After a number of years of calm, stress is once more constructing within the hidden plumbing of the US monetary system — the short-term funding markets that transfer trillions of {dollars} in in a single day money and securities every day. These markets, notably the repurchase (“repo”) market and its benchmark Secured In a single day Financing Price (SOFR), are important to the sleek functioning of the monetary system. After they seize up, the implications ripple outward into Treasury buying and selling, financial institution liquidity administration, and even the implementation of financial coverage.

The final time the repo market buckled, in September 2019, it occurred instantly and dramatically: in a single day borrowing charges spiked from round two p.c to greater than eight p.c, exposing how fragile the post-crisis liquidity framework had grow to be. When company tax funds and the settlement of a big Treasury public sale drained roughly $120 billion in money from the system in a single day, main banks — constrained by liquidity protection guidelines and post-Basel capital surcharges — hoarded their reserves. The end result was a shocking bounce in repo charges, a one-day surge in SOFR to five.25 p.c, and a near-immediate intervention by the New York Fed, which pumped as much as $100 billion per day into the market to revive order. In different phrases, a sudden money drain triggered the same old lenders in in a single day markets to step again abruptly, leaving debtors scrambling for funds and driving charges sharply larger — a basic liquidity squeeze reasonably than a credit score panic. The episode taught regulators a humbling lesson: in a world of regulatory liquidity flooring, “ample reserves” can show illusory when these reserves grow to be erratically distributed.

Secured In a single day Financing Price, 2018 – 2020

A easy chart of every day SOFR from 2018 by way of 2020 captures the purpose clearly. The September 2019 spike (see above) seems as a pointy vertical wall — an nearly instantaneous lack of equilibrium — whereas the newer uptick of late 2025 appears tame however unmistakably directional. In each instances, seemingly minor reserve drains uncovered simply how nonlinear the system turns into close to its decrease consolation restrict.

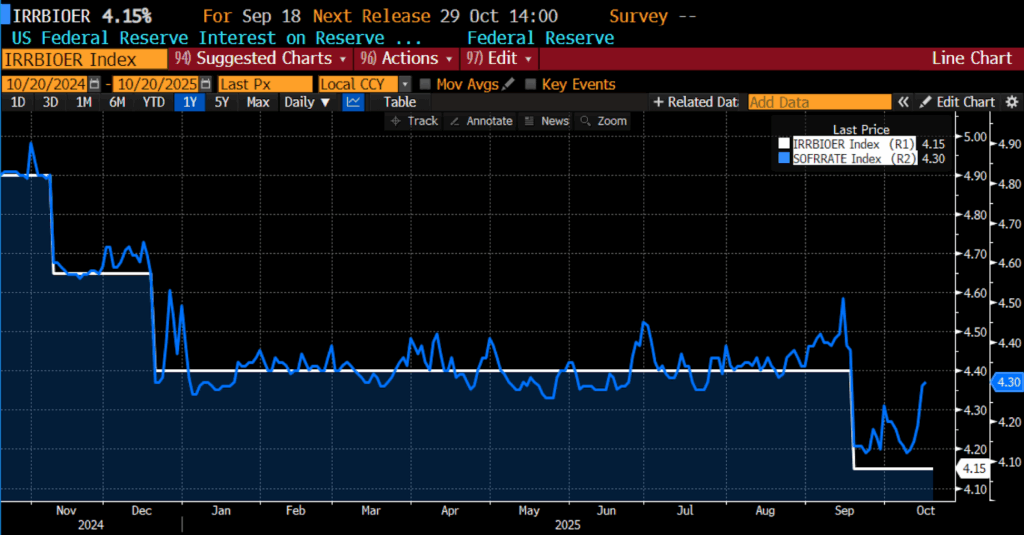

Quick-forward six years, and a few acquainted signs are re-emerging. Indicators of renewed short-term funding stress have begun to floor throughout US cash markets. Nothing approaching the 2019 spike has but occurred, however the tremors are unmistakable. In mid-September 2025, the Federal Reserve’s Standing Repo Facility (SRF) was tapped for roughly $18.5 billion in a single day — its largest draw since inception — suggesting that banks have been once more leaning on official backstops for liquidity. Across the similar time, SOFR rose to about 4.42 p.c, and associated secured funding benchmarks such because the Tri-Occasion Normal Collateral Price (TGCR) climbed in tandem. By October 16, SOFR remained elevated close to 4.3 p.c, underscoring lingering stress regardless of some easing.

Current information of souring debt on financial institution steadiness sheets, together with the sudden failures of each First Manufacturers Group and Tricolor Holdings, are possible key drivers of the abrupt rise in danger aversion throughout bespoke lending markets. The tightness might, moreover, be attributable to acquainted quarter-end forces that periodically drain liquidity: tax deadlines, Treasury settlement flows, and a surge in short-term debt issuance that competes for money.

Analysts on the Dallas Fed noticed that within the first week of September 2025, SOFR rose by 5 to eight foundation factors and TGCR by about 10 foundation factors to roughly 4.50 p.c — modest however telling strikes that reveal a system working with thinner cushions. The repo market, the place Treasuries function collateral for in a single day borrowing, is the circulatory system of contemporary finance. When reserves are plentiful, small shocks are absorbed simply; when they’re tight, even routine settlement flows can push funding charges up.

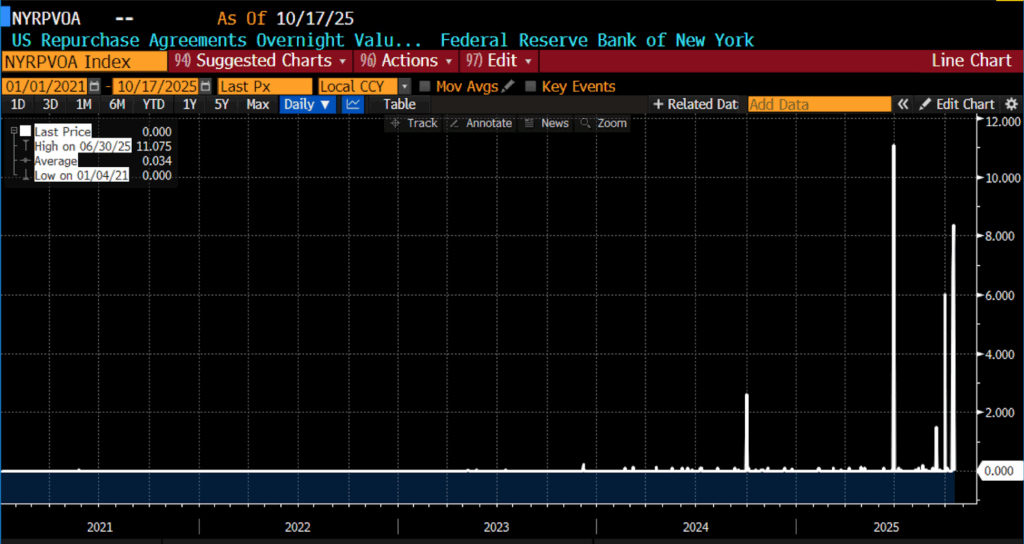

US Repurchase Agreements In a single day Complete Worth Accepted, 2021 – current

From a monetary-plumbing perspective, these latest developments recommend that the “ample reserves” framework might once more be brushing up towards its decrease consolation restrict. When reserves method banks’ inner liquidity minimums, the demand curve for money turns into steep and inelastic, that means that small drains could cause disproportionate strikes in funding charges. The September–October tightening seems to suit that sample. Massive Treasury settlements and tax flows drew money out of vendor accounts simply as invoice issuance surged, forcing funds and banks to pay extra for liquidity. The SOFR-to-IORB (Curiosity on Reserve Balances) unfold widened barely, and rising SRF utilization confirmed that personal lenders have been hesitant to satisfy the marginal demand on their very own. A chart of SOFR minus IORB over the previous two years would present this unfold drifting steadily larger — a visible signal of creeping stress beneath in any other case orderly floor situations.

Though reserves right now are far larger than in 2019 and the Fed’s SRF gives a prepared backstop, the identical structural sensitivities stay. Quarter-end strains, elevated secured charges, and heavier use of official services all level to a system as soon as once more edging towards the boundary the place small imbalances can amplify. The Dallas Fed has cautioned that funding situations are nonetheless “ample” however trending towards constraint — a diplomatic approach of claiming the buffer is thinner than it appears.

The SRF itself has grow to be a sort of canary within the coalmine. A easy bar chart of its every day utilization since 2021 reveals an extended stretch of near-zero take-up interrupted by a sudden, towering spike in mid-September 2025. What makes that surge significant shouldn’t be absolutely the quantity — $18.5 billion is manageable in a $25 trillion market — however that it occurred absent any main coverage shift or market shock. It was, in impact, a voluntary stress take a look at of the system’s plumbing, and the outcomes have been blended.

A number of variables now deserve shut scrutiny: the extent of extra reserves above banks’ inner minima, vendor balance-sheet capability below regulatory capital guidelines, and the conduct of key spreads reminiscent of SOFR versus the Efficient Federal Funds Price (EFFR) or the IORB ground. Sustained SRF utilization would recommend that stress is migrating from the periphery towards the core of the funding community. In the meantime, combination reserve balances plotted towards the Fed’s complete belongings inform one other story — reserves are declining whilst Treasury issuance expands, tightening the efficient provide of money collateral. Up to now, none of those pink lights are flashing, however a number of are flickering amber.

Secured In a single day Financing Price (blue) & US Federal Reserve Curiosity on Reserve Balances (white), October 2024 – current

Ahead SOFR contracts already worth roughly 7–8 foundation factors above EFFR for late-year settlements, hinting at expectations of continued tightness. Treasury issuance stays traditionally heavy, and money-market funds now play an excellent bigger function as collateralized lenders, leaving banks considerably extra reliant on the Fed’s standing services. From a free-market, liquidity-plumbing perspective, the message is evident: this isn’t but a disaster, however the system’s margin for error is narrowing.

The elevated repo prints are manageable due to stronger buffers and improved instruments, however they spotlight how even reasonable drains can take a look at the structure of post-crisis cash markets. If an unexpected fiscal occasion, a serious settlement failure, or a sudden vendor retrenchment have been to happen, a pointy bounce in funding charges may reappear in a single day. Cash-market plumbing is as soon as once more creaking below pressure. Comparable indications have been seen within the months earlier than the collapse of Silicon Valley Financial institution and a handful of different monetary establishments.

Presently, the scenario stays below management however is clearly leaning towards stress — an early warning, not a five-alarm hearth. Markets are nonetheless functioning, however extra delicately balanced than policymakers may desire. If funding situations tighten additional or freeze up solely, intervention will nearly actually comply with — bringing with it the acquainted mixture of short-term aid, long-term distortions, and the ever-present danger of cascades and collateral harm.