RiverNorthPhotography

Pink Robin Gourmand Burgers, Inc. (NASDAQ:RRGB) reported the corporate’s Q1 ends in late Could, not exhibiting indicators of enhancements but because the weak earnings have carried on. The corporate hinted at a extra constructive begin to Q2, although, which might enhance the funding case significantly. Alternatively, with the weak efficiency and excessive debt, the development may be very vital and continued weak spot might pose an actual menace to the enterprise’ capacity to proceed working.

I beforehand wrote an article on the corporate, revealed on the 30th of April with the title “Pink Robin: Margin Enhancements Are Urgently Wanted”. Within the article, I initiated Pink Robin at Promote as a result of firm’s excessive debt, continued weak financials, and a valuation pricing a too optimistic base situation.

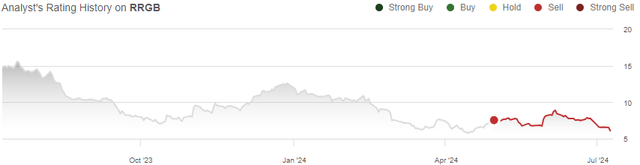

The inventory has since misplaced -19% of its worth in comparison with S&P 500’s appreciation of 11% as Q1 confirmed no indicators but of an enhancing backside line.

My Ranking Historical past on RRGB (Searching for Alpha)

Pink Robin’s Bleak Q1 Financials

The Q1 outcomes didn’t present a great begin to 2024. Comparable restaurant revenues declined by -6.5% year-over-year resulting in revenues of $388.5 million, a -7.0% complete decline. The weaker gross sales led to weakening profitability, as revenue from operations declined from $4.2 million within the prior Q1 into -$2.1 million – worryingly, Pink Robin hasn’t but confirmed any indicators of enhancing demand by way of a renewed menu and different North Star initiatives. The associated fee financial savings that the plan targets have in the end been countered by continued weak gross sales, and the current sale-and-leasebacks additional strain operative revenue.

The weak spot is partly associated to business weak spot, as shopper spending continues to be pressured. The restaurant business has seen the decrease shopper spending’s results, however Pink Robin’s -6.5% comparable gross sales in Q1 nonetheless appear to be a lot weaker than the business’s gross sales efficiency as an entire.

Hints of a Stronger Q2

Pink Robin famous an improved efficiency firstly of Q2 – within the first 5 weeks of the quarter, comparable restaurant revenues managed to develop by 0.3% with the corporate’s renewed menu gadgets together with the Lava Queso Burger and Gold Medal Burger. The Q1 earnings name additionally shines some insights into the anticipated Q2, because the administration expects the North Star plan to lastly begin reaping rewards because the operational enhancements are anticipated to draw extra clients. Pink Robin’s loyalty program additionally continues to develop with updates made into this system.

A greater same-restaurant gross sales efficiency is essentially the most vital think about Pink Robin’s turnaround, and continued enhancements might push ahead the deliberate turnaround.

I nonetheless wouldn’t extrapolate the higher begin to Q2 too far – 5 weeks are nonetheless too wanting a interval to show sustainably improved buyer visitors, and Pink Robin’s poor previous doesn’t add religion. The 0.3% progress can be nonetheless under inflation, and an much more improved progress is required. Pink Robin continues guiding for revenues of $1250-1275 million for 2024, a mid-point decline of -3.1% from 2023, weakened by a 52-week fiscal 12 months 2024 as a substitute of 53 weeks in Pink Robin’s fiscal 2023.

There’s A Actual Mid-Time period Menace of Going Beneath

Pink Robin’s accessible liquidity of $55.6 million after Q1, nonetheless offering liquidity for the short-term future – short-term, the corporate’s operations ought to go on with out a right away liquidity threat.

The excessive remaining debt of $162.0 million poses a mid-term menace, nonetheless – a small quantity of principal funds at a quarterly 1% of the principal quantity have to be made to the credit score facility. Potential debt covenant breaches might even act as a short-term threat, as Pink Robin has a covenant regarding the entire internet leverage ratio. Until earnings enhancements are made, paying off the debt is close to unimaginable and not using a vital fairness elevate or refinancing.

The credit score facility matures in March 2027. The maturity poses a mid-term threat to operations, as refinancing the debt with the present monetary profile might turn into extremely difficult, and an fairness elevate can be extremely diluting and borderline inexecutable – within the mid-term, there’s an actual menace of Pink Robin going beneath if earnings enhancements don’t begin to present quickly.

As such, I imagine that the Q2 outcomes weigh closely on the funding. The quarter’s complete same-restaurant gross sales progress possible impacts the short- to mid-term outlook considerably attributable to Pink Robin’s current constructive remarks elevating religion within the turnaround. If the higher efficiency doesn’t maintain, the funding shortly turns into bleak.

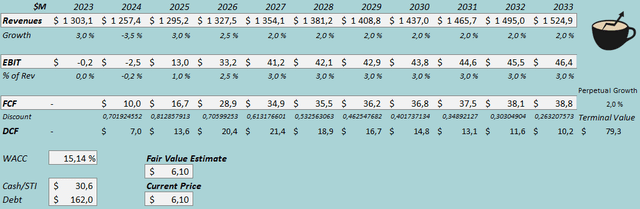

Up to date Reverse DCF Valuation

I up to date the reverse DCF mannequin to indicate what markets are actually pricing in for the inventory. With the decrease inventory value, a extra modest gross sales restoration is predicted with some elevation in 2025 and 2026. The EBIT margin is predicted to rise into 3.0%, down from the earlier 4.0% estimate. The margin leverage nonetheless estimates superb enhancements.

The money move conversion ought to nonetheless be good with capital expenditures largely being placed on halt.

DCF Mannequin (Creator’s Calculation)

I nonetheless don’t assume that such enhancements must be held as the bottom situation. The Q2 outcomes will possible play fairly a great half in figuring out the probability for such a turnaround, although – I counsel traders to observe the quarter’s efficiency very carefully, as sustained higher same-restaurant gross sales clearly enhance the probability of a turnaround.

A greater-than-estimated turnaround would simply flip the funding enticing particularly because the leveraged stability sheet leverages shareholders’ fairness valuation.

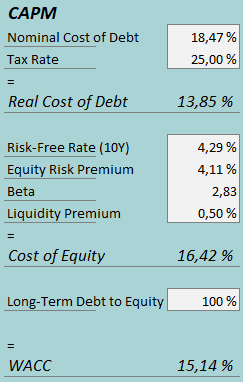

CAPM

A weighted common value of capital of 15.14% is used within the DCF mannequin. The used WACC is derived from a capital asset pricing mannequin:

CAPM (Creator’s Calculation)

In Q1, Pink Robin had $7.5 million in curiosity bills, making the corporate’s rate of interest an extremely excessive 18.47% with the present quantity of interest-bearing debt. I proceed estimating a long-term debt-to-equity ratio of 100% as a result of firm’s struggles in paying down the entire debt.

To estimate the price of fairness, I take advantage of the 10-year bond yield of 4.29% because the risk-free fee. The fairness threat premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, up to date in July. I proceed estimating the beta at 2.83. With a liquidity premium of 0.5%, the price of fairness stands at 16.42% and the WACC at 15.14%.

Whereas the beta will ultimately recuperate right into a dramatically decrease degree if a turnaround occurs, I imagine that the extremely excessive value of fairness is justified in the interim with the present threat profile.

Takeaway

With Q1 persevering with Pink Robin’s poor efficiency, the corporate’s future appears to be like bleak. Optimistic same-restaurant gross sales remarks had been made with the Q1 report and earnings name, although, because the metric returned to progress in the course of the first 5 weeks of Q2. I imagine that the Q2 report performs a vital half within the funding, as a mid-term turnaround is probably going wanted for Pink Robin to not go beneath, and as margin enhancements are clearly wanted.

I nonetheless imagine a turnaround to not be the bottom situation, as 5 weeks is simply too wanting a interval to extrapolate a lot additional and the 0.3% progress doesn’t but present the wanted quantity of progress. As such, I stay with a Promote score for Pink Robin.

Editor’s Word: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.