 2022:Q1, and by 7.4 % from 2022:Q1 to 2023:Q1. Though provide constraints contributed to extra inflation, the core downside was that the Fed didn’t stabilize mixture demand (Beckworth and Horan 2025; Luther 2024; Schibuola and Martinez 2021).

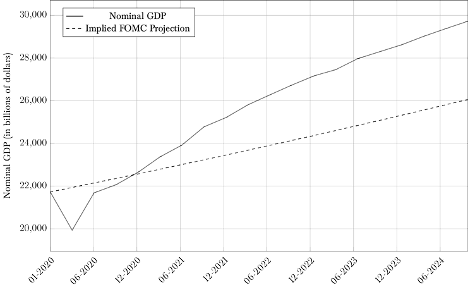

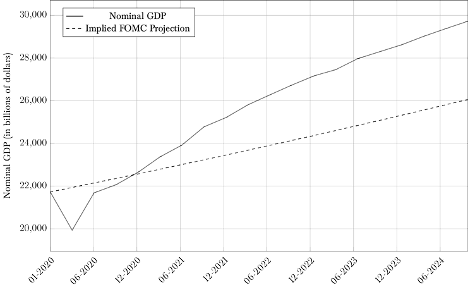

To understand the dimensions of the surge in nominal spending, it’s helpful to match the precise trajectory of nominal GDP to the Federal Open Market Committee’s (FOMC) implicit pre-pandemic projection. This projection will be inferred by combining the FOMC’s projections of actual GDP development and inflation to estimate the anticipated path of nominal spending — merely the sum of these two elements. In December 2019, the median projection for long-run annual actual GDP development was 1.9 % and for inflation was two %, implying a projected long-run nominal GDP development charge of three.9 % per 12 months. Determine 3 plots this projected path alongside the precise path of nominal GDP.

Determine 3: The Path of Nominal GDP and the FOMC’s Implied Projection

Because the determine reveals, nominal spending surged previous the FOMC’s implied projection in early March 2021 and has remained elevated ever since. By the top of 2024, nominal GDP stood 14 % above the extent implied by the FOMC’s December 2019 projection. This divergence underscores the extent to which the Fed allowed mixture demand to overshoot. It additionally highlights the central coverage failure behind the inflation surge: had the Fed begun tightening in early 2021 — when nominal GDP started rising above its pre-pandemic pattern — it may need prevented the persistent rise within the value degree.

This surge additionally helps account for the rise in company income and the autumn in unemployment beneath its “pure charge.” If output costs rise sooner than enter costs, then an sudden surge in nominal spending — just like the one skilled after the pandemic — will quickly improve company income.[16] Corporations, wanting to seize these income by assembly the rising demand, will rent extra employees and thereby drive the unemployment charge decrease. These developments — which the greedflation and supply-constraint views wrestle to clarify — comply with naturally from a demand-driven story. Therefore, in contrast to the opposite explanations of inflation, the give attention to nominal spending can account for all of the “stylized info” of the post-pandemic inflation.

Why did the Fed wait so lengthy to tighten regardless of this surge in nominal spending? As the subsequent part explains, the delay possible stemmed from policymakers’ perception that the inflation was supply-driven. Had they targeted on nominal spending reasonably than inflation, Fed officers would have seen a lot sooner that financial coverage was off monitor — and may need averted the inflationary surge altogether. Extra importantly, it could have averted the lack of credibility and actual financial distortions related to such a protracted and preventable overshoot.

3. The Fed’s Misdiagnosis: Mistaking Demand for Provide

In his remarks on the January 2025 press convention, Chair Powell claimed that the Fed started tightening financial coverage as quickly as information indicated that inflation wouldn’t come down by itself. As proven, this declare is unfaithful; the information had turned in opposition to the supply-constraint view of inflation months earlier than Powell formally retired the time period “transitory” in November 2021. Furthermore, as late as December 2021, the Fed’s inflation projections implied that officers nonetheless anticipated inflation to say no with none coverage tightening — suggesting that they continued to view inflation as the results of short-term provide constraints, regardless of mounting proof on the contrary.

This failure to acknowledge the demand-driven nature of the issue was evident all through 2021. FOMC members have been gradual to acknowledge the rise in mixture demand, as mirrored of their post-meeting statements in April, June, July, and September of that 12 months. In every case, they described the rise in inflation as “largely reflecting transitory elements” (Bergman and Luther 2022). That characterization is per the view that inflation was on account of provide constraints — not extra mixture demand.

This disconnect can be evident within the FOMC’s 2021 Abstract of Financial Projections. Desk 1 experiences the median FOMC member’s precise and implied inflation projections — i.e., what inflation must be within the remaining months to hit the year-end goal — together with their projections for the federal funds charge (FFR) (Federal Reserve 2021a, 2021b, 2021c, 2021d, 2022a, 2022b). For every projection spherical, the annualized PCE inflation charge that had already occurred — from the start of the 12 months by way of the newest month for which information was out there on the time of the projection — is calculated. From that is derived the implied annualized inflation charge for the remaining months of the 12 months — that’s, the speed that will be per the median FOMC member’s full-year projection given the inflation already noticed.

Desk 1: Median FOMC Member’s Precise and Implied PCE Inflation Projections and Federal Funds Charge Projections for 2021 and 2022

| Projection Date | Inflation Projection for Present 12 months | Annualized Inflation 12 months-to-Date | Implied Annualized Inflation for Remaining Months | Median FFR Projection for Present 12 months | Median FFR Projection for Following 12 months |

| Mar 2021 | 2.4% | 5.1% | 2.2% | 0.1% | 0.1% |

| Jun 2021 | 3.4% | 5.7% | 2.3% | 0.1% | 0.1% |

| Sep 2021 | 4.2% | 5.9% | 1.9% | 0.1% | 0.3% |

| Dec 2021 | 5.3% | 5.8% | 2.7% | 0.1% | 0.9% |

| Mar 2022 | 4.3% | 6.0% | 4.1% | 1.9% | 2.8% |

| Jun 2022 | 5.2% | 5.8% | 4.3% | 3.4% | 3.8% |

Notes: Annualized inflation year-to-date displays the change in costs from the start of the 12 months wherein the projection was made by way of final month for which PCE information was out there on the time of the projection. Implied annualized inflation charge for remaining months is set by the change in costs required over the months not but recorded on the time of the projection to attain the median FOMC member’s projection for the 12 months, given the change in costs that had already been recorded.

In March 2021, with year-to-date inflation averaging 5.1 % annualized, the median FOMC member projected simply 2.4 % inflation for the total 12 months. That implied they anticipated inflation to common solely 2.2 % annualized over the remaining months. By June, recorded year-to-date inflation had risen to five.7 %, and the median FOMC projection elevated to three.4 % — however once more, this assumed inflation would gradual, with an implied annualized charge of simply 2.3 % for the remainder of the 12 months. In September, year-to-date inflation averaged 5.9 % annualized, and the median projection rose to 4.2 % — implying a pointy deceleration to only 1.9 % annualized over the ultimate months. In December, year-to-date inflation averaged 5.8 % annualized, but the median projection for the 12 months rose solely to five.3 % — once more suggesting that FOMC officers anticipated a dramatic slowdown in inflation over the ultimate two months regardless of no change in financial coverage.

All through this era, the median projection for the federal funds charge remained unchanged, signaling that FOMC members anticipated inflation to fall with out the necessity for coverage tightening. They may see that offer constraints had largely eased, but they continued to anticipate inflation to return to regular by itself. Certainly, the FOMC’s post-meeting assertion from November 2021 indicated that officers continued responsible provide constraints for the elevated inflation charges, noting that they have been “largely reflecting elements which are anticipated to be transitory.”

By December, FOMC members seemed to be shedding confidence within the supply-disruptions view. The phrase “transitory” was purged from the post-meeting assertion, and Fed officers lastly acknowledged the demand-side downside: “Provide and demand imbalances associated to the pandemic and the reopening of the economic system have continued to contribute to elevated ranges of inflation,” they wrote. However they nonetheless anticipated inflation — which had averaged 5.8 % by way of October — would fall to a median of two.7 % over the remaining two months. Furthermore, the FOMC didn’t instantly increase its coverage charge, regardless of having acknowledged the demand-side downside. As an alternative, it started tapering asset purchases and signaling that charge hikes wouldn’t start till March 2022.

Regardless of Powell’s declare on the contrary, the rising consensus amongst economists is that the Fed ought to have acknowledged the rise in mixture demand a lot earlier. By September 2021, the proof was clear sufficient {that a} shift in coverage stance was warranted. For instance, all eight coverage guidelines evaluated by Papell and Prodan-Boul (2024) advisable elevating the federal funds charge by 2021:Q3, if not earlier. Likewise, Eggertsson and Kohn (2023) argue that “from September 2021 onward, it was turning into more and more clear, at the least looking back, that the inflation surge was broad primarily based and protracted.”

4. A Sluggish and Hesitant Coverage Response

Chair Powell claims that when Fed officers acknowledged that inflation was demand-driven, they rapidly modified course. Once more, nonetheless, this assertion misses the mark. Though the FOMC acknowledged in December 2021 that inflation was at the least partially on account of extra mixture demand, it didn’t start elevating charges till March 2022 — a number of months later — and even then proceeded cautiously. Furthermore, as inflation continued to exceed the FOMC’s projections in the course of the early months of 2022, officers have been gradual to speed up the tempo of tightening. In brief, not solely did Fed officers misdiagnose the character of the issue — as soon as they acknowledged it, they have been gradual to behave.

As proven in Desk 1, the median FOMC member projected in December 2021 that inflation would attain 5.3 % for the 12 months. The total vary of projections (not proven within the desk) was 5.3 to five.5 %. On the time, FOMC members had entry to PCE information by way of October 2021 and different indicators — together with firsthand observations — by way of November. But they considerably underestimated inflation. In January 2022, the Bureau of Financial Evaluation introduced that inflation had truly been 5.8 % in 2021 — above your entire vary of projections. That estimate would later be revised as much as 6.2 %.

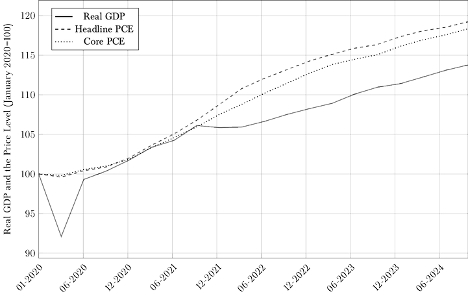

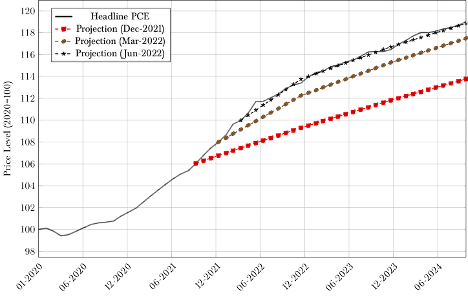

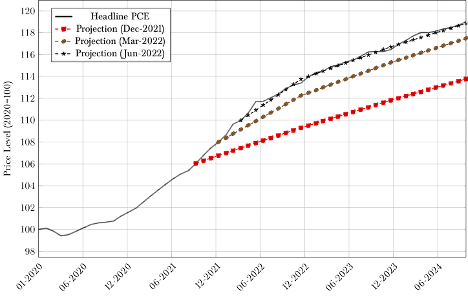

As an example how rapidly costs outpaced FOMC projections following their acknowledgment of demand-side pressures in December 2021, contemplate the worth degree paths implied by the median FOMC member’s inflation projections in December 2021, March 2022, and June 2022. In every case, the implied value degree begins with the newest month for which information was out there on the time of the projection. Determine 4 presents the ensuing collection.

Determine 4: Private Consumption Expenditures Value Index and Median FOMC Member’s Implicit Value Degree Projections

Notes: Implicit value degree projections are primarily based on the median FOMC member’s PCE inflation projections for the next years and the newest month for which PCE information was out there when the projections have been made.

PCE information launched in December 2021, January 2022, and February 2022 persistently confirmed that costs have been rising a lot sooner than the median FOMC member had projected. But the FOMC didn’t increase its coverage charge in January 2022, nor did it name a particular assembly to take action in February. It was not till March 2022 — with year-to-date inflation already at 6.0 % — that the FOMC lastly raised the federal funds charge, after which solely by 25 foundation factors. The median FOMC member revised their inflation projection for 2022 from 2.6 % in December 2021 (not proven in Desk 1) to 4.3 % in March 2022, and their projection for the federal funds charge from 0.9 % to 1.9 %. But officers didn’t speed up the tempo of tightening past what they’d beforehand indicated.[17]

Equally, PCE information launched in March and April 2022 confirmed that costs have been nonetheless rising properly above the median FOMC member’s expectations. But the FOMC didn’t name an emergency assembly in April. As an alternative, it raised the coverage charge by 50 foundation factors in each Might and June. In June 2022, the median FOMC member revised their 2022 inflation projection as much as 5.2 % and their federal funds charge projection as much as 3.4 %. However the actual federal funds charge remained adverse. The Fed had eased off the accelerator — however it had not but hit the brakes.

The Fed didn’t get severe about bringing down inflation till July 2022, when it stunned markets with a 75-basis-point charge hike. It then adopted up with further 75-basis-point hikes in September and November, a 50-basis-point hike in December, and 25-basis-point hikes in February, March, Might, and July 2023 — at which level the federal funds charge goal vary had elevated to five.25 to five.5 %. Sadly, the injury had already been executed: the Fed’s gradual response to the surge in mixture demand had pushed the worth degree properly above its pre-pandemic development path. As the subsequent part explains, the Fed’s uneven implementation of the FAIT framework all however assured that such an error would destabilize the worth degree path.

5. The Position of the FAIT Framework

In response to Chair Powell, the FAIT framework didn’t inhibit the Fed’s response to the post-pandemic inflation. Right here, too, Powell is mistaken. The FAIT framework inspired the Fed to delay tightening financial coverage and prevented the Fed from tightening sufficiently to convey the worth degree again right down to its prior two-percent development path. The delay meant costs rose greater than they in any other case would have. The shortcoming to return the worth degree to its prior development path risked unanchoring expectations from two %.

Beneath FAIT, the Fed goals to attain two % inflation on common over time — however it doesn’t goal inflation symmetrically. As an alternative, it offsets solely durations of below-target inflation. When inflation exceeds two %, because it did following the pandemic, the Fed merely goals to convey inflation again down to 2 %, with out compensating for the overshoot. Because of this, the worth degree stays completely elevated relative to its preliminary path.

The Fed adopted FAIT to deal with a selected downside. Following the onset of the Nice Recession in 2008, it persistently undershot its two-percent inflation goal. Regardless of a number of rounds of quantitative easing, inflation averaged simply 1.5 % from January 2009 to January 2020.[18] Fed officers frightened that persistently low inflation would unanchor expectations and put downward strain on nominal rates of interest. Coupled with slower inhabitants and productiveness development — which decrease actual rates of interest — below-target inflation risked pushing nominal charges to the zero decrease certain, thereby constraining the Fed’s capacity to reply to future downturns.[19] By committing to offset durations of below-target inflation, Fed officers believed the FAIT framework would assist anchor expectations at two % and scale back the probability that nominal rates of interest would once more strategy the zero decrease certain (Brainard 2020; Clarida 2020; Powell 2020).

Our latest expertise with FAIT reveals that Fed officers have been solely partially proper. The framework might assist stop inflation expectations from falling persistently beneath goal, however it doesn’t stop them from drifting persistently above it. Certainly, if corporations and households imagine the Fed will make up for below-target inflation however refuse to offset above-target inflation, they’ll fairly anticipate inflation to exceed two % on common. In brief, the “F” in FAIT — which provides Fed officers the pliability to pursue their inflation goal asymmetrically — conflicts with the “A,” which is meant to suggest that inflation will common two % over time.

One consequence of the FAIT framework is that, regardless of assertions on the contrary (see, for instance, Federal Reserve (2020)), inflation expectations is not going to be well-anchored at two %. Corporations and households can not reliably anticipate that inflation will common two % on a go-forward foundation. Because of this, any long-term contracts they enter into will probably be primarily based on the belief that inflation will are inclined to exceed two %. Extra troubling, nonetheless, is that events to long-term contracts should account for the chance that sudden inflation will result in everlasting wealth transfers (e.g., from lenders to debtors when fastened funds lose actual worth). Thus, long-term contracting beneath FAIT is riskier than it could be beneath different frameworks. To the extent that this better threat discourages long-term contracting, FAIT may impede financial development.

One other consequence of the FAIT framework is that it encourages the Fed to delay tightening financial coverage when obligatory. As a result of the framework permits inflation to run above two % for a time so as to make up for prior undershoots, officers might hesitate to reply to early indicators of rising inflation — particularly if latest inflation has averaged beneath goal. In observe, this creates an asymmetry: the Fed is fast to ease when inflation falls wanting two % however gradual to tighten when it exceeds the goal. This asymmetry was evident within the wake of the pandemic, when officers emphasised previous inflation shortfalls to justify continued lodging, at the same time as nominal spending surged and inflation pressures mounted. On this means, FAIT’s backward-looking nature blunted the Fed’s responsiveness at a important second.

Chair Powell might insist that FAIT didn’t inhibit the Fed, however this declare doesn’t match the information. FAIT not solely contributed to the preliminary rise within the value degree, it additionally provided no mechanism for correcting the price-level drift as soon as inflation took maintain.

6. What Ought to the Fed Do?

If FAIT didn’t inhibit the Fed’s response, as Chair Powell claims, one would possibly fairly anticipate Fed officers to protect the FAIT framework going ahead. Why repair what will not be damaged? Actually, in the course of the assessment course of, Fed officers have indicated that they’ll possible take away the asymmetry implied by FAIT. Regardless of their public statements, Chair Powell and different Fed officers clearly acknowledge the issues with the FAIT framework mentioned above. In any occasion, the query the Fed now faces is the best way to revise its framework in mild of latest expertise.

This part considers 4 potential revisions to the present framework:

- returning to a symmetric inflation goal

- implementing a symmetric common inflation goal

- elevating the inflation goal

- transitioning to a nominal spending goal

Though the final possibility might provide the best potential advantages, it additionally presents vital communication challenges. A symmetric common inflation goal may obtain lots of the similar advantages as a nominal spending goal, if applied successfully. In contrast, returning to a symmetric inflation goal or elevating the inflation goal doesn’t characterize an apparent enchancment over the present framework. Every proposal is reviewed in flip.

6.1. Symmetric Inflation Concentrating on

Maybe the least radical revision to the present framework could be to revert to the symmetric inflation goal (IT) adopted in 2016. Beneath IT, the Fed doesn’t try and make up for under- or overshoots. As an alternative, it lets bygones be bygones and goals to ship two-percent inflation interval by interval. The framework is symmetric within the sense that over- and undershoots are handled equally, with deviations from the goal leading to random short-run fluctuations across the two-percent path, reasonably than systematic over- or underperformance.

The principle benefit of IT is that it’s comparatively straightforward to speak to the general public. The draw back is that, if adopted strictly, it may well constrain the Fed’s capacity to conduct countercyclical financial coverage. Take into account a sudden adverse mixture demand shock that reduces inflation. If costs are sticky, actual output will quickly fall beneath its potential. Beneath IT, the Fed would proceed aiming for two-percent inflation going ahead, however from a cheaper price degree than households and corporations had anticipated previous to the shock. Since output will stay beneath potential till expectations and the worth degree regulate, this strategy can lead to a sluggish restoration.

Reasonably than decreasing the danger of long-term contracting, IT might make such contracts even riskier than beneath the present FAIT framework. Though households and corporations can fairly anticipate inflation to common two % beneath IT, the potential for sudden deviations implies that everlasting wealth transfers are extra possible. Beneath IT, the Fed doesn’t appropriate for previous errors, so it could (randomly) over- or undershoot its goal. In contrast, beneath FAIT, the Fed commits to creating up for durations of below-target inflation, so these getting into long-term contracts want solely fear about above-target surprises.[20] In brief, the vary of potential wealth transfers — and, correspondingly, the danger related to long-term contracting — is prone to be better beneath IT.

6.2. Symmetric Common Inflation Concentrating on

Probably the most easy revision to the present framework could be to make the typical inflation goal symmetrical. Beneath a symmetric common inflation focusing on (AIT) regime, the Fed would purpose to attain two-percent inflation, on common, over time — which means that officers would offset each over- and undershoots. As beneath the present FAIT framework, the Fed would enable inflation to exceed two % quickly following durations of below-target inflation. In contrast to FAIT, nonetheless, the Fed would additionally enable inflation to fall beneath two % quickly following durations of above-target inflation.

This strategy affords a number of benefits over FAIT. Most significantly, by making up for previous misses in each instructions, a symmetric AIT framework would are inclined to stabilize the worth degree over time. This end result is extra per the Fed’s value stability mandate, would assist tackle longstanding considerations concerning the redistributional results of price-level shocks, and would higher replicate the historic classes of the Volcker-Greenspan period (Binder 2025; Hetzel 2025) Furthermore, it could scale back the danger related to long-term contracting relative to each IT and FAIT.

To see how AIT would scale back the danger of long-term contracting, contemplate once more the potential outcomes for these getting into long-term contracts. Beneath AIT, the Fed would possibly (randomly) err by delivering above- or below-target inflation. In contrast to beneath the present framework, nonetheless, the Fed would then try and make up for this error, finally restoring the worth degree to its pre-shock anticipated path. By doing so, the AIT reduces the danger of long-term contracting. In brief, beneath AIT the worth degree is mean-reverting and, therefore, a lot simpler to foretell.

One other benefit of AIT is that it could immediate the Fed to behave extra rapidly following mixture demand shocks. As a result of AIT requires the Fed to make up for previous errors, the additional the worth degree deviates from its goal development path, the extra aggressively the Fed should reply to convey it again on monitor. For instance, suppose the Fed considerably undershoots its goal for an prolonged interval. In that case, it might want to generate inflation that’s greater for longer than would have been obligatory had officers acted sooner. Given the political unpopularity of sustained inflation, Fed officers would possibly choose to maintain inflation nearer to focus on by remaining vigilant for deviations and correcting them promptly after they happen.

Nonetheless, AIT has at the least one essential disadvantage: it permits the Fed to reply to provide shocks.[21] As Selgin (1997) explains, modifications within the value degree pushed by provide shocks convey helpful data that allows households and corporations to make knowledgeable manufacturing and consumption selections. When the Fed offsets such price-level modifications, it imposes pointless prices — particularly on corporations — that will in any other case stay unaffected by the shock, since they need to now regulate costs to accommodate the Fed’s response.[22]

The Fed would possibly allow a short lived deviation within the value degree attributable to a provide shock, anticipating it to dissipate as actual output returns to potential. However AIT doesn’t require such restraint; it permits — and will even encourage — offsetting these deviations, even when doing so is counterproductive.

In the course of the Fed’s most up-to-date framework assessment — which in the end produced the present FAIT framework — AIT “garnered probably the most public consideration…and lots of observers anticipated it to be the Fed’s new framework” (Beckworth and Horan 2025). Certainly, the prominence of AIT in these discussions possible contributed to the preliminary confusion concerning the Fed’s uneven implementation of FAIT. In sum, adopting AIT right now would characterize a modest — although significant — shift from the present framework. The general public would possible discover a symmetric goal extra intuitive, and Fed officers and journalists have already executed a lot of the work to clarify how AIT operates. For these causes, a transition to AIT would possible be simpler to speak than extra radical options.

6.3. Elevating the Inflation Goal

Some economists, together with Jason Furman (2023a), have argued that the Fed ought to use its upcoming framework assessment as a possibility to lift its two-percent inflation goal.[23] This revision may very well be applied throughout the present framework, or paired with one of many different inflation-targeting frameworks mentioned earlier. Furman contends {that a} greater inflation goal would “cushion the economic system in opposition to extreme recessions” and “give the Fed extra scope to chop rates of interest and thereby stimulate the economic system.” He additionally argues that, since households and corporations would incorporate greater anticipated inflation into wage and debt contracts, there may be little motive to fret about its results on employees and collectors (Furman 2023b).

There are a number of issues with this argument. First, the declare that greater inflation can cushion downturns depends on the view that employees are unwilling to simply accept nominal wage cuts (Akerlof, Dickens, and Perry 1996). However as White (2025) explains, this reluctance will not be an immutable behavioral truth; it’s an institutionally contingent end result.[24] In the course of the US postbellum interval (1865–1896), for instance, actual output grew at a median annual charge of three.7 % whereas inflation averaged 2.0 %. It’s unclear how greater inflation would have improved financial efficiency in that context.

Second, Furman’s declare {that a} greater inflation goal would give the Fed extra room to chop rates of interest is deceptive. The zero decrease certain on nominal rates of interest solely constrains coverage in a low-inflation atmosphere if the Fed restricts itself to rate of interest devices. As White (2025) notes, nonetheless, there is no such thing as a motive the Fed should achieve this. For instance, it may as a substitute conduct coverage by adjusting the financial base, wherein case the zero decrease certain could be irrelevant.

Lastly, Furman’s declare that greater anticipated inflation wouldn’t hurt employees and collectors is mistaken. As White (2025) explains, greater anticipated inflation will increase the price of holding cash balances, decreasing the features from alternate. It additionally distorts financial selections by interacting with unindexed taxes on curiosity revenue and capital features.[25] These results are removed from trivial and would in the end hurt each employees and collectors (Feldstein 1997, 1999; Lagos and Wright 2005; Lucas 2000). Fortuitously, Fed officers don’t look like taking this suggestion critically. Throughout his semiannual testimony to the US Senate Banking Committee, Chair Powell acknowledged, “We expect it’s actually essential that we do persist with a two-percent inflation goal and never contemplate altering it” (The Semiannual Financial Coverage Report back to the Congress 2023).

6.4. Nominal Spending Concentrating on

The most suitable choice could be for the Fed to desert inflation focusing on altogether and as a substitute undertake a nominal spending goal. Beneath this framework, the Fed adjusts the cash provide to offset modifications in cash demand, thereby making certain that nominal spending follows a predetermined development path. Like common inflation focusing on (AIT), this strategy requires the Fed to make up for durations when nominal spending deviates from its goal path, however it differs from AIT by permitting provide shocks to go by way of to the worth degree and inflation charge. A nominal spending goal thus behaves like AIT within the case of mixture demand shocks, however spares the Fed having to determine whether or not to deviate from its inflation goal in response to mixture provide shocks, which it’s ill-equipped to deal with instantly with its current instruments (rate of interest modifications and asset purchases) that may solely affect mixture demand, not provide. Like AIT, it makes the worth degree extra predictable over longer time horizons.[26]

To make certain, there’s a communication problem related to shifting from FAIT to a nominal spending goal. The Fed’s previous frameworks have conditioned the general public to assume by way of an inflation goal of 1 kind or one other. Because of this, a nominal spending goal might initially look like a radical departure from the established order. That stated, Binder (2020) argues that nominal spending focusing on would in the end enhance central financial institution communication:

A part of the problem of inflation focusing on is that many individuals both have no idea what inflation is or perceive it very in a different way than central bankers do. Many individuals don’t perceive that greater inflation could be a consequence of upper mixture demand. On surveys of client expectations, for a lot of shoppers, reported inflation expectations are actually a proxy for his or her beliefs concerning the normal state of the economic system — that’s, shoppers report greater inflation expectations when financial sentiment is poor.

By permitting “the Fed to border its coverage selections by way of revenue reasonably than inflation,” a nominal spending goal helps alleviate public confusion concerning the relationship between inflation and actual output fluctuations (Binder 2020). It additionally reduces uncertainty amongst households and corporations about how the Fed will stability the 2 sides of its twin mandate. On this means, a nominal spending goal may considerably enhance central financial institution communication.

Furthermore, whereas a nominal spending goal might sound like a dramatic departure from the established order, it may be applied utilizing acquainted rate of interest guidelines. For instance, Orphanides (2025) proposes a pure development focusing on rule, which prescribes how the Fed ought to set its coverage charge primarily based on the projected development of nominal spending and the “pure” development charge — outlined because the sum of the Fed’s two-percent inflation goal and the estimated development charge of potential output. Had the Fed adopted this rule throughout and instantly after the pandemic, it could have begun tightening a lot sooner and prevented the worth degree from rising as excessive because it did.

In sum, nominal spending focusing on will not be solely economically sound however institutionally possible, representing the best choice for selling financial stability going ahead.

7. Conclusion

Opposite to Chair Powell’s claims, the 2020-2024 rise within the value degree was not exogenous — it was the results of an mixture demand shock attributable to the Fed itself. Officers failed to acknowledge the demand-driven nature of the issue, regardless of mounting proof. Nor, opposite to Powell’s declare, did they act swiftly to appropriate course as soon as they realized that financial coverage was far off monitor. Removed from being irrelevant, the FAIT framework helps clarify why the worth degree stays properly above its pre-pandemic development path. In brief, FAIT has failed. It doesn’t promote value stability — it enabled the best inflation in forty years. It doesn’t anchor expectations — it has eroded the Fed’s credibility.

On reflection, these outcomes are hardly stunning. By focusing narrowly on inflation, FAIT will increase the danger of misdiagnosing demand shocks as provide shocks — because the Fed did in 2021. Had officers targeted on nominal spending, they’d have seen that mixture demand was rising quickly — in different phrases, that households and corporations have been rising their spending at a tempo properly above the corresponding change within the economic system’s productive capability, placing upward strain on costs, warranting tighter financial coverage. The Fed’s uneven strategy to FAIT possible contributed to its gradual response. If the framework had required officers to make up for above-target inflation, they’d have had stronger incentives to behave rapidly and restrict the dimensions of the mandatory correction. As an alternative, the asymmetry nearly ensures that inflation will exceed two % on common.

FAIT was designed to deal with the perceived downside of persistently low inflation following the Nice Recession. In that slender respect, it succeeded: it eradicated low inflation, however on the expense of value stability. What the Fed wants is a sturdy financial coverage framework able to responding to a variety of financial circumstances. No matter its different deserves, FAIT is less than the duty.

To that finish, every of 4 potential revisions to the Fed’s financial coverage framework was evaluated. Of those, two stand out as particularly promising. The most suitable choice could be for the Fed to undertake a nominal spending goal, which might assist anchor expectations, keep away from inappropriate responses to provide shocks, guarantee a well timed response to demand shocks, and enhance communication with the general public. This strategy could also be tough to clarify initially. A symmetric common inflation goal could be a viable second-best possibility, providing many — although not all — of the advantages of nominal spending focusing on. Both different could be a transparent enchancment over the established order and would possible have produced higher financial coverage in recent times.

Getting this historical past proper issues. If Fed officers are to keep away from repeating the identical errors, they need to acknowledge their function in driving costs completely greater. As they assessment the framework this 12 months, they need to bear one factor in thoughts: both FAIT enabled the worth degree to rise completely above its pre-pandemic path, or it failed to forestall it. Both means, it should go.

References

Akerlof, George A., William T. Dickens, and George L. Perry. 1996. “The Macroeconomics of Low Inflation.” Brookings Papers on Financial Exercise 1:1–59.

Alvarez, Santiago, Alberto Cavallo, Alexander MacKay, and Paolo Mengano. 2024. Markups and Value Cross-through Alongside the Provide Chain. Social Science Analysis Community.

Ball, Laurence. 2014. The Case for a Lengthy-Run Inflation Goal of 4 P.c. Working Paper. WP/14/92. Worldwide Financial Fund.

Beckworth, David, and Patrick J. Horan. 2025. “The Destiny of FAIT: Salvaging the Fed’s Framework.” Southern Financial Journal 91(4):1391–1403.

Bergman, William, and William J. Luther. 2022. “When Did The Fed Change Its Tune?” https://aier.org/article/when-did-the-fed-change-its-tune/.

Binder, Carola. 2020. “NGDP Concentrating on and the Public Fed Coverage.” Cato Journal 40(2):321–42.

Binder, Carola. 2025. “The Rise of Inflation Concentrating on.” Southern Financial Journal 91(4):1229–46.

Blanchard, Olivier J., Giovanni Dell’Ariccia, and Paolo Mauro. 2010. Rethinking Macroeconomic Coverage. Worldwide Financial Fund.

Blanco, Andrés. 2021. “Optimum Inflation Goal in an Economic system with Menu Prices and a Zero Decrease Certain.” American Financial Journal: Macroeconomics 13(3):108–41.

Brainard, Lael. 2020. “Bringing the Assertion on Longer-Run Targets and Financial Coverage Technique into Alignment with Longer-Run Adjustments within the Economic system.” Introduced on the Brookings Establishment, September 1, Washington, D.C.

Brown, Sherrod. 2023. “Brown To Powell: Put Staff First within the Battle Towards Inflation | U.S. Senator Sherrod Brown of Ohio.” https://www.brown.senate.gov/newsroom/press/launch/sherrod-brown-to-powell-put-workers-first-fight-against-inflation.

Cachanosky, Nicolás, Bryan P. Cutsinger, Thomas L. Hogan, William J. Luther, and Alexander W. Salter. 2021. “The Federal Reserve’s Response to the COVID-19 Contraction: An Preliminary Appraisal.” Southern Financial Journal 87(4):1152–74.

Clarida, Richard H. 2020.“The Federal Reserve’s New Framework: Context and Penalties.” Introduced on the Bookings Establishment, November 16, Washington, D.C.

Cochrane, John H. 2023. The Fiscal Principle of the Value Degree. Princeton College Press.

Cutsinger, Bryan P., and William J. Luther. 2022. “Seigniorage Funds and the Federal Reserve’s New Working Regime.” Economics Letters 220:110880.

Di Giovanni, Julian, Ṣebnem Kalemli-Özcan, Alvaro Silva, and Muhammed A. Yildirim. 2023. Pandemic-Period Inflation Drivers and World Spillovers. Nationwide Bureau of Financial Analysis.

Eggertsson, Gauti B., and Don Kohn. 2023. The Inflation Surge of the 2020s: The Position of Financial Coverage. 87. Brookings Establishment.

Federal Reserve. 2020.“2020 Assertion on Longer-Run Targets and Financial Coverage Technique.” https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications-statement-on-longer-run-goals-monetary-policy-strategy.htm.

Federal Reserve. 2021a. “December 2021: Abstract of Financial Projections.”

Federal Reserve. 2021b. “June 2021: Abstract of Financial Projections.”

Federal Reserve. 2021c. “March 2021: Abstract of Financial Projections.”

Federal Reserve. 2021d. “September 2021: Abstract of Financial Projections.”

Federal Reserve. 2022a.“June 2022: Abstract of Financial Projections.” https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20220615.htm.

Federal Reserve. 2022b.“March 2022: Abstract of Financial Projections.” https://www.federalreserve.gov/monetarypolicy/fomcprojtable20220316.htm.

Feldstein, Martin. 1997. “The Prices and Advantages of Going from Low Inflation to Value Stability.” Pp. 123–56 in Decreasing inflation: motivation and technique, edited by C. D. Romer and D. H. Romer. Chicago, IL: College of Chicago Press.

Feldstein, Martin. 1999. “Capital Revenue Taxes and the Advantage of Value Stability.” Pp. 9–40 in The prices and advantages of value stability, edited by M. Feldstein. Chicago, IL: College of Chicago Press.

Furman, Jason. 2023a. “The Fed Ought to Fastidiously Purpose for a Increased Inflation Goal.” Wall Road Journal, August 20.

Furman, Jason. 2023b. “Sudden Inflation Can Result in Redistribution, Hurting Collectors and Probably Staff.” https://x.com/jasonfurman/standing/1693791191760781471.

Gordon, Robert J. 1996. “Touch upon Akerlof et Al.” Brookings Papers on Financial Exercise 1:60–66.

Grimm, Maximilian, Òscar Jordà, Moritz Schularick, and Alan M. Taylor. 2023. “Free Financial Coverage and Monetary Instability.”

Hendrickson, Josh. 2024.“Value Principle as an Antidote.” https://www.economicforces.xyz/p/price-theory-as-an-antidote.

Hendrickson, Joshua. 2025. “The Case for Nominal GDP Degree Concentrating on.” Southern Financial Journal 91(4):1404–19.

Hetzel, Robert L. 2025. “Monetarism and Financial Coverage.” Southern Financial Journal 91(4):1347–71.

Hogan, Thomas L. 2025. “The Failure of Ahead Steering: Classes from the Pandemic Restoration.” Southern Financial Journal 91(4):1265–86.

Eire, Peter N. 2025. “The Devolution of Federal Reserve Financial Coverage Technique, 2012–24.” Southern Financial Journal 91(4):1247–64.

Jordan, Jerry L., and William J. Luther. 2022. “Central Financial institution Independence and the Federal Reserve’s New Working Regime.” The Quarterly Assessment of Economics and Finance 84:510–15.

Lagos, Ricardo, and Randall Wright. 2005. “A Unified Framework for Financial Principle and Coverage Evaluation.” Journal of Political Economic system 113(3):463–84.

Lorenzoni, Guido, and Iván Werning. 2023. Inflation Is Battle. Nationwide Bureau of Financial Analysis.

Lucas, Robert E. 2000. “Inflation and Welfare.” Econometrica 68(2):247–74.

Luther, William J. 2024. “Impartial Nominal Spending and the Nominal Spending Hole.”

Mankiw, N. Gregory. 1996. “Touch upon Akerlof et Al.” Brookings Papers on Financial Exercise 1:66–70.

Miller, Tracy. 2024. “Fiscal Coverage and Inflation Management: Insights from the COVID Financial Response.” Mercatus Coverage Transient Sequence.

Nelson, Invoice. 2025. “How the Federal Reserve Obtained so Big, and Why and How It Can Shrink.” Southern Financial Journal 91(4):1287–1322.

Orphanides, Athanasios. 2025. “Enhancing Resilience with Pure Development Concentrating on.” Southern Financial Journal 91(4):1420–39.

Papell, David H., and Ruxandra Prodan-Boul. 2024. Coverage Guidelines and Ahead Steering Following the Covid-19 Recession. Social Science Analysis Community.

Powell, Jerome. 2020.“New Financial Challenges and the Fed’s Financial Coverage Assessment.” https://www.federalreserve.gov/newsevents/speech/powell20200827a.htm.

Powell, Jerome. 2025.“FOMC Press Convention Transcript of January 29, 2025,” January 29, Washington, D.C.

Romer, Christina D. 2021. “The Fiscal Coverage Response to the Pandemic.” Brookings Papers on Financial Exercise 89–110.

Rouanet, Louis, and Alexander William Salter. 2025. “Mission Creep on the Federal Reserve.” Southern Financial Journal 91(4):1323–46.

Sargent, Thomas J. 1982. “The Finish of 4 Huge Inflations.” Pp. 41–98 in Inflation: Causes and Results, edited by R. E. Corridor. College of Chicago Press.

Schibuola, Alexander D., and Andrew B. Martinez. 2021. “The Expectations Hole.”

Selgin, George. 1997. Lower than Zero: The Case for a Falling Value Degree in a Rising Economic system. London: The Institute of Financial Affairs.

Selgin, George. 2018. Floored!: How a Misguided Fed Experiment Deepened and Extended the Nice Recession.

The Semiannual Financial Coverage Report back to the Congress. 2023.

Warren, Elizabeth. 2022. “One of many Causes Why Costs Are Up?” https://x.com/SenWarren/standing/1520495104380874760.

Weber, Isabella M., and Evan Wasner. 2023. “Sellers’ Inflation, Earnings and Battle: Why Can Giant Corporations Hike Costs in an Emergency?” Assessment of Keynesian Economics 11(2):183–213.

White, Lawrence H. 2025. “Ought to the Federal Reserve Increase Its Inflation Goal?” Southern Financial Journal 91(4):1372–90.

[1] Inflation refers back to the charge at which the worth degree is rising. The worth degree itself is a measure of the typical costs of products and companies at a time limit. A brief rise in inflation means costs are rising sooner for a interval; a everlasting rise within the value degree means they continue to be elevated even after inflation returns to regular, which is actually what occurred over the previous few years.

[2] Whereas Chair Powell has not explicitly endorsed the greedflation or fiscal-policy-driven explanations, these views have formed the broader public discourse round post-pandemic inflation and infrequently inform the interpretation of exterior or “exogenous” causes. Together with them right here clarifies the distinction between demand-driven inflation and non-monetary accounts of the inflation surge. Furthermore, even when Powell attributes inflation primarily to supply-side elements, these claims relaxation on the broader premise that inflation stemmed from forces outdoors the Fed’s management.

[3] The framework was supposed to anchor expectations and forestall rates of interest from approaching the zero (or, efficient) decrease certain. Some economists choose the phrase “efficient,” which acknowledges that, on account of transaction prices, nominal rates of interest would possibly fall to a degree barely beneath zero.

[4] The asymmetry within the Fed’s new framework was not initially apparent. Its 2020 Assertion on Longer-Run Targets and Financial Coverage Technique (Federal Reserve 2020) explicitly addresses solely the case of below-target inflation. But it surely additionally changed the language of “deviations of employment from the Committee’s assessments of its most degree” with “shortfalls of employment from the Committee’s evaluation of its most degree,” signaling a extra one-sided focus.

[5] This effort is a part of a broader symposium reviewing the Fed’s framework, together with contributions that look at the historic evolution of inflation focusing on (Binder 2025; Hetzel 2025), assess the Fed’s implementation of FAIT (Beckworth and Horan 2025; Eire 2025), and contemplate different rules-based frameworks (Hendrickson 2025; Orphanides 2025; White 2025). The symposium additionally explores problems with mission creep (Rouanet and Salter 2025), ahead steerage (Hogan 2025), and working regimes (Nelson 2025).

[6] Except in any other case acknowledged, inflation charges reported herein are calculated because the constantly compounded annualized charge of change within the private consumption expenditures value index. This strategy produces extra interpretable and comparable charges throughout time durations.

[7] Though Lorenzoni and Werning’s conflict-inflation mannequin affords a sublime formalization of how staggered price-setting by totally different brokers can generate sustained inflationary pressures, there is no such thing as a function for cash, financial coverage, or different nominal determinants of the worth degree. Because of this, the mannequin’s notion of “inflation” displays ongoing relative value changes in a purely actual atmosphere, elevating questions on whether or not it meaningfully describes the dynamics of inflation as economists sometimes perceive it.

[8] The collusion needn’t be specific. “In addition to a proper cartel and norms of value management,” Weber and Wasner write, “there will be implicit agreements that coordinate value hikes.”

[9] Alvarez et al. (2024) discover that complete markups have been secure over the interval. Since an increase in enter prices places downward strain on markups, one would possibly interpret the proof as indicating a relative improve in markups following the pandemic. In different phrases, corporations have been capable of go on greater prices to shoppers with out decreasing their margins — suggesting stronger demand, not rising greed.

[10] For a given charge of nominal spending development, there’s a one-to-one tradeoff between inflation and actual output development. Therefore, for decreased output to clarify even one proportion level of inflation, market energy would wish to have lowered actual GDP development by a full proportion level. That may characterize a roughly 50 % discount in pattern actual GDP development — implausible given the noticed restoration. In different phrases, blaming inflation on falling output on account of elevated market energy would require an unrealistically giant collapse in actual financial exercise — one thing we merely didn’t observe.

[11] See Cochrane (2023) for a theoretical account of the fiscal idea of the worth degree — the view that costs rise when folks imagine the federal government is not going to increase sufficient future tax income to cowl its money owed.

[12] Many advocates of the fiscal idea of the worth degree, together with Miller (2024), acknowledge that the latest extra inflation resulted from “a mix of financial and financial coverage.”

[13] Compounding these challenges, Russia’s invasion of Ukraine in February 2022 additional disrupted international provide — particularly in power markets — pushing oil and different commodity costs greater. The invasion was largely unanticipated, nonetheless, so its contribution to the noticed rise within the value degree (a lot of which occurred earlier) is restricted.

[14] Unemployment was additionally falling as inflation accelerated, additional undermining the supply-shock clarification.

[15] Di Giovanni et al. (2023) estimate a multi-country, multi-sector New Keynesian mannequin and equally conclude {that a} surge in mixture demand — not opposed provide shocks — was the first driver of inflation in 2021 and 2022.

[16] One more reason sudden will increase in nominal spending have a tendency to lift measured company income is that the Fed’s remittances to the Treasury — that are prone to rise with extreme financial stimulus — are recorded as company income within the Nationwide Revenue and Product Accounts.

[17] As Orphanides (2025) explains, rising inflation decreased the actual coverage charge over this era — passively loosening financial coverage when tighter financial coverage was required.

[18] Selgin (2018) explains how the Fed’s new flooring system, adopted in October 2008, prevented the massive improve in reserves from restoring the worth degree. See additionally: Cutsinger and Luther (2022), Jordan and Luther (2022), and Nelson (2025).

[19] As mentioned beneath, White (2025) notes that the zero decrease certain solely limits the Fed’s rate of interest coverage, not its general capacity to affect mixture demand.

[20] Technically, whether or not they should fear about below-target inflation is determined by the size of the contract, timing of funds, and the velocity at which the central financial institution makes up for undershooting its goal. However the normal level stays.

[21] As mentioned earlier, inflation pushed by provide shocks — reminiscent of disruptions to manufacturing or will increase in enter prices — is usually outdoors the Fed’s management. Makes an attempt to counteract these shocks threat imposing pointless financial distortions, particularly if actual output is already constrained.

[22] Furthermore, AIT might amplify macroeconomic volatility (Grimm et al. 2023).

[23] Such proposals are usually not new. See, for instance, Blanchard et al. (2010), Ball (2014), and Blanco (2021).

[24] Gordon (1996) and Mankiw (1996) make the same level.

[25] When taxes are levied on nominal curiosity revenue and capital features reasonably than inflation-adjusted quantities, greater anticipated inflation will increase the tax burden on savers and buyers. This discourages saving and funding, regardless that the actual (inflation-adjusted) return might not have modified.

[26] As Hendrickson (2025) explains, nominal spending focusing on replicates a Pareto-optimal aggressive financial equilibrium — that’s, an end result wherein nobody will be made higher off with out making another person worse off.