Republicans and Democrats are no closer to reaching a deal on the debt ceiling as the country grows ever nearer to default, potentially sparking a global economic catastrophe. But while Republicans say they won’t increase the limit without concessions like spending cuts, they don’t have a unified proposal for what that would look like — nor a particularly strong negotiating position given that Speaker of the House Kevin McCarthy is the one doing the negotiating.

The Treasury has already instituted “extraordinary measures” so the government can continue spending, but that can only stave off default until June, Treasury Secretary Janet Yellen estimated in January. Without a deal to increase the limit, US borrowing could be halted, downgrading creditworthiness and triggering a recession that would reverberate around the world.

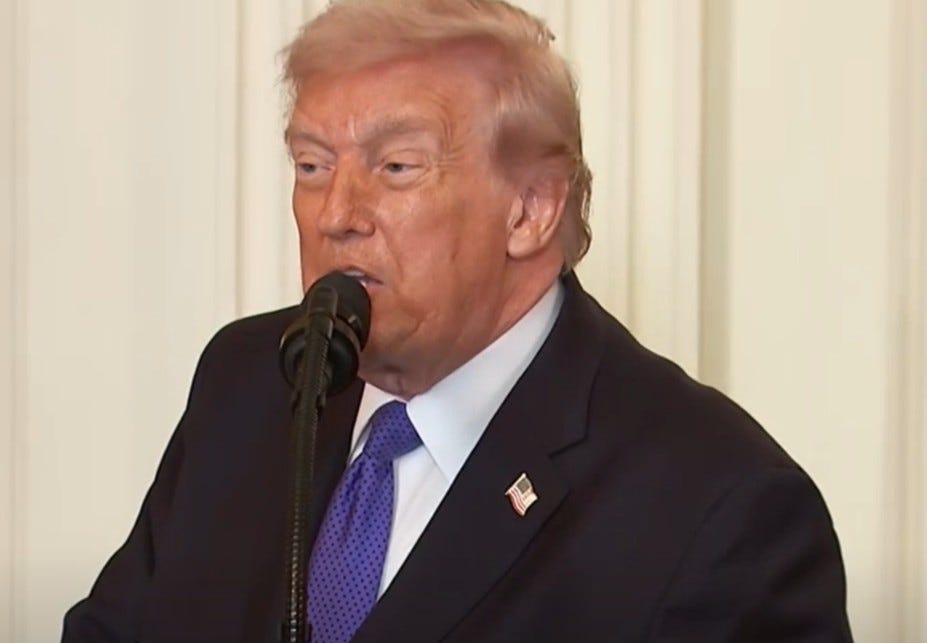

McCarthy met with President Joe Biden Wednesday to discuss the debt limit, though McCarthy told reporters that the two failed to reach a consensus. Biden, for his part, wants a debt ceiling increase without spending cuts. He has said he won’t negotiate on that position, but that he would be willing to discuss the federal deficit separately from the debt ceiling.

The nation’s debt ceiling — the amount the country is legally allowed to borrow from the Treasury in order to pay its bills — has ballooned to $31.4 trillion, since the US has run a budget deficit every year since 2000. The Treasury issues debt instruments, like bonds, to fund the spending that the government has already committed.

If the nation can’t pay its debt, the consequences for both the US and the global economy will be catastrophic, as experts including Treasury Secretary Janet Yellen, have repeatedly stressed. Last month, Yellen told CNN’s Christiane Amanpour that “a failure to make payments that are due, whether it’s the bondholders or to Social Security recipients or to our military, would undoubtedly cause a recession in the US economy and could cause a global financial crisis.”

The Treasury implemented extraordinary measures when the country hit the debt limit last month. It’s not an unprecedented move, but it does mean that the government is reducing investment in certain important funds, including the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund.

Here’s what could be on the table for the Republicans

Debt is an easy issue to weaponize, and Republicans do so often when arguing for spending cuts and negotiating budgets. In this case, they’re attempting to tie a debt ceiling increase to future spending cuts to decrease the federal deficit — the financial shortfall between the budget for government programs and the resources the government actually has to pay for those programs.

Democrats failed to raise the debt ceiling last year when they held a slim majority in both legislative chambers. Some of that, the New York Times’ Emily Cochrane wrote in December, was due to a lack of time before the holiday recess and the more pressing matter of avoiding a government shutdown. Democratic leadership also maintained that they wanted to pass a bipartisan deal on the debt limit — and, as Politico reported in November, Democrats may not have even had the 50 votes it would take to push a deal through via the budget reconciliation process, thereby avoiding a Republican filibuster.

The White House has said that there will be no negotiation on the federal deficit and spending cuts as part of the debt ceiling conversation, but Republicans are already discussing — and wildly disagreeing about — what kinds of cuts they want to propose.

As Amy Davidson Sorkin wrote for the New Yorker Sunday, Republicans are far from united about what they’d even ask for if, for some reason, the president and Democrats did decide to negotiate. Rep. Jim Jordan of Ohio wants to protect military spending, except for what he calls “woke policies,” while Sen. Rand Paul wants to reduce military spending by $100 million. Some 25 Republican senators called for vague “structural reforms” in a letter to Biden sent January 27, but failed to lay out a plan for such reforms.

Republicans could decide to back any number of measures in return for increasing the debt ceiling, as the Washington Post’s Jeff Stein wrote Sunday. McCarthy has said he won’t accept cuts to Social Security and Medicare, although other Republicans have floated the idea. There are also cuts to discretionary spending — in other words, federal spending that’s not for defense or “mandatory spending” like Social Security and Medicare — possibly on the table. But although discretionary programs might not be considered essential, they are important — and popular. Public K-12 education, the National Institutes of Health, and NASA are all considered discretionary spending, which makes up about 30 percent of federal spending. Other options include rolling back the massive investment in the IRS Biden and the Democrats recently made to help deal with backlogs, or try and recover some of the Covid-19 stimulus the government doled out during the pandemic.

Republicans could also propose policies that don’t have anything to do with the debt ceiling, Stein wrote, like backing harsher immigration legislation or new work requirements to receive welfare entitlements. Or they could decide to let the nation default on its debt for the first time ever.

Should default occur, Yellen outlined in a 2021 op-ed in the Wall Street Journal, the consequences would be immediate and severe. “In a matter of days, millions of Americans could be strapped for cash,” she wrote at the time. “We could see indefinite delays in critical payments. Nearly 50 million seniors could stop receiving Social Security checks for a time. Troops could go unpaid.” A default would also drive up the cost of borrowing for every day Americans: “Mortgage payments, car loans, credit card bills—everything that is purchased with credit would be costlier after default,” Yellen wrote. The nation’s creditworthiness enables the government to borrow money cheaply; a default would make government borrowing more expensive, which would then get passed on to consumers. That’s in addition to persistent global inflation and the interest rate hikes the Federal Reserve has instituted to combat inflation.

Over time, “it would certainly undermine the role of the dollar as a reserve currency that is used in transactions all over the world. And Americans — many people would lose their jobs and certainly their borrowing costs would rise,” Yellen told CNN in January. The national credit rating, which was briefly downgraded during a debt ceiling fight in 2011, would also go down again, limiting the country’s ability to borrow in the future and roiling financial markets as investors lost faith in the US economy.

Can McCarthy rally the troops?

The last time the government got this close to default was in 2011. The consequences of even approaching default were dire, as Vox’s Li Zhou wrote Wednesday:

In 2011, Republicans’ unwillingness to back down on spending cuts almost led the US to intentionally go over the brink for the first time, a near miss that contributed to the country’s credit rating getting downgraded by Standard & Poor’s. Back then, markets plummeted, interest rates increased, and the country’s borrowing costs went up by $1.3 billion. That same scenario could play out once again, potentially in an even more chaotic fashion.

At the time, Biden, then-President Barack Obama, former House Speaker John Boehner, and Senate Minority Leader Mitch McConnell were all involved in the negotiations, which ultimately failed and put the government within 72 hours of default. On the day that default would have occurred, congressional leadership put together the Budget Control Act of 2011 which, Zhou wrote, “initially increased the debt ceiling by $900 billion and guaranteed a similar amount in long-term savings across defense and non-defense expenditures. It also set up a super committee of lawmakers who were tasked with finding a set amount of additional spending cuts by late November, or automatic spending cuts would be triggered across the board.”

But in 2023, politics is even more polarized than it was at the time, and the Republican who’s supposed to be leading the negotiations is incredibly vulnerable, so the possibility of passing something like the Budget Control Act of 2011 seems farfetched.

McCarthy only became Speaker in January after 15 rounds of voting; a small cadre of far-right Republicans including Reps. Matt Gaetz and Lauren Boebert managed to hold up his election until he caved into several of their demands including the ability to call snap elections for a new Speaker.

Given McCarthy’s rocky start and the chaos Republicans are already demonstrating in deciding exactly what their bargaining chip will be, it’s hard to see how McCarthy will be able to wrangle his party to present a cohesive idea about what they want in exchange for an increase in the debt limit. This time, McConnell’s not party to the negotiations, but he did send McCarthy some words of encouragement on Wednesday, telling reporters, “We’re all behind Kevin, wishing him well.”

Congress has increased the debt limit 78 times since 1960, under both Democratic and Republican presidents. But it didn’t always carry the controversy it does now; only in 2011 did Congress really start using the debt ceiling as a method of political maneuvering.

“We let this issue and this challenge do everything possible to slow us down, and even to stop the business of our government, and it’s just unacceptable,” Sen. Dick Durbin (D-IL) told the New York Times in December. “If I had my way, we’d change it tomorrow.