SolStock/E+ by way of Getty Pictures

To many traders, the packaging business could not appear to supply that a lot in the way in which of alternatives. It might additionally not be probably the most thrilling house to spend money on. Nonetheless, the actual fact of the matter is that there are numerous high quality gamers on this house which have carried out effectively for themselves lately. One actually strong however small operator that warrants the eye of traders is Ranpak Holdings (NYSE:PACK). Income with the corporate continues to increase and its bottom-line outcomes have been usually optimistic. The corporate did hit a little bit of a mushy spot within the first quarter of this 12 months, however administration is guiding for income to proceed climbing 12 months over 12 months. Whereas it’s completely potential that the corporate might hit a mushy spot within the occasion of a broader financial downturn, shares are low cost sufficient at present, each on an absolute foundation and relative to comparable corporations, to deserve upside in the long term.

Understanding Ranpak Holdings

At first, Ranpak Holdings is positioned as a supplier of packaging options. To finest perceive the corporate, nonetheless, we must always focus on first its two essential strains of merchandise. On the high of the record is what administration refers to as its Protecting Packaging Options (or PPS) enterprise. By way of this, the corporate offers quite a lot of merchandise geared toward becoming the wants of e-commerce firms and different delivery corporations. These merchandise match into three completely different classes.

Certainly one of these is known as Void-Fill. And in response to administration, merchandise beneath this class Can finest be described as paper that’s used to fill empty areas in secondary packages for the aim of defending the objects throughout the packaging themselves. If in case you have ever ordered a set of glasses within the mail, you might have doubtless acquired them with folded brown paper filling up the empty house throughout the field they got here from in order that the glasses themselves wouldn’t transfer round unnecessarily. That is exactly what we’re speaking about right here. Throughout the firm’s 2021 fiscal 12 months, these merchandise, offered beneath the FillPak model identify, accounted for 40.2% of the corporate’s income.

The second class is known as Cushioning, and the corporate’s methods, beneath this class, convert paper into cushioning pads by crimping paper to entice air between the layers with a purpose to shield objects inside bins from exterior shocks and vibrations through the delivery course of. These merchandise are offered beneath the PadPak model identify and accounted for 42.4% of the corporate’s income in 2021. The corporate additionally has a class referred to as Wrapping. Its methods right here create pads or paper mesh with a purpose to securely wrap and shield fragile gadgets from shock and floor injury sustained through the delivery and dealing with course of. The corporate additionally makes use of these merchandise to line bins and supply separation when delivery a number of objects. In line with administration, model names that these are offered beneath embrace WrapPak, Geami, and ReadyRoll. Throughout the firm’s 2021 fiscal 12 months, these merchandise accounted for simply 13.5% of the corporate’s income.

What’s attention-grabbing about this line of merchandise is that the corporate sells precise methods devoted to turning these packaging merchandise from their base parts into the ultimate product in query. As an example, as of the tip of its 2021 fiscal 12 months, the corporate had 78,000 FillPak models put in globally. It additionally had 35,000 PadPak models and 21,000 WrapPak models. As an alternative of simply promoting these merchandise, the corporate prioritizes the continued possession over them. As an alternative, it focuses on leasing these out to its clients. Plus, naturally, it additionally generates income from the consumables used within the course of.

There’s one other income for the corporate that warrants consideration. And that is what administration refers to as its Automation Merchandise. These are automated methods That assist clients to optimize their very own delivery expertise. As an example, one system referred to as the Minimize’it! EVO takes bins and, utilizing a sensor to detect the very best stacked merchandise throughout the field, resize is the field in order that clients can use uniform field sizes, obtain custom-made field sizes prepared for cargo, and ship extra bins on a single pallet consequently. The corporate additionally has different comparable merchandise targeted on in any other case manipulating packaging. These units are usually offered on to its clients, whereas different units that concentrate on serving to customers to automate the void filling and field closure processes are normally retained by the corporate and leased out. Sadly, this can be a small a part of the corporate, accounting for justice 3.9% of income final 12 months. Nonetheless, administration has expressed curiosity in rising this a part of the enterprise additional and has made some main investments in that vein.

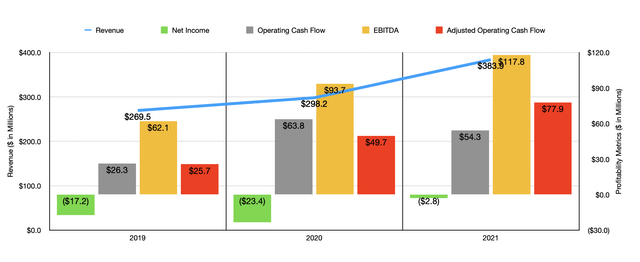

Writer – SEC EDGAR Knowledge

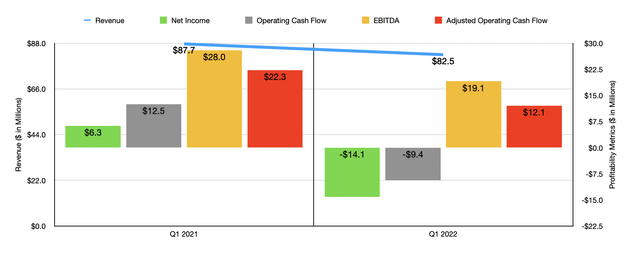

Though Ranpak Holdings has an extended working historical past, it is best to view the corporate by way of the lens of its efficiency over the previous three years. It is because, in 2018, the corporate agreed to mix with One Madison and such a mixture does convey into query problems with comparability from 12 months to 12 months. What efficiency knowledge we do have, nonetheless, has been fairly spectacular. Take into account income. From 2019 by way of 2021, gross sales on the firm elevated from $269.5 million to $383.9 million. Sadly, the corporate has skilled a little bit of ache to this point this 12 months. Administration expressed their disappointment when income for the most recent quarter got here in at simply $82.5 million. That is really down 5.9% in comparison with the $87.7 million generated the identical time one 12 months earlier. Regardless of this bump within the highway, administration did say that income for your entire 2022 fiscal 12 months must be strong, with gross sales climbing by between 13% and 18% in comparison with what the corporate achieved final 12 months.

Writer – SEC EDGAR Knowledge

On the underside line, the image has additionally been usually favorable for the corporate from a money movement perspective. Though internet revenue has been constantly unfavorable for the enterprise lately, it did see its working money movement rise from $26.3 million in 2019 to $54.3 million final 12 months. If we regulate for modifications in working capital, money movement would have risen from $25.7 million to $77.9 million. In the meantime, EBITDA practically doubled, leaping from $62.1 million to $117.8 million. For the present fiscal 12 months, the corporate, as soon as once more, has hit one thing of a roadblock. Within the newest quarter, the enterprise generated a internet lack of $14.1 million. That compares to the $6.3 million internet revenue reported one 12 months earlier. Working money movement went from $12.5 million to unfavorable $9.4 million. If we regulate for modifications in working capital even, this metric would have gone from $22.3 million to $12.1 million. Throughout this time, EBITDA additionally suffered, going from $28 million to $19.1 million. Regardless of these considerations, administration is cautiously optimistic in regards to the present fiscal 12 months. They assume that EBITDA will vary anyplace from 2.5% decrease than it was final 12 months to six% increased than it was. On the midpoint, this might see the metric inching as much as $120 million.

Writer – SEC EDGAR Knowledge

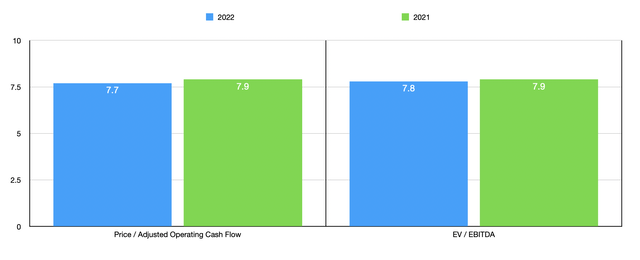

Utilizing the information we’ve got, it isn’t too troublesome to worth the enterprise. If we assume that working money movement will change on the similar charge that EBITDA ought to, then we must always anticipate an adjusted working money movement studying of $79.4 million. This could translate to a worth to adjusted working money movement a number of of seven.7. That is down from the 7.9 studying we get utilizing 2021 outcomes. In the meantime, the EV to EBITDA a number of of the corporate would are available in at 7.8. That compares favorably to final 12 months’s 7.9. To place this in perspective, I in contrast the corporate to 5 comparable corporations. On a worth to working money movement foundation, these firms ranged from a low of 4.8 to a excessive of 35.1. Solely one of many 5 firms was cheaper than Ranpak Holdings. Utilizing the EV to EBITDA method as a substitute, we find yourself with a spread of 8.2 to 41.6. On this case, Ranpak Holdings was the most affordable of the group.

| Firm | Value / Working Money Move | EV / EBITDA |

| Ranpak Holdings | 7.9 | 7.9 |

| Pactiv Evergreen (PTVE) | 4.8 | 8.3 |

| Sonoco Merchandise (SON) | 35.1 | 41.6 |

| Graphic Packaging Holding Firm (GPK) | 10.9 | 12.0 |

| Sealed Air Corp. (SEE) | 12.9 | 10.7 |

| Packaging Company of America (PKG) | 10.6 | 8.2 |

Takeaway

Based mostly on the information offered, I do imagine that Ranpak Holdings is a singular firm that may doubtless proceed performing effectively in the long term. It will likely be attention-grabbing to see whether or not administration’s expectations for the 12 months change into correct. Even when the corporate does see its monetary situation weaken shifting ahead, shares are priced at a low sufficient degree that I’ve a troublesome time believing that important draw back might be on the desk for traders. Due to this, I’ve determined to charge the enterprise a ‘purchase’ right now.