Plyushkin/iStock via Getty Images

ProPhase Labs, Inc. (NASDAQ:PRPH) is a small-cap biotech stock with a market cap of $163.43 million with an attractively low price-to-earnings ratio of 6.58. Year to date, it has rewarded shareholders with returns of 48.92%, although the stock has dropped by 9.12% over the last six months.

Stock trend year to date (SeekingAlpha.com)

The pressing question is what happens to these small biotech companies once the highly lucrative COVID-19 testing starts to dwindle, as is already the case for more prominent players such as Abbott Laboratories (ABT) and Roche Holding (OTCQX:RHHBY). If we look at PRPH pre-COVID-19, its historical performance is underwhelming, even though the company is growing and profitable, investing capital in three exciting subsidiaries that could have multi-billion-dollar potential in the future, with a specific focus on DNA sequencing research through a partnership with billion-dollar AI company G42. I am cautious of the rate at which COVID-19 testing is decreasing, the growing economic downturn and the lack of revenue possibilities shortly. Therefore I recommend a Hold rating after the underwhelming third-quarter results.

Overview

In my previous article, I introduced PRPH, a biotech company that has significantly changed its business over the last few years. It is broken up into five business divisions. ProPhase Diagnostic is responsible for the jump in revenue during the previous two years through its lab that conducts COVID-19 testing. Furthermore, it tests for flu and respiratory infections, and the company is diversifying it into a full genetic testing lab.

Business divisions (Investor Presentation)

Nebula Genomics, acquired last year, has excellent revenue potential. It does whole genome sequencing, highly sought-after research into predisposed diseases. The company recently started collaborating with G42 Healthcare, an Abu-Dhabi-based AI firm part of a $10 billion parent company. This business sells direct to consumers online but is looking to further opportunities with universities across the USA.

ProPhase BioPharma researches high-potential cancer compounds aimed to inhibit cancer growth. Preclinical studies have shown positive results, and the company is collaborating with Dana-Farber Cancer Institute, in addition to research with a Harvard scientist to further the analysis.

Pharmaloz Contract manufacturing is a legacy manufacturing facility kept from the original over-the-counter Cold-EEZE product. Lastly, TK Supplements, sold in over 40,000 food, drug, and mass stores across the country, developed a new line of dietary supplements. Although the future looks promising with exciting collaborations, research progress and international partnerships, and the prediction that COVID-19, flu and other respiratory tests will rise during Q4’s seasonal high, guiding the company into a most likely record-breaking fiscal year performance. It remains worrying to think what the company might financially look like if COVID-19 testing were to fall away suddenly.

Financials and Valuation

PRPH has had an outstanding performance this year, with a twelve-month trailing income of $31.5 million. However, the performance is highly correlated to COVID-19 testing, which is predicted to decline significantly. If we look at the company’s long-term performance, it paints less of a colourful picture. Although PRPH is excited about its three segments that could generate billions, currently, they need to create more cash flow.

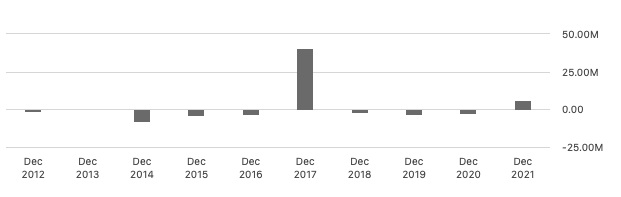

Below we can see the annual net income, which has decreased by 84% from $40.6 million to $6.3 million over the last five years. 2017 was an exceptionally high year because the company sold its Cold-EEZE brand for $50 million. Although the company will end its 2022 fiscal year on a solid performance, there is a worry as to how it will continue growing its net income at the current rate.

Annual Net Income (SeekingAlpha.com)

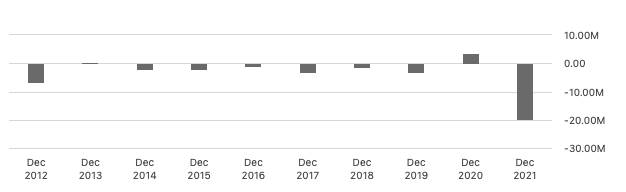

Free cash flow is critical to analyse whether the company can buy back shares, give special dividends as mentioned by the CEO, pay off debts and use it to grow the company organically or through potential new acquisitions. Over five years, the cash flow has mainly remained negative. Last year was exceptionally high due to the purchase of Nebula Genomics for $15 million. TTM has a positive leveraged cash flow of $17.0 million. However, this is exceptional if we look at its historical performance.

Annual levered free cash flow (SeekingAlpha.com)

On the revenue front, if we look at the performance before COVID-19 testing, we can see that the revenue performance needs to be consistent with more growth. The COVID-19 revenue skews the commission and has been critical to a successful 2021, and on route to making 2022 a big year.

Annual revenue (SeekingAlpha.com)

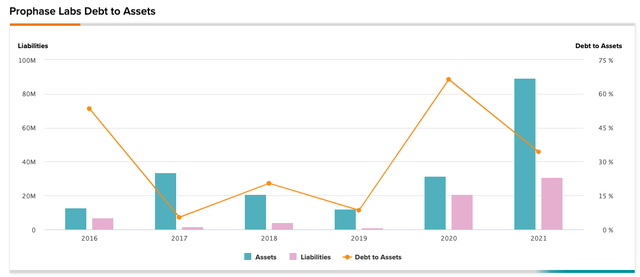

If we look at the debt-to-asset ratio, we see a positive activity, although, pre-COVID-19 testing, the company was on a declining asset trend.

Debt to Asset Annual trend (Tipranks.com)

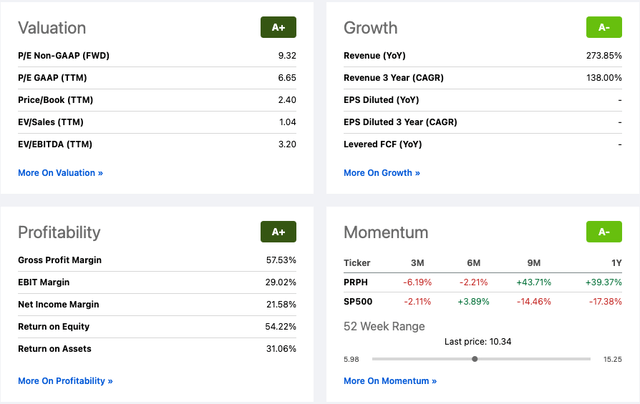

PRPH is graded very highly on Seeking Alpha’s Factor Grades with a valuation and profitability grade of A+. The Quant Rating is a Hold at 3.04, and Zacks’s Rank gives it a Sell rating of 4, with a VGM (value, growth and momentum) score of A. We can see that PRPH has a meagre price-to-earnings ratio of 6.65, indicating that it is undervalued. Furthermore, the growth is exceptionally high at 273.85%. However, we know that the last two years are outliers compared to the company’s historical performance and that its revenue driver will most likely continue to decline.

Valuation

Quant Ranking (SeekingAlpha.com)

Final thoughts

It is undeniable that the company has had impressive profit and growth improvement in 2021 and that it is on its way to delivering a solid 2022 fiscal year of results. COVID-19 has given the company sufficient cash to continue funding exciting future products that could lead to new revenue streams. It is heavily invested in expanding the lab functionality, focusing on genome sequencing research with multi-billion-dollar market potential. However, post Q4, it will be difficult for the company to maintain its level of growth and profitability, especially if we look at its historically poor performance pre-2021. For this reason, I want to wait for more concrete financial progress in its various business segments and downgrade my initial stance to a Hold position.