Vertigo3d

The iShares World REIT (NYSEARCA:REET) ETF provides you what you’d count on, a comparatively broad-based publicity to REITs. Whereas we do not have an issue with REITs in any respect, the truth is we’ll clarify why buyers can be smart to contemplate them proper now, we predict the idea of a broad REIT ETF like this simply does not make an excessive amount of sense. A few of its sectorial breakdowns individually may need been attention-grabbing, however with REITs being a portfolio already, we do not see the purpose of diversifying on one other stratum.

What’s in REET?

REET incorporates on the prime of the holding listing some acquainted names. Prologis (PLD) might be referred to as a specialty REIT, and it owns logistics and warehousing properties. In the meanwhile, this type of actual property may be very useful, and can possible proceed to be as producers around the globe attempt to construct extra flatbeds at vehicles, pushing arduous up towards the provision chain constraints which are limiting these meeting strains.

In any other case, we get different acquainted names like Equinix (EQIX) which owns colocation facilities that enable for web trade between decrease tier networks, and advantages from highly effective community economics. To date, very resilient exposures.

Taking place the listing we get extra storage REITs and even some on line casino properties, however being a fairly diversified portfolio, it is the sectorial breakdowns which are going to provide us a clearer image.

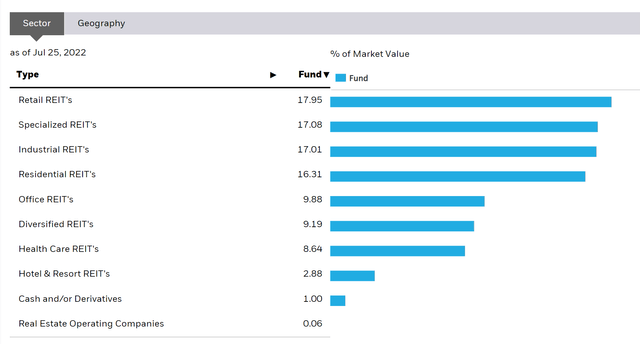

REET Breakdown (iShares.com)

Specialised REITs like some already listed usually are going to offer area of interest and resilient publicity. The place REITs are already resilient, the precise markets and niches right here ought to usually put these property homeowners in an excellent higher place. Residential REITs are one of many different main classes, and whereas asset values may fall, a housing scarcity in lots of US means vacancies are going to be fairly unlikely. The geographic publicity is 70% US so we may be protected in assuming US housing dynamics prevail right here. Industrial REITs needs to be fairly protected too, with leases to industrial corporations in all probability offering loads of worth as manufacturing and capability stays a key subject for world markets. Nevertheless, be aware that industrial tenants is likely to be affected by inflation in their very own companies. Retail REITs is a bit scarier, however a few years have handed of ecommerce progress and whereas secularly not notably attention-grabbing, the property nonetheless in operation are typically protected from any additional oversupply dynamics that is likely to be hitting the phase fairly arduous. In actual fact, retail is getting a bit little bit of a renaissance as folks handle their procuring prices with transport prices from ecommerce gamers (not Amazon Prime customers), incentivising extra of a combination between retail and at-home supply shopping for.

Hazard areas like workplace REITs sit decrease within the portfolio. Whereas it is a battleground matter, there are nonetheless some dangers to workplace REITs particularly as an incredible resignation persists regardless of macroeconomic considerations. Gubernatorial tax coffers are positively starting to really feel the consequences of many individuals not desirous to stay in locations like San Francisco anymore.

Conclusions

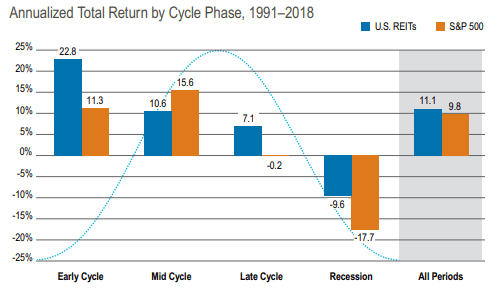

REITs usually are an space that folks may wish to have a look at. Due to the economics of proudly owning actual property, the knowledge REITs ship in loads of instances make them a resilient asset class and fairly countercyclical. Getting into right into a recession they sometimes carry out nicely, they usually additionally carry out nicely on the rebound after the mud settles. With the dividends, particularly from US REITs, being very dependable, a head begin on returns is delivered the place capital appreciation turns into arduous to earn.

REIT Returns (Cohen and Steers)

The factor is retail buyers, particularly within the US, are fairly acquainted with the REIT asset class as a result of pensioners rely available on the market for dividends. Furthermore, individuals are usually fairly useful with fascinated by actual property. It strikes us as a very bizarre securitisation option to make a REIT portfolio. We really feel assured in choosing a single REIT which is already a portfolio to make a narrower guess on a market that we’re completely able to understanding, and we might count on folks like mother and father and pals outdoors of the business to have the ability to try this as nicely, which they do when shopping for their very own property. When there are clear selections you wish to make, for instance selecting US REITs that are extra dedicated to dividends, and avoiding sectors extra prone to capital impairment like workplaces, why not simply go make them and purchase a single REIT? You’d keep away from the little 0.14% administration payment too.