matejmo/iStock by way of Getty Pictures

Regulators’ myopia

The underlying drawback that has splintered the marketplace for short-term wholesale debt is the failure of presidency regulators’ imaginative and prescient.

First, the regulators’ response to the 2007 monetary disaster was to extend financial institution security by decreasing the industrial banks’ capability to carry out their position as monetary intermediaries, requiring market-makers to carry additional capital, and discouraging banks from accessing the wholesale deposit market.

Regulators did not see defending your entire course of of economic intermediation as their accountability, as a substitute seeing defending a element of the method, the industrial banks, as their job.

Second, the regulators’ reply to LIBOR’s substitute was to guard the index, not the market. Once more, the regulators did not see their accountability to the underlying marketplace for industrial debt. Their job, they imagine, is to supply an index that’s impervious, thus sadly additionally unresponsive, to market chaos.

Regulators have abrogated their accountability for market perform, focusing as a substitute on defending hyperlinks of the chain of market stability on the expense of the power of the chain itself.

The for-profit hyperlinks within the chain of economic intermediation should strengthen themselves or await the subsequent collapse.

SOFR’s inadequacy

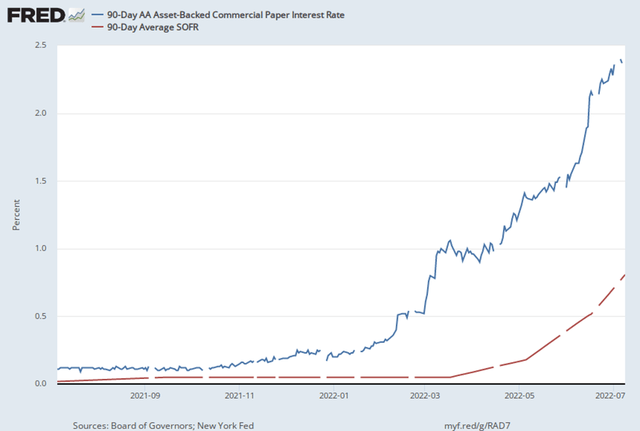

FRED

The volatility of short-term charges blasts off, returning to regular pre-financial disaster ranges. In consequence, the unfold between the financial policy-related secured in a single day financing price (SOFR) and the price of company debt (measured by the 90-day industrial paper price) explodes, overwhelming the unimportant SOFR portion of the price of credit score. This habits thus lays naked the inadequacy of SOFR as a short-term credit score dangerous rate of interest index. (See the graph above.)

Debt markets misplaced their focus

How can monetary markets develop a reputable substitute for Fed-controlled SOFR? There are 4 necessary necessities for an index.

- It have to be a weighted common of transaction charges.

- It have to be accessible even when credit score markets are threatened with failures.

- It should replicate present credit score circumstances out there for company debt.

- It have to be forward-looking, reflecting anticipated circumstances throughout the coming three-month time period.

SOFR fails two of the checks

- SOFR displays credit score circumstances within the Treasury-based credit-riskless repo markets. It’s unresponsive to credit score threat.

- Three-month SOFR is a backward-looking price, describing the historical past of the market, not its anticipated future.

Making a dependable company short-term debt index requires:

- A brief-term debt instrument that can stay in demand throughout crises that threaten major cash market funds.

- A homogenous instrument that survives particular person company failures inside the broader company credit score system.

- A market with liquidity corresponding to the soon-to-be-retired Eurodollar futures market.

Advert hoc indexes additionally fail

The primary tried SOFR replacements – rate of interest indexes just like the Bloomberg short-term financial institution yield index (BSBY) – had been the primary post-LIBOR industrial variations of a short-term credit score price index. However these indexes are doomed to failure too as a result of there’s a substantial chance that the present short-term credit score market will shut down throughout an financial disaster, leaving the world briefly and not using a strategy to worth short-term debt. No index constructed from rates of interest within the present industrial paper market will work.

A viable index can thus solely be created from a newly created market with crisis-resistant demand and provide.

Wholesale deposits had been as soon as a extra helpful measure of the present price of company debt than industrial paper. Banks centered on the investor demand for deposits – deposits are a demand-side centered instrument – whereas industrial paper has all the time been issued to match the irregular company want for short-term funding – a supply-side focus.

A profitable market abstract instrument should steadiness the wants of the demand and the provision facet of the marketplace for short-term credit score.

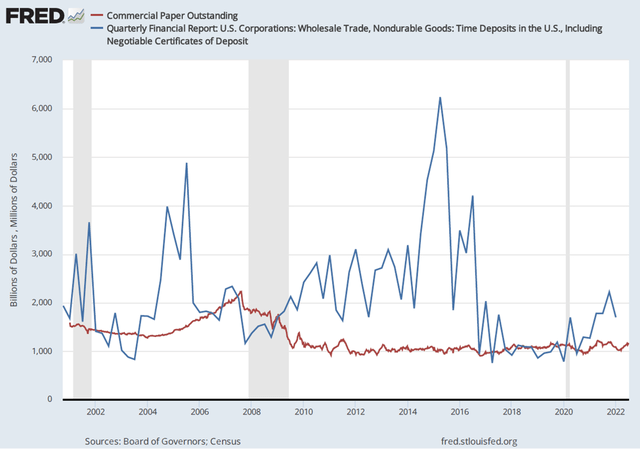

Deposit yields are now not possible indexes. As banks have step by step withdrawn from the wholesale deposit market in response to the regulator’s greater capital necessities, financial institution deposit yield-based rates of interest have ceased to be viable indexes for the measurement of the present price of company short-term debt. Financial institution deposit quantities are too delicate to the well being of the economic system to supply adequate liquidity to allow the calculation of a transaction-based index.

FRED

However because the graph above exhibits, the excellent provide of wholesale financial institution deposits has develop into too unstable to be a reliable supply of an index. The provision of economic paper is way extra secure. But the industrial paper market has problems with its personal that suppliers of a credit score index would wish to beat.

Liquidity

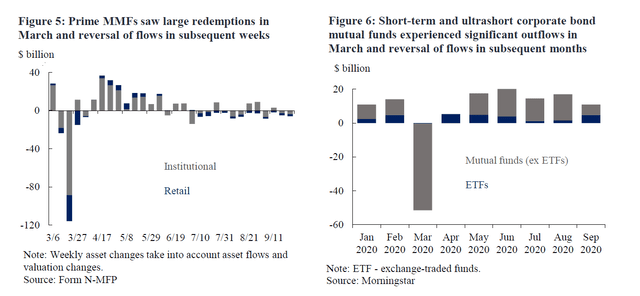

The first cause right now’s industrial paper market can’t be the idea of an rate of interest index is its illiquidity. There’s a tendency for demand for particular person points to break down throughout crises, because the graphic under exhibits. Moreover, after a selected situation is offered, it not often trades in a secondary market.

SEC

Because the SEC employees report notes, the collapse is a results of traders’ (demand-side) rejection of the instrument quite than disinterest from debtors.

In abstract, two key points have to be addressed to supply a secure short-term credit score market index.

- The index have to be the product of transactions in a liquid market.

- The underlying market should proceed to perform in disaster circumstances.

How you can construct a dependable debt index

The industrial paper market’s liquidity issues may be divided right into a supply-side drawback and a demand-side drawback.

Provide-side. The wholesale financial institution deposit market can now not present an index like LIBOR as a result of regulation-induced provide drawback.

In dangerous conditions, post-financial disaster regulatory capital expenses power the banks to drag of their horns, decreasing deposit provide. The regulators have denied the banks the chance to supply markets with a crisis-stabilized funding different with their strain to curtail wholesale deposit issuance.

Demand-side. Within the industrial paper market, cash managers pull their funds from the first Cash Market funds (Prime MMFs) throughout crises, creating a requirement drawback. To resolve that drawback the instruments of finance – notably the issuance of funding autos designed from very dangerous property to create much less dangerous property via diversification is beneficial.

A brand new model of the thought of an funding fund. Prime MMFs can not provide a credit score market index as a result of they’re topic to break down throughout monetary crises. However this weak spot of prime funds could possibly be resolved by making a cash market instrument backed by a fund created with a special goal.

Prime funds appeal to traders by promising greater yields in addition to much less threat. To attain this aim, prime fund managers restrict the chosen industrial paper to points that promise an above-average yield.

By increasing the collection of points to signify your entire market, the share of any single situation in the entire could possibly be decreased to insignificance, giving the fund assured stability.

How you can construct a liquid market.

The creation of the secure fund above begs an necessary query. If the fund doesn’t search to enhance the anticipated return, who would make investments? The reply lies in an understanding of the workings of the Eurodollar futures market.

The Eurodollar futures market is liquid as a result of it summarizes the common efficiency of the credit score markets. For that reason, its perform can solely be carried out if a decline in its worth is as probably as a rise.

This explains the conundrum that regulators can not clarify – the strong liquidity of Eurodollar futures regardless of the intense illiquidity of its spot market kin, the London Interbank deposit market.

To settle a liquid futures contract, a monetary instrument wants solely to be valued on the shut on settlement day. The liquidity of the delivered safety is irrelevant. And settlement worth that day is definitely found within the futures market.

Conclusion

The current run-up in short-term charges uncovered the inadequacy of SOFR as a measure of short-term credit score threat.

There’s a private-sector answer to the failure of SOFR to supply a helpful hedge of short-term credit score threat. The answer hyperlinks a futures market to a spot instrument created by the change that trades the futures contract. The resultant index would do greater than substitute LIBOR. It will be a considerable enchancment.

However the non-public sector – funding administration corporations, exchanges, and broker-dealers – should settle for the problem. This for-profit reply is past the remit of economic market regulators.