Stadtratte

By Antoine Bouvet, Benjamin Schroeder, Padhraic Garvey, CFA

The ECB is seen more appreciative of downside risk to growth

The ECB hiked rates by 75bp as expected and signalled it had more ground to cover. Still, markets rallied as the European Central Bank was perceived as being more appreciative of the downside risks to growth. It may be a bit of a selective perception, markets being predisposed with potential policy pivots of central banks globally. President Lagarde did spend more time on risks to growth in the press conference, yet the downbeat views and warnings on rising unemployment were offset by inflation risks now seen “clearly” to the upside. The perceived dovishness has its price – markets have pushed their inflation expectations higher in reaction to the ECB meeting, the often-cited 5y5y forward inflation swap nudging around 5bp higher.

Money market pricing of future hikes eased notably, with the terminal rate slipping almost 30bp towards 2.5% – that is still another 100bp of further rate hikes from here. While the ECB itself also expects to raise rates further, it removed the reference to “the next several meetings” from its press statement, though Lagarde still made that reference in the press conference. It later emerged that the ECB was also not unanimous on the size of yesterday’s hike with three council members calling for a smaller hike, according to Bloomberg. But reportedly, the Council did not intend to send any specific signal for the size of future rate hikes.

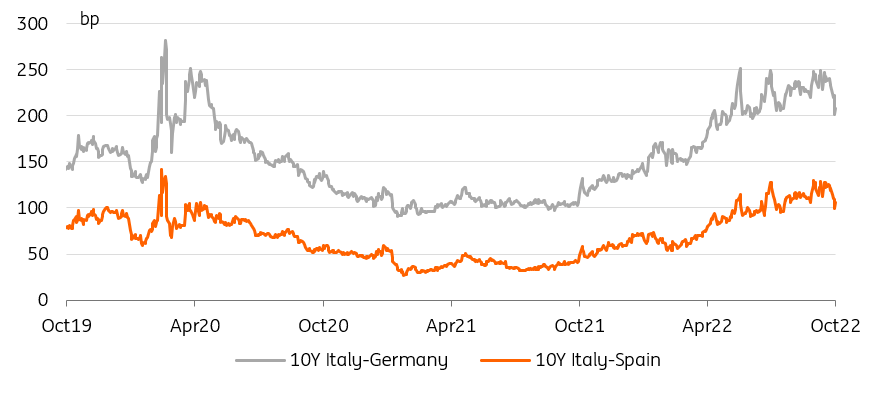

The clearest dovish signal was that quantitative tightening had not been discussed further at this meeting. A decision for the key parameters has been left for December, with an actual start date for quantitative tightening to follow later. That still leaves all options for a start next year on the table, but clearly, the ECB has not set itself on a pre-set course as some hawks would have liked to see it happen given their remarks over the past month. The market’s reaction was clear, with the yield spread of the 10Y Italian government bonds tightening by more than 10bp yesterday closer towards 200bp again.

Peripheral Bonds Are The Main Beneficiaries Of An ECB Perceived To Be Less Hawkish (Refinitiv, ING)

Money markets are the next battleground after TLTRO tweaks

The ECB also changed the targeted longer-term refinancing operation lending terms and lowered the remuneration of banks minimum reserve holdings. Of all the options available to the ECB, they were probably the least disruptive. The latter only marginally reduces the ECB’s interest rate expenses, though the ECB may at some later stage still opt to increase the minimum reserve requirement – recall that it was halved in 2012. And think of it more like a tax on banks which does not change any of the incentives driving market rates.

The former decision on TLTROs increased the effective lending rate for the remainder of the operations’ terms and could thus lead to larger early repayments. To that end, the ECB has also offered additional repayment dates outside of the established quarterly rhythm. As our banking analyst notes, repayments should edge up but maybe not overwhelmingly in the beginning, as even the higher rate may still compare favourably to market funding for some banks.

The TLTRO decision marks the ECB’s first steps towards reducing its balance sheet. The ECB’s stated aim is to “normalise bank funding costs”, which effectively should be read as higher rates. Even after TLTROs are paid down, the excess liquidity levels should still be high enough to prevent a larger updrift of the overnight ESTR rate, but term rates should increase first, meaning wider money market (credit) spreads. Recall that TLTROs were instrumental in bringing down Euribor rates relative to OIS, the high excess liquidity levels also largely suppressing the pass-through of sovereign risks down to the money market level. This effect is now about to unwind.

Do the TLTRO tweaks ease the collateral squeeze? Lagarde said it was not their primary intent, but it could be a side effect. The collateral pledged in the operations itself is hardly the high quality and liquid type that is so dearly in demand, but repaying the TLTROs can still mean on aggregate less excess liquidity chasing the same-quality collateral. It may thus still ease the strains at the margin.

As Excess Liquidity Retreats, Euribor Will Become More Sensitive To Credit And Sovereign Spreads (Refinitiv, ING)

Today’s events and market view

Near term, the ECB has more ground to cover in its fight against inflation, and the first background reports after the meeting seem to suggest that it was not the ECB’s intention to signal any loss of determination or slowing in the tightening process. More pushback from the hawks could be forthcoming, though that may prove difficult with the markets’ current predisposition for central banks to shift into a lower gear and the focus now turning to the BoE and Fed next week. Our economists anticipate that the ECB will manage to deliver another 75bp of rate increases in total, but eventually also the ECB will not be able to withdraw itself from a souring economic reality.

Data today should highlight the ECB’s struggle, with first preliminary inflation data from individual eurozone countries staying elevated, if not edging higher. Also for release are the first 3Q GDP readings confirming the slowdown. In the US, the PCE core deflator – the Fed’s preferred inflation measure – will also show that this central bank’s job is not done yet, as it is seen edging up again. Q3 employment cost index will also provide an important clue as to the strength of underlying inflation. Also on the menu are personal income and spending data, as well as the final University of Michigan consumer confidence readings.

Today’s bond supply comes from Italy, which will reopen a 5Y bond and a 5Y floating rate note, as well as auction a new 10Y benchmark – all in all for a total of up to €7.5 billion.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post